Imagine getting paid $12,000 today for a service you’ll deliver over the next year. Sounds great, right? But here’s the catch: you can’t count it all as profit just yet. Welcome to the world of deferred revenue—a critical accounting concept that affects everything from subscription businesses to software companies, and understanding it could change how you evaluate investing opportunities in 2025.

TL;DR

- Deferred revenue is money a company receives upfront for goods or services it hasn’t delivered yet—it’s recorded as a liability, not income

- The basic formula is: Deferred Revenue = Total Advance Payment – (Revenue Recognized to Date)

- Common examples include subscription services (Netflix, SaaS companies), insurance premiums, and annual memberships (gym contracts, software licenses)

- Deferred revenue appears on the balance sheet as a liability and gradually converts to revenue on the income statement as the company fulfills its obligations

- Understanding deferred revenue helps investors assess a company’s future revenue stability and cash flow health when evaluating stocks

What Is Deferred Revenue? A Clear Definition

In simple terms, deferred revenue means money a company has collected from customers but hasn’t yet earned by delivering the promised product or service.

Also called “unearned revenue” or “advance payments,” deferred revenue represents a company’s obligation to deliver something in the future. Think of it as an IOU—but in reverse. Instead of owing money, the company owes a service or product.

Why Does Deferred Revenue Matter?

Deferred revenue is crucial for three main reasons:

- Accurate Financial Reporting: It ensures companies don’t inflate their profits by counting money they haven’t truly earned

- Cash Flow Indicator: High deferred revenue often signals strong customer demand and healthy cash flow

- Future Revenue Visibility: For investors analyzing what moves the stock market, deferred revenue provides insight into predictable future income

According to Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), companies must record advance payments as liabilities until they fulfill their contractual obligations. This practice follows the revenue recognition principle, which states that revenue should only be recognized when it’s earned, not when cash is received.

How Deferred Revenue Works: The Accounting Mechanics

Let’s break down the accounting treatment step by step.

The Two-Stage Process

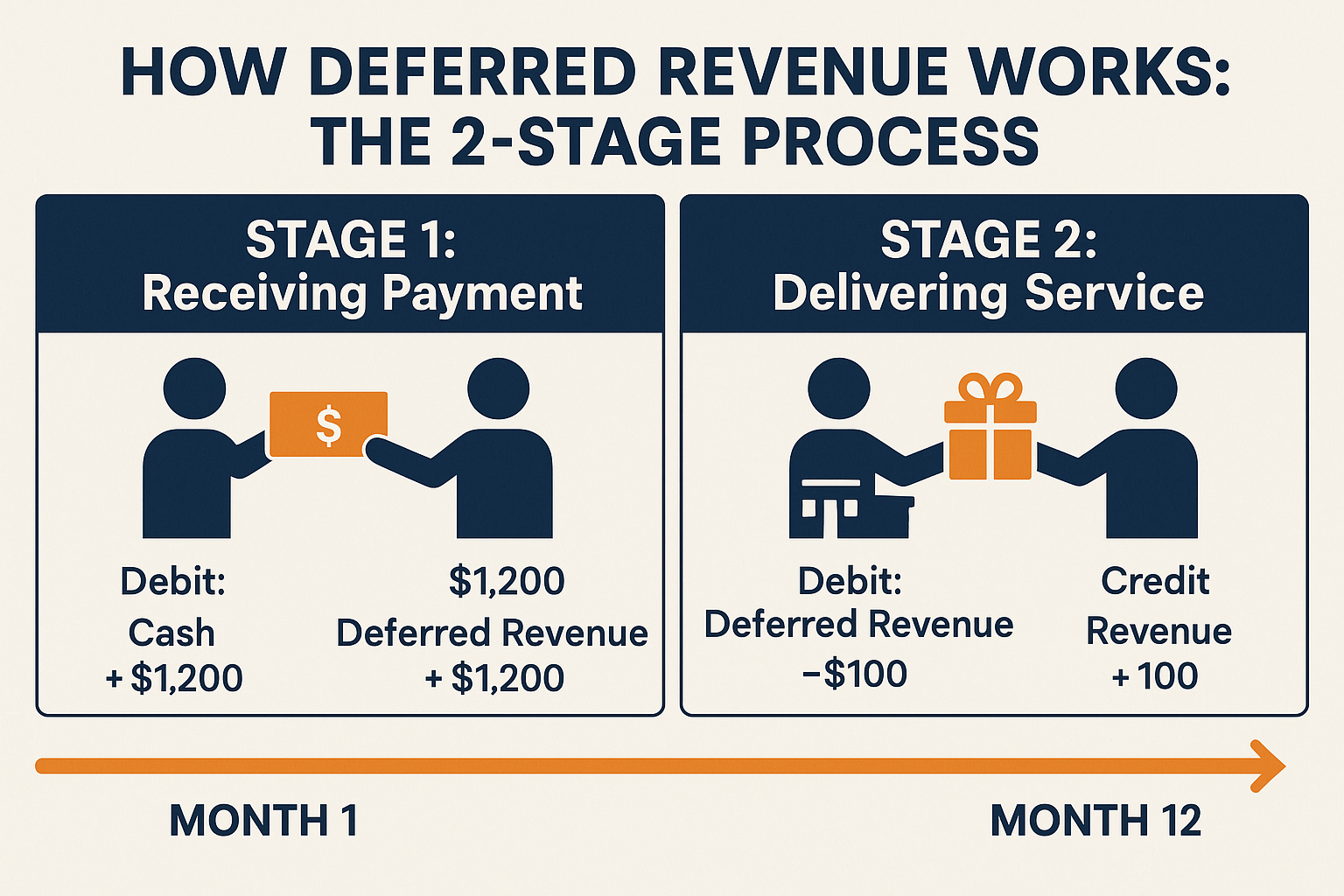

Stage 1: Receiving Payment (Creating the Liability)

When a customer pays in advance:

- Debit: Cash (Asset increases)

- Credit: Deferred Revenue (Liability increases)

Stage 2: Delivering the Service (Recognizing Revenue)

As the company delivers the product or service:

- Debit: Deferred Revenue (Liability decreases)

