Imagine sitting around the dinner table with your grandchildren, not worrying about whether they’ll afford college or buy their first home. Instead, you’re sharing stories about how your family built something that will outlast you, a financial foundation so strong that it supports generation after generation. That’s the power of generational wealth, and it’s not just reserved for billionaires or trust fund babies.

In 2025, building generational wealth has become more accessible than ever before, yet most families still struggle to pass meaningful financial resources to the next generation. According to recent data, 70% of wealthy families lose their wealth by the second generation, and a staggering 90% lose it by the third. Why? Because wealth without wisdom, strategy, and proper planning evaporates faster than morning dew.

This guide will walk you through everything you need to know about creating, growing, and protecting generational wealth, even if you’re starting from scratch. Whether you’re a young professional planting the first seeds or a parent looking to secure your children’s future, understanding these principles can transform your family’s financial trajectory for decades to come.

Key Takeaways

- Generational wealth is the accumulation and transfer of financial assets, knowledge, and opportunities across multiple generations of a family

- Building generational wealth requires a combination of smart investing, strategic planning, financial education, and legal protection

- The stock market, real estate, and businesses are the primary vehicles for creating lasting wealth that compounds over time

- 70% of wealth transfers fail due to lack of communication, poor estate planning, and inadequate financial education for heirs

- Starting early with consistent contributions and tax-advantaged accounts can turn modest savings into millions over multiple generations

What Is Generational Wealth?

Generational wealth refers to financial assets, stocks, bonds, real estate, businesses, or other investments that are passed down from one generation to the next. But it’s more than just money in a bank account. True generational wealth includes:

- Financial assets: Investment portfolios, retirement accounts, real estate holdings

- Business ownership: Family businesses or equity stakes that generate ongoing income

- Financial literacy: Knowledge and skills to manage, grow, and protect wealth

- Social capital: Networks, connections, and opportunities that open doors

- Values and mindset: Attitudes about money, work, and giving that shape behavior

Think of the Rockefeller family, now in their seventh generation of wealth. Or consider Warren Buffett, who’s committed to passing not just money but investment wisdom to future generations. These families understand that generational wealth isn’t just about accumulation, it’s about sustainable transfer and multiplication across time. Investopedia: GW Overview

Why Generational Wealth Matters

The wealth gap in America continues to widen. According to the Federal Reserve’s 2025 Survey of Consumer Finances, the median net worth of white families is nearly eight times higher than that of Black families and five times higher than Hispanic families. Much of this disparity stems from generational wealth, or the lack thereof.

When families build generational wealth, they create:

✅ Educational opportunities without crushing student debt

✅ Business startup capital without predatory loans

✅ Home ownership without insurmountable down payment barriers

✅ Financial stability during economic downturns

✅ Freedom of choice in career and life decisions

The Foundation: How to Start Building Generational Wealth

1. Shift Your Money Mindset

Before you can build wealth that lasts generations, you need to think beyond your own lifetime. This requires a fundamental shift in how you view money:

Short-term thinking: “How can I afford that new car?”

Generational thinking: “How can I invest this money so my grandchildren have opportunities I never had?”

Sarah Martinez, a first-generation college graduate, made this shift in her late twenties. “My parents worked three jobs between them and still lived paycheck to paycheck,” she recalls. “I decided my kids wouldn’t start at zero like I did. Every dollar I invest is a brick in their foundation.”

2. Master the Basics of Personal Finance

You can’t build generational wealth if your own financial house isn’t in order. Start with these fundamentals:

Emergency Fund: Save 3-6 months of expenses in a high-yield savings account

Debt Management: Eliminate high-interest debt (credit cards, personal loans)

Budget System: Track income and expenses to identify wealth-building opportunities

Credit Health: Maintain a good credit score (720+) for better borrowing terms

These basics might seem unrelated to generational wealth, but they’re the soil in which your wealth tree will grow. Without them, you’ll constantly be starting over instead of building forward.

