Credit utilization is the percentage of your available credit that you are currently using. It is calculated by dividing your credit card balance by your total credit limit and multiplying by 100. This number, called your credit utilization ratio, plays a major role in determining your credit score because it shows lenders how much of your borrowing capacity you rely on. Lower utilization ratios signal responsible credit management, while higher ratios can indicate financial risk.

Understanding how utilization works is a core part of smart credit card management. In fact, it is a key concept covered in the credit basics guide, where card limits, balances, interest charges, and payment behavior all connect to your utilization rate. Small changes in how and when you pay your balances can cause noticeable shifts in your credit score over time.

In this guide, you will learn what credit utilization means, how the credit utilization ratio is calculated, why it affects your credit score, what percentage is considered healthy, and practical steps you can take to reduce your utilization and improve your overall credit profile.

Key Takeaways

- Credit utilization ratio measures the percentage of available credit you’re using — calculated by dividing your total balances by your total credit limits

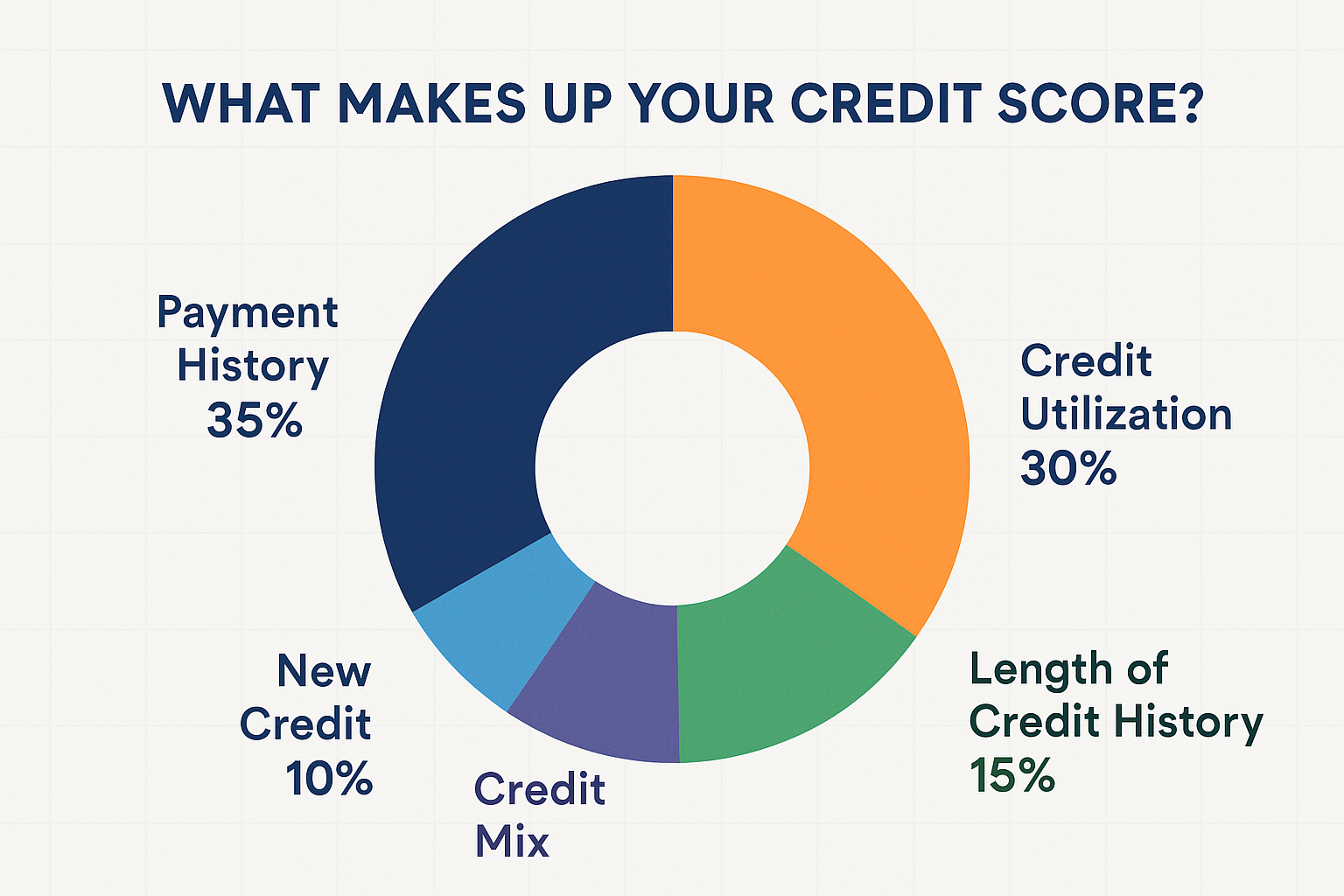

- Utilization accounts for 30% of your FICO score, making it the second most important factor after payment history

- Keep utilization below 30% as a standard rule — and below 10% for optimal credit score performance

- Both individual card and overall utilization matter — maxing out even one card can hurt your score, even if overall utilization is low

- Strategic payment timing can lower reported utilization — paying before your statement closing date reduces the balance reported to credit bureaus

What Is Credit Utilization?

Credit utilization refers to the amount of revolving credit you’re currently using compared to the total credit available to you. This concept primarily applies to credit cards and other forms of revolving credit, rather than installment loans such as mortgages or auto loans.

When you have a credit card with a $10,000 limit and carry a $2,000 balance, you’re utilizing $2,000 of your available credit. This usage pattern sends signals to lenders about your financial behavior and risk profile.