- Credit: Revenue (Income increases)

Real-World Illustration

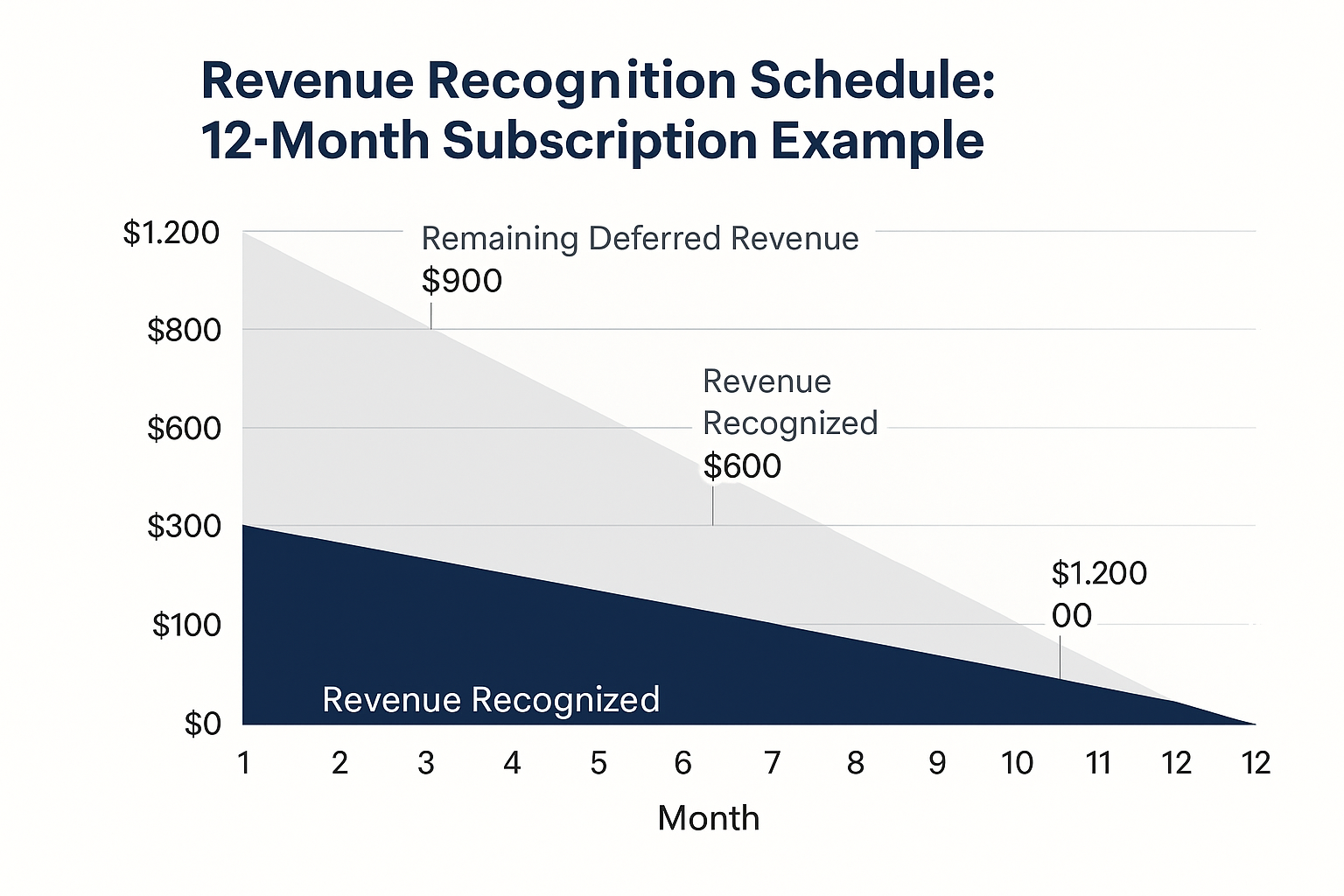

Example: A software company sells an annual subscription for $1,200 on January 1st.

January 1st Entry:

- Cash: +$1,200

- Deferred Revenue: +$1,200

Each Month (January through December):

- Deferred Revenue: -$100

- Revenue: +$100

By December 31st, the entire $1,200 has been “earned” and recognized as revenue, and the deferred revenue liability is zero.

The Deferred Revenue Formula and Calculation

The formula for calculating deferred revenue at any point in time is straightforward:

Deferred Revenue = Total Advance Payment – Revenue Recognized to Date

Or, if you’re calculating the remaining balance:

Remaining Deferred Revenue = Initial Deferred Revenue × (Remaining Service Period ÷ Total Service Period)

Practical Calculation Example

Scenario: A fitness center sells a 12-month membership for $600 on March 1st, 2025.

Initial entry (March 1st):

- Deferred Revenue = $600

After 3 months (May 31st):

- Revenue Recognized = $600 × (3 months ÷ 12 months) = $150

- Remaining Deferred Revenue = $600 – $150 = $450

After 8 months (October 31st):

- Revenue Recognized = $600 × (8 months ÷ 12 months) = $400

- Remaining Deferred Revenue = $600 – $400 = $200

Common Examples of Deferred Revenue Across Industries

Deferred revenue appears in virtually every sector of the economy. Here are the most common examples:

1. Subscription-Based Businesses

- Software as a Service (SaaS): Companies like Microsoft, Adobe, and Salesforce collect annual subscription fees upfront

- Streaming Services: Netflix, Spotify, and Disney+ receive monthly or annual payments before delivering content

- Magazine and Newspaper Subscriptions: Publishers collect advance payments for future issues

2. Insurance Companies

Insurance premiums are collected at the beginning of the coverage period (monthly, quarterly, or annually), but the coverage extends over time. The unearned portion represents deferred revenue.

3. Professional Services

- Legal Retainers: Law firms collect retainer fees before performing legal work

- Consulting Contracts: Consultants may receive upfront payments for projects spanning several months

- Accounting Firms: Annual tax preparation or bookkeeping services paid in advance

4. Rental and Lease Agreements

- Commercial Real Estate: Tenants often pay the first and last month’s rent upfront

- Equipment Leasing: Companies leasing machinery or vehicles may collect advance payments

5. Gift Cards and Store Credits

Retailers record gift card sales as deferred revenue until customers redeem them for merchandise.

