REITs are a popular option for income-focused investors and play an important role in

long-term investing strategies, especially for portfolio diversification. Finding the best REITs to invest in 2026 requires understanding both the math behind their returns and the fundamental drivers of each property sector.

A REIT (Real Estate Investment Trust) is a company that owns, operates, or finances income-producing real estate across various sectors. By law, REITs must distribute at least 90% of taxable income to shareholders as dividends, creating consistent cash flow for investors.

Why REITs remain attractive in 2026: These investment vehicles offer exposure to real estate without the capital requirements, management burden, or illiquidity of direct property ownership. They provide inflation protection through rent escalations and combine current income with long-term appreciation potential.

This guide breaks down the metrics that separate quality REITs from yield traps, examines the best sectors for income and growth, and provides the analytical framework to evaluate REIT investments using data-driven insights.

What makes a REIT “best”? The answer depends on sustainable dividend coverage, sector-specific demand drivers, balance sheet strength, and management’s capital allocation track record. The following analysis teaches the financial literacy needed to identify these characteristics.

Key Takeaways

- REITs must legally distribute 90% of taxable income, creating predictable dividend streams, but dividend safety depends on FFO coverage and payout ratios below 80%

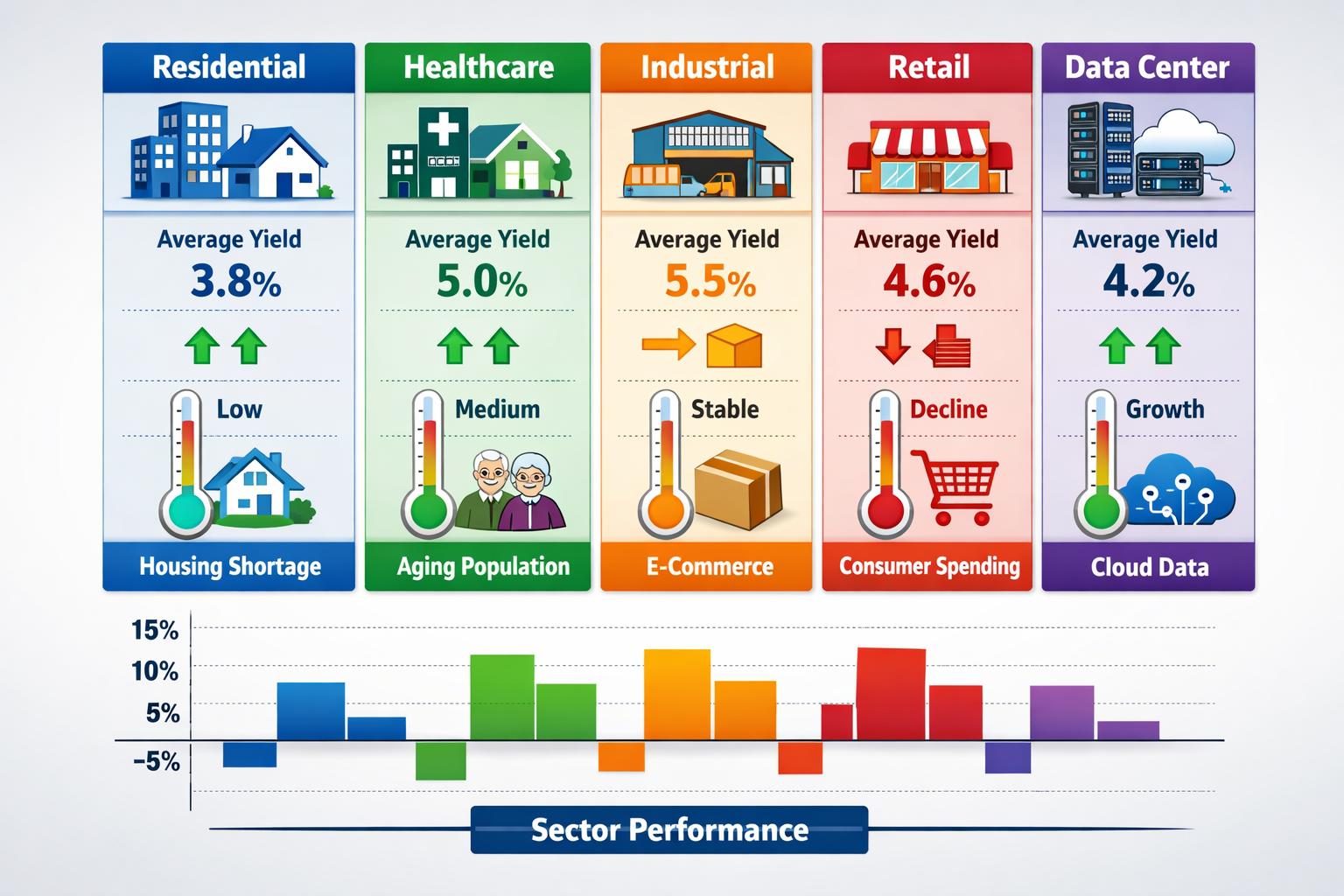

- Sector selection drives returns more than individual REIT picking, with healthcare, industrial, and data center REITs showing the strongest 2026 tailwinds from demographic and technological trends

