← Back to Budgeting and Saving

Most people approach saving money backward. They pay bills, cover expenses, enjoy discretionary spending, and hope something remains at the month’s end.

That approach fails 87% of the time, according to Federal Reserve data showing that nearly 40% of Americans couldn’t cover a $400 emergency in 2024. The math behind money reveals a simple truth: when savings come last, they rarely happen at all.

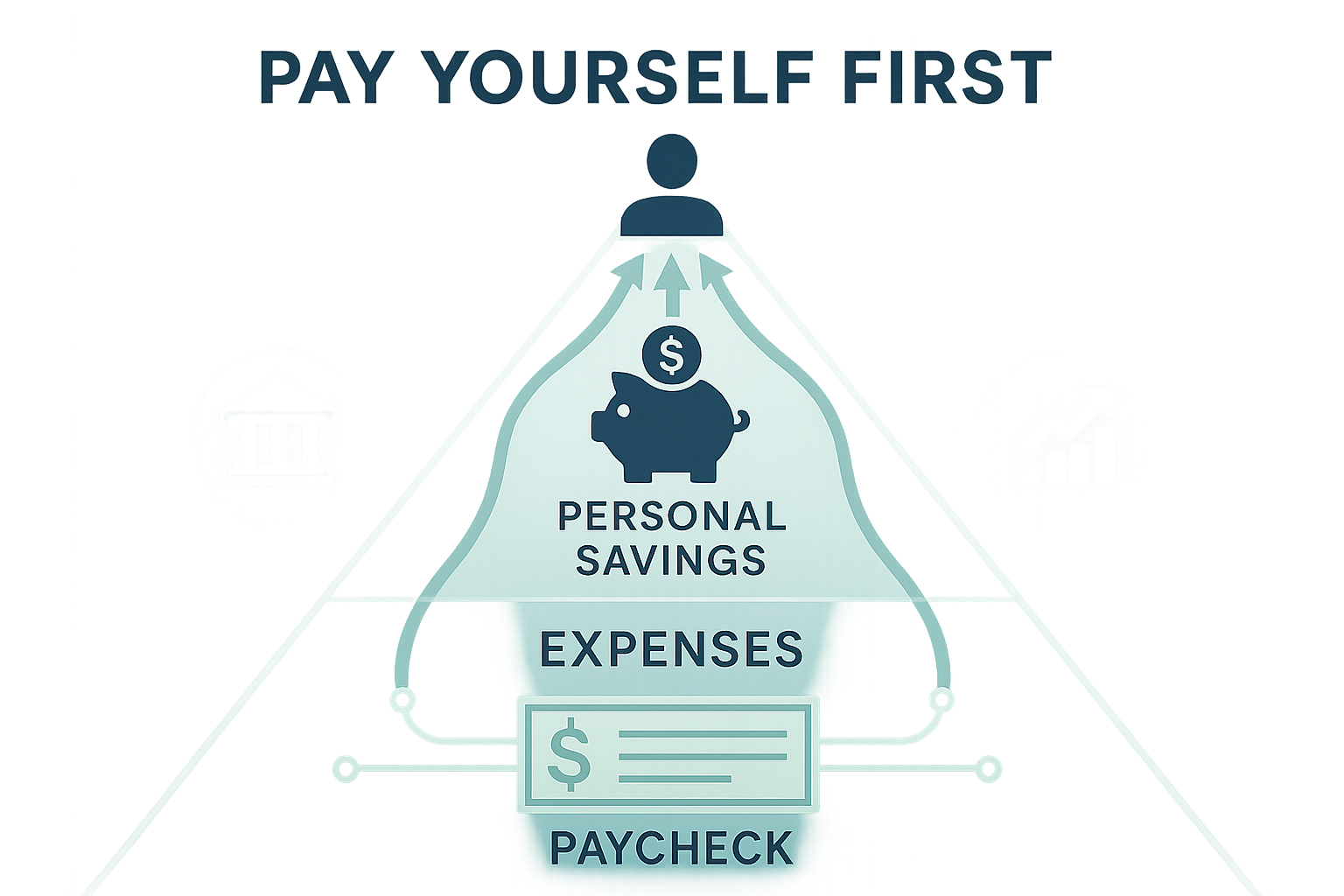

Pay Yourself First flips this equation. Instead of saving what’s left over, this evidence-based strategy treats savings as the first “bill” paid each month, automatically, consistently, and before spending temptation enters the equation.

