Imagine two friends, Sarah and Mike, each inheriting $10,000 from their grandparents. Sarah puts her money in a savings account earning simple interest, while Mike chooses one that compounds annually. Fast forward 20 years, and Mike has thousands more than Sarah, even though they started with the same amount and the same interest rate. How is that possible?

The answer lies in understanding one of the most powerful concepts in personal finance: the difference between compound interest vs simple interest. This distinction can literally make or break your financial future, yet most people don’t fully grasp how these two types of interest work. Whether you’re saving for retirement, paying off debt, or building wealth, knowing this difference is absolutely crucial. Thrivent

TL;DR Summary

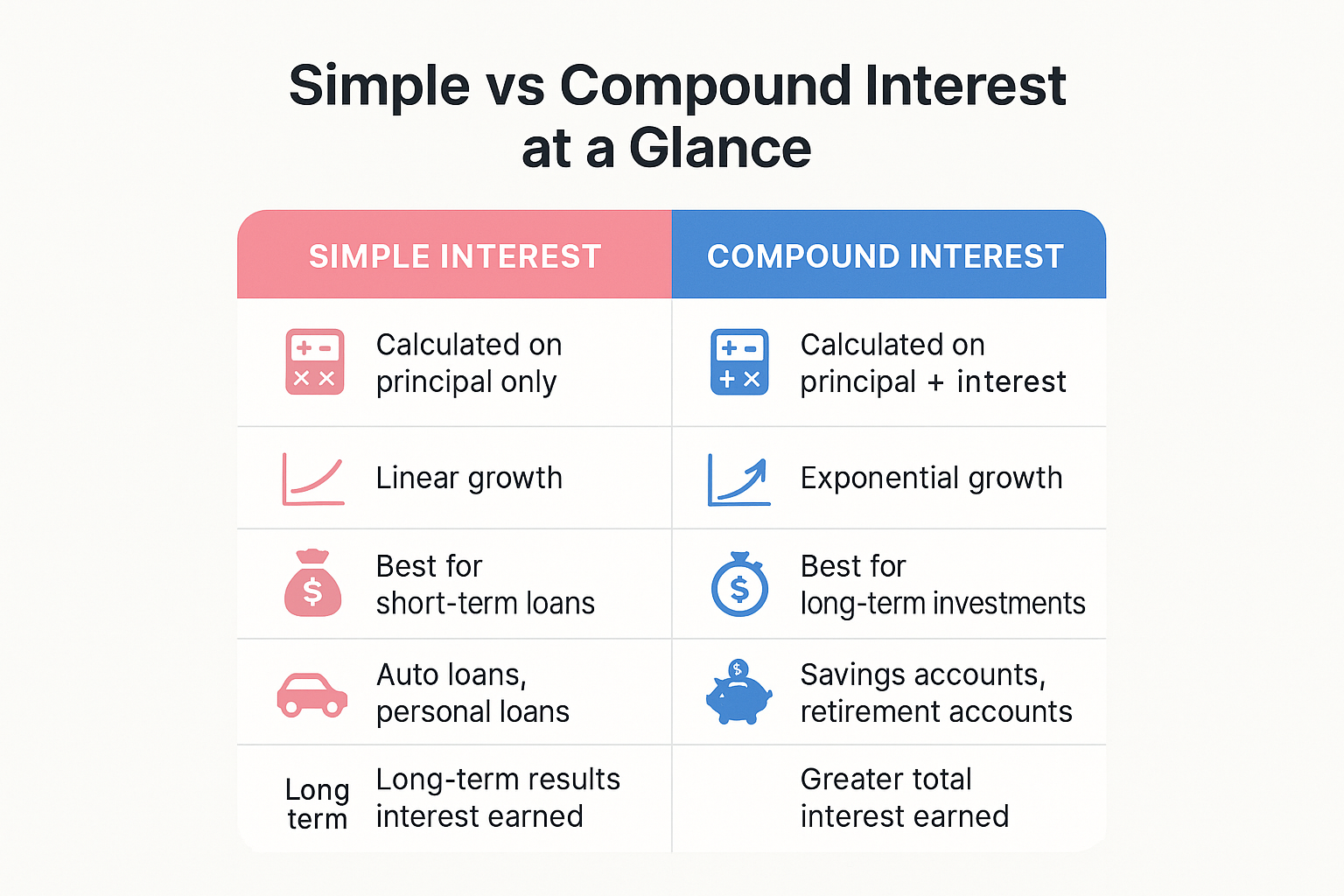

- Simple interest is calculated only on the principal amount, meaning you earn the same dollar amount each year regardless of accumulated interest.