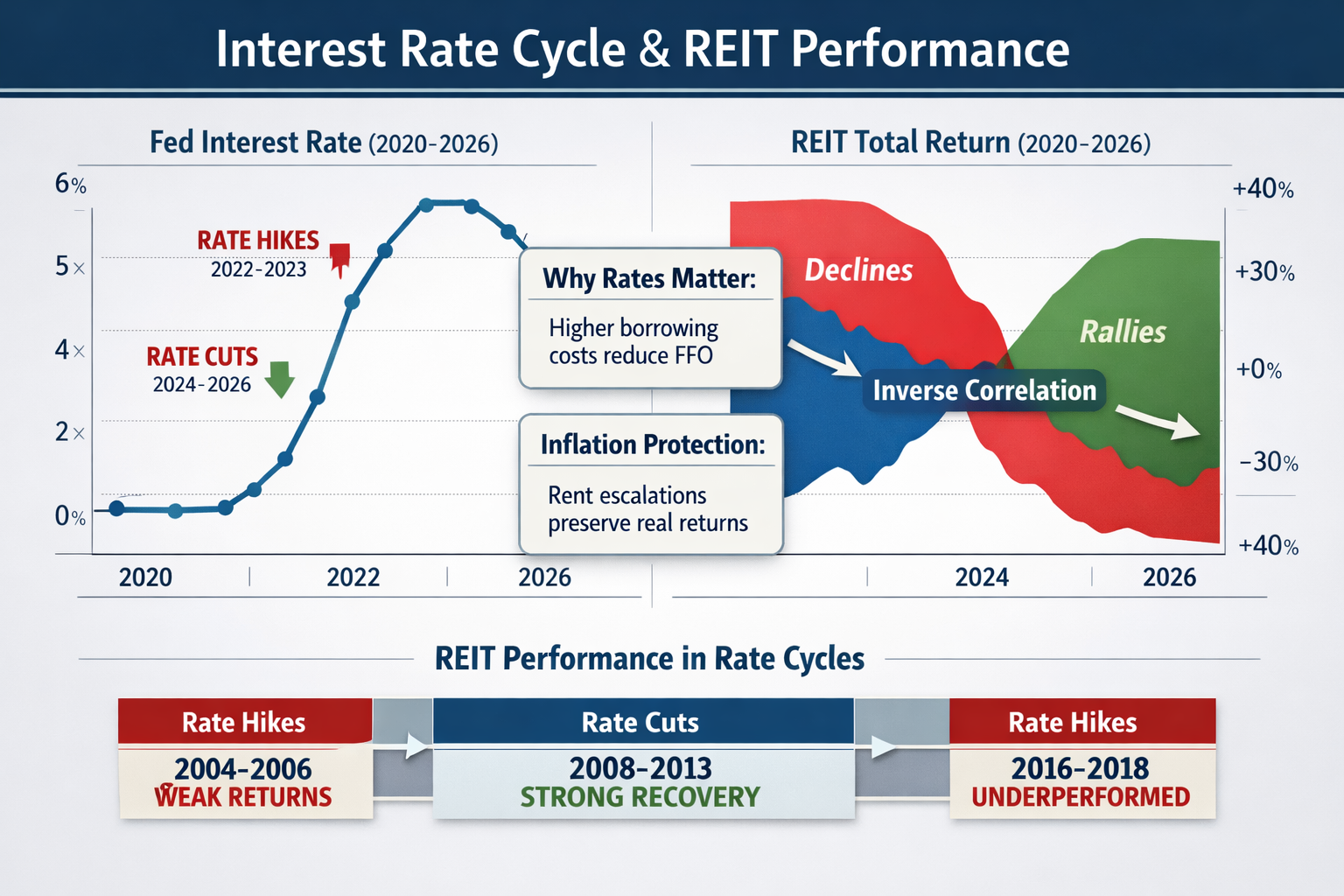

- Interest rate sensitivity creates both risk and opportunity, as rising rates pressure REIT valuations while falling rates typically boost performance through lower borrowing costs

- FFO (Funds From Operations) and AFFO measure true REIT profitability better than net income, which includes depreciation, making these metrics essential for valuation analysis

- Tax treatment differs from qualified dividends, with most REIT distributions taxed as ordinary income, making retirement accounts optimal for holding these assets

What Makes a REIT One of the Best Investments?

The best REITs combine three elements: sustainable dividend coverage, sector positioning in growing markets, and balance sheet resilience during economic stress. Unlike traditional stocks, REITs require specialized metrics to evaluate operational performance.

Traditional earnings metrics fail for REITs because depreciation creates a non-cash expense that understates actual cash generation. A REIT might show low net income while generating substantial distributable cash flow.

The investment thesis for quality REITs: They provide access to institutional-grade real estate portfolios, professional management expertise, and liquidity that direct property ownership cannot match. The compound growth comes from reinvested dividends plus property value appreciation over time.

Understanding what drives returns requires examining both the income component (dividend yield) and the growth component (FFO growth rate). Together, these create total return potential.

Key Metrics to Evaluate REITs

Funds From Operations (FFO) represents net income plus depreciation and amortization, minus gains on property sales. This metric shows the actual cash a REIT generates from operations.

The formula: FFO = Net Income + Depreciation + Amortization – Gains on Sales

FFO removes the distortion that depreciation creates. Real estate typically appreciates over time, yet accounting rules require depreciation charges that reduce reported earnings. FFO adds this back to show true operating performance.

Adjusted FFO (AFFO) goes further by subtracting recurring capital expenditures needed to maintain properties. AFFO represents the cash actually available for dividend distribution.

The calculation: AFFO = FFO – Recurring Capital Expenditures – Straight-line Rent Adjustments

AFFO provides the most accurate measure of dividend sustainability. A REIT paying dividends that exceed AFFO is depleting capital and cannot sustain that payout long-term.

Dividend yield versus sustainability creates the central tension in REIT investing. High yields attract investors, but unsustainable payouts lead to dividend cuts and share price declines.

The payout ratio for REITs uses AFFO as the denominator: Payout Ratio = Annual Dividend / AFFO per Share

Quality REITs maintain payout ratios between 70-80% of AFFO, providing dividend coverage while retaining capital for growth investments and an economic cushion.

Occupancy rates measure the percentage of leasable space currently generating rent. High occupancy (above 90%) indicates strong demand and pricing power.