6. Event Tickets and Advance Bookings

- Concert and Sports Tickets: Sold months before the event

- Airline Tickets: Purchased weeks or months before the flight

- Hotel Reservations: Prepaid accommodations

7. Annual Maintenance Contracts 🔧

Technology companies, HVAC services, and equipment manufacturers often sell annual maintenance agreements with an upfront payment.

Deferred Revenue vs Accounts Receivable: Key Differences

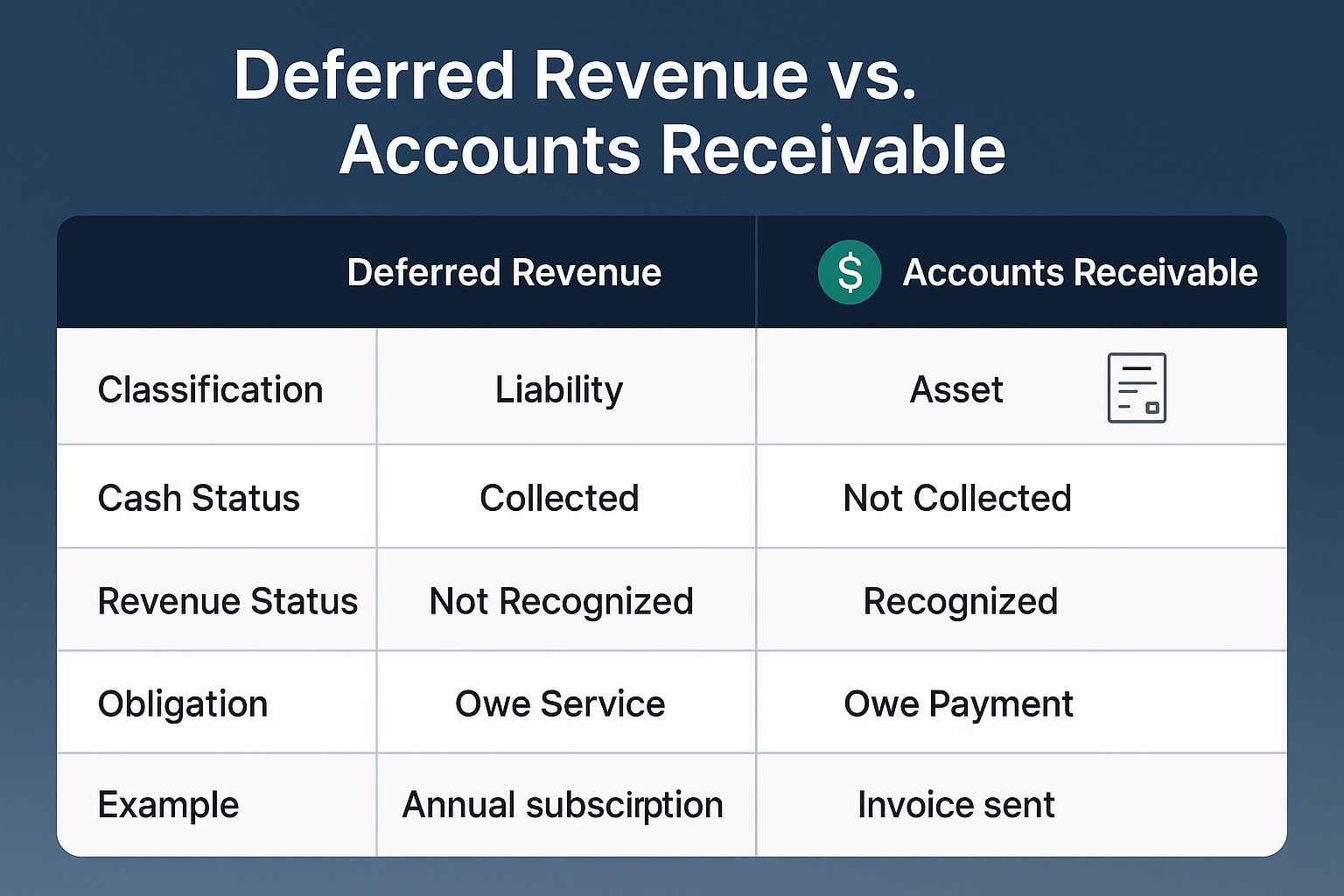

Many beginners confuse deferred revenue with accounts receivable. Here’s a clear comparison:

| Aspect | Deferred Revenue | Accounts Receivable |

|---|---|---|

| Definition | Money received but not yet earned | Money earned but not yet received |

| Classification | Liability (Balance Sheet) | Asset (Balance Sheet) |

| Cash Status | Cash already collected | Cash not yet collected |

| Revenue Status | Revenue not yet recognized | Revenue already recognized |

| Example | Annual subscription paid upfront | Services delivered, invoice sent, payment pending |

| Obligation | Company owes a service/product | Customer owes payment |

Key Insight: Deferred revenue represents a company’s obligation to deliver, while accounts receivable represent a customer’s obligation to pay.

Where Deferred Revenue Appears on Financial Statements

Understanding where to find deferred revenue in financial statements is essential for investors and business owners.

Balance Sheet Location

Deferred revenue appears under Current Liabilities (if it will be earned within one year) or Long-Term Liabilities (if it extends beyond one year). See our full guide on Balance Sheet

Example Balance Sheet Extract:

LIABILITIES

Current Liabilities:

Accounts Payable $50,000

Deferred Revenue $120,000

Short-term Debt $30,000

Total Current Liabilities $200,000Income Statement Impact

Deferred revenue doesn’t appear directly on the income statement. Instead, as it’s recognized over time, it flows into the Revenue line item.

Cash Flow Statement

On the cash flow statement (indirect method), an increase in deferred revenue is added back to net income in the operating activities section because it represents cash collected that hasn’t yet been recognized as revenue.