This isn’t motivational advice. It’s behavioral finance applied to wealth building, and the data prove it works.

Key Takeaways

- Pay Yourself First means automatically saving a set percentage of income immediately upon receiving payment, before any other expenses

- Automation removes human psychology barriers, creating consistent wealth accumulation through compound growth without requiring ongoing discipline

- Starting with 10-15% of income provides an optimal balance for most earners, though even 5% builds the habit and generates measurable results

- The strategy outperforms traditional budgeting by guaranteeing savings happen first, eliminating the “leftover money” approach that typically fails

- Implementation requires three steps: choose a percentage, open separate accounts, and automate transfers on payday to make the system work without thinking

What Does “Pay Yourself First” Mean?

Pay Yourself First is a budgeting method that prioritizes saving a predetermined percentage of income immediately when payment arrives, rather than waiting to save whatever remains after expenses.

The concept inverts traditional financial planning. Instead of the common formula (Income – Expenses = Savings), Pay Yourself First operates on: Income – Savings = Spendable Amount.

This seemingly small change creates profound behavioral differences.

Simple Definition

When a paycheck is deposited into a checking account, an automatic transfer immediately moves a fixed percentage, typically 10-20%, into savings or investment accounts before any spending occurs.

The remaining balance becomes the budget for all other expenses: rent, groceries, utilities, entertainment, and discretionary purchases.

Why It Works (Behavioral Finance)

Human psychology consistently sabotages end-of-month savings attempts. Behavioral finance research identifies several cognitive biases that make traditional budgeting fail:

Present bias causes people to overvalue immediate gratification while undervaluing future benefits. A dinner out today feels more rewarding than retirement savings 30 years away.

Decision fatigue depletes willpower throughout the month. By the time bills are paid and daily choices accumulate, the mental energy required to “decide” to save has vanished.

Mental accounting leads people to treat money differently based on its source or intended use. Money sitting in a checking account feels “spendable,” while money in a separate savings account feels protected.

Pay Yourself First eliminates these psychological barriers. The decision happens once during setup, then automation handles execution. Savings become invisible—transferred before conscious spending choices begin.

Difference From Traditional Budgeting

Traditional budgeting tracks expenses across categories, attempting to control spending through monitoring and discipline. It requires ongoing effort: recording purchases, comparing to limits, and exercising restraint.

Pay Yourself First requires minimal ongoing effort. After initial setup, the system operates automatically.

Traditional budgeting asks: “How much can I save this month?” Pay Yourself First declares: “I’m saving X% regardless of what happens this month.”

The 50/30/20 rule budgeting approach combines both philosophies—allocating 20% to savings first, then dividing the remainder into needs (50%) and wants (30%). Pay Yourself First can work independently or integrate with percentage-based budgeting frameworks.

The critical distinction: Pay Yourself First makes savings non-negotiable rather than aspirational.

Why Paying Yourself First Works (Backed by Data)

The effectiveness of Pay Yourself First isn’t theoretical. Multiple studies across behavioral economics, personal finance, and retirement planning demonstrate measurable advantages.

Removes Human Error + Discipline Issues

A 2023 study by the National Bureau of Economic Research found that automatic enrollment in retirement plans increased participation rates from 49% to 91%[3]. When the decision became automatic rather than optional, behavior changed dramatically.

Pay Yourself First applies this principle to all savings, not just retirement. By removing the monthly decision to save, the strategy eliminates the primary failure point in traditional budgeting: human inconsistency.

Discipline is a finite resource. Willpower depletes throughout the day as decisions accumulate. Expecting consistent savings discipline for decades is mathematically unrealistic; the probability of sustained perfect behavior approaches zero over extended timeframes.

Automation transforms savings from a discipline problem into a systems problem. Systems operate independently of motivation, energy levels, or competing priorities.

Savings Grow Automatically

Compound growth requires consistency. Missing even occasional contributions significantly reduces long-term wealth accumulation.

Consider two savers, both earning $50,000 annually:

Saver A uses Pay Yourself First, automatically saving 15% ($625/month) with 7% annual returns.

Saver B uses traditional budgeting, averaging 10% savings ($417/month) but missing 3 months per year due to unexpected expenses.

After 30 years:

- Saver A accumulates $757,169

- Saver B accumulates $378,540

The difference, nearly $380,000, results primarily from consistency, not contribution amount. Pay Yourself First guarantees that consistency.