The metric: Occupancy Rate = Occupied Square Footage / Total Leasable Square Footage × 100

Declining occupancy signals weakening fundamentals and typically precedes rent reductions and FFO declines.

Debt-to-equity ratio shows leverage levels and balance sheet risk. REITs use debt to finance acquisitions and developments, but excessive leverage amplifies downside during downturns.

The calculation: Debt-to-Equity = Total Debt / Total Equity

Conservative REITs maintain debt-to-equity ratios below 1.0, while aggressive operators may exceed 2.0. Lower ratios indicate stronger financial stability.

The interest coverage ratio measures the ability to service debt from operating cash flow. This metric becomes critical when interest rates rise.

The formula: Interest Coverage = EBITDA / Interest Expense

Coverage ratios above 3.0x indicate comfortable debt service capacity. Ratios below 2.0x suggest financial stress and limited flexibility.

Dividend Safety vs High Yield

Yield traps occur when high dividend yields reflect market expectations of imminent dividend cuts rather than attractive value. A 10% yield often signals distress, not opportunity.

The math reveals the trap: If a REIT trades at $10 with a $1 annual dividend (10% yield), but the market expects a 50% dividend cut, the true yield is 5% on a security likely to decline to $7-8 as the cut materializes.

Payout ratio benchmarks separate sustainable dividends from unsustainable ones. REITs paying more than 90% of AFFO lack margin for error when occupancy declines or expenses increase.

The relationship: Dividend Coverage = AFFO / Dividends Paid

Coverage ratios above 1.25x (payout ratio below 80%) indicate sustainable dividends with room for growth. Ratios below 1.1x (payout ratio above 90%) signal vulnerability.

Historical dividend growth provides evidence of management’s commitment to shareholder returns and operational execution. REITs that consistently grow dividends demonstrate both FFO growth and conservative payout discipline.

The compound effect matters: A REIT yielding 4% today that grows dividends 5% annually produces a 6.6% yield on cost after 10 years, plus share price appreciation. This creates wealth building through time.

Best REITs to Invest In by Category

Different REIT sectors respond to distinct economic drivers, demographic trends, and technological changes. Sector selection determines the majority of REIT portfolio returns because sector-specific fundamentals drive performance more than individual company execution.

The framework for sector analysis examines supply-demand dynamics, lease structures, tenant creditworthiness, and secular growth trends. Each sector carries unique risk-return characteristics.

Diversification across sectors reduces concentration risk and smooths returns. A portfolio combining residential, healthcare, industrial, and specialty REITs captures different economic exposures.

Comparison Table: Best REIT Sectors for 2026

| Sector | Typical Yield | Risk Level | Key Advantage | Primary Risk |

|---|---|---|---|---|

| Residential | 3.5-4.5% | Medium | Housing shortage drives demand | Interest rate sensitivity |

| Healthcare | 4.5-5.5% | Medium-Low | Aging demographics | Regulatory/reimbursement changes |

| Industrial | 3.0-4.0% | Low-Medium | E-commerce growth, long leases | Economic cycle sensitivity |

| Retail | 5.0-7.0% | Medium-High | Essential retail resilience | E-commerce disruption |

| Data Center | 2.5-3.5% | Medium | Cloud computing demand | Technology obsolescence risk |

| Office | 5.5-8.0% | High | Deep value potential | Work-from-home structural change |

Best Residential REITs

Residential REITs own apartment communities, single-family rental homes, manufactured housing, and student housing. These properties benefit from fundamental housing shortages across most U.S. metropolitan areas.

Demand drivers for 2026: Limited new construction during 2020-2023, millennial household formation, and homeownership affordability challenges create sustained rental demand. The math shows housing starts have lagged household formation by approximately 2 million units over the past decade.[3]

Apartment REITs focus on multifamily properties in urban and suburban markets. Strong operators maintain occupancy above 95% and achieve annual rent growth of 3-5% in balanced markets.

Key metrics to examine:

- Same-store NOI growth: Measures revenue growth from existing properties

- Lease renewal rates: High renewals (above 60%) indicate tenant satisfaction and pricing power

- Development pipeline: New construction adds growth but increases risk during downturns

Single-family rental REITs emerged as a distinct sector following the 2008 financial crisis. These companies own portfolios of detached homes in suburban markets, offering tenants yard space and privacy.

The advantage: Single-family rentals attract longer-term tenants (average 3-4 years versus 12-15 months for apartments), reducing turnover costs and vacancy. The trade-off involves higher maintenance expenses and geographic dispersion.

Occupancy rates for quality residential REITs consistently exceed 94%, demonstrating sustained demand. Declining occupancy below 92% signals oversupply or management problems.

The relationship between occupancy and pricing power: Effective Rent Growth = Asking Rent Growth × Occupancy Rate

A REIT achieving 5% rent growth at 90% occupancy generates less revenue than one achieving 3% growth at 96% occupancy (4.5% effective growth versus 2.9%).

Best Healthcare REITs

Healthcare REITs own medical office buildings, hospitals, senior housing communities, skilled nursing facilities, and life science properties. These assets benefit from demographic tailwinds as the population ages.

The demographic math: Americans aged 65+ will grow from 58 million in 2022 to 82 million by 2050, increasing healthcare real estate demand by 40% over this period.[4]

Medical office buildings (MOBs) located on or near hospital campuses provide stable, long-term income. Physicians prefer proximity to hospitals for patient referrals and access to diagnostic equipment.

Lease structures typically run 7-10 years with annual escalations of 2-3%, creating predictable cash flow growth. Tenant creditworthiness varies from individual practices to major health systems.

Senior housing includes independent living, assisted living, and memory care facilities. These properties generate higher yields (5-6%) but carry operational complexity because the REIT often manages services beyond just providing space.

