What is a Dividend Growth Stock?

A dividend growth stock is a publicly traded company that consistently increases its dividend payouts over time, often annually. These stocks are typically financially healthy, with predictable cash flows, low payout ratios, and a long-term commitment to rewarding shareholders.

They differ from high-yield stocks, which may offer larger upfront dividends but without the growth potential or reliability over time.

Examples of dividend growth companies:

- Visa and Mastercard (payment processors with consistent dividend hikes)

- ConocoPhillips (commodity-based, yet disciplined in shareholder returns)

- NextEra Energy (renewables-focused utility with rising distributions)

Why Dividend Growth Stocks Matter

Dividend growth stocks offer a powerful mix of income and capital appreciation. Unlike high-yield stocks that may stagnate, these companies consistently raise dividends, signaling financial strength, good cash flow, and shareholder value.

In 2025, investors are prioritizing resilient, growing income streams to outpace inflation, hedge against volatility, and build long-term wealth.

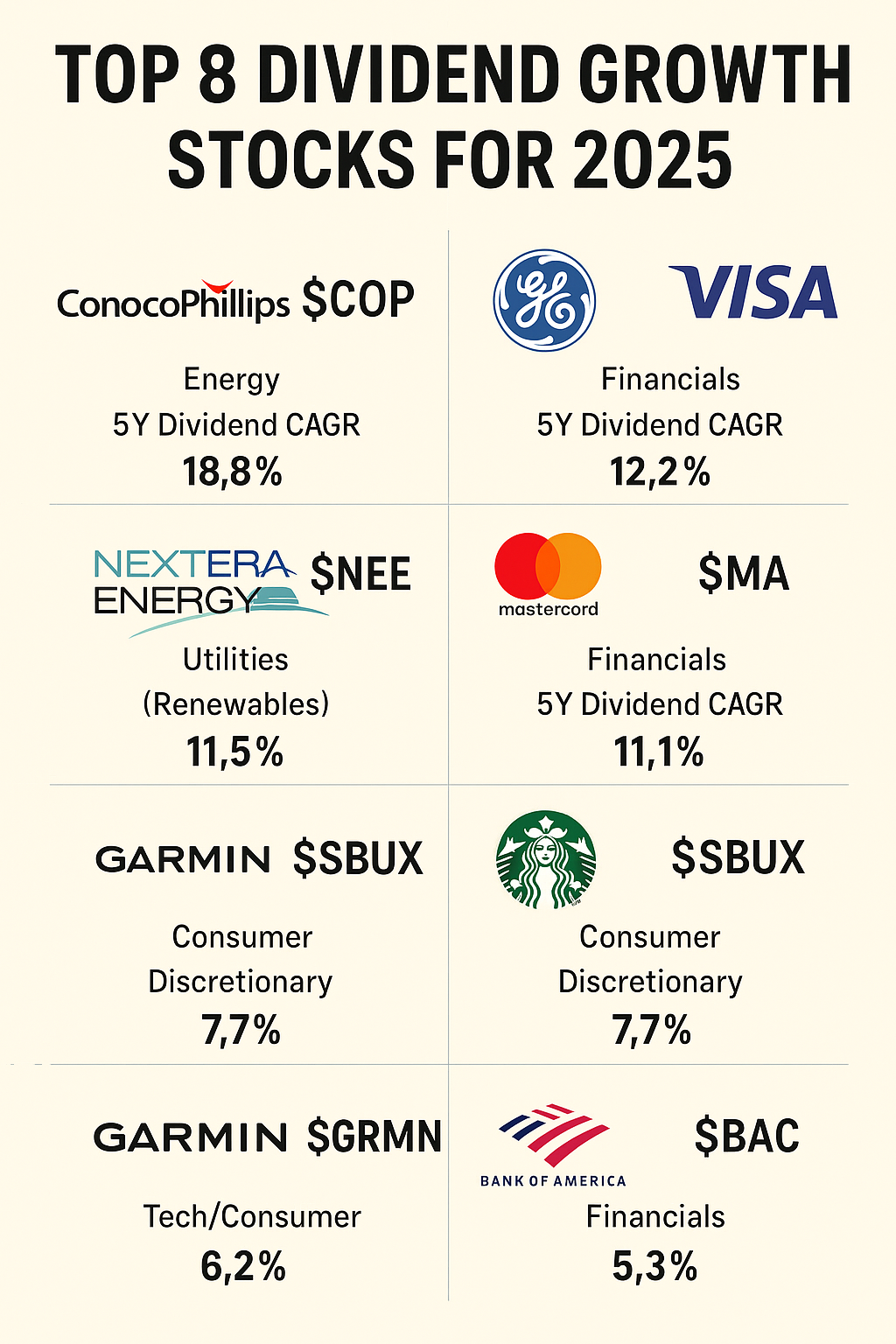

The 8 Best Dividend Growth Stocks for 2025

Below are the top dividend growth stocks to watch in 2025, ranked by 5-year Dividend Compound Annual Growth Rate (CAGR):

1. ConocoPhillips ($COP) – 18.8% 5Y Dividend CAGR

- Sector: Energy

- Why it stands out: With high oil demand and disciplined capital spending, COP has raised dividends aggressively while returning value through buybacks.