The math behind compound interest rewards regular contributions. Each month’s savings begins generating returns immediately, creating exponential growth over decades.

Helps People Hit Long-Term Goals

Vanguard’s 2024 “How America Saves” report revealed that participants in plans with automatic features had median account balances 2.3 times higher than those in plans requiring manual contributions.

Long-term goals, retirement, home down payments, and education funding require sustained effort over years or decades. The longer the timeline, the more opportunities for derailment.

Pay Yourself First removes timeline as a variable. Whether the goal is 5, 15, or 30 years away, the system continues operating without requiring renewed commitment each month.

This consistency transforms ambitious goals from aspirational to mathematical. A 25-year-old saving 15% of a $45,000 salary with 7% returns will accumulate over $1 million by age 60. Not through exceptional discipline or market timing, but through automated consistency and compound growth.

Beats Reactive Budgeting

Reactive budgeting responds to monthly variations: higher utility bills in summer, holiday spending in December, and unexpected car repairs.

These variations create savings volatility. Some months contribute $500, others $50, some nothing at all. The average might appear reasonable, but the inconsistency undermines compound growth.

Pay Yourself First maintains consistency regardless of monthly variations. If expenses increase, the budget adjusts by reducing discretionary spending, not by raiding savings.

This approach forces financial adaptation in real-time rather than postponing difficult choices. When the budget tightens because 15% already been moved to savings, spending decisions become more intentional.

The result: better spending habits develop naturally as a byproduct of the system, not as a primary goal requiring constant attention.

How to Pay Yourself First (Step-by-Step Guide)

Implementing Pay Yourself First requires five concrete steps. The entire setup takes approximately 30-60 minutes, then operates automatically.

Step 1: Decide on Your Savings Goal

Define what the savings will accomplish. Clarity on purpose strengthens commitment when the initial setup requires effort.

Common savings goals include:

- Emergency fund: 3-6 months of expenses in liquid savings

- Retirement: Long-term wealth building through tax-advantaged accounts

- Major purchase: Home down payment, vehicle replacement, education

- Financial independence: Building investment portfolios for passive income

Multiple goals can coexist. Many savers allocate percentages across several objectives: 10% to retirement, 5% to an emergency fund, and 5% to a home down payment.

The goal determines the account type and investment strategy. Short-term goals (under 3 years) require liquid, low-risk accounts. Long-term goals (10+ years) benefit from growth-oriented investments.

Calculate the target amount and timeline. A $30,000 emergency fund built over 3 years requires $833 monthly contributions. If the monthly income is $6,000, that’s approximately 14% of gross income.

Step 2: Pick a Percentage (10% / 15% / 20% Rule)

The savings percentage determines wealth-building velocity. Higher percentages accelerate goal achievement but require tighter spending discipline.

Starter percentage (5-10%): Appropriate for those new to systematic saving, carrying high-interest debt, or living in high-cost-of-living areas. This range builds the habit while allowing budget adjustment.

Standard percentage (10-15%): Recommended by most financial planners as the minimum for long-term wealth building. This range typically allows comfortable lifestyle maintenance while ensuring meaningful progress toward financial goals.

Aggressive percentage (20-30%): Accelerates wealth building significantly. Appropriate for high earners, those with low fixed expenses, or individuals prioritizing early financial independence.

Maximum percentage (40%+): Possible for high-income earners or those practicing extreme savings strategies. Requires significant lifestyle optimization but can compress decades of wealth building into years.

The percentage should feel slightly uncomfortable but sustainable. If it’s effortless, increase it. If it creates genuine hardship, reduce it temporarily.

Many successful savers start at 10% and increase by 1-2% annually, or allocate 50-100% of raises to savings increases. This prevents lifestyle inflation while gradually accelerating wealth building.

Before committing to long-term savings percentages, capture any available 401(k) employer match—this represents immediate 50-100% returns that exceed any other investment opportunity.

Step 3: Open a Separate Savings or Investment Account

Keeping savings in the primary checking account undermines the entire strategy. Money needs physical and psychological separation from daily spending.