- Compound interest is calculated on both the principal and previously earned interest, creating exponential growth over time—often called “interest on interest.”

- The formula for simple interest is: I = P × r × t, while compound interest uses: A = P(1 + r/n)^(nt).

- Over long periods, compound interest significantly outperforms simple interest, sometimes by hundreds of thousands of dollars on the same principal.

- Understanding this difference is essential for maximizing investment returns and minimizing debt costs; it’s the foundation of smart financial moves.

What Is Simple Interest?

In simple terms, simple interest means you earn interest only on your original principal amount, period. No matter how long your money sits in the account, the interest calculation never changes; it’s always based on that initial deposit.

Think of simple interest like a part-time job where you get paid the same hourly rate every single shift. If you earn $20 per hour, you make $20 every hour you work, no raises, no bonuses. Simple interest works the same way: your money “works” at the same rate throughout the entire investment period.

The Simple Interest Formula

The formula for simple interest is refreshingly straightforward:

I = P × r × t

Where:

- I = Interest earned

- P = Principal (initial amount)

- r = Annual interest rate (as a decimal)

- t = Time (in years)

Example: If you invest $5,000 at 5% simple interest for 10 years:

- I = $5,000 × 0.05 × 10

- I = $2,500

You’d earn exactly $2,500 in interest over those 10 years, $250 per year, every year. Your total would be $7,500 ($5,000 principal + $2,500 interest).

Where You’ll Find Simple Interest

Simple interest is relatively rare in modern savings and investment accounts, but you’ll still encounter it in:

- Short-term personal loans

- Auto loans (in some cases)

- Certificates of deposit (occasionally)

- Bonds (coupon payments)

- Some money market accounts

Many consumer loans use simple interest because it’s easier to calculate and explain to borrowers. However, the simplicity comes at a cost, or a benefit, depending on which side of the transaction you’re on.

What Is Compound Interest? (The Exponential Growth Machine)

Compound interest is interest calculated on both the initial principal and all previously accumulated interest. This creates a snowball effect where your money grows faster and faster over time.

Albert Einstein allegedly called compound interest “the eighth wonder of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.” Whether he actually said this or not, the sentiment is absolutely true.