The risk-return trade-off: Senior housing revenue depends on occupancy and private-pay rates, creating more volatility than triple-net leased medical offices. However, the aging population provides sustained demand growth.

Skilled nursing facilities serve post-acute care needs, with revenue largely from Medicare and Medicaid reimbursements. Government payment rates create regulatory risk that depresses valuations.

Life science properties house biotechnology and pharmaceutical research facilities. These specialized buildings require significant capital investment for laboratory infrastructure, creating barriers to entry and tenant stickiness.

Triple-net lease structures dominate healthcare REITs, where tenants pay property taxes, insurance, and maintenance. This arrangement shifts operating risk to tenants and creates stable cash flow for the REIT.

Medicare and tenant risk deserve careful analysis. REITs with tenant concentration above 20% from any single operator face elevated risk if that tenant experiences financial distress.

Understanding risk management principles helps investors size healthcare REIT positions appropriately within diversified portfolios.

Best Industrial REITs

Industrial REITs own warehouses, distribution centers, logistics facilities, and specialized industrial properties. This sector has delivered exceptional performance over the past decade as e-commerce transformed retail distribution.

E-commerce drives structural demand: Online retail requires 3x the warehouse space of traditional retail because inventory must be positioned near population centers for rapid delivery. This creates sustained demand for modern logistics facilities.[5]

Warehouse characteristics that command premium rents include:

- Clear height above 32 feet: Allows vertical storage density

- Proximity to major highways and ports: Reduces transportation costs

- Modern loading docks: Enable efficient truck operations

- Location near population centers: Supports same-day and next-day delivery

Long-term lease stability characterizes quality industrial REITs. Average lease terms run 5-7 years, with many tenants signing 10+ year commitments for build-to-suit facilities.

The economics favor tenants renewing leases: Relocation costs, operational disruption, and limited alternative space create high switching costs. Renewal rates typically exceed 70%.

Rent growth dynamics show embedded upside in industrial portfolios. Many REITs signed leases during 2015-2019 at rents 20-30% below current market rates. As these leases expire and renew at market rates, FFO growth accelerates.

The calculation: Mark-to-Market Rent Growth = (Market Rent – In-Place Rent) / In-Place Rent × 100

A property with $5/sq ft in-place rent renewing at $7/sq ft market rent generates 40% mark-to-market growth, directly increasing FFO.

Supply-demand balance requires monitoring because new construction can quickly add capacity. Markets with limited land availability (coastal ports, established logistics hubs) show more favorable supply constraints.

The best industrial REITs maintain portfolios in supply-constrained markets with diversified tenant bases across e-commerce, third-party logistics, and traditional distribution.

Best Retail REITs

Retail REITs face structural challenges from e-commerce but show significant divergence between property types. Essential retail in convenient locations maintains relevance, while enclosed malls struggle.

Strip centers and neighborhood shopping centers anchored by grocers, pharmacies, and service-oriented tenants demonstrate resilience. These properties provide convenience for daily needs that e-commerce cannot easily replace.

Tenant mix matters enormously. Centers with grocery anchors (Kroger, Publix, Whole Foods) maintain occupancy above 93%, while centers anchored by struggling retailers face chronic vacancy.

Enclosed malls divide into A-malls (luxury, high-traffic destinations) and B/C-malls (struggling properties facing obsolescence). The performance gap between these categories exceeds any other REIT sector.

A-malls in affluent markets with experiential retail (Apple, Lululemon, restaurants, entertainment) maintain occupancy above 95% and achieve rent growth. B/C-malls face declining traffic, tenant bankruptcies, and potential redevelopment needs.

Tenant quality determines outcomes more than any other factor in retail REITs. Investment-grade tenants with strong balance sheets continue paying rent through economic downturns. Weak tenants default, leaving the REIT with vacancy and re-leasing costs.

The analysis framework examines:

- Tenant credit ratings: Percentage of rent from investment-grade tenants

- Sales per square foot: Tenant productivity indicates lease sustainability

- Lease rollover schedule: Concentration of near-term expirations creates risk

Net lease retail REITs own single-tenant properties leased to drugstores, dollar stores, quick-service restaurants, and convenience stores. These properties trade location convenience for tenant credit quality.

The triple-net structure shifts all operating expenses to tenants, creating bond-like income streams. However, single-tenant properties face total vacancy if the tenant leaves, versus multi-tenant centers that maintain partial occupancy.

Retail REITs typically offer higher yields (5-7%) than other sectors, reflecting higher perceived risk. Careful selection focusing on essential retail and strong tenant credit can capture this yield while managing downside.

Best Data Center & Tech REITs

Data center REITs own facilities that house servers, networking equipment, and data storage infrastructure for cloud computing, enterprise IT, and telecommunications. This sector benefits from exponential data growth and cloud migration.

Cloud computing demand drives structural growth as enterprises shift from on-premise IT infrastructure to cloud services. Amazon Web Services, Microsoft Azure, and Google Cloud require massive data center capacity to serve customers.

The math behind data growth: Global data creation grows approximately 25% annually, doubling every three years. This sustained growth creates continuous demand for new data center capacity.[6]

Hyperscale data centers serve the largest cloud providers with facilities exceeding 100,000 square feet and power capacity above 10 megawatts. These properties require significant capital investment but generate long-term leases with creditworthy tenants.

Colocation facilities offer space, power, and connectivity to multiple tenants ranging from enterprises to cloud providers. This multi-tenant model provides diversification but requires active management and customer acquisition.

Edge data centers positioned near population centers support applications requiring low latency (gaming, autonomous vehicles, real-time analytics). This emerging category adds growth potential but involves execution risk.

Growth versus valuation risk creates the central tension in data center REITs. Strong growth prospects attract investor enthusiasm, compressing yields to 2.5-3.5% and elevating valuation multiples.