For emergency funds and short-term goals (under 3 years):

- High-yield savings accounts (currently offering 4-5% APY in 2025)

- Money market accounts with check-writing restrictions

- Separate savings accounts at different banks to create access friction

For medium-term goals (3-10 years):

- Certificates of Deposit (CDs) with laddered maturity dates

- Conservative balanced funds (60% bonds, 40% stocks)

- Tax-advantaged 529 plans for education goals

For long-term goals (10+ years):

- Roth IRA for tax-free retirement growth

- Traditional 401(k) for pre-tax retirement contributions

- Taxable brokerage accounts invested in index funds for maximum growth potential

Account selection impacts returns significantly. A $500 monthly contribution over 30 years generates:

- $180,000 in a 0% checking account

- $349,680 in a 4% high-yield savings account

- $566,764 in a 7% stock index fund

The longer the timeline, the more aggressive the investment allocation should become. Time horizon, not age, determines appropriate risk levels.

Step 4: Automate Transfers on Payday

Automation is non-negotiable. Manual transfers reintroduce the decision-making that Pay Yourself First is designed to eliminate.

Set up automatic transfers to occur 1-2 days after payday deposits. This timing ensures funds are available while preventing spending from occurring first.

For employed individuals with direct deposit:

- Many employers allow direct deposit splitting across multiple accounts

- Request X% to savings/investment accounts, remainder to checking

- This approach makes savings completely invisible—the money never appears in the spending account

For those without direct deposit splitting:

- Set up automatic transfers through the bank’s online platform

- Schedule transfers for the same day each pay period

- Use recurring transfer features rather than manual one-time transfers

For variable income earners:

- Calculate the percentage based on the average monthly income over the past 6-12 months

- Set an automatic transfer for the conservative amount

- Manually transfer additional amounts during high-income months

Most banks and investment platforms offer automatic transfer features. The setup takes 5-10 minutes and requires:

- Account and routing numbers for both accounts

- Transfer amount or percentage

- Frequency (weekly, bi-weekly, monthly)

- Start date

After setup, verify the first 2-3 transfers execute correctly, then let the system operate without intervention.

Step 5: Treat Savings Like a Bill You Must Pay

Mental framing matters. Savings positioned as “optional” or “if there’s money left over” will always lose to immediate spending opportunities.

Instead, categorize savings as a fixed expense—as non-negotiable as rent, utilities, or loan payments.

This reframing changes the question from “Can I afford to save this month?” to “How do I cover my other expenses with what remains after savings?”

The psychological shift is subtle but powerful. Bills get paid regardless of convenience or desire. Treating savings as a bill creates the same mental obligation.

When unexpected expenses arise, the question becomes “What can I cut from discretionary spending?” rather than “Should I skip savings this month?”

This approach builds financial discipline as a byproduct. By forcing spending to fit within post-savings income, lifestyle inflation gets controlled automatically. The budget adapts to reality rather than expanding to consume all available income.

Over time, living on 80-90% of income becomes the new normal. The savings transfers become invisible, and the reduced checking account balance feels like the “real” income.

What Percentage Should You Pay Yourself First?

The optimal savings percentage depends on current financial position, income level, fixed expenses, and wealth-building timeline.

No universal percentage fits all situations, but research-backed guidelines provide starting points.

Starter: 5%

Appropriate for:

- Those new to systematic saving with no existing emergency fund

- High debt-to-income ratios (over 40%)

- Very high cost-of-living areas where housing exceeds 40% of income

- Variable income earners establishing baseline habits

Expected outcomes:

On $3,000 monthly income, 5% equals $150/month or $1,800 annually.

Over 10 years at 4% returns (high-yield savings): $22,132

Over 30 years at 7% returns (stock index funds): $181,899

While 5% won’t build substantial wealth quickly, it establishes the automation habit and creates meaningful emergency fund protection within 12-18 months.

The goal at this level is habit formation, not wealth maximization. After 6-12 months, increase to 7-8%, then gradually progress toward 10%+.

Standard: 10-15%

Appropriate for:

- Most middle-income earners ($40,000-$100,000 annually)

- Those with emergency funds established

- Individuals targeting traditional retirement age (62-67)

- Balanced approach between current lifestyle and future security

Expected outcomes:

On $5,000 monthly income, 12% equals $600/month or $7,200 annually.

Over 10 years at 7% returns: $103,276

Over 30 years at 7% returns: $726,317

This range represents the minimum recommended by most financial planners for achieving financial security. It allows comfortable lifestyle maintenance while ensuring retirement readiness and emergency fund protection.

The 10-15% range aligns with traditional budgeting frameworks that allocate 20% to savings and debt repayment combined. For those without debt, the full 15-20% can flow toward wealth building.