Advantages and Limitations of Deferred Revenue

Advantages

For Companies:

- Improved Cash Flow: Collecting payment upfront provides immediate working capital

- Revenue Predictability: Deferred revenue offers visibility into future earnings

- Customer Commitment: Advance payments indicate customer confidence and reduce churn risk

- Business Valuation: High deferred revenue can signal strong customer demand and recurring revenue streams

For Investors:

- Future Revenue Insight: Deferred revenue indicates guaranteed future income, making it easier to forecast earnings

- Business Health Indicator: Growing deferred revenue often signals an expanding customer base

- Cash Position: Shows the company has cash on hand, reducing liquidity concerns

Limitations and Risks

For Companies:

- Obligation to Deliver: The company must fulfill its promises or potentially refund customers

- Cash vs. Profit Confusion: High cash doesn’t mean high profit if most is deferred revenue

- Accounting Complexity: Properly tracking and recognizing deferred revenue requires robust systems

- Tax Implications: In some jurisdictions, companies may owe taxes on cash received even before recognizing revenue

For Investors:

- Not True Earnings: Deferred revenue is a liability, not income—it can’t be distributed as dividends

- Delivery Risk: If the company fails to deliver, it may face refunds and damage to its reputation

- Revenue Quality: High deferred revenue might mask underlying business problems if customers aren’t renewing

How to Interpret Deferred Revenue in Investing Decisions

When analyzing companies for investment opportunities, deferred revenue provides valuable insights.

What Growing Deferred Revenue Signals

Positive Indicators:

- Strong Customer Demand: More customers are prepaying for services

- Subscription Model Success: The business model is attracting loyal customers

- Predictable Revenue Stream: Future quarters have built-in revenue

- Competitive Advantage: Customers trust the company enough to pay upfront

Example: If a SaaS company shows deferred revenue growing from $10 million to $15 million year-over-year, it suggests strong new customer acquisition and retention.

What Declining Deferred Revenue Signals

Warning Signs:

- Customer Attrition: Fewer renewals or new subscriptions

- Market Saturation: The company may be running out of new customers

- Competitive Pressure: Customers switching to competitors

- Business Model Shift: Moving away from the subscription model

Key Metrics to Calculate

1. Deferred Revenue Growth Rate

Formula: (Current Period Deferred Revenue - Prior Period Deferred Revenue) ÷ Prior Period Deferred Revenue × 100

2. Deferred Revenue as % of Total Revenue

Formula: Deferred Revenue ÷ Annual Revenue × 100

A higher percentage indicates a stronger recurring revenue base.

3. Days of Deferred Revenue

Formula: (Deferred Revenue ÷ Daily Revenue) = Number of Days of Future Revenue

This shows how many days’ worth of revenue is already “in the bank.”

Common Mistakes and Misconceptions About Deferred Revenue

Mistake #1: Treating Deferred Revenue as Profit

The Error: Thinking that collecting $100,000 upfront means $100,000 in profit.

The Reality: That money is a liability until the service is delivered. The company must still incur costs to fulfill the obligation.

Mistake #2: Ignoring the Delivery Obligation

The Error: Assuming all deferred revenue will automatically convert to profit.

The Reality: If the company fails to deliver (due to bankruptcy, operational issues, or service disruption), it may need to refund customers.

Mistake #3: Confusing Cash Flow with Profitability

The Error: Believing a company with high cash from deferred revenue is automatically profitable.

The Reality: High cash doesn’t equal profit. The company might be burning cash on operations while sitting on large deferred revenue balances.

Mistake #4: Overlooking Refund Risks

The Error: Not considering customer satisfaction and potential refund requests.

The Reality: If customers are unhappy and demand refunds, deferred revenue can quickly become a cash drain.

Mistake #5: Misunderstanding Tax Treatment

The Error: Assuming deferred revenue provides tax deferral benefits.

The Reality: Tax treatment varies by jurisdiction. In the U.S., companies may need to recognize revenue for tax purposes even if it’s deferred for accounting purposes (though IRS Revenue Procedure 2004-34 allows some deferral).

Real-World Case Study: Deferred Revenue in Action

Case Study: SaaS Company “CloudTech Solutions”

Background: CloudTech Solutions sells annual software licenses for $1,200 per customer. In Q1 2025, they signed 500 new customers.

Financial Impact:

January 1, 2025 (Contract Signing):

- Cash Collected: 500 customers × $1,200 = $600,000

- Deferred Revenue (Liability): $600,000

- Revenue Recognized: $0

March 31, 2025 (End of Q1):

- Time Elapsed: 3 months (25% of the year)

- Revenue Recognized: $600,000 × 25% = $150,000

- Remaining Deferred Revenue: $450,000

June 30, 2025 (End of Q2):

- Time Elapsed: 6 months (50% of the year)

- Total Revenue Recognized: $600,000 × 50% = $300,000

- Remaining Deferred Revenue: $300,000

December 31, 2025 (End of Year):

- Time Elapsed: 12 months (100%)

- Total Revenue Recognized: $600,000

- Remaining Deferred Revenue: $0

Investor Perspective

An investor analyzing CloudTech in February 2025 would see:

- Strong cash position (+$600,000)

- High deferred revenue ($600,000 liability)

- Predictable revenue stream for the next 12 months

- Low customer acquisition risk (already paid)

This makes CloudTech an attractive investment for those seeking stable, predictable returns, similar to how dividend investors value consistency.

Deferred Revenue Recognition Methods

Different industries and contract types require different recognition methods.

1. Straight-Line Method (Most Common)

Revenue is recognized evenly over the contract period.

Example: $1,200 annual subscription = $100/month for 12 months

Best for: Subscriptions, memberships, insurance, software licenses

2. Milestone Method

Revenue is recognized when specific milestones are achieved.

Example: Construction project with payments at 25%, 50%, 75%, and 100% completion

Best for: Long-term projects, construction contracts, custom software development

3. Proportional Performance Method

Revenue is recognized based on the percentage of work completed.

Example: If 40% of the consulting work is complete, recognize 40% of the contract value

Best for: Professional services, consulting, custom manufacturing

4. Completed Contract Method

Revenue is recognized only when the entire contract is fulfilled.