The valuation framework compares:

- Price-to-FFO ratio: Data center REITs trade at 25-35x FFO versus 15-20x for diversified REITs

- Implied cap rates: The FFO yield on equity (FFO/share price) shows expected returns

- Growth rates: FFO growth of 8-12% annually justifies premium valuations if sustained

Technology obsolescence represents a unique risk. Data centers require continuous investment in power infrastructure, cooling systems, and connectivity to remain competitive. Facilities that fall behind technological requirements lose tenants to newer competitors.

The best data center REITs maintain modern portfolios in key connectivity hubs with diversified tenant bases and strong balance sheets to fund ongoing capital investment.

Best REIT ETFs for Instant Diversification

REIT exchange-traded funds provide immediate diversification across dozens of individual REITs, reducing single-stock risk and simplifying portfolio construction. These funds suit investors seeking REIT exposure without individual security analysis.

The diversification benefit: A single REIT faces company-specific risks from management decisions, tenant concentration, or regional economic weakness. A REIT ETF holding 50-100 REITs eliminates these idiosyncratic risks.

The math shows concentration risk clearly: A portfolio of 5 REITs where one cuts its dividend by 50% suffers a 10% income reduction (assuming equal weighting). A 100-REIT ETF experiencing the same event loses only 0.5% of income.

Why Some Investors Prefer REIT ETFs

Reduced single-stock risk eliminates the possibility that poor management, unexpected tenant losses, or property-specific problems destroy returns. ETFs provide the sector’s average performance without individual company volatility.

Lower volatility results from diversification. Individual REITs can decline 20-30% on disappointing earnings or dividend cuts. Diversified REIT ETFs typically show 30-40% less volatility than individual holdings.

The trade-off: ETFs eliminate both downside disasters and upside home runs. Investors sacrifice the potential 100%+ returns from selecting winning REITs in exchange for more predictable sector-average performance.

Simplified portfolio management appeals to investors lacking time or expertise for individual REIT analysis. A single ETF purchase provides exposure to the entire REIT sector or specific subsectors.

Lower minimum investment allows portfolio construction with limited capital. Buying 10 individual REITs at $50-100 per share requires $5,000-10,000. A REIT ETF provides the same diversification for any amount.

Automatic rebalancing occurs as the ETF maintains its target allocation. Individual portfolios require periodic selling of winners and buying of laggards to maintain desired weights—a discipline many investors struggle to execute.

For those building diversified portfolios, understanding asset allocation principles helps determine appropriate REIT exposure levels.

Popular REIT ETF Examples

Broad market REIT ETFs track indices containing all publicly traded REITs across sectors. These funds provide complete REIT market exposure with expense ratios typically below 0.15%.

Example characteristics of broad REIT ETFs:

- Holdings: 150-200 REITs across all property sectors

- Yield: 3.5-4.5% depending on market conditions

- Expense ratio: 0.10-0.15% annually

- Liquidity: High daily trading volume enables easy entry and exit

Sector-specific REIT ETFs focus on particular property types like residential, healthcare, or industrial. These funds suit investors with conviction about specific sector opportunities.

The strategic use: An investor believing industrial REITs will outperform due to e-commerce growth can overweight that sector through a focused ETF while maintaining some diversification within the sector.

Dividend-focused REIT ETFs screen for REITs with strong dividend growth histories and sustainable payout ratios. These funds typically yield less than broad market ETFs but offer better dividend growth prospects.

The income strategy combines current yield with dividend growth: A fund yielding 3.5% today with 5% annual dividend growth provides a 5.7% yield on cost after 10 years, plus share price appreciation from FFO growth.

International REIT ETFs provide exposure to real estate markets outside the United States. These funds add geographic diversification but introduce currency risk and different regulatory frameworks.

Comparing dividend-focused ETF strategies across asset classes helps optimize income portfolio construction.

Are REITs a Good Investment Right Now?

The attractiveness of REITs in 2026 depends on interest rate expectations, inflation trends, and sector-specific fundamentals. No asset class remains universally attractive across all market conditions.

Current market context: After Federal Reserve rate hikes during 2022-2023, rates have stabilized in 2026, creating a more favorable environment for rate-sensitive assets like REITs. However, valuations reflect improved conditions, reducing the margin of safety.

The analytical framework examines relative value: REIT FFO Yield versus 10-Year Treasury Yield = REIT Risk Premium

When REIT FFO yields exceed Treasury yields by 200+ basis points (2%), REITs offer attractive compensation for additional risk. Spreads below 100 basis points suggest expensive valuations.

Interest Rates & REIT Performance

Why rates matter: REITs use debt financing to acquire properties and fund development. Rising interest rates increase borrowing costs, reducing FFO and making new investments less profitable.

The mathematical relationship: A REIT earning a 6% cap rate on properties while borrowing at 3% generates positive leverage. If borrowing costs rise to 5%, the spread narrows from 3% to 1%, reducing returns significantly.

Valuation sensitivity to interest rates occurs because investors compare REIT yields to risk-free Treasury yields. When Treasury yields rise from 2% to 5%, the relative attractiveness of a 4% REIT yield declines substantially.

The discount rate effect: Higher interest rates increase the discount rate applied to future cash flows, reducing present value. A REIT expected to generate $5/share FFO in perpetuity is worth $100/share at a 5% discount rate but only $71/share at a 7% discount rate.

Historical behavior during rate cycles shows REITs typically underperform during rapid rate increases but outperform during rate stability or declining rate environments.

The data from 1995-2025 shows:

- Rising rate periods: REITs returned 5-7% annually versus 10-12% for broader equities

- Stable rate periods: REITs returned 10-12% annually, matching broader markets

- Falling rate periods: REITs returned 15-20% annually, outperforming significantly

The 2026 outlook depends on Federal Reserve policy and inflation trends. If rates remain stable or decline modestly, REITs should deliver attractive total returns from 4% yields plus 3-5% FFO growth.