Credit utilization exists as a real-time snapshot of your borrowing behavior. Unlike payment history, which reflects past actions, utilization shows current credit dependency. Lenders interpret high utilization as a potential warning sign that you may be overextended financially.

The concept matters because it demonstrates credit management discipline. Borrowers who consistently use only a small portion of their available credit appear less risky than those who regularly approach their credit limits.

Takeaway: Credit utilization measures how much of your available revolving credit you’re actively using at any given time, serving as a key indicator of financial health to lenders.

What Is Credit Utilization Ratio?

Credit utilization ratio is the mathematical expression of your credit usage, calculated as a percentage. The formula provides a standardized metric that credit scoring models use to evaluate your credit behavior.

The formula is:

Credit Utilization Ratio = (Total Credit Card Balances ÷ Total Credit Limits) × 100

This calculation converts your raw credit usage into a percentage that scoring models can consistently evaluate across all borrowers.

Practical Example

If you have three credit cards with the following details:

- Card A: $2,000 balance, $10,000 limit

- Card B: $500 balance, $5,000 limit

- Card C: $0 balance, $5,000 limit

Your total balances equal $2,500 ($2,000 + $500 + $0).

Your total credit limits equal $20,000 ($10,000 + $5,000 + $5,000).

Your credit utilization ratio = ($2,500 ÷ $20,000) × 100 = 12.5%

This percentage represents your overall utilization across all revolving accounts. Credit bureaus and scoring models use this figure to assess your credit management effectiveness.

The ratio provides a normalized comparison point. A borrower with $5,000 in balances and $50,000 in limits (10% utilization) demonstrates better credit management than someone with $5,000 in balances and $10,000 in limits (50% utilization), even though both carry identical debt amounts.

Takeaway: The credit utilization ratio converts your credit usage into a percentage using a simple division formula, enabling standardized credit risk assessment across different credit profiles.

Why Credit Utilization Matters For Your Credit Score

Credit utilization ratio directly influences your credit score because it accounts for approximately 30% of your FICO score calculation — the second-largest factor after payment history at 35%.