3. Understand Why You Should Invest

Saving money in a traditional bank account won’t build generational wealth. With inflation averaging 3-4% annually, your purchasing power actually decreases over time. Understanding why investing is crucial helps you overcome the fear that keeps many families stuck in low-growth savings accounts.

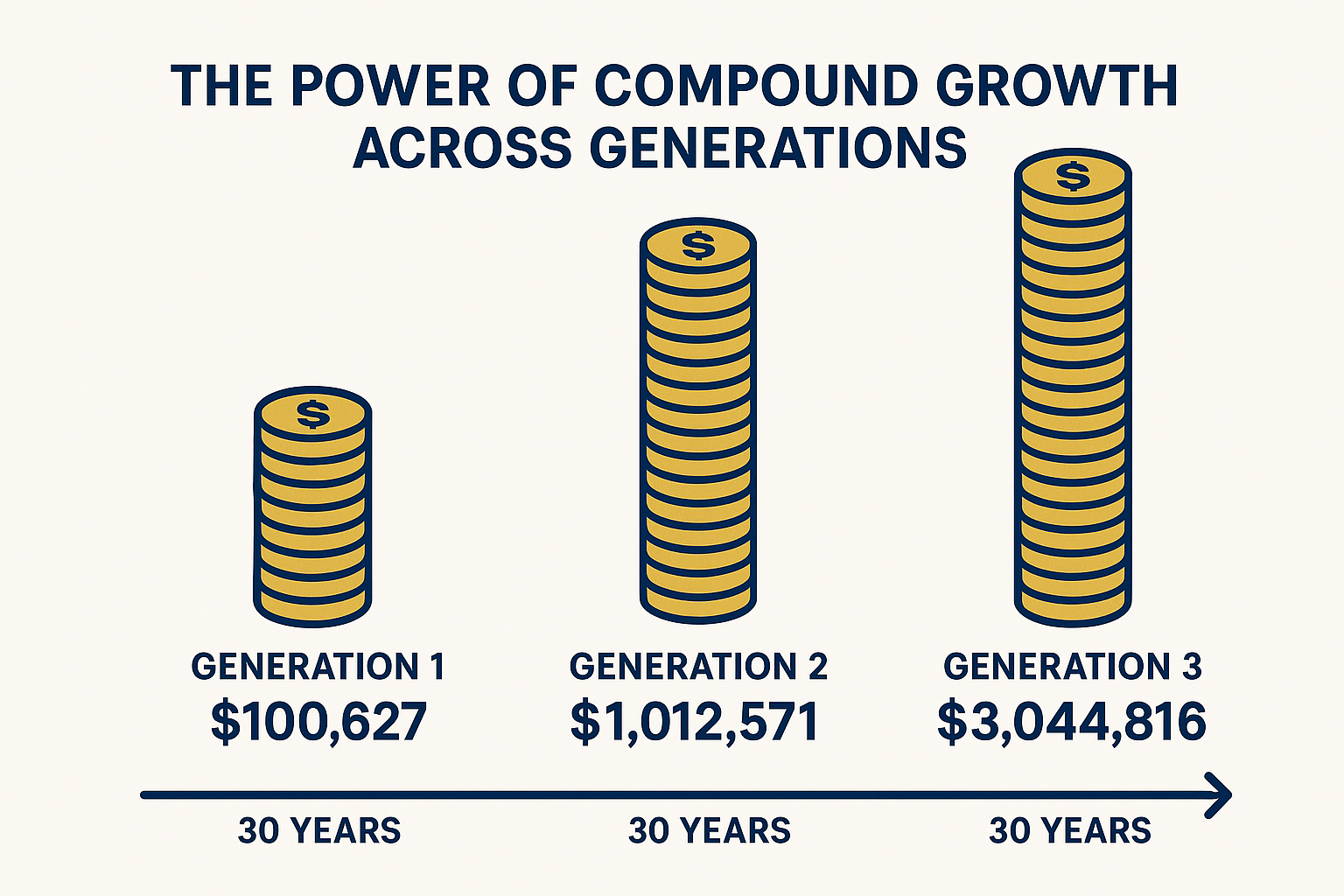

The math is simple but powerful:

| Starting Amount | Annual Return | 30 Years | 60 Years (2 Generations) |

|---|---|---|---|

| $10,000 | 2% (Savings) | $18,114 | $32,810 |

| $10,000 | 8% (Stock Market) | $100,627 | $1,012,571 |

| $10,000 | 10% (Aggressive Growth) | $174,494 | $3,044,816 |

That’s the difference between leaving your grandchildren $32,000 or over $3 million—from the same initial investment.

The Vehicles: Where to Build Generational Wealth

Stock Market Investing

The stock market has historically been the most reliable wealth-building tool for everyday families. The stock market’s long-term upward trajectory makes it ideal for generational wealth building.

Why stocks work for generational wealth:

- Compound growth: Reinvested dividends create exponential returns over decades

- Liquidity: Easy to access when needed (unlike real estate)

- Diversification: Spread risk across hundreds or thousands of companies

- Passive income: Dividend-paying stocks provide cash flow without selling assets

Getting started with stocks:

- Open a brokerage account (Vanguard, Fidelity, Schwab)

- Start with broad index funds (S&P 500, Total Stock Market)

- Consider high dividend stocks for income generation

- Invest consistently regardless of market conditions

- Understand the cycle of market emotions to avoid panic selling

Real story: The Johnson family started investing $500 monthly in index funds in 1985. By 2025, that portfolio had grown to over $1.2 million, despite multiple market crashes. Their children inherited not just the portfolio, but the discipline and knowledge to continue growing it.

Real Estate Holdings

Real estate has created more millionaires than any other asset class. For generational wealth, it offers unique advantages:

Benefits of real estate:

- Tangible asset: Physical property that can be used and enjoyed

- Appreciation: Property values generally increase over time

- Rental income: Ongoing cash flow that can be passed down

- Tax advantages: Depreciation, 1031 exchanges, and step-up basis benefits

- Leverage: Use borrowed money to control valuable assets

Strategies for building real estate wealth:

- Primary residence: Build equity instead of paying rent

- Rental properties: Generate passive income while building equity

- REITs: Real estate investment trusts for stock-like liquidity

- Commercial property: Higher returns but requires more expertise

The key is starting small and scaling up. You don’t need to buy an apartment complex; a single rental property can be the seed that grows into a real estate empire over generations.

Business Ownership

Family businesses represent one of the most powerful forms of generational wealth. According to the Family Business Alliance, family-owned businesses account for 64% of U.S. GDP and employ 62% of the workforce.

Why businesses build generational wealth:

- Unlimited income potential: No salary cap

- Asset appreciation: Businesses grow in value over time

- Employment opportunities: Jobs for family members

- Tax efficiency: Business deductions reduce tax burden

- Legacy and purpose: More than money, a family mission

Consider the Mars family (Mars candy), the Waltons (Walmart), or the Cargill family. These businesses have sustained wealth for 3-5+ generations by combining profitable operations with smart succession planning.

The Strategy: Smart Wealth-Building Tactics

Maximize Tax-Advantaged Accounts

Uncle Sam offers powerful tools for building generational wealth, if you know how to use them:

401(k) and IRA accounts:

- Contribute up to $23,500 annually to 401(k)s in 2025

- Get employer match (free money!)