The Compound Interest Formula

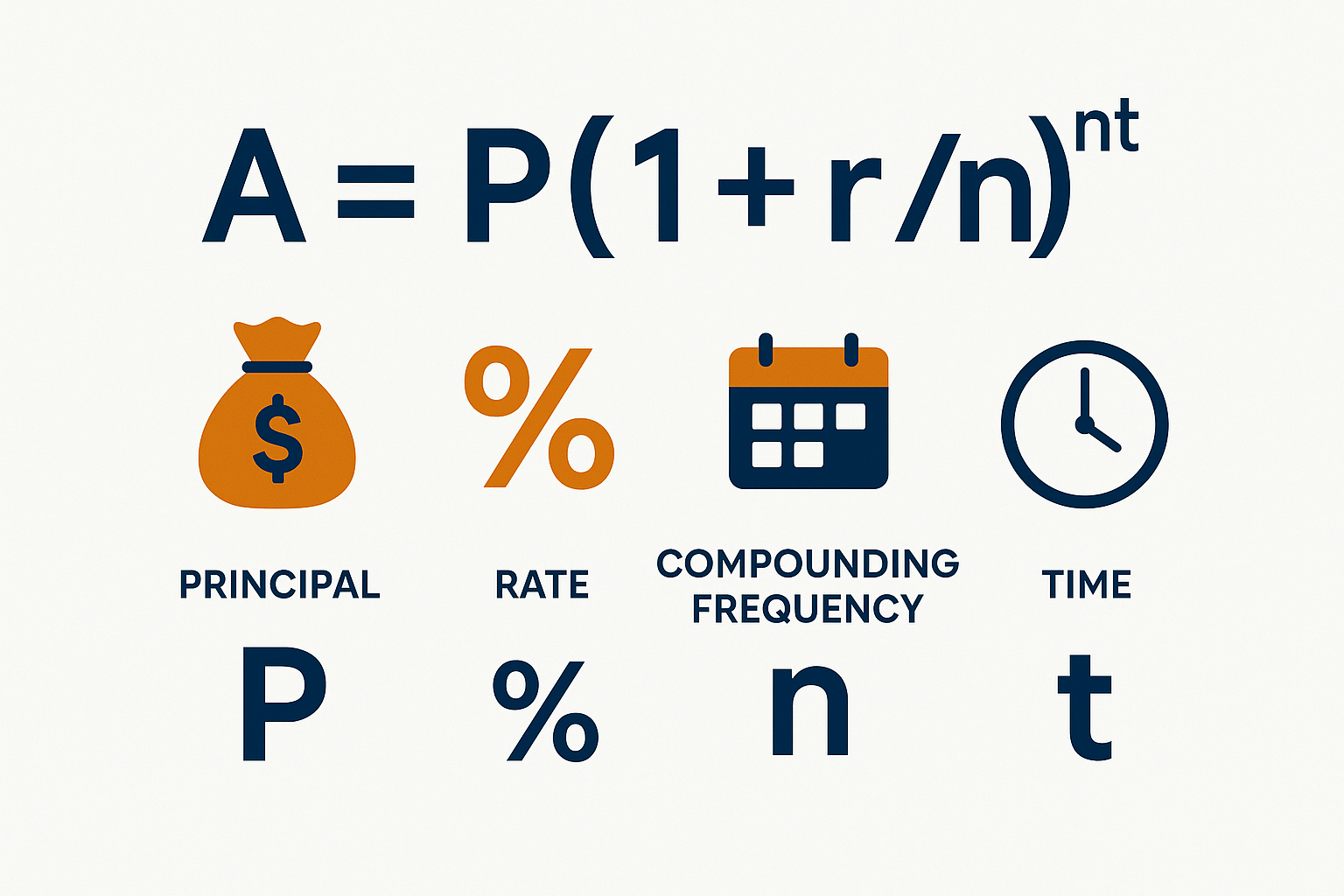

The compound interest formula is more complex but incredibly powerful:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Time (in years)

Example: Using the same $5,000 at 5% for 10 years, but compounded annually (n=1):

- A = $5,000(1 + 0.05/1)^(1×10)

- A = $5,000(1.05)^10

- A = $5,000 × 1.6289

- A = $8,144.47

Your total would be $8,144.47, that’s $3,144.47 in interest, compared to just $2,500 with simple interest. That’s an extra $644.47 just from compounding!

Compounding Frequency Matters

Interest can compound at different intervals:

| Compounding Frequency | Times Per Year (n) |

|---|---|

| Annually | 1 |

| Semi-annually | 2 |

| Quarterly | 4 |

| Monthly | 12 |

| Daily | 365 |

| Continuously | ∞ (uses different formula) |

The more frequently interest compounds, the more you earn. Using our $5,000 example at 5% for 10 years:

- Annually: $8,144.47

- Quarterly: $8,218.10

- Monthly: $8,235.05

- Daily: $8,243.32

The difference between annual and daily compounding is nearly $100, free money just from more frequent compounding!

Compound Interest vs Simple Interest: The Head-to-Head Comparison

Let’s break down the key differences in a way that makes the contrast crystal clear:

Calculation Method

Here’s a quick comparison between simple interest and compound interest:

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Calculated only on the principal amount | Calculated on the principal plus accumulated interest |

| Growth Type | Linear growth | Exponential growth |

| Interest Earned | Same dollar amount each period | Increases each period as interest compounds |

| Predictability | Predictable and constant | Grows faster over time, less predictable |

| Example | $10,000 at 5% for 3 years = $11,500 | $10,000 at 5% compounded yearly for 3 years ≈ $11,576.25 |

As shown above, the main difference between simple interest and compound interest lies in how interest is calculated — simple interest grows linearly, while compound interest grows exponentially.”