FICO and VantageScore models interpret utilization as a predictor of credit risk. Statistical analysis shows that borrowers with high utilization rates default more frequently than those with low utilization, creating a mathematical correlation between usage patterns and repayment probability.

How Scoring Models Use Utilization

Credit scoring algorithms evaluate utilization in multiple ways:

Overall utilization across all cards: The aggregate percentage of all your revolving credit usage

Individual card utilization: The percentage used on each specific card

Recent utilization trends: Whether your usage is increasing or decreasing over time

Research from FICO indicates that borrowers with the highest credit scores (above 800) typically maintain utilization rates below 10%. Conversely, borrowers with utilization above 50% often see significant score reductions.

The impact operates on a continuous scale rather than fixed thresholds. A decrease from 40% to 30% utilization will improve your score, and a further decrease from 30% to 20% will improve it again. This creates an incentive structure for minimizing utilization as much as practically possible.

The Mathematical Relationship

Because utilization comprises 30% of your FICO score, a 100-point credit limit increase on a card where you carry a balance immediately improves your ratio and can boost your score within one reporting cycle.

For example, if you carry a $3,000 balance on a card with a $5,000 limit (60% utilization), increasing the limit to $10,000 drops your utilization to 30% — potentially adding 20-40 points to your credit score.

This mathematical sensitivity makes utilization one of the fastest ways to improve credit scores, unlike the length of credit history, which requires time to build.

Takeaway: Credit utilization affects 30% of your FICO score, making it the second most important scoring factor and one of the quickest levers for credit score improvement.

What Is A Good Credit Utilization Ratio?

Credit experts and scoring model research establish clear benchmarks for optimal credit utilization ratios, though these thresholds represent guidelines rather than absolute rules.

The 30% Standard Rule

The most commonly cited guideline recommends keeping overall credit utilization below 30%. This threshold emerged from FICO’s research showing that borrowers who maintain utilization under 30% demonstrate significantly better repayment behavior than those above this level.

Staying under 30% signals to lenders that you’re not overly dependent on credit and maintain an adequate financial cushion. This benchmark applies to both overall utilization across all cards and individual card utilization.

The 10% Optimal Target

For borrowers seeking excellent credit scores (750+), maintaining utilization below 10% produces optimal results. Data from credit scoring companies shows that consumers with scores above 800 typically keep utilization in the single digits.

The difference between 30% and 10% utilization can represent a 20-50 point credit score variation, depending on other factors in your credit profile. This gap matters significantly when applying for mortgages, auto loans, or premium credit cards that require excellent credit.

The 0% Consideration

While 0% utilization might seem ideal, it’s not necessarily optimal. Credit scoring models prefer to see some credit activity rather than complete inactivity. Using your cards occasionally and paying them off demonstrates active credit management.

Maintaining 1-9% utilization typically produces better scores than 0% utilization because it shows you’re an active borrower who manages credit responsibly. However, the difference between 0% and 5% is minimal compared to the difference between 30% and 50%.

Utilization Benchmarks by Credit Score Range

- 800+: Typically 1-10% utilization

- 740-799: Typically 10-20% utilization

- 670-739: Typically 20-40% utilization

- 580-669: Typically 40-60% utilization

- Below 580: Often above 60% utilization

These ranges reflect observed patterns rather than guaranteed outcomes, as credit scores incorporate multiple factors beyond utilization alone.

Takeaway: Keep utilization below 30% as a standard practice and below 10% for optimal credit scores, while maintaining some activity to demonstrate active credit management.

How To Calculate Your Credit Utilization Ratio

Calculating your credit utilization ratio requires accurate information about all your revolving credit accounts and a systematic approach to ensure precision.

Step 1: Gather Your Credit Card Statements

Collect current statements for all credit cards, including:

- Store credit cards

- Bank-issued credit cards

- Business credit cards (if they report to personal credit)

- Retail financing cards

You need two specific numbers from each statement: your current balance and your credit limit.

