Imagine waking up to notifications that money has landed in your account—not from your 9-to-5 job, but from investments working for you around the clock. Portfolio income is the financial fuel that powers this dream, transforming everyday investors into wealth-builders who earn while they sleep. Whether you’re tired of trading time for money or want to diversify your income streams, understanding portfolio income is your first step toward financial freedom.

In simple terms, portfolio income means earnings generated from your investment assets, stocks, bonds, mutual funds, and other securities that produce dividends, interest, and capital gains without requiring your active participation.

TL;DR

- Portfolio income is money earned from investments like stocks, bonds, and mutual funds through dividends, interest, and capital gains

- Unlike earned income from a job, portfolio income works for you 24/7 and offers favorable tax treatment on long-term gains

- Building portfolio income requires strategic asset allocation, consistent investing, and patience. Most successful investors start small and scale gradually

- Diversification across asset classes (stocks, bonds, REITs) reduces risk while maximizing income potential

- Tax-advantaged accounts like IRAs and 401(k)s can accelerate portfolio income growth by deferring or eliminating taxes

What Is Portfolio Income?

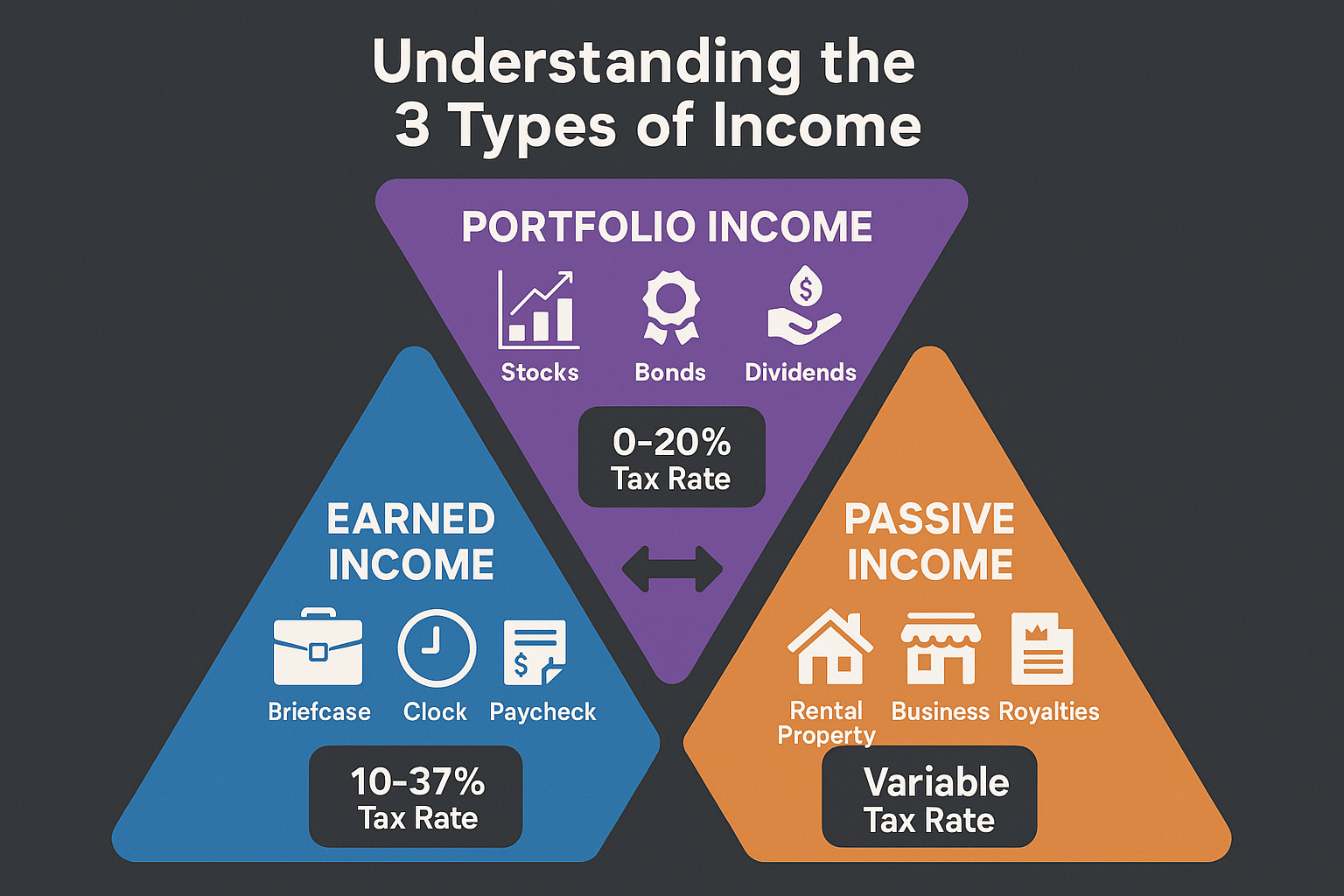

Portfolio income represents earnings generated from paper assets and investments rather than from active work or business operations. According to the IRS, it’s one of three primary income categories (alongside earned income and passive income), distinguished by its origin from investment activities.

The Three Types of Income

| Income Type | Source | Examples | Tax Treatment |

|---|---|---|---|

| Earned Income | Active work | Salaries, wages, tips, commissions | Highest tax rates (10-37%) |