Growth Pattern Over Time

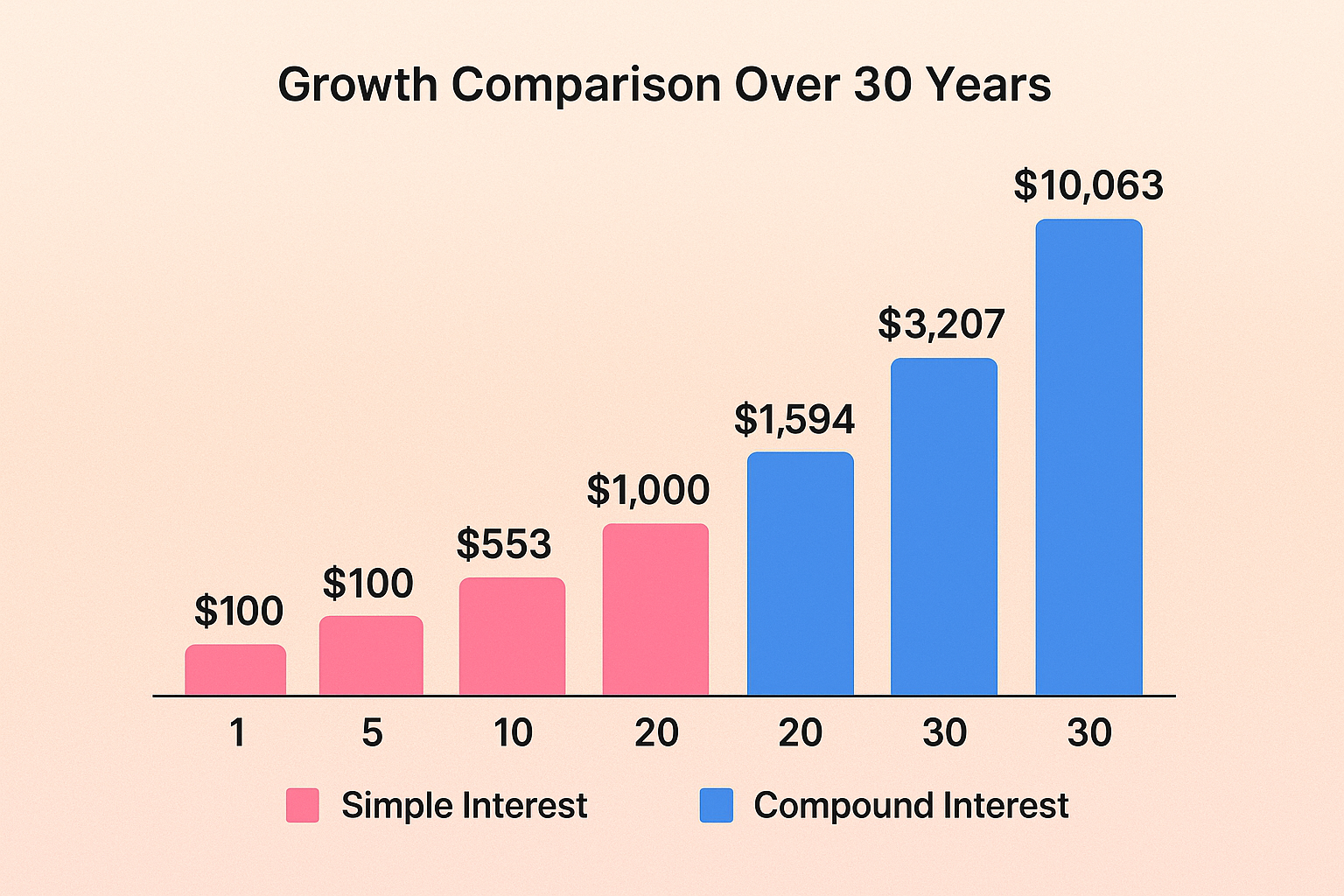

Here’s where things get really interesting. Let’s compare $10,000 invested at 6% for 30 years:

Here’s how your money grows under simple and compound interest over time:

| Year | Simple Interest ($) | Compound Interest (Annual, $) |

|---|---|---|

| 1 | 10,600 | 10,600 |

| 5 | 13,000 | 13,382 |

| 10 | 16,000 | 17,908 |

| 20 | 22,000 | 32,071 |

| 30 | 28,000 | 57,435 |

Under simple interest, your balance grows in a straight line, adding the same $600 each year.