Inflation Protection Explained

Rent escalations built into leases provide natural inflation hedging. Most commercial leases include annual rent increases of 2-3% or inflation-linked adjustments.

The mechanism: A lease with 3% annual escalations automatically increases NOI by 3% each year, offsetting inflation’s impact on operating expenses and preserving real returns.

Real asset advantage comes from owning physical property that appreciates with inflation. Unlike bonds that pay fixed nominal returns, real estate values and rents rise with general price levels.

The long-term evidence: From 1972-2025, REITs delivered 9.2% annualized returns while inflation averaged 3.8%, producing real returns of 5.4% annually. This outpaced inflation by a comfortable margin.

Operating expense inflation creates the offset risk. Property taxes, insurance, utilities, and maintenance costs rise with inflation, partially offsetting rent growth.

The net effect depends on the lease structure:

- Triple-net leases: Tenants pay operating expenses, fully protecting REIT margins

- Gross leases: REITs pay operating expenses, exposing margins to inflation

- Modified gross leases: Expenses are shared, creating partial protection

Quality REITs with triple-net lease exposure or strong pricing power to pass through expense increases provide superior inflation protection.

Risks of Investing in REITs

Understanding REIT risks requires examining both obvious factors (interest rates) and subtle vulnerabilities (lease rollover concentration, regulatory changes) that create unexpected losses.

Interest rate sensitivity receives extensive attention but manifests differently across REIT sectors. Long-lease industrial REITs show less sensitivity than short-lease apartment REITs because cash flows are locked in longer.

The duration concept applies: REITs with average lease terms of 7+ years behave like intermediate-term bonds, showing moderate rate sensitivity. REITs with 1-2 year average lease terms reprice quickly, showing less rate sensitivity but more economic cycle exposure.

High leverage risk amplifies both gains and losses. REITs with debt-to-equity ratios above 1.5x face significant refinancing risk if credit markets tighten or interest rates rise further.

The math of leverage: A REIT with 60% debt financing (debt-to-equity of 1.5x) that experiences a 10% decline in property values sees equity value decline 25% (10% loss ÷ 40% equity = 25% equity loss).

Tenant concentration creates binary risk. REITs deriving more than 20% of revenue from any single tenant face severe consequences if that tenant defaults or exercises lease termination rights.

The analysis requires examining:

- Largest tenant as a percentage of total rent

- Top 10 tenants as a percentage of total rent

- Tenant lease expiration schedule

- Tenant financial health and credit ratings

Sector-specific downturns can devastate even well-managed REITs. Office REITs face structural challenges from remote work adoption. Retail REITs suffered from e-commerce disruption. Hotel REITs collapsed during COVID-19 travel restrictions.

The diversification imperative: Sector concentration risk requires either deep conviction in sector fundamentals or diversification across multiple property types.

Tax treatment of dividends creates a hidden cost many investors overlook. Most REIT dividends are taxed as ordinary income (up to 37% federal rate) rather than qualified dividends (20% maximum rate).

The after-tax math: A REIT yielding 5% produces 3.15% after-tax yield for an investor in the 37% bracket, versus 4% after-tax for qualified dividends at a 20% tax rate.

Liquidity risk during market stress can create forced selling at depressed prices. REITs trade like stocks and can decline 30-50% during market panics, even if underlying property values remain stable.

The behavioral challenge: Investors who need to access capital during downturns may be forced to sell at precisely the wrong time, crystallizing losses that patient investors avoid.

Applying risk management frameworks helps investors size REIT positions appropriately within the overall portfolio context.

How to Build a REIT Portfolio (Beginner-Friendly)

Portfolio construction begins with defining objectives: income generation, capital appreciation, or balanced total returns. The strategy determines sector selection, individual REIT versus ETF choice, and position sizing.

Asset allocation establishes REIT exposure as a percentage of the total portfolio. Financial advisors typically recommend 5-15% REIT allocation within diversified portfolios, though income-focused investors may allocate 20-30%.

The framework considers:

- Age and time horizon: Younger investors can emphasize growth-oriented sectors

- Income needs: Retirees may prioritize high-yield, stable sectors

- Risk tolerance: Conservative investors favor healthcare and residential over development-heavy REITs

- Tax situation: High-tax-bracket investors should hold REITs in retirement accounts

Income-Focused Strategy

High-yield sectors include retail, office, and mortgage REITs, offering yields of 5-8%. These higher yields compensate for the elevated risk from sector challenges or leverage.

The portfolio construction:

- 40% Healthcare REITs: Demographic tailwinds, stable cash flows, 4.5-5.5% yields

- 30% Retail REITs (essential/grocery-anchored): Resilient tenants, 5-6% yields

- 20% Residential REITs: Housing shortage support, 3.5-4.5% yields

- 10% Diversified REITs: Multi-sector exposure, 4-5% yields

Target portfolio yield: 4.5-5.5% with moderate risk from sector diversification

Dividend sustainability screening eliminates yield traps:

- Payout ratios below 85% of AFFO

- Positive dividend growth over the past 5 years

- Investment-grade credit ratings (BBB- or higher)

- Debt-to-equity below 1.2x

The income strategy prioritizes current cash flow over capital appreciation, accepting lower growth potential in exchange for higher immediate yields.

Growth-Oriented Strategy

High-growth sectors include industrial, data center, and self-storage REITs, offering FFO growth of 6-10% annually but lower current yields of 2.5-4%.