Wealth-Building: 20-30%

Appropriate for:

- High-income earners ($100,000+)

- Those targeting early retirement (before age 60)

- Individuals with low fixed expenses (under 40% of income)

- Aggressive wealth-building strategies

Expected outcomes:

On $7,000 monthly income, 25% equals $1,750/month or $21,000 annually.

Over 10 years at 7% returns: $301,305

Over 20 years at 7% returns: $913,247

Over 30 years at 7% returns: $2,119,258

This range creates substantial wealth within 15-20 years and enables early financial independence. The 4% rule suggests that $2.1 million generates approximately $84,000 in sustainable annual retirement income.

Achieving 20-30% savings rates typically requires intentional lifestyle design: moderate housing costs, controlled transportation expenses, and limited lifestyle inflation as income grows.

High Income: 40%+ Possible

Appropriate for:

- Very high earners ($200,000+)

- Those practicing FIRE (Financial Independence, Retire Early) strategies

- Individuals with paid-off housing or very low fixed expenses

- Short-term wealth building (5-15 years to financial independence)

Expected outcomes:

On $12,000 monthly income, 50% equals $6,000/month or $72,000 annually.

Over 10 years at 7% returns: $1,039,276

Over 15 years at 7% returns: $1,897,737

At this savings rate, financial independence becomes achievable within 10-15 years, regardless of starting point. The math becomes exponential; each year of work funds multiple years of financial freedom.

This approach requires significant lifestyle optimization and often includes strategies like house hacking, geographic arbitrage, or business ownership to maximize the income-to-expense ratio.

The percentage matters less than consistency. A sustained 15% savings rate outperforms sporadic 30% attempts that frequently pause during “difficult months.”

Pay Yourself First vs The 50/30/20 Rule

Both Pay Yourself First and the 50/30/20 rule represent evidence-based budgeting strategies, but they emphasize different aspects of financial management.

Comparison

Pay Yourself First:

- Primary focus: Automate savings before any spending occurs

- Flexibility: Doesn’t prescribe specific spending category percentages

- Complexity: Minimal, set percentage, automate, spend the rest

- Best for: Those who struggle with spending discipline or category tracking

50/30/20 Rule:

- Primary focus: Balanced allocation across needs (50%), wants (30%), and savings (20%)

- Structure: Provides spending guidelines for all income

- Complexity: Moderate, requires categorizing expenses and monitoring percentages

- Best for: Those who want a comprehensive budget framework with built-in savings

The 50/30/20 budgeting approach actually incorporates Pay Yourself First principles by allocating 20% to savings and debt repayment first, then dividing the remaining 80% between essential needs and discretionary wants.

Which One Is Better

Neither is universally superior. The optimal choice depends on individual financial behavior and goals.

Pay Yourself First excels when:

- Spending control isn’t the primary problem

- Income comfortably exceeds expenses

- Simplicity and automation are priorities

- Savings rates need to exceed 20%

50/30/20 Rule excels when:

- Spending regularly exceeds income

- Category-level awareness would improve financial decisions

- A balanced approach between present enjoyment and future security is desired

- A clear framework reduces financial anxiety

Many successful savers combine both approaches: use Pay Yourself First automation for savings (potentially exceeding the 20% guideline), then apply 50/30 thinking to the remaining income.

The critical insight: both strategies prioritize savings before discretionary spending. This fundamental principle matters more than the specific framework.

When to Use Each Method

Use Pay Yourself First when:

- Starting from zero savings and needing immediate habit formation

- Income is variable or irregular

- Previous budgeting attempts failed due to tracking fatigue

- Aggressive savings goals (30%+) exceed standard framework recommendations

- Financial situation is straightforward without complex expense categories

Use 50/30/20 when:

- Expenses frequently exceed income

- Unclear where the money currently goes each month

- Need structure for both saving and spending decisions

- Want to ensure needs don’t exceed 50% of income

- Balancing debt repayment with savings goals

Combine both when:

- Wanting automated savings with spending awareness

- Savings goals exceed 20% but spending categories need attention

- Transitioning from financial instability to wealth building

- Income level allows both aggressive saving and a comfortable lifestyle

The framework matters less than execution. Consistent 15% savings through any method outperforms perfect 30% planning that never gets implemented.

Pay Yourself First Examples (Real Numbers)

Abstract percentages become meaningful when translated into actual dollars and projected outcomes.

Someone Earning $2,000/Month

Gross monthly income: $2,000

Annual income: $24,000

This income level represents entry-level positions, part-time work, or individuals in lower cost-of-living areas.