- Consideration: Volatile earnings due to commodity cycles.

2. Visa ($V) – 12.2% 5Y Dividend CAGR

- Sector: Financials (Payments)

- A global payment titan with consistent revenue growth, Visa’s low payout ratio leaves room for future dividend hikes.

- Bonus: Exposure to the digital payments boom.

3. General Electric ($GE) – 11.7% 5Y Dividend CAGR

- Sector: Industrials

- Following a major turnaround, GE is back with renewed dividend growth potential across aviation and energy segments.

- Repositioned for growth after spinoffs.

4. NextEra Energy ($NEE) – 11.5% 5Y Dividend CAGR

- Sector: Utilities (Renewables)

- A leader in clean energy, NEE combines stable cash flows with rapid dividend growth, rare in the utility space.

- Long-term ESG play.

5. Mastercard ($MA) – 11.1% 5Y Dividend CAGR

- Sector: Financials (Payments)

- Like Visa, Mastercard benefits from global transactions and fintech expansion, delivering steady dividend growth.

- Strong brand moat and margins.

6. Starbucks ($SBUX) – 7.7% 5Y Dividend CAGR

- Sector: Consumer Discretionary

- With global expansion and customer loyalty, Starbucks has room to grow dividends even during inflationary periods.

- Coffee meets cash flow.

7. Garmin ($GRMN) – 6.2% 5Y Dividend CAGR

- Sector: Tech/Consumer

- Known for innovation in GPS and fitness tech, Garmin pays reliable dividends and maintains a debt-free balance sheet.

- Under-the-radar performer.

8. Bank of America ($BAC) – 5.3% 5Y Dividend CAGR

- Sector: Financials

- As interest rates remain elevated, BAC benefits from net interest income growth and moderate dividend increases.

- Steady, large-cap financial play.

Benefits of Investing in Dividend Growth Stocks

Dividend growth stocks are favored by long-term investors and retirees for their unique blend of income and capital appreciation. Here’s why they stand out:

1. Compounding Income

- Rising dividends reinvested over time create a snowball effect on your portfolio.

- A stock that raises its dividend by 10% annually could double your income stream in 7 years.

2. Inflation Protection

- Dividend hikes help offset rising costs, preserving your purchasing power.

3. Sign of Financial Strength

- Companies that raise dividends during downturns (like GE or Starbucks) signal strong leadership and confidence.

4. Lower Volatility

- Dividend payers typically have lower beta and can buffer against sharp market declines.

5. Tax Efficiency (in many jurisdictions)

- Qualified dividends may be taxed lower rate than interest income, making them more attractive in taxable accounts.

Important Considerations When Choosing Dividend Growth Stocks

Not all dividend growers are equal. Here’s what to watch for when evaluating which dividend growth stocks to watch in 2025 and beyond:

1. Dividend Growth History

- Look for 5–10+ years of consistent dividend increases.

- Be cautious of companies that paused or cut dividends recently.

2. Payout Ratio

- A healthy payout ratio (typically < 60%) leaves room for future increases.

- High payout ratios may limit reinvestment and become unsustainable.

3. Earnings Growth

- Dividends are paid from profits — consistent EPS growth supports dividend hikes.

4. Business Model Resilience

- Choose companies with moats (competitive advantages), strong balance sheets, and global reach.

5. Sector Diversification

- Balance across sectors like energy, financials, consumer, utilities, and tech to reduce risk.

🕵️♂️ 6. Management’s Track Record

- Favor companies that prioritize shareholder returns and have a history of delivering on capital allocation promises.

Key Takeaways on Dividend Growth Investing

- Dividend CAGR reflects a company’s ability to increase payouts consistently.

- Growth > Yield: A 5–10% annual dividend growth rate often beats static high-yield stocks over time.

- Diversify across sectors (energy, fintech, utilities, consumer).

- Watch for companies with low payout ratios and strong cash flow.

FAQ – Answering Your Top Questions

Dividend CAGR measures the annualized rate of dividend growth over a period. It’s key to identifying stocks with compounding income potential.

Not always. Growth stocks compound better long-term, but high-yielders may be better for immediate income. Balance is ideal.

At least twice a year, or when major earnings, dividend cuts, or macro shifts occur.

Final Thoughts

Dividend growth stocks are a cornerstone for building reliable, inflation-beating income over time. In 2025, these 8 companies show strong fundamentals, sector leadership, and proven dividend-raising track records.

Whether you’re a beginner or a seasoned investor, including a mix of these dividend growth stocks to watch in 2025 could position your portfolio for sustainable long-term wealth.