With compound interest, growth accelerates — you earn interest on interest, creating an exponential curve.

The difference? $29,435! That’s more than double the original principal, and it’s all because of compounding. This is why starting to invest early makes such a massive difference in wealth building.

The Rule of 72

Here’s a quick mental math trick: The Rule of 72 tells you approximately how long it takes for your money to double with compound interest.

Formula: 72 ÷ interest rate = years to double

Examples:

- At 6% interest: 72 ÷ 6 = 12 years to double

- At 8% interest: 72 ÷ 8 = 9 years to double

- At 10% interest: 72 ÷ 10 = 7.2 years to double

This rule only works with compound interest; simple interest doesn’t double your money in any predictable timeframe because the growth is linear, not exponential.

Real-World Examples: Where Each Type Matters

Savings and Investments (Compound Interest Wins)

When you’re building wealth, compound interest is your best friend. This is why:

- Retirement accounts (401(k), IRA) use compound interest

- Stock market returns compound over time through dividend reinvestment

- High-yield savings accounts compound (usually daily or monthly)

- Certificates of Deposit (CDs) typically compound

Real Story: Meet Jennifer, who started investing $200 monthly at age 25 in an account earning 8% annually. By age 65, she’d contributed $96,000 of her own money. But thanks to compound interest, her account would be worth approximately $622,000! That’s over $526,000 in compound interest earnings, more than five times her contributions.

Understanding how the stock market works and the power of compounding can help you make informed investment decisions that leverage this exponential growth.

Debt and Loans (Compound Interest Can Hurt)

On the flip side, when you’re borrowing money, compound interest works against you:

- Credit card debt compounds (often daily!)

- Student loans typically compound

- Mortgages use a form of compound interest

- Personal loans may use either type

Warning Story: Michael had $5,000 in credit card debt at 18% APR (compounded daily). He made only minimum payments of $100/month. It took him over 7 years to pay off the debt, and he paid nearly $3,400 in interest, 68% of the original balance! This is why understanding the cycle of financial emotions and avoiding high-interest debt is crucial.

Auto Loans and Personal Loans (Often Simple Interest)

Many auto loans and personal loans use simple interest, which actually benefits borrowers:

- Interest is calculated on the remaining principal

- Paying extra goes directly to the principal

- No penalty for early payoff

- More predictable payment schedules

Pro Tip: When you pay extra on a simple interest loan, that money goes straight to reducing the principal, which immediately reduces future interest charges. With compound interest debt, the impact can be less immediate.

Advantages and Limitations of Each

Simple Interest: Pros and Cons

Advantages:

Easy to calculate and understand

Predictable returns or costs

Beneficial for borrowers (lower total interest)

Transparent—no hidden compounding

Better for short-term scenarios

Limitations:

Significantly lower returns for savers/investors

Doesn’t take advantage of the time value of money

Rarely used in modern investment accounts

Misses out on exponential growth potential

Not ideal for long-term wealth building

Compound Interest: Pros and Cons

Advantages:

Exponential growth over time

Maximizes long-term returns

“Interest on interest” accelerates wealth building

Standard for most investment accounts

Time becomes your ally; the longer, the better

Creates passive income streams that grow automatically

Limitations:

More complex to calculate

Can work against you with debt

Requires patience; short-term gains are modest

Credit card companies use it to maximize profits

It can be devastating if you’re on the wrong side (as a borrower)

How to Use This Knowledge in Your Financial Decisions

For Savers and Investors

1. Always choose compound interest accounts

Look for savings accounts, investment accounts, and retirement funds that compound interest—ideally daily or monthly for maximum effect.

2. Reinvest dividends and interest

When investing in dividend-paying stocks, always reinvest those dividends to take full advantage of compounding.