10% Pay Yourself First:

- Monthly savings: $200

- Annual savings: $2,400

- Spendable income: $1,800/month

15% Pay Yourself First:

- Monthly savings: $300

- Annual savings: $3,600

- Spendable income: $1,700/month

20% Pay Yourself First:

- Monthly savings: $400

- Annual savings: $4,800

- Spendable income: $1,600/month

12-Month Projected Savings

Starting from zero savings, here’s the accumulated wealth after one year at each percentage level:

| Savings Rate | Monthly Amount | Year 1 Total (0% return) | Year 1 Total (4% HYSA) |

|---|---|---|---|

| 10% | $200 | $2,400 | $2,449 |

| 15% | $300 | $3,600 | $3,674 |

| 20% | $400 | $4,800 | $4,899 |

Even at modest income levels, consistent Pay Yourself First creates a meaningful emergency fund protection within 12 months.

Long-Term Projection ($2,000/Month Income)

Assuming 7% average annual returns through index fund investing:

10% savings rate ($200/month):

- 10 years: $34,426

- 20 years: $104,159

- 30 years: $242,726

15% savings rate ($300/month):

- 10 years: $51,638

- 20 years: $156,239

- 30 years: $364,088

20% savings rate ($400/month):

- 10 years: $68,851

- 20 years: $208,318

- 30 years: $485,451

The difference between 10% and 20% savings rates—just $200 monthly—creates a $242,725 wealth difference over 30 years. This demonstrates the exponential power of compound growth on consistent contributions.

Higher Income Example: $5,000/Month

Gross monthly income: $5,000

Annual income: $60,000

10% Pay Yourself First:

- Monthly savings: $500

- Annual savings: $6,000

- 30-year accumulation at 7%: $606,816

15% Pay Yourself First:

- Monthly savings: $750

- Annual savings: $9,000

- 30-year accumulation at 7%: $910,224

20% Pay Yourself First:

- Monthly savings: $1,000

- Annual savings: $12,000

- 30-year accumulation at 7%: $1,213,632

25% Pay Yourself First:

- Monthly savings: $1,250

- Annual savings: $15,000

- 30-year accumulation at 7%: $1,517,040

At moderate income levels, aggressive savings rates create millionaire status through systematic contributions alone—no exceptional investment returns, inheritance, or business success required.

The math is simple: consistent contributions + compound growth + sufficient time = substantial wealth.

Advanced Version (For Faster Results)

Basic Pay Yourself First automation creates consistent wealth building. Advanced strategies accelerate results through optimization and strategic account selection.

Direct Deposit Splitting

Most employers with direct deposit capabilities allow splitting deposits across multiple accounts. This represents the ultimate automation—savings never appear in checking accounts.

Implementation:

Contact HR or the payroll department and request a direct deposit allocation form. Specify:

- Account 1: Savings/Investment account — X% or fixed dollar amount

- Account 2: Retirement account (if employer allows) — Y%

- Account 3: Checking account — Remainder

Example allocation for $5,000 monthly gross pay:

- 15% ($750) → Roth IRA

- 10% ($500) → High-yield savings (emergency fund)

- 5% ($250) → Taxable brokerage (investment account)

- 70% ($3,500) → Checking (living expenses)

This approach makes savings completely invisible. The checking account balance becomes the “real” income, eliminating temptation.

Using High-Yield Savings

Traditional savings accounts at major banks typically offer 0.01-0.10% interest—essentially zero real growth after inflation.

High-yield savings accounts (HYSA) at online banks currently offer 4.0-5.0% APY as of 2025, representing 40-50x higher returns[5].

Impact on emergency fund building:

Saving $500/month for 24 months (building $12,000 emergency fund):

- Traditional savings (0.05% APY): $12,006

- High-yield savings (4.5% APY): $12,551

The difference—$545—represents free money requiring zero additional effort beyond choosing the right account.

For short-to-medium term goals (1-5 years), high-yield savings provide an optimal balance between growth and liquidity. The returns aren’t exceptional, but they’re guaranteed and immediately accessible.

Auto-Investing in Index Funds

For long-term goals (10+ years), stock market index funds historically deliver 7-10% average annual returns, significantly outpacing savings accounts.