The portfolio construction:

- 40% Industrial REITs: E-commerce tailwinds, 3-4% yields, 6-8% FFO growth

- 30% Data Center REITs: Cloud computing growth, 2.5-3.5% yields, 8-12% FFO growth

- 20% Self-Storage REITs: Operational efficiency, 3.5-4.5% yields, 4-6% FFO growth

- 10% Residential (single-family): Emerging sector, 3-4% yields, 5-7% FFO growth

Target portfolio yield: 3-4% with higher total return potential from FFO growth and multiple expansion

Growth sustainability screening identifies quality operators:

- FFO growth above 5% annually over the past 5 years

- Development pipeline with pre-leasing above 50%

- Same-store NOI growth consistently positive

- Market share gains in target sectors

The growth strategy sacrifices current income for capital appreciation potential, suiting investors who don’t need immediate cash flow.

Balanced REIT Allocation Example

The balanced approach combines income and growth objectives through diversified sector exposure:

- 25% Industrial REITs: Growth and stability

- 20% Healthcare REITs: Demographic support and income

- 20% Residential REITs: Inflation protection

- 15% Data Center REITs: High growth potential

- 10% Self-Storage REITs: Operational excellence

- 10% Diversified REITs: Multi-sector exposure

Target portfolio yield: 3.5-4.5% with 5-7% FFO growth potential

This allocation provides current income while participating in secular growth trends across multiple sectors. The diversification reduces single-sector risk while maintaining growth potential.

Rebalancing discipline maintains target allocations as sectors outperform or underperform. Annual rebalancing sells winners and buys laggards, enforcing buy-low, sell-high behavior.

The mathematical benefit: Rebalancing a portfolio of assets with 10% average returns but uncorrelated volatility adds 0.5-1.0% annually versus buy-and-hold through the volatility reduction benefit.

Understanding portfolio allocation strategies across all asset classes creates the foundation for wealth building.

REIT Taxes Explained

Tax treatment significantly impacts REIT returns, particularly for investors in high tax brackets. Understanding these rules enables optimal account placement and after-tax return maximization.

Ordinary income versus qualified dividends creates the primary tax disadvantage of REITs. Most REIT distributions are taxed at ordinary income rates (10-37% federal) rather than the preferential qualified dividend rate (0-20%).

The reason: REITs don’t pay corporate income tax because they distribute 90%+ of taxable income. Therefore, dividends represent ordinary income passed through to shareholders rather than qualified dividends from taxed corporate earnings.

The tax calculation example:

- REIT dividend: $1,000

- Investor tax bracket: 32% ordinary income, 15% qualified dividends

- Tax on REIT dividend: $320

- Tax on equivalent qualified dividend: $150

- Additional tax cost: $170 (53% higher)

Return of capital distributions occurs when REITs distribute more than their current-year taxable income. These distributions reduce cost basis rather than creating immediate taxable income.

The mechanism: A REIT might distribute $3/share when taxable income is only $2.50/share. The $0.50 difference is a return of capital, reducing your cost basis from $50 to $49.50 per share.

The deferred tax benefit: Return of capital isn’t taxed until you sell the shares, when it increases capital gains. This deferral provides a time value benefit.

Section 199A deduction (Qualified Business Income deduction) allows investors to deduct 20% of REIT ordinary dividends, reducing the effective tax rate.

The calculation for a 32% bracket investor:

- REIT dividend: $1,000

- Section 199A deduction: $200 (20% of $1,000)

- Taxable amount: $800

- Tax owed: $256 (32% of $800)

- Effective tax rate: 25.6% instead of 32%

This deduction expires after 2025 under current law, though Congress may extend it. Investors should plan for potential tax increases if the deduction expires.

Taxable versus retirement accounts creates the account placement decision. REITs generate tax-inefficient income, making them ideal for tax-deferred accounts.

The priority for account placement:

- Tax-deferred accounts (Traditional IRA, 401k): Best for high-yield REITs

- Tax-free accounts (Roth IRA): Good for growth-oriented REITs

- Taxable accounts: Use only after retirement accounts are maximized

REITs in IRAs eliminate annual tax on dividends, allowing full dividend reinvestment and compound growth. The trade-off: Distributions from traditional IRAs in retirement are taxed as ordinary income regardless of source.

The math of tax-deferred compounding: A REIT yielding 5% in a taxable account for a 32% bracket investor nets 3.4% after taxes (assuming 199A deduction). The same REIT in a traditional IRA compounds at the full 5% until withdrawal.

Over 30 years, the difference is dramatic:

- Taxable account: $10,000 grows to $27,400 at 3.4% after-tax return

- Traditional IRA: $10,000 grows to $43,200 at 5% pre-tax return

Even accounting for taxes on IRA distributions, the tax-deferred compounding advantage exceeds 30%.

For comprehensive tax planning, reviewing capital gains tax strategies provides additional optimization opportunities.

REIT Portfolio Builder

Calculate your personalized REIT allocation and projected returns

Your REIT Portfolio Projection

Conclusion — Are REITs Worth Investing In?

REITs deserve consideration in most diversified portfolios because they provide income, inflation protection, and exposure to real estate without direct property ownership burdens. The best REITs to invest in combine sustainable dividend coverage, sector positioning in growing markets, and balance sheet strength.

Who should invest in REITs:

- Income-focused investors seeking current cash flow above bond yields

- Investors wanting real estate exposure without property management

- Portfolio builders seeking diversification beyond stocks and bonds

- Long-term investors who can hold through interest rate cycles

- Tax-deferred account holders who can maximize tax efficiency

Who should avoid REITs:

- Investors needing principal preservation and minimal volatility

- Those in high tax brackets with only taxable accounts available

- Short-term traders are unable to handle 20-30% drawdowns

- Investors are already heavily exposed to real estate through property ownership

- Those seeking maximum capital appreciation over income generation

Key takeaway summary:

The math behind REIT investing shows that sustainable dividends from quality operators in growing sectors create wealth building through compound growth. FFO analysis, payout ratio evaluation, and sector selection determine outcomes more than market timing.