Example: A one-time custom product delivered after 6 months—no revenue recognized until delivery

Best for: Short-term contracts, custom manufacturing, unique deliverables

Deferred Revenue and ASC 606 / IFRS 15

In 2018, new revenue recognition standards were implemented:

- ASC 606 (U.S. GAAP)

- IFRS 15 (International standards)

These standards established a 5-step model for revenue recognition:

The 5-Step Model

- Identify the Contract: Establish a valid, enforceable agreement

- Identify Performance Obligations: Determine distinct goods or services promised

- Determine Transaction Price: Establish the amount the company expects to receive

- Allocate Transaction Price: Assign the price to each performance obligation

- Recognize Revenue: Record revenue when (or as) each performance obligation is satisfied

Impact on Deferred Revenue

These standards provide clearer guidance on when to recognize revenue, especially for complex contracts with multiple deliverables. Companies must now:

- Separate distinct performance obligations

- Allocate revenue to each obligation

- Recognize revenue as each obligation is fulfilled

Source: Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB)

Industry-Specific Deferred Revenue Considerations

Technology and SaaS Companies

Characteristics:

- High deferred revenue balances are normal

- Multi-year contracts create long-term deferred revenue

- Investors view growing deferred revenue as a positive indicator

Example Companies: Salesforce, Adobe, Microsoft (Office 365), Zoom

Metric to Watch: Deferred revenue growth rate quarter-over-quarter

Publishing and Media

Characteristics:

- Subscription renewals are critical

- Deferred revenue from annual subscriptions

- Digital transformation has increased subscription models

Example Companies: The New York Times, The Wall Street Journal, Netflix

Metric to Watch: Subscription renewal rates and churn

Insurance Industry

Characteristics:

- Premiums collected upfront for coverage periods

- Deferred revenue (unearned premiums) is a major liability

- Regulated by state insurance departments

Example Companies: State Farm, Allstate, Progressive

Metric to Watch: Loss ratios and combined ratios

Telecommunications

Characteristics:

- Prepaid phone plans create deferred revenue

- Contract phones with service agreements

- Bundled services (phone + internet + TV)

Example Companies: Verizon, AT&T, T-Mobile

Metric to Watch: Average revenue per user (ARPU) and customer lifetime value

How Deferred Revenue Impacts Company Valuation

When valuing companies, especially for stock market investments, deferred revenue plays a significant role.

Positive Valuation Impacts

- Revenue Visibility: Predictable future revenue reduces uncertainty

- Lower Customer Acquisition Cost: Customers already paid, reducing marketing spend needs

- Cash Flow Strength: Upfront payments improve liquidity and working capital

- Recurring Revenue Premium: Subscription businesses often trade at higher multiples

Valuation Metrics Affected

Price-to-Sales (P/S) Ratio: High deferred revenue can temporarily depress current revenue, making P/S appear higher than it actually is when considering future recognized revenue.

Enterprise Value to Revenue: Analysts often add deferred revenue to enterprise value calculations to account for future obligations.

Discounted Cash Flow (DCF): Deferred revenue provides more accurate cash flow projections, improving DCF model reliability.

Tax Treatment of Deferred Revenue

Tax treatment varies by jurisdiction and can be complex.

United States 🇺🇸

General Rule: The IRS generally requires businesses to recognize income when received (cash basis) or when earned (accrual basis).

Exception – Revenue Procedure 2004-34: Allows companies to defer revenue recognition for tax purposes for up to one year if:

- The revenue is also deferred for financial accounting purposes

- The deferral doesn’t extend beyond the end of the tax year following receipt

Example: Payment received in December 2025 for services through June 2026 can be deferred for tax purposes until 2026.

Important: This is a simplified overview. Consult tax professionals for specific situations.

International Considerations

- IFRS Jurisdictions: Tax treatment varies by country

- VAT/GST: Some countries require VAT/GST payment when cash is received, regardless of revenue recognition

- Transfer Pricing: Multinational companies must consider transfer pricing rules

Source: Internal Revenue Service (IRS) and respective international tax authorities

Deferred Revenue Management Best Practices

For business owners and finance professionals, proper deferred revenue management is crucial.

1. Implement Robust Tracking Systems

- Use accounting software with deferred revenue modules (QuickBooks, NetSuite, Xero)

- Maintain detailed records of contract start/end dates

- Set up automated revenue recognition schedules

2. Regular Reconciliation

- Monthly reconciliation of deferred revenue accounts

- Verify revenue recognition calculations

- Ensure alignment between billing and accounting systems

3. Clear Contract Terms

- Define service delivery timelines clearly

- Specify refund policies

- Document performance obligations

4. Internal Controls

- Segregate duties between billing and revenue recognition

- Implement approval processes for revenue recognition adjustments

- Regular audits of deferred revenue balances

5. Customer Communication

- Provide clear invoices showing service periods

- Send reminders before renewal dates

- Maintain transparency about service delivery timelines

Interactive Calculator: Understanding Your Deferred Revenue

📊 Deferred Revenue Calculator

Calculate how deferred revenue is recognized over time

| Month | Revenue Recognized | Cumulative Revenue | Remaining Deferred |

|---|

Key Risks and Red Flags for Investors

When analyzing companies with significant deferred revenue, watch for these warning signs:

Red Flag #1: Declining Deferred Revenue with Increasing Marketing Spend

What it means: The company is spending more to acquire customers but collecting less upfront—a sign of weakening competitive position or customer confidence.

Red Flag #2: High Refund Rates

What it means: If customers frequently request refunds, deferred revenue can quickly reverse, impacting both cash and future revenue.

Red Flag #3: Deferred Revenue Growing Faster Than Operational Capacity

What it means: The company may struggle to deliver on its promises, leading to customer dissatisfaction and potential refunds.

Red Flag #4: Sudden Changes in Revenue Recognition Policy

What it means: Management might be manipulating earnings by changing how quickly deferred revenue converts to recognized revenue.

Red Flag #5: Deferred Revenue Declining While Revenue Increases

What it means: The company may be shifting away from subscription models or experiencing customer churn—fewer renewals and new subscriptions.