3. Start as early as possible

Time is the most powerful factor in compound interest. Starting 10 years earlier can literally double or triple your final wealth, even with the same monthly contribution.

4. Be consistent

Regular contributions amplify the compounding effect. Even small amounts add up significantly over time.

5. Choose the right compounding frequency

All else being equal, daily compounding beats monthly, which beats quarterly, which beats annual. Check before you invest!

For Borrowers

1. Avoid compound interest debt like credit cards

Credit card debt compounds daily at high rates—it’s financial quicksand. Pay these off first.

2. Make extra payments on compound interest loans

Extra payments reduce the principal, which reduces the amount that future interest compounds on.

3. Prefer simple interest loans when possible

For auto loans and personal loans, simple interest is usually better for borrowers.

4. Pay attention to compounding frequency

A loan that compounds daily will cost you more than one that compounds monthly, even at the same APR.

5. Understand amortization

Mortgages use compound interest, but with amortization, your payments are structured so you pay more interest upfront. Extra principal payments early in the loan can save massive amounts.

Common Mistakes to Avoid

1: Underestimating the Power of Time

Many people think, “I’ll start investing seriously in my 30s or 40s.” But they don’t realize that starting at 25 versus 35 can mean a difference of hundreds of thousands of dollars due to compound interest.

The Fix: Start now, even with small amounts. A 25-year-old investing $100/month will likely end up with more at 65 than a 35-year-old investing $200/month, thanks to those extra 10 years of compounding.

2: Withdrawing Investment Gains Early

When you withdraw investment gains or dividends instead of reinvesting them, you break the compounding chain and dramatically reduce your long-term wealth.

The Fix: Set up automatic dividend reinvestment (DRIP) and resist the urge to cash out early. Let compounding do its magic.

3: Ignoring Compounding Frequency

Two accounts might advertise the same annual percentage rate (APR), but if one compounds daily and the other annually, the daily compounding account will earn significantly more.

The Fix: Always check the Annual Percentage Yield (APY), which accounts for compounding frequency, not just the APR.

4: Only Making Minimum Payments on Compound Interest Debt

Minimum payments on credit cards barely cover the compounding interest, leaving the principal virtually untouched. This can trap you in debt for years or even decades.

The Fix: Pay more than the minimum—ideally, pay off the full balance monthly. If you can’t, pay as much as possible to reduce the principal that interest compounds on.

5: Not Understanding Investment Returns

Many investors don’t realize that stock market returns compound over time. They see a 10% annual return and think linearly, not exponentially.

The Fix: Educate yourself on how compound returns work. A consistent 10% annual return doesn’t mean your money grows by 10% of the original principal each year—it grows by 10% of the current total, which includes all previous gains.

6: Falling for “Get Rich Quick” Schemes

Understanding compound interest helps you spot financial scams. If someone promises returns that seem too good to be true, they probably are. Legitimate compound interest growth is powerful but gradual.

The Fix: Be skeptical of investments promising unrealistic returns. Many people lose money in the stock market by chasing impossible returns instead of trusting steady compound growth.

Interpreting the Numbers: What Good Rates Look Like in 2025

For Savings and Investments

In 2025’s economic environment, here’s what to expect:

High-Yield Savings Accounts:

- Good rate: 4.5% – 5.5% APY

- Compounding: Daily

- Best for: Emergency funds and short-term savings

Certificates of Deposit (CDs):

- Good rate: 4.0% – 5.5% APY (depending on term)

- Compounding: Varies (monthly to annually)

- Best for: Money you won’t need for a specific period

Stock Market (Historical Average):

- Expected return: 10% – 11% annually (long-term average)

- Compounding: Continuous through reinvestment

- Best for: Long-term wealth building (10+ years)

Bonds:

- Good rate: 4% – 6% (varies by type and duration)

- Compounding: Usually semi-annual coupon payments

- Best for: Conservative investors seeking steady income

For Debt

Credit Cards:

- Average APR: 20% – 25% (compounded daily)

- Action: Pay off immediately—this is expensive debt!