| Portfolio Income | Investments | Dividends, interest, capital gains | Preferential rates (0-20% for long-term gains) |

| Passive Income | Business activities | Rental properties, limited partnerships | Varies by activity |

See our full guide on Types of income

Portfolio income specifically includes:

- Dividends – Regular cash payments from stocks and mutual funds

- Interest – Earnings from bonds, CDs, and savings accounts

- Capital gains – Profits from selling investments at higher prices than purchase prices

- Royalties – Payments from intellectual property investments (patents, mineral rights)

“A higher portfolio income usually indicates a well-diversified investment strategy that generates consistent cash flow independent of employment status.”

Why Portfolio Income Matters for Wealth Building

Building portfolio income isn’t just about having extra money; it’s about creating financial resilience and time freedom. Here’s why savvy investors prioritize it:

Key Benefits

- Financial Independence – Portfolio income can eventually replace or supplement earned income, allowing earlier retirement or career flexibility

- Tax Efficiency – Long-term capital gains and qualified dividends receive preferential tax treatment (0%, 15%, or 20% depending on income level) compared to ordinary income tax rates

- Compound Growth – Reinvested portfolio income accelerates wealth accumulation through the power of compounding

- Inflation Protection – Well-constructed portfolios typically outpace inflation, preserving purchasing power over time

- Legacy Building – Investment portfolios can be passed to heirs, creating generational wealth

According to the Federal Reserve’s Survey of Consumer Finances, households with investment income have median net worths nearly 10 times higher than those relying solely on earned income.