Deferred Revenue in Different Business Models

Subscription-Based Model (SaaS)

Characteristics:

- Monthly or annual billing cycles

- High customer lifetime value

- Predictable revenue streams

- Low marginal cost of service delivery

Deferred Revenue Pattern: Consistently high, growing with the customer base

Investor Appeal: High—provides revenue visibility and recurring income similar to dividend-paying stocks

Project-Based Model (Consulting)

Characteristics:

- Milestone-based payments

- Variable project timelines

- Custom deliverables

- Higher delivery costs

Deferred Revenue Pattern: Fluctuates based on project pipeline

Investor Appeal: Moderate—less predictable than subscriptions

Retail with Gift Cards

Characteristics:

- Gift cards sold but not redeemed

- “Breakage” (unredeemed cards) becomes revenue over time

- Seasonal fluctuations

Deferred Revenue Pattern: Spikes during holidays, declines throughout the year

Investor Appeal: Low to moderate—less predictable, subject to consumer trends

Insurance Model

Characteristics:

- Premiums collected upfront

- Coverage period typically 6-12 months

- Claims paid over the coverage period

Deferred Revenue Pattern: Stable, matches coverage periods

Investor Appeal: Moderate to high—predictable but subject to claims volatility

Advanced Deferred Revenue Analysis Techniques

For sophisticated investors and analysts, here are advanced techniques:

1. Deferred Revenue Velocity

Formula: (Ending Deferred Revenue - Beginning Deferred Revenue) ÷ Beginning Deferred Revenue × 100

Interpretation: Measures how quickly deferred revenue is growing. Accelerating velocity indicates strong new customer acquisition.

2. Billings Metric

Formula: Billings = Revenue + Change in Deferred Revenue

Interpretation: Represents total customer invoicing, providing insight into sales momentum before revenue recognition.

3. Deferred Revenue Coverage Ratio

Formula: Deferred Revenue ÷ Quarterly Operating Expenses

Interpretation: Shows how many quarters of operations are covered by deferred revenue. Higher ratios indicate better financial cushion.

4. Customer Prepayment Rate

Formula: (Customers Paying Annually ÷ Total Customers) × 100

Interpretation: Higher rates indicate strong customer confidence and improved cash flow.

The Future of Deferred Revenue Accounting

Emerging Trends in 2025

1. Cryptocurrency and Blockchain Integration 🔗

Some companies now accept cryptocurrency for subscriptions, creating new deferred revenue tracking challenges due to price volatility.

2. Usage-Based Pricing Models 📊

Shift from fixed subscriptions to consumption-based pricing (pay-per-use) reduces traditional deferred revenue but creates different recognition patterns.

3. AI-Powered Revenue Recognition 🤖

Automated systems using artificial intelligence are streamlining deferred revenue tracking and recognition, reducing errors and improving compliance.

4. Enhanced Disclosure Requirements 📋

Regulators are requiring more detailed disclosures about contract terms, performance obligations, and revenue recognition timing.

Practical Tips for Business Owners

Maximizing the Benefits of Deferred Revenue

1. Offer Annual Payment Discounts 💰

Encourage customers to pay annually (e.g., 12 months for the price of 10) to boost cash flow and deferred revenue.

2. Implement Automated Billing Systems ⚙️

Use software like Stripe, Chargebee, or Recurly to automate billing and revenue recognition.

3. Monitor Customer Health Scores 📈

Track customer usage and satisfaction to predict renewal likelihood and potential refund risks.

4. Maintain Adequate Reserves 🏦

Set aside cash reserves to handle potential refunds and ensure service delivery capabilities.

5. Communicate Value Continuously 💬

Regular customer engagement reduces churn and protects deferred revenue from refund requests.

Deferred Revenue and Investment Strategy

For investors building portfolios focused on passive income and stable returns, companies with strong deferred revenue profiles offer unique advantages:

Why Deferred Revenue Matters for Income Investors

1. Predictable Cash Flows: Similar to how dividend investors value consistent payouts, deferred revenue provides visibility into future earnings.

2. Lower Volatility: Companies with high deferred revenue often experience less revenue volatility, similar to stable dividend stocks.

3. Growth Indicator: Growing deferred revenue signals expanding customer base, which can lead to future dividend increases.

4. Financial Health: Strong deferred revenue balances indicate healthy cash positions, reducing financial stress.

Screening for Deferred Revenue Stocks

When building a portfolio, consider companies with:

- ✅ Deferred revenue growing 15%+ year-over-year

- ✅ Deferred revenue representing 3+ months of revenue

- ✅ Low customer churn rates (below 5% annually)

- ✅ Strong cash positions relative to total liabilities

- ✅ Transparent revenue recognition policies

Comparing Deferred Revenue Across Companies

Here’s a hypothetical comparison of three SaaS companies:

| Metric | Company A | Company B | Company C |

|---|---|---|---|

| Annual Revenue | $100M | $100M | $100M |

| Deferred Revenue | $40M | $25M | $15M |

| Deferred Revenue Growth (YoY) | +25% | +10% | -5% |

| Customer Count | 10,000 | 15,000 | 20,000 |

| Average Contract Value | $10,000 | $6,667 | $5,000 |

| Months of Revenue Covered | 4.8 | 3.0 | 1.8 |

| Investor Verdict | 🟢 Strong | 🟡 Moderate | 🔴 Concerning |

Analysis:

- Company A shows strong customer commitment (higher ACV), growing deferred revenue, and excellent revenue visibility

- Company B is stable but not growing as fast—moderate investment potential

- Company C has declining deferred revenue despite more customers, suggesting smaller contracts and potential churn issues

Real-World Example: Analyzing a Public Company

Let’s examine Salesforce (CRM), a leading SaaS company:

Salesforce Deferred Revenue Analysis (Hypothetical 2025 Data)

Q4 2024 Financial Highlights:

- Total Revenue: $34.9 billion (annual)

- Deferred Revenue: $17.8 billion

- Deferred Revenue Growth: +12% YoY

What This Tells Investors:

- Strong Revenue Visibility: Deferred revenue represents approximately 6 months of annual revenue—excellent visibility

- Subscription Model Success: High deferred revenue indicates customers are committing to multi-year contracts

- Growth Trajectory: 12% growth in deferred revenue suggests healthy new customer acquisition and renewals

- Cash Flow Strength: Collecting payments upfront provides substantial working capital

Investment Implication: Companies like Salesforce with strong, growing deferred revenue often make attractive long-term holdings for investors seeking stable growth, similar to how dividend investors seek consistent income.