Step 2: List All Balances and Limits

Create a simple table with three columns:

| Card Name | Current Balance | Credit Limit |

|---|---|---|

| Card A | $2,000 | $10,000 |

| Card B | $500 | $5,000 |

| Card C | $0 | $5,000 |

| Total | $2,500 | $20,000 |

Include cards with zero balances because they contribute to your total available credit and lower your overall utilization ratio.

Step 3: Calculate Total Balances

Add all current balances across every card. In the example above: $2,000 + $500 + $0 = $2,500 total balance.

Step 4: Calculate Total Credit Limits

Add all credit limits across every card. In the example above: $10,000 + $5,000 + $5,000 = $20,000 total credit limit.

Step 5: Apply the Formula

Divide total balances by total credit limits, then multiply by 100 to convert to a percentage:

($2,500 ÷ $20,000) × 100 = 12.5%

This percentage represents your overall credit utilization ratio.

Step 6: Calculate Individual Card Utilization

For each card, divide its balance by its limit:

- Card A: ($2,000 ÷ $10,000) × 100 = 20%

- Card B: ($500 ÷ $5,000) × 100 = 10%

- Card C: ($0 ÷ $5,000) × 100 = 0%

Individual card utilization matters because scoring models evaluate both overall and per-card ratios.

Verification Method

You can verify your calculation by checking your credit report from Experian, Equifax, or TransUnion. Most credit monitoring services display your utilization ratio automatically, though the reported figure may differ slightly based on reporting timing.

Takeaway: Calculate credit utilization by dividing total credit card balances by total credit limits, then multiplying by 100 for a percentage, and calculate individual card ratios separately for complete visibility.

Individual Card Utilization vs Overall Utilization

Credit scoring models evaluate both your overall utilization across all cards and the utilization rate on each card, making it essential to understand how both metrics affect your credit score.

Overall Utilization

Overall utilization represents your aggregate credit usage across all revolving accounts. This metric provides a broad view of your total credit dependency and available capacity.

If you have $5,000 in total balances and $50,000 in total credit limits, your overall utilization is 10% — regardless of how those balances are distributed across individual cards.

Individual Card Utilization

Individual card utilization measures the percentage used on each specific card. This metric reveals whether you’re maxing out specific accounts, even if your overall utilization appears healthy.

Consider this scenario:

- Card A: $4,900 balance, $5,000 limit (98% utilization)

- Card B: $0 balance, $25,000 limit (0% utilization)

- Card C: $0 balance, $20,000 limit (0% utilization)

Your overall utilization is ($4,900 ÷ $50,000) × 100 = 9.8%, which appears excellent.

However, Card A shows 98% individual utilization, which negatively impacts your score because it signals potential financial stress or poor credit management on that specific account.

Why Both Matter

FICO and VantageScore models penalize high individual card utilization even when overall utilization is low because research shows that maxing out individual cards correlates with increased default risk.

A borrower who carries high balances on one card while leaving others empty may be:

- Approaching credit limits due to financial pressure

- Engaging in credit cycling, which lenders view negatively

- Unable to qualify for additional credit on other cards

Optimal Strategy

Maintain both overall and individual card utilization below 30%, and ideally below 10%, on every card. If you must carry balances, distribute them proportionally across multiple cards rather than concentrating debt on one account.

For example, instead of carrying a $6,000 balance on one card with a $10,000 limit (60% utilization), split it as:

- Card A: $2,000 balance, $10,000 limit (20% utilization)

- Card B: $2,000 balance, $10,000 limit (20% utilization)

- Card C: $2,000 balance, $10,000 limit (20% utilization)

This distribution maintains the same total debt but presents better optics to scoring algorithms.

Takeaway: Credit scores evaluate both overall utilization across all cards and individual utilization on each card — requiring you to manage both metrics below recommended thresholds for optimal credit health.