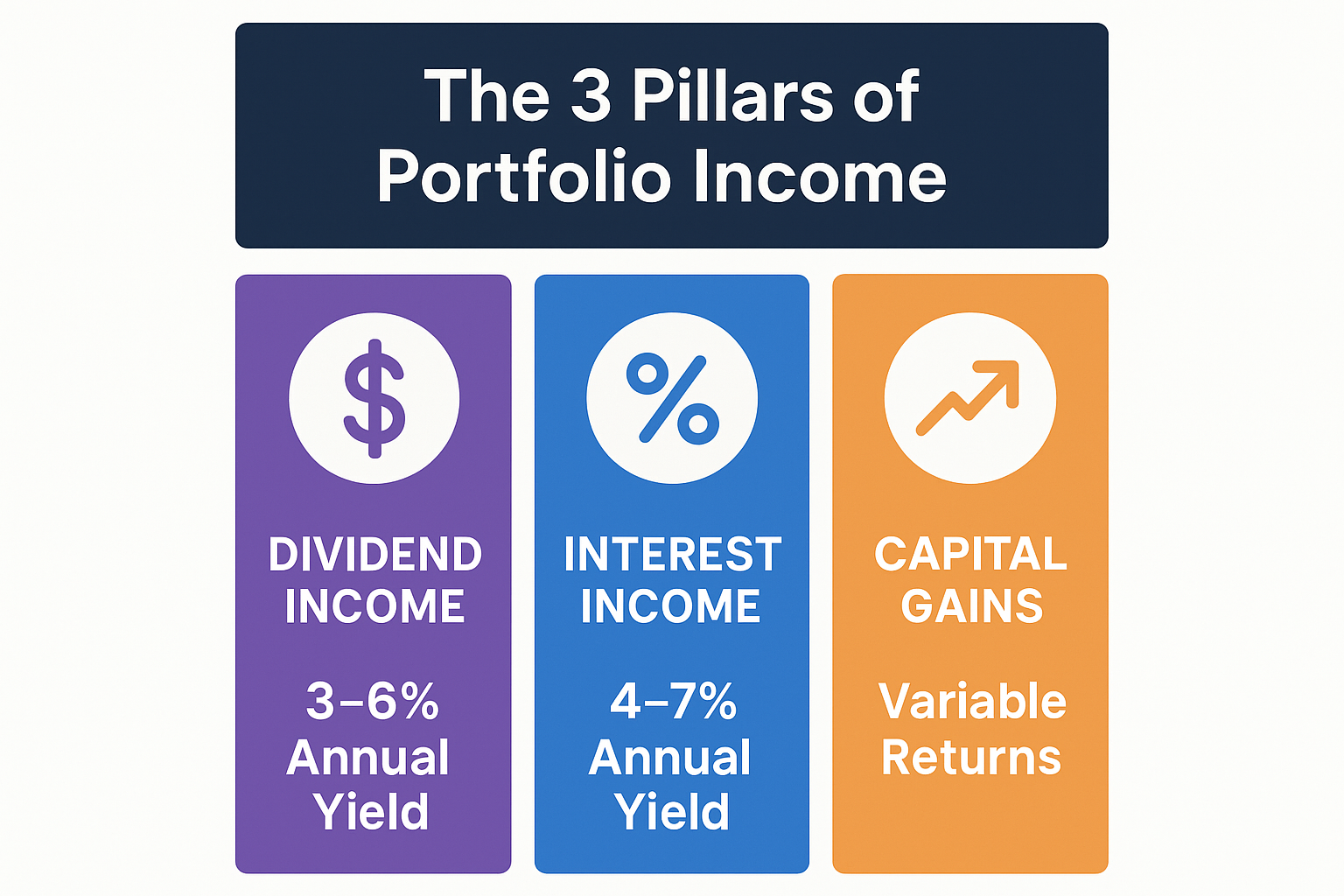

The Three Pillars of Portfolio Income

Understanding the components of portfolio income helps you build a balanced strategy that generates consistent returns.

1. Dividend Income

Dividends are cash distributions that companies pay to shareholders from their profits. Dividend investing provides regular income while maintaining ownership of appreciating assets.

Key characteristics:

- Paid quarterly by most U.S. companies

- Can be qualified (taxed at capital gains rates) or non-qualified (taxed as ordinary income)

- Dividend yields typically range from 1%-6% annually

- High dividend stocks often come from mature, stable companies

Example: If you own 100 shares of a stock trading at $50 with a 4% annual dividend yield, you’d receive $200 annually ($50 × 100 × 0.04), typically paid as $50 quarterly.

2. Interest Income

Interest represents compensation for lending money through bonds, CDs, money market accounts, and other fixed-income instruments.