Most major brokerages (Vanguard, Fidelity, Schwab) offer automatic investment features:

Setup process:

- Open a taxable brokerage or IRA account

- Link checking account for transfers

- Select target index fund (total market or S&P 500)

- Schedule automatic purchases (monthly recommended)

- Enable dividend reinvestment for compound acceleration

Example: $1,000 monthly auto-investment in a total stock market index fund

Assuming 7% average annual returns:

- 10 years: $172,561

- 20 years: $521,795

- 30 years: $1,213,632

The automation eliminates market timing attempts—a strategy that fails for 90% of active investors. Consistent monthly purchases average out market volatility through dollar-cost averaging.

Dividend reinvestment further accelerates growth by automatically purchasing additional shares with dividend payments, creating compound-on-compound effects.

Roth IRA / 401(k) Automation

Tax-advantaged retirement accounts provide the most powerful wealth-building acceleration through tax savings and compound growth.

401(k) automation:

- Contributions occur automatically through payroll deduction

- Many employers match 50-100% of contributions up to 3-6% of salary

- This match represents immediate 50-100% returns; capture it before any other savings

- Contributions reduce current taxable income (traditional 401k)

Roth IRA automation:

- Set up automatic monthly transfers from checking to Roth IRA

- Contributions grow tax-free forever

- Withdrawals in retirement are completely tax-free

- 2025 contribution limit: $7,000 annually ($583/month)

Combined strategy for maximum acceleration:

For someone earning $75,000 annually:

- Contribute enough to 401(k) to capture full employer match (typically 6% = $4,500)

- Max out Roth IRA ($7,000 annually = $583/month)

- Return to 401(k) and increase contributions toward $23,000 annual limit

- Add taxable brokerage investments if all tax-advantaged space is filled

This layered approach optimizes tax efficiency while maintaining automation throughout.

The tax savings compound over decades. A $500 monthly Roth IRA contribution growing at 7% for 30 years creates $606,816 in completely tax-free wealth, potentially saving $100,000+ in retirement taxes compared to taxable accounts.

Common Mistakes to Avoid

Even well-designed Pay Yourself First systems fail when common implementation errors occur.

Saving After Spending

The most fundamental mistake: treating Pay Yourself First as a philosophy rather than a mechanical system.

The error: Intending to save 15% but waiting until mid-month or month-end to transfer funds.

Why it fails: Money in checking accounts feels spendable. Unexpected expenses, lifestyle creep, and spending impulses consume available balances. By month-end, the intended savings often don’t materialize.

The solution: Automate transfers for 1-2 days after payday, before any spending occurs. The timing matters more than the percentage.

Keeping Savings in Checking

Combining savings and spending money in a single account undermines the psychological separation that makes Pay Yourself First effective.

The error: Saving diligently but keeping accumulated savings in the primary checking account.

Why it fails: Large checking balances create a false sense of spending capacity. The mental accounting that protects dedicated savings accounts doesn’t activate when everything pools together.

The solution: Maintain separate accounts at different institutions if necessary. The friction of transferring between banks provides psychological protection against impulse withdrawals.

Emergency funds belong in high-yield savings accounts. Long-term investments belong in retirement or brokerage accounts. Only the monthly spending money should remain in the checking.

Not Automating

Manual execution reintroduces all the psychological barriers that Pay Yourself First is designed to eliminate.

The error: Calculating the savings amount correctly, but transferring each month manually.

Why it fails: Manual transfers require ongoing decision-making. Eventually, a “temporary” skip becomes permanent, or frequency becomes irregular, destroying the compound growth advantage of consistency.

The solution: Spend the 10 minutes required to set up automation once, then never think about it again. The system operates independently of motivation, memory, or monthly circumstances.

Research consistently shows automated savings achieve 3-5x higher success rates than manual commitment-based approaches[6].

Setting Unrealistic Percentages

Aggressive savings goals that create genuine financial hardship lead to system abandonment.

The error: Committing to 30% savings when current spending requires 95% of income, then abandoning the entire system when it proves unsustainable.

Why it fails: Unsustainable systems eventually break. When they do, the psychological failure often prevents restarting at more reasonable levels.

The solution: Start conservatively. A sustained 10% savings rate outperforms an abandoned 25% attempt. Build the habit first, then increase percentages gradually as income grows or expenses decrease.

The goal is permanent behavior change, not maximum short-term savings. Sustainability matters more than optimization.

Raiding Savings for Non-Emergencies

The final common failure: building savings successfully but withdrawing for non-emergency purposes.

The error: Accumulating $5,000 in savings, then withdrawing $2,000 for a vacation or discretionary purchase.