How To Lower Your Credit Utilization Ratio

Reducing your credit utilization ratio improves your credit score rapidly because utilization updates monthly when creditors report to credit bureaus. These strategies provide actionable methods to optimize your ratio.

1. Pay Down Existing Balances

The most direct method to lower utilization is to reduce your outstanding balances. Every dollar you pay toward your credit card balance decreases your utilization ratio immediately.

Mathematical impact: If you carry a $5,000 balance on a card with a $10,000 limit (50% utilization), paying $2,000 drops your balance to $3,000 and your utilization to 30%.

Prioritize paying down cards with the highest individual utilization rates first, as these create the most significant negative impact on your score. A card at 90% utilization damages your score more than a card at 20% utilization, even if the dollar amounts are similar.

2. Request Credit Limit Increases

Increasing your credit limits lowers your utilization ratio without requiring you to pay down balances. Most credit card issuers allow limit increase requests every 6-12 months.

Mathematical impact: If you carry a $3,000 balance on a card with a $5,000 limit (60% utilization), increasing the limit to $10,000 drops your utilization to 30% without any payment.

When requesting increases:

- Ensure your account is in good standing with no late payments

- Request increases during periods of income growth or improved credit scores

- Avoid requesting increases on multiple cards simultaneously, as this may trigger multiple hard inquiries

Most issuers offer online limit increase requests that result in soft inquiries (no credit score impact) if approved using existing account data.

3. Open New Credit Cards Strategically

Adding new credit cards increases your total available credit, thereby lowering your overall utilization ratio. This strategy works best when you don’t add new balances to the additional cards.

Mathematical impact: If you have $5,000 in balances across $20,000 in limits (25% utilization), opening a new card with a $10,000 limit increases your total limits to $30,000, dropping utilization to 16.7%.

Considerations:

- New card applications generate hard inquiries that temporarily lower your score by 5-10 points

- The utilization benefit typically outweighs the inquiry impact within 2-3 months

- Opening too many cards in a short period signals risk to lenders

This strategy proves most effective for borrowers with good credit (680+) who can qualify for cards with substantial credit limits.

4. Make Multiple Payments Per Month

Instead of making one monthly payment, make multiple payments throughout the billing cycle to keep your reported balance low. Credit card issuers typically report your balance to credit bureaus on your statement closing date, not your payment due date.

Strategic timing:

- Make a payment before your statement closing date to reduce the reported balance

- Make another payment before your due date to avoid interest charges

For example, if your statement closes on the 25th of each month and your payment is due on the 20th of the following month, making a payment on the 24th ensures a lower balance gets reported to credit bureaus.

This approach is particularly effective if you use your cards for regular expenses but pay them off completely each month. By making a mid-cycle payment, you prevent high balances from appearing on your credit report, even temporarily.

5. Distribute Balances Across Multiple Cards

If you must carry balances, distribute them proportionally across multiple cards rather than concentrating debt on one or two accounts. This prevents individual cards from showing high utilization rates.

Example distribution:

Instead of:

- Card A: $6,000 balance, $10,000 limit (60% utilization)

- Card B: $0 balance, $10,000 limit (0% utilization)

Distribute as:

- Card A: $3,000 balance, $10,000 limit (30% utilization)

- Card B: $3,000 balance, $10,000 limit (30% utilization)

This maintains the same total debt but improves how scoring models evaluate your credit management.

6. Become an Authorized User

Being added as an authorized user on someone else’s credit card with low utilization and high credit limits can improve your utilization ratio. The account’s credit limit and balance typically appear on your credit report, affecting your overall utilization calculation.

Requirements for effectiveness:

- The primary cardholder must maintain low utilization (under 30%)

- The card issuer must report authorized user accounts to credit bureaus

- The primary cardholder must have an excellent payment history

This strategy works well for individuals building or rebuilding credit, though it depends entirely on the primary cardholder’s responsible credit management.