Common sources:

- Treasury bonds – Backed by the U.S. government, lowest risk

- Corporate bonds – Higher yields, moderate risk

- Municipal bonds – Tax-free interest for certain investors

- High-yield savings accounts – Liquid, FDIC-insured

- Certificates of Deposit (CDs) – Fixed rates, term commitments

Interest rates in 2025: With the Federal Reserve adjusting monetary policy, interest rates on safe instruments range from 4-5% for high-yield savings to 5-7% for investment-grade corporate bonds.

3. Capital Gains

Capital gains occur when you sell an investment for more than its purchase price. Understanding why the stock market goes up helps investors capture these gains strategically.

Two categories:

Short-term capital gains (held ≤ 1 year):

- Taxed as ordinary income

- Rates from 10-37% depending on tax bracket

- Higher tax burden reduces net returns

Long-term capital gains (held > 1 year):

- Preferential tax rates: 0%, 15%, or 20%

- Encourages buy-and-hold strategies

- Significantly improves after-tax returns

Example: Purchase 50 shares at $100 ($5,000 investment). Sell after 18 months at $130 ($6,500 total). Your long-term capital gain is $1,500, taxed at preferential rates rather than ordinary income rates.

How to Calculate Your Portfolio Income

Investors use portfolio income to measure investment performance and plan financial goals. The formula for portfolio income is straightforward:

Portfolio Income Formula

Annual Portfolio Income = Dividends Received + Interest Earned + Realized Capital Gains

Real-World Example Calculation

Let’s examine Sarah’s 2025 investment portfolio:

Portfolio holdings:

- $50,000 in dividend stocks (3% yield) = $1,500 dividends

- $30,000 in corporate bonds (5% yield) = $1,500 interest

- Sold appreciated stock for $8,000 gain = $8,000 capital gains

Total Portfolio Income: $1,500 + $1,500 + $8,000 = $11,000

Portfolio Income Yield: $11,000 ÷ $80,000 total portfolio = 13.75% annual return

This calculation helps Sarah understand her investment performance and plan future contributions to reach income goals.

Building Your Portfolio Income Strategy: Step-by-Step Guide

Creating sustainable portfolio income requires planning and consistent execution. Follow this proven framework:

Step 1: Assess Your Current Financial Position

Before investing, establish your foundation:

- Emergency fund – 3-6 months of expenses in liquid savings

- High-interest debt payoff – Credit cards, personal loans (interest rates typically exceed investment returns)

- Clear financial goals – Retirement timeline, income targets, risk tolerance

- Investment timeline – Short-term (< 5 years), medium-term (5-10 years), long-term (10+ years)

Step 2: Choose Tax-Advantaged Accounts

Maximize growth by selecting appropriate account types:

Retirement accounts:

- 401(k) – Employer-sponsored, often with matching contributions (free money!)

- Traditional IRA – Tax-deductible contributions, tax-deferred growth

- Roth IRA – After-tax contributions, tax-free withdrawals in retirement

- SEP IRA – For self-employed individuals, higher contribution limits

Taxable brokerage accounts:

- Unlimited contributions

- Access funds anytime without penalties

- Taxed annually on dividends, interest, and realized gains

- Ideal for goals before retirement age

Step 3: Diversify Across Asset Classes

Diversification reduces risk while capturing returns from multiple sources. A balanced portfolio might include:

Sample Asset Allocation (Moderate Risk):

| Asset Class | Allocation | Primary Purpose |

|---|---|---|

| U.S. Large-Cap Stocks | 35% | Growth + dividends |

| U.S. Small/Mid-Cap Stocks | 15% | Higher growth potential |

| International Stocks | 20% | Geographic diversification |

| Bonds (Investment-Grade) | 20% | Stable income + principal protection |

| REITs | 5% | Real estate exposure + high dividends |

| Cash/Money Market | 5% | Liquidity + opportunity fund |

This allocation provides exposure to stock market growth while generating consistent income through dividends and interest.