Why it fails: Each withdrawal resets progress and reinforces the mental pattern that savings are available for spending. The compound growth gets interrupted, and the psychological protection of “untouchable” money erodes.

The solution: Define clear criteria for emergency withdrawals before they’re needed. True emergencies are unexpected, necessary, and urgent—job loss, medical expenses, critical home/auto repairs.

Everything else gets funded through separate sinking funds or by temporarily reducing the savings percentage while maintaining the automation.

Maintaining the psychological barrier between savings and spending is as important as the savings themselves.

💰 Pay Yourself First Calculator

Calculate your automatic savings and long-term wealth projection

Conclusion

Pay Yourself First transforms savings from an aspirational goal into an automatic system. By prioritizing wealth building before spending, the strategy eliminates the psychological barriers that cause traditional budgeting to fail.

The math is straightforward: consistent contributions plus compound growth over sufficient time create substantial wealth regardless of income level. A 25-year-old saving 15% of a $45,000 salary accumulates over $1 million by age 60 through automation alone.

Implementation requires three actions:

- Choose a sustainable percentage (start with 10-15% for most earners)

- Open separate accounts for different goals (emergency fund, retirement, investments)

- Automate transfers to occur immediately after payday

The system operates independently after setup. No ongoing discipline, tracking, or decision-making required.

Start today, not next month. Even 5% of current income builds the habit and generates measurable results within 12 months. Increase the percentage as income grows or expenses decrease.

The wealth-building strategy that works automatically isn’t complex financial engineering. It’s behavioral finance applied through systematic automation, paying yourself first, every time, without exception.

References

[1] Board of Governors of the Federal Reserve System. (2024). “Report on the Economic Well-Being of U.S. Households in 2023.” Federal Reserve. https://www.federalreserve.gov/

[2] Thaler, R. H. (1999). “Mental accounting matters.” Journal of Behavioral Decision Making, 12(3), 183-206.

[3] National Bureau of Economic Research. (2023). “The Power of Automatic Enrollment.” NBER Working Paper Series. https://www.nber.org/

[4] Vanguard Group. (2024). “How America Saves 2024.” Vanguard Research. https://institutional.vanguard.com/

[5] Federal Deposit Insurance Corporation. (2025). “National Rates and Rate Caps.” FDIC. https://www.fdic.gov/

[6] Benartzi, S., & Thaler, R. H. (2013). “Behavioral economics and the retirement savings crisis.” Science, 339(6124), 1152-1153.

Disclaimer

This article provides educational information about personal finance strategies and wealth-building principles. It is not personalized financial advice, investment recommendations, or tax guidance.

Individual financial situations vary significantly based on income, expenses, debt levels, risk tolerance, tax circumstances, and personal goals. The percentages, examples, and projections presented represent general guidelines and hypothetical scenarios, not guaranteed outcomes.

Investment returns fluctuate based on market conditions. Historical performance does not guarantee future results. All investments carry risk, including potential loss of principal.

Before implementing significant financial changes, consult with qualified financial advisors, tax professionals, or certified financial planners who can evaluate your specific circumstances and provide personalized recommendations.

The Rich Guy Math provides data-driven financial education to improve financial literacy and understanding of wealth-building principles. We do not provide individualized financial planning, investment management, or tax preparation services.

Author Bio

Max Fonji is the founder of The Rich Guy Math, a financial education platform dedicated to explaining the math behind money through data-driven analysis and evidence-based strategies. With expertise in behavioral finance, investment analysis, and wealth-building systems, Max translates complex financial concepts into actionable frameworks that empower readers to make informed decisions.

Max’s approach combines analytical precision with educational clarity, focusing on the cause-and-effect relationships that drive financial outcomes. Through detailed research and practical application, The Rich Guy Math helps individuals understand not just what to do with money but why specific strategies work based on mathematical principles and behavioral science.

Connect with Max and explore more financial insights at The Rich Guy Math.

Frequently Asked Questions

What is the Pay Yourself First rule?

It’s a budgeting strategy where you automatically save or invest part of your income before spending anything else.

How much should I pay myself first?

Most people start with 10–15%. If your income allows it, 20–30% accelerates wealth-building.

Is paying yourself first better than budgeting?

Yes — it guarantees savings by making it automatic and non-negotiable.

Can I pay myself first on low income?

Yes. Start with 1–5%, then increase gradually.

Should I automate paying myself first?

Yes. Automation is what makes this method effective.