Student Loans:

- Federal: 5% – 8% (compounded daily)

- Private: 4% – 14% (compounded daily)

- Action: Pay extra when possible, especially on high-rate loans

Mortgages:

- Good rate: 6% – 7.5% (as of 2025)

- Compounding: Monthly

- Action: Consider extra principal payments if the rate is above 6%

Auto Loans:

- Good rate: 5% – 8% (often simple interest)

- Action: Shop around and consider shorter terms

The Mathematical Truth: A 30-Year Comparison

Let’s look at a comprehensive example that shows the dramatic difference between compound and simple interest over a typical investment lifetime.

Scenario: $10,000 initial investment, $500 monthly contributions, 7% annual return, 30 years

Simple Interest Results:

- Total contributions: $190,000 ($10,000 + $500 × 12 × 30)

- Interest earned: $199,500 (7% of average balance over time)

- Final value: ~$389,500

Compound Interest Results:

- Total contributions: $190,000 (same)

- Interest earned: $422,000+ (compounding effect)

- Final value: ~$612,000

The difference: $222,500!

That’s an extra quarter-million dollars from the same contributions and same interest rate—just because interest was compounding instead of simple. This is more than the original principal and monthly contributions combined!

“Compound interest is the most powerful force in the universe.” — Often attributed to Albert Einstein (though likely apocryphal, the wisdom remains true)

Key Risks and Considerations

Inflation Risk

Both simple and compound interest can be eroded by inflation. If you’re earning 3% compound interest but inflation is running at 4%, you’re actually losing purchasing power.

Solution: Seek investments that historically outpace inflation, like stocks and dividend-paying equities, which have averaged 10%+ returns over the long term.

Tax Implications

Interest income is typically taxable, whether simple or compound. However, the timing differs:

- Simple interest: Tax liability is straightforward—you’re taxed on interest received each year

- Compound interest: You may owe taxes on interest you haven’t withdrawn (especially in non-retirement accounts)

Solution: Use tax-advantaged accounts (401(k), IRA, Roth IRA) to let your money compound tax-deferred or tax-free.

Market Risk

While we’ve used fixed interest rates in our examples, real-world investments like stocks have variable returns. The stock market experiences emotional cycles, and returns fluctuate year to year.

Solution: Focus on long-term averages and don’t panic during downturns. Compound interest works best over decades, not months.

Liquidity Considerations

Some compound interest accounts (like CDs) lock up your money for specific periods. Breaking them early can result in penalties that negate your compound interest gains.

Solution: Maintain an emergency fund in a liquid, high-yield savings account while keeping long-term money in higher-return compound interest investments.

FAQ

Simple interest is calculated only on the principal amount, while compound interest is calculated on both the principal and accumulated interest. This means compound interest grows exponentially over time, while simple interest grows linearly at a constant rate.

Compound interest is always better for investors and savers because it generates significantly higher returns over time. The longer the investment period, the more dramatic the difference becomes—often hundreds of thousands of dollars over a lifetime.

Use the formula A = P(1 + r/n)^(nt), where A is the final amount, P is the principal, r is the annual interest rate (as a decimal), n is the compounding frequency per year, and t is time in years. Many online calculators can do this automatically.

Most modern savings accounts, especially high-yield savings accounts, use compound interest that compounds daily or monthly. This benefits savers by maximizing their returns, though the effect is most noticeable over longer periods.

Credit card companies use compound interest (usually compounded daily) to maximize their profits from borrowers who carry balances. This is why credit card debt can spiral out of control quickly—the interest compounds on previous interest, creating exponential growth of what you owe.

In investment accounts, you can experience losses if the underlying investments decline in value, but the compounding mechanism itself doesn’t cause losses. However, with debt, compound interest can dramatically increase what you owe if you don’t make adequate payments.

The Rule of 72 provides a good guideline: divide 72 by your interest rate to find how many years it takes to double your money. Generally, you’ll see noticeable benefits after 5-10 years, with dramatic differences appearing after 20-30 years. Starting early is crucial.