Step 4: Select Income-Generating Investments

Focus on quality investments with proven income track records:

Dividend stocks criteria:

- Dividend aristocrats – Companies with 25+ consecutive years of dividend increases

- Payout ratios – Below 60% indicates sustainable dividends

- Strong fundamentals – Consistent earnings, low debt, competitive advantages

- Sector diversity – Spread across healthcare, consumer goods, technology, and utilities

Bond selection:

- Credit ratings – Investment-grade (BBB or higher) for stability

- Duration matching – Align bond maturity with your timeline

- Laddering strategy – Stagger maturity dates for consistent income and reinvestment opportunities

Index funds and ETFs:

- Dividend-focused ETFs – Instant diversification across dividend payers

- Bond index funds – Broad fixed-income exposure

- REIT funds – Real estate income without property management

Step 5: Implement Dollar-Cost Averaging

Rather than timing the market (which even professionals struggle with), invest consistently regardless of market conditions.

Dollar-cost averaging benefits:

- Reduces emotional decision-making

- Averages out the purchase prices over time

- Takes advantage of market dips automatically

- Builds discipline and consistency

Example: Invest $500 monthly into a diversified portfolio. Some months you’ll buy when prices are high, others when they’re low. Over the years, this smooths out volatility and reduces the risk of poor timing.

Understanding the cycle of market emotions helps maintain discipline during market fluctuations.

Step 6: Reinvest for Compound Growth

The most powerful wealth-building strategy is reinvesting portfolio income to purchase additional income-generating assets.

Compound growth example:

Starting with $10,000, earning 8% annually:

- Without reinvestment: $800/year income = $24,000 total income after 30 years

- With reinvestment: Portfolio grows to $100,627 after 30 years = $90,627 in compound gains

Enable dividend reinvestment plans (DRIPs) to automatically purchase additional shares with dividend payments, often without transaction fees.

Step 7: Monitor and Rebalance Regularly

Review your portfolio quarterly to ensure alignment with goals:

- Rebalance allocations – Sell overweight positions, buy underweight assets

- Review performance – Compare against benchmarks and expectations

- Adjust for life changes – Marriage, children, career shifts, approaching retirement

- Tax-loss harvesting – Sell losing positions to offset capital gains taxes

Portfolio Income vs Passive Income vs Earned Income

Understanding these distinctions helps with tax planning and wealth strategy:

Key Differences

Earned Income:

- Requires active time and effort

- Highest tax rates

- Limited by hours available

- Examples: Salary, hourly wages, commissions

Portfolio Income:

- Requires capital investment, minimal time

- Preferential tax treatment on long-term gains

- Scales with investment amount

- Examples: Stock dividends, bond interest, capital gains

Passive Income:

- Requires initial setup, then minimal involvement

- Mixed tax treatment depending on structure

- Can provide tax advantages through depreciation

- Examples: Rental properties, business partnerships, royalties

“Investors use portfolio income to measure how effectively their capital generates returns without active labor involvement.”

Many successful wealth-builders combine all three income types for maximum financial security and tax efficiency. Learn more about smart ways to make passive income to complement your portfolio income strategy.

Tax Considerations for Portfolio Income

Understanding tax implications maximizes your after-tax returns; what you keep matters more than what you earn.

Tax Rates by Income Type (2025)

Qualified Dividends & Long-Term Capital Gains:

| Filing Status | 0% Rate | 15% Rate | 20% Rate |

|---|---|---|---|

| Single | Up to $47,025 | $47,026-$518,900 | Over $518,900 |

| Married Filing Jointly | Up to $94,050 | $94,051-$583,750 | Over $583,750 |

Ordinary Income (Interest, Non-Qualified Dividends, Short-Term Gains):

Taxed at regular income tax brackets (10%, 12%, 22%, 24%, 32%, 35%, 37%)

Tax Optimization Strategies

- Hold investments > 1 year – Qualify for long-term capital gains rates

- Maximize tax-advantaged accounts – IRAs and 401(k)s defer or eliminate taxes

- Tax-loss harvesting – Offset gains with strategic losses

- Asset location – Place high-income assets in tax-advantaged accounts, growth assets in taxable accounts

- Qualified dividend focus – Prioritize stocks paying qualified dividends over ordinary dividends

- Municipal bonds – Tax-free interest for high-income investors

Example: A married couple earning $100,000 annually pays 0% federal tax on qualified dividends and long-term capital gains up to their threshold, while ordinary interest income is taxed at 22%.