Start with broad diversification through REIT ETFs, then add individual REITs in sectors you understand as knowledge develops. Prioritize dividend sustainability over high yields, maintain sector diversification, and hold REITs in tax-advantaged accounts when possible.

The evidence-based approach combines current yields of 3-5% with FFO growth of 4-7% annually, producing total returns of 7-12% over full market cycles. This performance supports long-term financial goals when REITs occupy appropriate portfolio allocations.

For investors building comprehensive financial plans, exploring passive income strategies across multiple asset classes creates resilient wealth-building systems.

References

[1] Securities and Exchange Commission. “Real Estate Investment Trusts (REITs).” SEC.gov, 2026.

[2] National Association of Real Estate Investment Trusts (Nareit). “Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO).” Nareit.com, 2026.

[3] U.S. Census Bureau. “Housing Units Authorized by Building Permits.” Census.gov, 2026.

[4] U.S. Census Bureau. “2023 National Population Projections Tables.” Census.gov, 2023.

[5] Prologis Research. “The Impact of E-Commerce on Logistics Real Estate.” Prologis.com, 2025.

[6] International Data Corporation. “Worldwide Global DataSphere Forecast, 2026–2030.” IDC.com, 2026.

[7] Nareit. “REIT Industry Total Return Performance.” Nareit.com, 2026.

Disclaimer

This article is for educational purposes only and does not constitute financial, investment, tax, or legal advice. The information presented represents a general analysis of REIT investing principles and should not be interpreted as recommendations to buy or sell specific securities.

REIT investments carry risks including interest rate sensitivity, sector-specific downturns, dividend cuts, and share price volatility. Past performance does not guarantee future results. Individual circumstances vary significantly, and investors should conduct thorough due diligence or consult qualified financial advisors before making investment decisions.

Tax treatment of REITs depends on individual circumstances and current tax law, which changes periodically. Consult tax professionals for guidance specific to your situation.

The Rich Guy Math provides educational content to improve financial literacy and does not provide personalized investment advice or manage client assets.

About the Author

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform dedicated to teaching the math behind money. With expertise in investment analysis, valuation principles, and evidence-based wealth-building strategies, Max translates complex financial concepts into clear, actionable insights.

His analytical approach combines quantitative frameworks with practical application, helping readers understand cause-and-effect relationships in personal finance and investing. Max’s work emphasizes financial literacy through data, logic, and proven principles rather than speculation or market timing.

Learn more about evidence-based financial education at The Rich Guy Math.

FAQs — Best REITs to Invest In

What are the best REITs to invest in for beginners?

Beginners should start with diversified REIT ETFs rather than individual REITs to reduce single-stock risk and simplify portfolio management.

A broad market REIT ETF provides exposure to 100+ REITs across multiple sectors with a single purchase. This diversification helps smooth volatility and limits the impact of poor performance from any single property type.

After gaining experience, investors can add individual REITs in easier-to-understand sectors such as residential or healthcare REITs, which tend to have stable demand drivers and predictable cash flows.

Are REITs safer than stocks?

REITs are not inherently safer than stocks—they carry different types of risk. REITs provide more predictable income due to mandatory dividend distributions and ownership of tangible real estate assets.

However, REITs are more sensitive to interest rate changes and property market conditions than many traditional stocks. A high-quality healthcare REIT may be safer than a speculative tech stock, but riskier than a defensive consumer staples company.

Safety depends on the specific REIT, its balance sheet strength, property quality, and sector exposure—not on the REIT structure alone.

How much should I invest in REITs?

Financial advisors commonly recommend allocating 5% to 15% of a diversified portfolio to REITs.

Income-focused investors or retirees may increase allocations to 15%–25% to generate higher cash flow. However, concentrating more than 25% in REITs increases exposure to interest rate and real estate sector risks.

The ideal allocation depends on age, income needs, risk tolerance, and existing real estate exposure, such as owning a primary residence. Beginners should start with 5%–10% and increase gradually as they gain experience.

Do REITs pay monthly dividends?

Most REITs pay dividends quarterly, though a smaller number distribute dividends monthly.

Monthly dividend REITs can appeal to investors who want consistent cash flow for living expenses. However, dividend frequency should not be the primary investment criterion.

Total return, dividend sustainability, property quality, and balance sheet strength matter more than whether dividends are paid monthly or quarterly.

Can REITs lose value?

Yes, REIT share prices can decline due to market volatility, rising interest rates, or weakening property fundamentals.

During the 2008 financial crisis, REIT indices fell 60%–70%. In the 2020 pandemic, hotel and retail REITs declined 40%–50%.

However, high-quality REITs with strong balance sheets and diversified portfolios typically recover as property markets stabilize. While REIT prices can be volatile, underlying property values tend to change more gradually, creating opportunities for long-term investors.

Are REITs good during inflation?

REITs generally provide better inflation protection than bonds, but results vary compared to stocks.

Rising rents, lease escalations, and property value appreciation help REITs maintain purchasing power during inflation. However, rising interest rates—which often accompany inflation—can pressure REIT valuations.

Historically, REITs have delivered positive real (inflation-adjusted) returns in most inflationary periods, especially in sectors with short-term leases such as residential and self-storage REITs.

Should REITs be held in a retirement account?

Yes, REITs are well-suited for retirement accounts because their dividends are taxed as ordinary income in taxable accounts.

Holding REITs in a traditional IRA or 401(k) allows dividends to compound tax-deferred, while Roth IRAs provide tax-free growth and withdrawals.

For example, a 5% REIT yield taxed at a 32% marginal rate produces only a 3.4% after-tax return in a brokerage account, but compounds at the full 5% in a retirement account.