- Roth versions grow tax-free forever

- Can be inherited by beneficiaries

529 Education Savings Plans:

- Tax-free growth for education expenses

- Can be transferred between family members

- Grandparents can contribute (estate tax benefits)

- Leftover funds can now be rolled to Roth IRAs

Health Savings Accounts (HSAs):

- Triple tax advantage (deductible, grows tax-free, withdraws tax-free)

- Can be invested like an IRA

- Becomes a retirement account after 65

- Inheritable by spouse

Create Multiple Income Streams

Generational wealth rarely comes from a single source. Diversifying income protects your family from economic shifts and creates redundancy. Learn about smart ways to make passive income that can continue generating wealth for decades.

Income stream examples:

- Primary employment: W-2 income or business profits

- Investment dividends: Regular payments from stock holdings

- Rental income: Monthly cash flow from real estate

- Royalties: From books, patents, or creative work

- Business partnerships: Equity stakes in ventures

- Digital assets: Websites, courses, or intellectual property

James Chen built his family’s wealth through this approach. “I have my day job as an engineer, three rental properties, a dividend portfolio, and a side consulting business,” he explains. “No single income stream makes me rich, but together they’re building something my kids can inherit and expand.”

Invest in Financial Education

The greatest asset you can pass to the next generation isn’t money, it’s financial literacy. This is where most wealthy families fail. Children inherit millions but lack the knowledge to preserve or grow them.

Teaching the next generation:

- Include children in age-appropriate money conversations

- Give them investment accounts to manage (custodial accounts)

- Share your financial wins and mistakes

- Require financial education before inheritance

- Create family meetings about wealth and values

The Vanderbilt family fortune, once the largest in America, was completely gone by the third generation. Why? No one taught the heirs how to manage it. Don’t let this happen to your family.

Understand and Avoid Common Mistakes

Many people lose money in investing because they make emotional decisions. Understanding why people lose money in the stock market helps you avoid these pitfalls and preserve wealth across generations.

Common-wealth-destroying mistakes:

- Panic selling during market downturns

- Chasing get-rich-quick schemes

- Failing to diversify investments

- Ignoring estate planning until too late

- Not communicating plans with heirs

- Excessive lifestyle inflation

- Poor business succession planning

The Protection: Preserving Wealth Across Generations

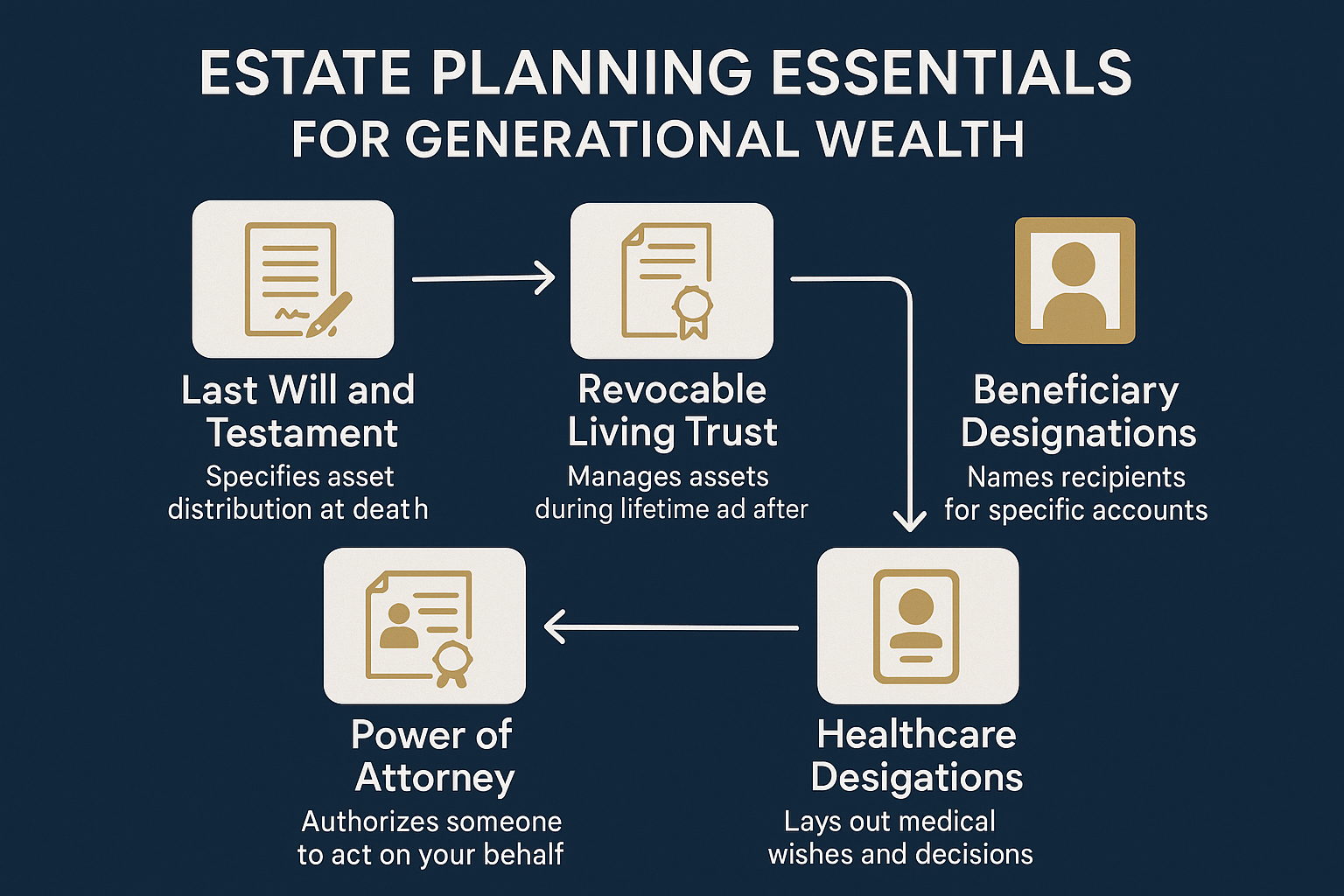

Estate Planning Essentials

You can build a fortune, but without proper estate planning, taxes, legal fees, and family disputes can destroy it in months. Estate planning isn’t just for the wealthy; it’s for anyone who wants to control what happens to their assets.

Must-have estate planning documents:

- Last will: Directs asset distribution

- Revocable Living Trust: Avoids probate, maintains privacy

- Durable Power of Attorney: Financial decisions if incapacitated

- Healthcare Power of Attorney: Medical decisions

- Living Will: End-of-life care preferences

- Beneficiary Designations: For retirement accounts and insurance

Advanced strategies:

- Irrevocable Life Insurance Trusts (ILITs): Remove insurance from taxable estate

- Grantor Retained Annuity Trusts (GRATs): Transfer appreciating assets tax-efficiently

- Family Limited Partnerships: Maintain control while gifting interests

- Charitable Remainder Trusts: Income now, charity later, tax deduction today

Asset Protection Strategies

Lawsuits, creditors, and divorce can obliterate generational wealth overnight. Proper asset protection creates legal barriers between threats and your family’s assets.

Protection methods:

- Business entities: LLCs and corporations shield personal assets

- Insurance: Umbrella policies provide lawsuit protection

- Homestead exemptions: Protect primary residence from creditors

- Retirement accounts: ERISA protection from most creditors

- Prenuptial agreements: Protect family wealth from divorce

The Gift and Estate Tax Strategy

In 2025, the federal estate tax exemption is $13.61 million per person ($27.22 million for couples). Sounds like a lot, but with decades of compound growth, your portfolio might exceed this threshold, especially when combined with real estate and business assets.

Tax-efficient transfer strategies:

- Annual gifting: Give up to $18,000 per person annually tax-free

- Educational/medical payments: Pay directly to institutions (unlimited)

- 529 superfunding: Contribute 5 years’ worth ($90,000) at once

- Lifetime exemption: Use your $13.61M exemption strategically

- Step-up in basis: Heirs receive assets at current market value (no capital gains)

The Communication: Family Governance and Values

Creating a Family Wealth Mission

Generational wealth fails when families lack shared values and purpose. Creating a family wealth mission statement aligns everyone around common goals.