Deferred Revenue in Merger & Acquisition (M&A) Scenarios

How Acquirers View Deferred Revenue

Positive Factors:

- ✅ Represents future revenue certainty

- ✅ Indicates customer loyalty and product stickiness

- ✅ Provides cash for operations

- ✅ Reduces customer acquisition costs post-acquisition

Negative Factors:

- ❌ Represents service obligations that must be fulfilled

- ❌ May require investment to deliver on promises

- ❌ Potential refund liabilities if integration fails

- ❌ Complex accounting integration

Valuation Impact

Acquirers typically value deferred revenue at 50-80% of face value, depending on:

- Remaining service period

- Delivery costs

- Customer satisfaction scores

- Churn risk

- Integration complexity

Example: A company with $10M in deferred revenue might see that valued at $6-8M in an acquisition, not the full $10M.

Regulatory and Compliance Considerations

SEC Reporting Requirements 📋

Public companies must disclose:

- Total deferred revenue balances (current and long-term)

- Significant changes in deferred revenue

- Revenue recognition policies

- Contract terms affecting revenue recognition

Source: U.S. Securities and Exchange Commission (SEC.gov)

Audit Focus Areas 🔍

External auditors pay special attention to:

- Proper classification of deferred revenue

- Accurate revenue recognition timing

- Adequate documentation of contracts

- Internal controls over revenue recognition

- Compliance with ASC 606/IFRS 15

Industry-Specific Regulations

Insurance: State insurance regulators monitor unearned premium reserves

Software: Must comply with specific revenue recognition guidance for software licenses vs. SaaS

Telecommunications: FCC and state regulators may have specific requirements

Tools and Software for Managing Deferred Revenue

Accounting Software Solutions

1. NetSuite

- Enterprise-level ERP with advanced revenue recognition

- Automated deferred revenue schedules

- ASC 606/IFRS 15 compliance built-in

2. QuickBooks Online Advanced

- Small to mid-sized business solution

- Basic deferred revenue tracking

- Integration with billing platforms

3. Sage Intacct

- Cloud-based financial management

- Multi-entity revenue recognition

- Real-time reporting

Specialized Revenue Recognition Tools

1. Zuora RevPro

- Designed specifically for subscription businesses

- Complex revenue recognition scenarios

- Audit-ready reporting

2. Chargebee

- Subscription billing and revenue recognition

- Integration with accounting systems

- Customer lifecycle management

3. Stripe Revenue Recognition

- Built into Stripe payment platform

- Automated accrual accounting

- Real-time revenue reporting

Building a Deferred Revenue Dashboard

For business owners and CFOs, creating a real-time dashboard helps monitor deferred revenue health:

Key Metrics to Track

1. Total Deferred Revenue Balance 📊

- Current vs. prior period

- Trend over 12 months

- Breakdown by product/service line

2. Deferred Revenue Growth Rate 📈

- Month-over-month

- Year-over-year

- Comparison to revenue growth

3. Days of Deferred Revenue 📅

- Formula: (Deferred Revenue ÷ Daily Revenue)

- Indicates months of future revenue secured

4. Revenue Recognition Rate ⚡

- Monthly revenue recognized from deferred balance

- Percentage of total deferred revenue recognized

5. Customer Cohort Analysis 👥

- Deferred revenue by customer acquisition date

- Retention rates by cohort

- Average contract value trends

Recommended Visualization Tools

- Tableau: Advanced data visualization

- Power BI: Microsoft ecosystem integration

- Google Data Studio: Free, cloud-based dashboards

- Klipfolio: Real-time business dashboards

Deferred Revenue and Financial Ratios

How Deferred Revenue Affects Key Metrics

1. Current Ratio

- Formula: Current Assets ÷ Current Liabilities

- Impact: High deferred revenue increases current liabilities, potentially lowering the current ratio

- Interpretation: Not necessarily negative—the company has cash from deferred revenue

2. Quick Ratio (Acid Test)

- Formula: (Current Assets – Inventory) ÷ Current Liabilities

- Impact: Similar to current ratio, deferred revenue increases denominator

- Interpretation: Investors should adjust for deferred revenue’s unique nature

3. Working Capital

- Formula: Current Assets – Current Liabilities

- Impact: Deferred revenue reduces working capital calculation

- Interpretation: Misleading for subscription businesses; adjusted working capital (excluding deferred revenue) is more meaningful

4. Debt-to-Equity Ratio

- Formula: Total Liabilities ÷ Shareholders’ Equity

- Impact: Higher deferred revenue increases total liabilities

- Interpretation: Some analysts exclude deferred revenue when calculating leverage ratios

Adjusted Financial Metrics

Adjusted Working Capital = Working Capital + Deferred Revenue

Adjusted Current Ratio = Current Assets ÷ (Current Liabilities – Deferred Revenue)

These adjustments provide clearer pictures of financial health for subscription-based businesses.

Conclusion: Mastering Deferred Revenue for Better Financial Decisions

Understanding deferred revenue is essential whether you’re an investor evaluating companies, a business owner managing cash flow, or a finance professional ensuring compliance. This accounting concept represents far more than just a balance sheet line item—it’s a window into a company’s future revenue, customer relationships, and business model strength.