Actionable Next Steps: Your Compound Interest Strategy

Now that you understand the profound difference between compound interest and simple interest, here’s your action plan:

Immediate Actions (This Week)

- Audit your current accounts

- Check if your savings accounts compound interest (and how frequently)

- Identify any simple interest accounts and consider switching

- Review your debt to see what’s compounding against you

- Open a high-yield savings account

- Look for accounts offering 4%+ APY with daily compounding

- Move your emergency fund there immediately

- Set up automatic transfers

- Review your credit card situation

- If you carry balances, create an aggressive payoff plan

- Consider balance transfer cards with 0% intro APR

- Commit to paying off compound interest debt first

Short-Term Actions (This Month)

- Set up retirement account contributions

- If your employer offers a 401(k) match, contribute at least enough to get the full match

- Open an IRA if you don’t have one

- Explore building passive income through investing

- Enable dividend reinvestment

- Set up DRIP (Dividend Reinvestment Plans) on all investment accounts

- This automates the compounding process

- Never withdraw investment gains unless necessary

- Educate yourself further

- Read about different investment strategies and approaches

- Understand the vehicles available for compound growth

- Learn about tax-advantaged accounts

Long-Term Actions (This Year and Beyond)

- Increase contribution amounts

- Aim to increase retirement contributions by 1% every year

- As your income grows, save the raises rather than spending them

- Automate increases so you don’t have to think about it

- Diversify your compound interest strategies

- Don’t put all eggs in one basket

- Consider a mix of stocks, bonds, and real estate

- Balance growth potential with risk tolerance

- Track your progress

- Review your accounts quarterly

- Celebrate milestones (first $10K, $50K, $100K, etc.)

- Adjust strategy as life circumstances change

- Teach others

- Share this knowledge with family and friends

- Help your children understand compound interest early

- Consider reading about how to set up your kids for financial success

The Bottom Line: Time Is Your Most Valuable Asset

The difference between compound interest and simple interest isn’t just a mathematical curiosity; it’s the difference between financial mediocrity and financial freedom. While simple interest offers predictability and transparency, compound interest offers something far more valuable: exponential growth that can transform modest savings into substantial wealth over time.

The key takeaway? Start now, be consistent, and let time work its magic.

Whether you’re 25 or 55, the best time to plant a tree was 20 years ago, and the second-best time is today. The same principle applies to compound interest. Every day you wait is a day of potential compound growth you’ll never get back.

Remember: compound interest is a double-edged sword. It can work powerfully in your favor when you’re saving and investing, but it can work devastatingly against you when you’re in debt. The wise financial decision is to position yourself on the right side of this equation, as the earner of compound interest, not the payer.

Your financial future is being written right now, with every decision you make about saving, investing, and borrowing. Armed with the knowledge of how compound interest works, you now have the power to write a much more prosperous story.

The question isn’t whether compound interest will work; it absolutely will, with mathematical certainty. The only question is: will it work for you or against you?

Make it work for you. Start today. Your future self will thank you.

Interactive Compound Interest Calculator

💰 Compound vs Simple Interest Calculator

References and Further Reading

This article draws on established financial principles and formulas that have been verified by authoritative sources:

- U.S. Securities and Exchange Commission (SEC) – Compound Interest Calculator – Official government resource on investment calculations

- Investopedia – Comprehensive definitions and examples of simple and compound interest

- Federal Reserve – Economic data and interest rate information

- CFA Institute – Professional standards for investment calculations and time value of money principles

For more in-depth exploration of related topics, consider reviewing academic finance textbooks and consulting with a certified financial planner for personalized advice.

Disclaimer

This article is for educational purposes only and does not constitute financial, investment, or legal advice. The calculations and examples provided are simplified illustrations and may not reflect real-world scenarios exactly. Interest rates, tax implications, and investment returns can vary significantly based on individual circumstances, market conditions, and specific financial products.

Before making any financial decisions, consult with a qualified financial advisor who can assess your personal situation, goals, and risk tolerance. Past performance does not guarantee future results, and all investments carry risk, including the potential loss of principal.

The information presented here is accurate to the best of our knowledge as of 2025, but financial products, interest rates, and regulations change frequently. Always verify current rates and terms with financial institutions before making decisions.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment strategy, Max is your go-to source for clear, data-backed investing education. Through TheRichGuyMath.com, Max helps thousands of readers understand complex financial concepts and make informed decisions about their money. His mission is to demystify personal finance and empower everyday people to build lasting wealth through proven principles and smart strategies.