Questions to answer together:

- What does wealth mean to our family?

- What values do we want to preserve?

- How should wealth be used (education, entrepreneurship, charity)?

- What responsibilities come with inheritance?

- How do we balance supporting family members and encouraging independence?

The Rockefeller family holds annual meetings where all generations discuss wealth stewardship, philanthropy, and family values. This practice has kept their wealth intact for over 150 years.

Regular Family Wealth Meetings

Schedule quarterly or annual meetings where you:

- Review investment performance

- Discuss financial goals and progress

- Educate younger members

- Address concerns or questions

- Plan for upcoming needs or opportunities

- Celebrate financial wins together

These meetings transform wealth from a taboo topic into a family conversation, ensuring everyone understands and supports the generational wealth plan. IRS: Estate and Gift Taxes

Balancing Support and Independence

One of the trickiest aspects of generational wealth is finding the balance between providing support and creating dependency. Too much support can rob children of motivation; too little can waste the advantages you’ve created.

Finding the balance:

- Match children’s earned income with investment contributions

- Pay for education, but require good grades

- Provide startup capital for businesses, but require business plans

- Offer down payment assistance, but require a mortgage qualification

- Create trust distributions tied to milestones (education, career, age)

“The best inheritance I received wasn’t money, it was my grandfather teaching me to invest, taking me to shareholder meetings, and explaining compound interest. The money helped, but the knowledge transformed my life.” Michael Torres, third-generation investor

The Action Plan: Your 90-Day Generational Wealth Roadmap

Ready to start building? Here’s your step-by-step action plan:

Month 1: Foundation (Days 1-30)

Week 1-2:

- Calculate current net worth (assets minus liabilities)

- Review and optimize the budget

- Build or strengthen an emergency fund

- Check credit reports and scores

Week 3-4:

- Open investment accounts (brokerage, IRA, 401k)

- Research investment options (index funds, dividend stocks)

- Set up automatic contributions

- Read beginner investing guides

Month 2: Growth (Days 31-60)

Week 5-6:

- Make first investments

- Research real estate opportunities in your area

- Explore side income possibilities

- Start financial education for children

Week 7-8:

- Increase retirement contributions by 1-2%

- Set up 529 accounts for children

- Meet with a fee-only financial advisor

- Create family wealth mission statement draft

Month 3: Protection (Days 61-90)

Week 9-10:

- Consult an estate planning attorney

- Draft will and healthcare directives

- Review insurance coverage (life, umbrella, disability)

- Update beneficiary designations

Week 11-12:

- Establish trust(s) if appropriate

- Hold the first family wealth meeting

- Create 5-year and 20-year wealth goals

- Implement smart financial moves for long-term growth

Common Questions About Generational Wealth

How much money do you need to create generational wealth?

You don’t need millions to start. Even $200-500 monthly invested consistently can grow to $500,000-$1 million over 30-40 years. The key is starting early and staying consistent. Generational wealth is built through time and compound growth, not lottery winnings.

Can you build generational wealth without a high income?

Absolutely. Many wealthy families started with modest incomes but made smart decisions: living below their means, investing consistently, avoiding debt, and thinking long-term. A teacher earning $50,000 who invests 15% for 40 years can build more wealth than a doctor earning $300,000 who spends it all.

What’s the biggest threat to generational wealth?

Poor communication and a lack of financial education for heirs. This is why 70% of wealth transfers fail. Money without wisdom disappears quickly. The second biggest threat is inadequate estate planning, letting taxes and legal fees consume assets unnecessarily.

Should I tell my children about family wealth?

