What Is the VIX and How Is It Calculated?

The Volatility Index (VIX), published by the Chicago Board Options Exchange (CBOE), represents the market’s expectations of 30-day volatility. It’s calculated using prices of S&P 500 options and serves as a real-time barometer of investor sentiment.

Traders interpret it as a gauge of how uncertain or confident the market feels about the near future.

Key facts:

- VIX rises when markets fall (usually)

- Calculated using S&P 500 options with 23 to 37 days to expiration

- It’s not a stock or ETF — it’s an index, though you can trade it indirectly

Why the VIX Is Called the “Fear Index”

The VIX is commonly called the “fear index” because it tends to spike when markets panic. When investors fear a crash or correction, they buy protective options, driving the VIX higher.

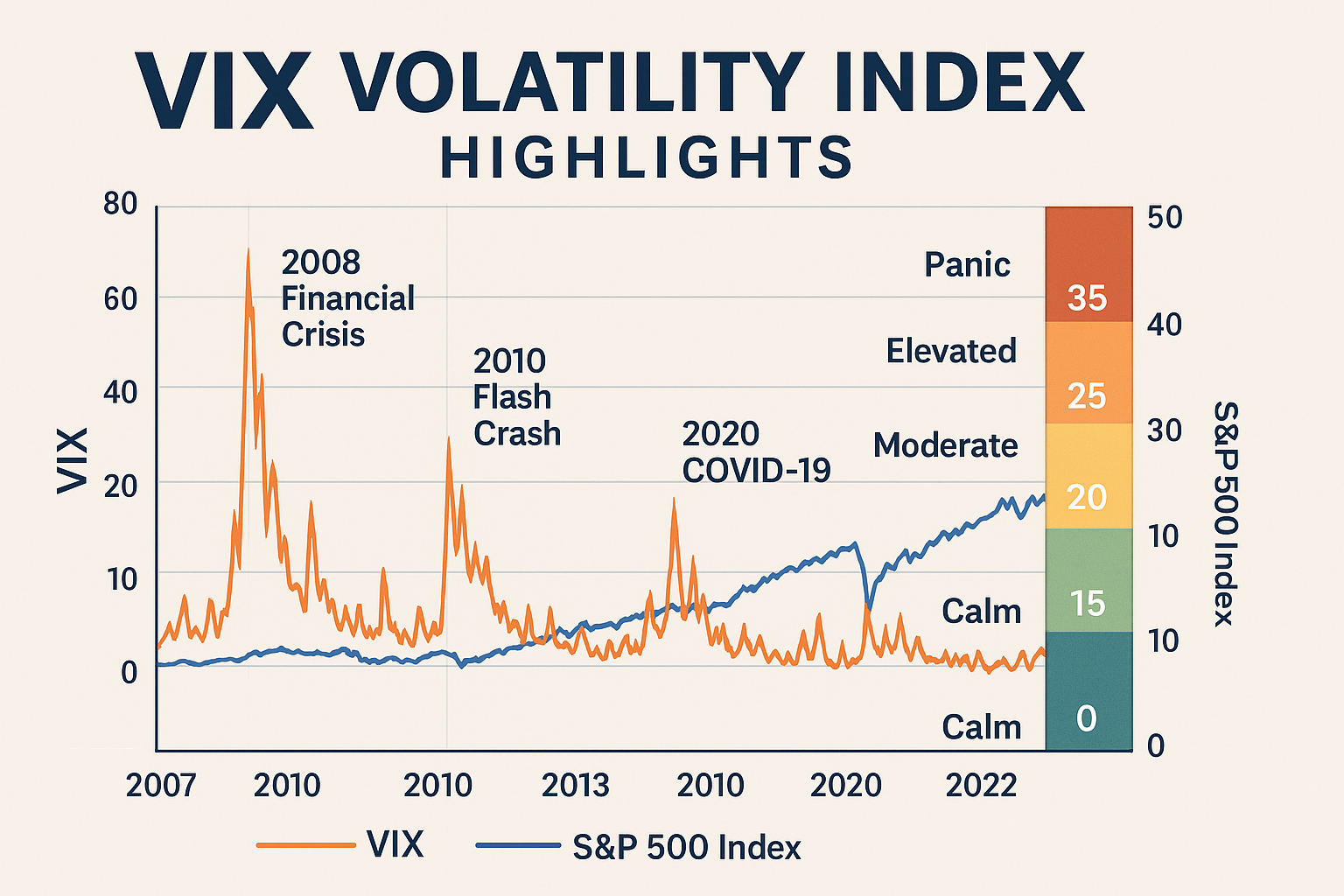

Historical spikes:

- 2008 crash (~80)

- COVID-19 panic in March 2020 (82.69)

- Flash crash of 2010

A spike signals anxiety, while a dip suggests calm or even complacency.

How Investors Monitor Volatility in the Market

Professional traders, fund managers, and even retail investors watch the VIX to:

- Gauge market sentiment

- Anticipate possible reversals

- Decide when to hedge or stay defensive

A rising value may prompt caution; a falling number often supports risk-on strategies.

Market Signals Behind the Numbers

| Volatility Index Range | Market Sentiment |

|---|---|

| Below 12 | Market calm, low risk |

| 12–20 | Normal conditions |

| 20–30 | Growing uncertainty |

| 30–50 | High caution, risk-off |

| Above 50 | Panic, extreme uncertainty |

Note: This metric doesn’t indicate direction — only potential size of moves.

Trading Strategies That Use Volatility as a Guide

You can’t directly buy the VIX itself, but you can access related instruments like:

- Futures contracts

- ETPs like VXX, UVXY

- Options on VIX futures

Example Use:

If you expect increased volatility due to upcoming elections or earnings, you might allocate to a volatility ETF to reduce portfolio drawdowns.

These tools can hedge against losses or create gains during market dislocations, but they’re not for beginners due to decay, leverage, and tracking issues.gs season or geopolitical event), buying a VIX-related ETF may hedge your portfolio.

Drawbacks of Relying Solely on Volatility Indicators

While it’s a powerful tool, the VIX has limitations:

- Doesn’t predict direction (just size of moves)

- Can be misleading during rapid reversals

- Related ETFs often decay over time (due to contango)

Pro tip: Combine this index with technical analysis, fundamentals, or macro indicators for a full picture. one of many tools in your decision-making process, not a standalone signal.

It means investors expect large market movements, typically due to fear or uncertainty.

No. You can’t buy the VIX directly, but you can trade products like VIX futures, ETFs, or options.

A low VIX suggests calm markets — but if it’s too low, it might mean complacency is high, which can precede sharp corrections.

Final Thoughts: Should You Watch the VIX?

Absolutely — the VIX is a powerful real-time sentiment gauge, especially for active investors and traders. While it’s not a crystal ball, it gives critical clues about fear, risk, and uncertainty in the markets.

If you’re managing a portfolio, making trades, or timing entries, keeping an eye on the VIX can help you better understand when to play defense or offense.

However, like any tool, the VIX works best when used in conjunction with other data points and sound judgment.