7. Keep Paid-Off Cards Open

Closing credit cards reduces your total available credit, which increases your utilization ratio even if you don’t add new debt. Unless a card charges an annual fee you can’t justify, keep accounts open to maintain higher total credit limits.

Mathematical impact: If you have $2,000 in balances across $20,000 in limits (10% utilization) and close a card with a $5,000 limit, your utilization increases to ($2,000 ÷ $15,000) × 100 = 13.3%.

Even inactive cards contribute to your available credit and help maintain low utilization ratios.

Takeaway: Lower credit utilization by paying down balances, requesting limit increases, making strategic mid-cycle payments, distributing balances across cards, and keeping paid-off accounts open.

Common Credit Utilization Mistakes

Understanding what not to do with credit utilization helps prevent score-damaging behaviors that many borrowers unknowingly commit.

Mistake 1: Maxing Out Credit Cards

Carrying balances at or near your credit limit (90-100% utilization) severely damages your credit score. Scoring models interpret maxed-out cards as a sign of financial distress and significantly increase perceived lending risk.

A single card at 100% utilization can drop your credit score by 50-100 points, depending on your overall credit profile. This impact occurs even if all your other cards show zero balances.

Why it matters: Lenders view maxed-out cards as evidence that you’re overextended and may struggle to repay new obligations.

Mistake 2: Only Paying Minimum Payments

Making only minimum payments keeps your balances high relative to your limits, maintaining elevated utilization ratios month after month. While minimum payments prevent late payment penalties, they don’t improve your utilization or credit score.

Mathematical reality: A $5,000 balance with a 2% minimum payment ($100) takes over 20 years to pay off if you only make minimum payments, assuming 18% APR. Your utilization remains high throughout this period.

Paying more than the minimum — even $50-100 extra — accelerates balance reduction and improves utilization faster.

Mistake 3: Closing Credit Cards After Paying Them Off

Closing paid-off credit cards reduces your total available credit, which increases your utilization ratio on remaining cards. This creates an unintended negative consequence from what seems like responsible financial behavior.

Example: If you have $3,000 in balances across $30,000 in total limits (10% utilization) and close a paid-off card with a $10,000 limit, your utilization jumps to ($3,000 ÷ $20,000) × 100 = 15%.

Unless the card charges an annual fee that outweighs the credit score benefit, keep it open and use it occasionally for small purchases to maintain activity.

Mistake 4: Not Monitoring Individual Card Utilization

Focusing only on overall utilization while ignoring individual card ratios creates blind spots. A single card with high utilization damages your score even when overall utilization appears healthy.

Solution: Check each card’s utilization individually and ensure none exceed 30%, regardless of your overall ratio.

Mistake 5: Ignoring Statement Closing Dates

Many borrowers assume their credit card balance is reported on their payment due date, but issuers typically report balances on the statement closing date — usually 20-25 days before the due date.

If you charge $4,000 to a card with a $5,000 limit throughout the month and pay it off by the due date, your credit report may still show 80% utilization if that balance existed on the statement closing date.

Solution: Make a payment before your statement closing date to ensure a lower balance gets reported to credit bureaus.

Mistake 6: Applying for Multiple Credit Cards Simultaneously

While opening new cards can lower utilization by increasing available credit, applying for too many cards in a short period generates multiple hard inquiries and may signal credit-seeking behavior that lenders view negatively.

Guideline: Limit new credit card applications to one every 3-6 months unless you have a specific strategic reason for multiple applications.

Mistake 7: Using Balance Transfer Cards Without a Payoff Plan

Balance transfer cards with 0% introductory APR periods can help reduce interest costs, but transferring balances without a concrete payoff plan often leads to carrying the same debt once the promotional period ends.

Additionally, balance transfer fees (typically 3-5%) add to your total debt, potentially increasing your utilization if you’re transferring to a card with a similar credit limit.

Solution: Calculate the exact monthly payment needed to eliminate the balance before the promotional period ends, and commit to that payment schedule.