Key Takeaways to Remember

For Investors:

- Deferred revenue provides visibility into future earnings, making it valuable for predicting company performance

- Growing deferred revenue often signals strong customer demand and healthy business momentum

- Analyze deferred revenue trends alongside other metrics like customer acquisition costs and churn rates

- Companies with substantial, growing deferred revenue can offer stability similar to dividend-paying stocks

For Business Owners:

- Properly managing deferred revenue improves cash flow and provides working capital

- Implement robust accounting systems to ensure accurate tracking and recognition

- Use deferred revenue strategically by offering annual payment incentives

- Monitor deferred revenue health through regular dashboards and KPI tracking

For Finance Professionals:

- Ensure compliance with ASC 606/IFRS 15 revenue recognition standards

- Maintain detailed documentation of contracts and performance obligations

- Implement strong internal controls over revenue recognition processes

- Provide clear disclosures to stakeholders about deferred revenue balances and trends

Actionable Next Steps

If you’re an investor:

- Add deferred revenue analysis to your stock screening process

- Compare deferred revenue trends across companies in the same industry

- Look for companies with 15%+ annual deferred revenue growth

- Consider how deferred revenue fits into your overall investment strategy

If you’re a business owner:

- Review your current deferred revenue tracking methods

- Implement or upgrade accounting software with automated revenue recognition

- Create a deferred revenue dashboard with key metrics

- Develop strategies to increase upfront payments (annual discounts, incentives)

- Establish clear refund policies and customer satisfaction monitoring

If you’re studying finance:

- Practice calculating deferred revenue with real company financial statements

- Analyze how different industries handle deferred revenue

- Study the impact of ASC 606/IFRS 15 on revenue recognition

- Compare companies’ deferred revenue disclosures in 10-K filings

The Bigger Picture

In 2025’s increasingly subscription-based economy, deferred revenue has become a critical metric for understanding business health and future performance. From software companies to insurance providers, from fitness centers to professional services, the ability to collect payment upfront while delivering value over time defines modern business models.

For those building wealth through smart investment decisions, understanding deferred revenue provides an edge in identifying companies with predictable revenue streams and strong customer relationships. Just as understanding why the stock market goes up helps investors make better long-term decisions, mastering deferred revenue analysis helps identify businesses built for sustainable growth.

Whether you’re evaluating a potential investment, managing your business finances, or simply expanding your financial knowledge, the concepts covered in this guide provide a foundation for making more informed decisions. Deferred revenue isn’t just an accounting technicality—it’s a powerful indicator of business quality, customer trust, and future potential.

Remember: In simple terms, deferred revenue means money collected today for value delivered tomorrow—and understanding this timing difference is key to reading between the lines of any financial statement.

FAQ

A “good” deferred revenue balance depends on the industry and business model. For subscription-based businesses, deferred revenue equal to 3-12 months of revenue is common and healthy. Growing deferred revenue (year-over-year) typically signals strong customer demand and business growth. However, extremely high deferred revenue relative to operational capacity might indicate the company has over-committed and faces delivery challenges.

The formula for deferred revenue is: Total Advance Payment – Revenue Recognized to Date. For example, if a company receives $12,000 for an annual service and three months have passed, the calculation is: $12,000 – ($12,000 ÷ 12 × 3) = $12,000 – $3,000 = $9,000 remaining deferred revenue.

Deferred revenue is a liability, not an asset. It represents an obligation to deliver goods or services in the future. The company has received cash (an asset), but it owes performance to the customer, creating a liability on the balance sheet until the obligation is fulfilled.

In bankruptcy, deferred revenue becomes a liability that must be addressed. Customers who prepaid may become unsecured creditors in the bankruptcy proceedings. Depending on the bankruptcy type (Chapter 7 liquidation or Chapter 11 reorganization), customers may receive partial refunds, service continuation, or nothing at all. This is why understanding a company’s financial health before prepaying is crucial when evaluating investment risks.

No, deferred revenue cannot be negative. The lowest it can go is zero, which occurs when all advance payments have been earned through service delivery. If a company recognizes more revenue than it collected upfront, that would create accounts receivable (an asset), not negative deferred revenue.

Deferred revenue positively impacts cash flow in the period it’s collected. When customers pay upfront, cash increases immediately, even though revenue recognition is delayed. On the cash flow statement (indirect method), an increase in deferred revenue is added back to net income in operating activities because it represents cash collected but not yet recognized as earnings.

No, only companies that receive payment before delivering goods or services have deferred revenue. Businesses that operate on a cash-on-delivery or invoice-after-service model typically don’t have significant deferred revenue. Industries with high deferred revenue include SaaS, insurance, publishing, telecommunications, and professional services.

Financial Disclaimer

This article is for educational purposes only and does not constitute financial, investment, tax, or legal advice. The information provided is based on general accounting principles and should not be relied upon as the sole basis for financial decisions. Deferred revenue accounting can be complex and varies by jurisdiction, industry, and specific circumstances.

Before making investment decisions or implementing accounting policies, consult with qualified professionals, including:

- Certified Public Accountants (CPAs)

- Financial advisors

- Tax professionals

- Legal counsel

The examples and case studies presented are for illustrative purposes only and may not reflect actual company data. Past performance and financial metrics do not guarantee future results. All investments carry risk, including potential loss of principal.

Always conduct thorough due diligence and seek professional advice tailored to your specific situation before making financial or business decisions.

About the Author

Written by Max Fonji — With over a decade of experience in financial education and investment analysis, Max is your go-to source for clear, data-backed investing education. As the founder of TheRichGuyMath.com, Max has helped thousands of readers understand complex financial concepts through practical, actionable insights.

Max specializes in breaking down sophisticated accounting and investment topics into accessible content for everyday investors. His mission is to democratize financial knowledge and empower readers to make informed decisions about their money.

Connect with Max:

- Read more insights at TheRichGuyMath.com

- Learn about passive income strategies

- Explore stock market fundamentals

References and Further Reading

Authoritative Sources:

- Financial Accounting Standards Board (FASB) – ASC 606 Revenue from Contracts with Customers

- International Accounting Standards Board (IASB) – IFRS 15 Revenue from Contracts with Customers

- U.S. Securities and Exchange Commission (SEC) – Public company financial reporting requirements

- Investopedia – Comprehensive financial education resources

- CFA Institute – Professional investment and accounting standards

- Internal Revenue Service (IRS) – Tax treatment of deferred revenue (Revenue Procedure 2004-34)

Recommended Further Reading:

- “Revenue Recognition” by KPMG

- “Financial Reporting for SaaS Companies” by Deloitte

- “The SaaS CFO” by Ben Murray

- SEC 10-K filings from public companies with significant subscription revenue