Yes, but age-appropriately. Hiding wealth creates problems when children eventually inherit. Start teaching financial concepts early, gradually sharing more details as they mature. By adulthood, they should understand family assets, values, and responsibilities.

How do I protect wealth from divorce or lawsuits?

Use legal structures (trusts, LLCs), prenuptial agreements, adequate insurance, and proper asset titling. Consult with asset protection attorneys before problems arise. Once you’re sued or divorcing, it’s too late for many protections.

💰 Generational Wealth Calculator

See how your investments can grow across multiple generations

Generation 1 (Your Wealth)

Generation 2 (Your Children)

Generation 3 (Your Grandchildren)

💡 Important: This calculator assumes the wealth continues to grow without withdrawals and maintains the same rate of return. Actual results will vary based on market conditions, withdrawals, taxes, and investment choices. Consider consulting with a financial advisor for personalized guidance.

Taking Your First Steps Today

Building generational wealth isn’t about getting rich quickly; it’s about making consistent, smart decisions over decades. Every wealthy family started somewhere, often with less than you have right now.

The difference between families that build lasting wealth and those that don’t comes down to three things:

- Starting: Taking the first step, however small

- Consistency: Making wealth-building automatic and habitual

- Education: Continuously learning and teaching the next generation

You don’t need a trust fund, inheritance, or six-figure income. You need a plan, discipline, and time. The best time to start was 20 years ago. The second-best time is today.

Your next steps:

✅ Calculate your current net worth this week

✅ Open an investment account if you don’t have one

✅ Set up automatic monthly contributions

✅ Schedule a family conversation about money and values

✅ Read one book on investing or wealth building

✅ Meet with a fee-only financial advisor within 90 days

✅ Create or update your estate planning documents

Remember: Generational wealth isn’t just about money, it’s about creating opportunities, security, and freedom for people you’ll never meet. Your great-grandchildren might not remember your name, but they’ll live better lives because of the decisions you make today.

That’s a legacy worth building.

Generational wealth refers to assets, such as cash, real estate, investments, or businesses, passed down from one generation to another. The goal is to give future family members a financial head start.

It provides long-term financial stability, reduces dependence on debt, and allows future generations to invest in education, business, and homeownership without starting from zero.

Start with basic wealth-building steps:

Save consistently (pay yourself first).

Invest early in diversified assets (like index funds).

Eliminate high-interest debt.

Get insured and create a will or trust.

It typically takes two to three generations of disciplined saving, investing, and financial education to create lasting wealth.

Real estate (rental or inherited homes)

Retirement and brokerage accounts

Dividend-paying stocks

Family-owned businesses

Life insurance with beneficiaries

Yes. It’s often lost by the second or third generation due to poor money management, lack of education, and overconsumption, a pattern known as “shirtsleeves to shirtsleeves in three generations.”

Disclaimer

This article is for educational and informational purposes only and should not be construed as financial, investment, legal, or tax advice. Generational wealth building involves risk, and past performance does not guarantee future results. The stock market can be volatile, and you may lose money. Real estate values can decline, and businesses can fail. Before making any financial decisions, please consult with qualified professionals, including financial advisors, tax professionals, and estate planning attorneys who understand your specific situation. The strategies discussed may not be suitable for all investors, and individual results will vary based on personal circumstances, market conditions, and execution. The author and publisher are not responsible for any financial losses or legal issues that may result from applying the information in this article.

About the Author

Max Fonji is a financial educator and wealth strategist with over a decade of experience helping families build and preserve generational wealth. As the founder of TheRichGuyMath.com, Max combines practical investment strategies with accessible financial education to empower everyday people to achieve extraordinary financial outcomes. His mission is to democratize wealth-building knowledge and help families break cycles of financial struggle. Max holds certifications in financial planning and has helped hundreds of families create comprehensive wealth-building strategies. When he’s not researching investment strategies or writing, Max enjoys teaching financial literacy workshops and mentoring young investors.