Takeaway: Avoid maxing out cards, making only minimum payments, closing paid-off accounts, ignoring individual card utilization, and missing strategic payment timing opportunities.

How Credit Utilization Fits Into Credit Card Basics

Credit utilization represents one component of broader credit card management principles that collectively determine your financial health and borrowing capacity. Understanding how utilization connects to other credit card concepts creates a complete picture of responsible credit usage.

The Relationship to Credit Limits

Your credit limit establishes the denominator in the utilization formula. Higher credit limits mathematically reduce your utilization ratio for any given balance amount, which is why limit increases improve credit scores.

Credit limits reflect the issuer’s confidence in your creditworthiness. As you demonstrate responsible usage and income growth, requesting periodic limit increases becomes a strategic tool for maintaining low utilization.

Connection to Payment Timing and Grace Periods

Understanding your card’s grace period — the time between your statement closing date and payment due date — enables strategic payment timing to minimize reported utilization.

Most cards offer 21-25 day grace periods. By making payments before your statement closes, you reduce the balance that appears on your credit report, even if you plan to pay in full by the due date anyway.

Integration With Overall Credit Strategy

Credit utilization works alongside other credit factors, including:

- Payment history (35% of FICO score): Making on-time payments consistently

- Length of credit history (15% of FICO score): Maintaining accounts over time

- Credit mix (10% of FICO score): Having diverse credit types

- New credit (10% of FICO score): Managing new account applications

While utilization accounts for 30% of your score, neglecting other factors limits your maximum achievable score. A comprehensive approach addresses all components simultaneously.

Utilization in the Context of Revolving Credit

Credit utilization applies specifically to revolving credit accounts like credit cards and lines of credit, not installment loans like mortgages or auto loans.

Revolving credit allows you to borrow, repay, and borrow again up to your credit limit. This flexibility makes utilization a dynamic metric that changes monthly based on your borrowing and repayment behavior.

The Role in Financial Planning

Beyond credit scores, monitoring utilization serves as a financial health indicator. Consistently high utilization may signal:

- Spending exceeds income

- Insufficient emergency savings

- Over-reliance on credit for regular expenses

Using utilization as a financial dashboard metric helps identify when spending patterns need adjustment before they create serious financial stress.

Takeaway: Credit utilization integrates with credit limits, payment timing, grace periods, and other credit factors to form a comprehensive credit management framework that extends beyond simple score optimization.

Conclusion

Credit utilization ratio is one of the most important factors you can actively control in your credit profile. By keeping balances low relative to your credit limits, you can improve your credit score faster than with most other credit factors. Maintaining utilization below 30% and ideally under 10% helps signal responsible credit use to lenders and scoring models.

Lowering your utilization comes down to simple, repeatable actions: paying down balances, making payments before statement closing dates, requesting credit limit increases, and avoiding behaviors like maxing out cards or carrying high revolving balances. Paying attention to both overall utilization and individual card usage ensures you are managing risk across your entire credit portfolio.

Because credit utilization is updated monthly, small changes can produce noticeable results in a short period of time. By tracking your ratios and adjusting your payment strategy, you can build stronger credit habits and improve your long-term financial standing.

Disclaimer

This article provides educational information about credit utilization ratios and credit management for informational purposes only. It does not constitute financial, legal, or credit repair advice.

Credit scoring models vary by bureau and lender, and individual results may differ based on complete credit profiles. The strategies discussed represent general principles that may not apply equally to all situations.

Before making significant credit decisions, consult with qualified financial advisors or credit counselors who can evaluate your specific circumstances. Credit card terms, reporting practices, and scoring algorithms change periodically, and readers should verify current information with issuers and credit bureaus.

The Rich Guy Math provides data-driven financial education to help readers understand the math behind money, but does not guarantee specific credit score improvements or financial outcomes. All credit and financial decisions carry risk and should be made based on individual circumstances and professional guidance.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a data-driven financial education platform that explains the math behind money with precision and clarity. With a background in financial analysis and a commitment to evidence-based investing principles, Max translates complex financial concepts into actionable insights for beginner and intermediate investors.

Max's approach combines analytical rigor with educational accessibility, helping readers understand wealth building, risk management, and financial decision-making through numbers, logic, and data. His work focuses on demystifying financial ratios, credit mechanics, investment fundamentals, and valuation principles that drive long-term financial success.

Through The Rich Guy Math, Max provides comprehensive guides on topics ranging from credit management to investment analysis, always grounding explanations in mathematical frameworks and empirical evidence.

References

[1] FICO, "What's in my FICO Scores?" myFICO.com, accessed May 2026.

[2] Consumer Financial Protection Bureau, "What is a credit utilization rate?" consumerfinance.gov, accessed May 2026.

[3] Experian, "What Is a Good Credit Utilization Ratio?" Experian.com, accessed May 2026.

[4] Equifax, "How Does Credit Card Utilization Affect Your Credit Score?" Equifax.com, accessed May 2026.

[5] TransUnion, "Credit Utilization and Your Credit Score," TransUnion.com, accessed May 2026.

Frequently Asked Questions

Does credit utilization reset every month?

Yes, credit utilization resets monthly based on the balance your credit card issuer reports to credit bureaus. Most issuers report your balance on your statement closing date each month, which means your utilization ratio can change from one month to the next.

For example, carrying a $5,000 balance on a $10,000 limit results in 50% utilization. If you pay it down to $1,000 before the next statement closes, your reported utilization drops to 10%.

This monthly reset makes utilization one of the fastest ways to improve your credit score. A single month of high utilization won’t permanently damage your score, but it will affect your score until the next reporting cycle updates with a lower balance.

Does paying your credit card early help utilization?

Yes, paying your credit card before your statement closing date reduces the balance reported to credit bureaus, which lowers your utilization ratio.

For example, charging $4,000 on a card with a $5,000 limit creates 80% utilization if unpaid at statement close. Paying $3,500 before the closing date reduces the reported balance to $500, or 10% utilization.

This strategy is especially effective for people who use credit cards heavily but pay them off monthly. Knowing your statement closing date allows you to control what balance is reported.

Does closing a credit card increase your utilization ratio?

Yes, closing a credit card reduces your total available credit, which can increase your utilization ratio even if your balances don’t change.

For example, $3,000 in balances across $30,000 in limits equals 10% utilization. Closing a card with a $10,000 limit reduces total credit to $20,000, raising utilization to 15%.

This increase can lower your credit score by 10–30 points. Closing a card with no balance still removes available credit and may also affect your average account age.

Does credit utilization affect credit card approval?

Yes, credit utilization plays a major role in credit card approval decisions. Issuers view high utilization as a sign of financial stress or overextension.

Utilization above 50% can lead to denials or lower credit limits, while utilization below 10% signals responsible credit use and available capacity.

Before applying for a new card, reducing utilization below 30%—and ideally below 10%—can significantly improve approval odds and offered limits.

Is credit utilization reported daily or monthly?

Credit utilization is typically reported monthly, not daily. Most issuers report your balance once per billing cycle, usually on your statement closing date.

This means the balance on that date is what appears on your credit report, regardless of how your balance fluctuated during the month.

Some issuers may report more frequently, but monthly reporting is the standard. You can confirm your issuer’s reporting behavior by comparing your statement balance to your credit report.

Can you have 0% credit utilization?

Yes, you can have 0% utilization if all credit cards report a $0 balance. This happens when you pay off cards before their statement closing dates.

However, 0% utilization isn’t always optimal for scoring. Credit models slightly favor low usage (1–9%) because it shows active, responsible credit use.

The difference between 0% and 5% utilization is usually small—around 5–10 points. The biggest scoring improvements come from lowering utilization from high levels to below 10%.