According to the IRS Publication 550, proper tax planning on investment income can save thousands annually for active investors.

Common Mistakes to Avoid When Building Portfolio Income

Even experienced investors fall into these traps. Awareness helps you sidestep costly errors:

1: Chasing High Yields Without Research

The problem: Extremely high dividend yields (8%+) often signal financial distress or unsustainable payouts.

The solution: Research payout ratios, company fundamentals, and dividend history. Sustainable yields typically range from 2-6%.

2: Ignoring Diversification

The problem: Concentrating investments in one sector or company exposes you to catastrophic losses.

The solution: Spread investments across sectors, geographies, and asset classes. No single holding should exceed 5-10% of your portfolio.

Understanding why people lose money in the stock market highlights the importance of diversification.

3: Emotional Decision-Making

The problem: Panic selling during downturns or FOMO buying during rallies destroys long-term returns.

The solution: Establish an investment plan and stick to it. Automate contributions to remove emotion from the process.

4: Neglecting Fees and Expenses

The problem: High expense ratios and trading fees silently erode returns over decades.

The solution: Favor low-cost index funds (expense ratios < 0.20%) and minimize trading frequency.

Example: A 1% annual fee on a $100,000 portfolio costs $1,000 yearly. Over 30 years with 7% returns, that fee costs over $60,000 in lost compound growth.

5: Forgetting About Inflation

The problem: Conservative portfolios earning 2-3% lose purchasing power when inflation runs at 3-4%.

The solution: Include growth assets (stocks) that historically outpace inflation over long periods.

6: Tax Inefficiency

The problem: Placing high-income assets in taxable accounts while growth assets sit in tax-advantaged accounts.

The solution: Optimize asset location—bonds and REITs in IRAs, growth stocks in taxable accounts.

7: Inadequate Research

The problem: Investing based on tips, headlines, or social media hype without understanding fundamentals.

The solution: Research companies, read annual reports, understand what moves the stock market, and invest only in what you understand.

Advanced Strategies to Maximize Portfolio Income

Once you’ve mastered the basics, consider these sophisticated approaches:

Strategy 1: The Dividend Growth Approach

Focus on companies with consistent dividend increases rather than the highest current yields.

Benefits:

- Dividend growth typically outpaces inflation

- Indicates strong business fundamentals

- Creates a rising income stream over time

Example: A stock with a 2% initial yield growing dividends at 7% annually doubles its payout in 10 years, yielding 4% on your original investment.

Strategy 2: Bond Laddering

Stagger bond maturity dates to provide regular income and reinvestment opportunities.

How it works:

- Purchase bonds maturing in years 1, 2, 3, 4, and 5

- As each matures, reinvest in a new 5-year bond

- Creates consistent income while maintaining liquidity

Benefits:

- Reduces interest rate risk

- Provides regular access to capital

- Smooths income across market cycles

Strategy 3: Covered Call Writing

Generate additional income from stock holdings by selling call options.

Mechanics:

- Own 100+ shares of a stock

- Sell call options at strike prices above the current value

- Collect premium income regardless of outcome

- If the stock reaches the strike price, shares are sold at a profit

Risk: Limits upside potential if the stock surges above the strike price.

Best for: Moderate-growth stocks in stable portfolios where additional income is prioritized over maximum appreciation.

Strategy 4: REIT Allocation for High Income

Real Estate Investment Trusts (REITs) legally must distribute 90% of taxable income as dividends, creating high yields.

REIT categories:

- Equity REITs – Own and operate properties (offices, apartments, retail)

- Mortgage REITs – Finance real estate through mortgages

- Hybrid REITs – A Combination of Both

Typical yields: 3-7% annually, higher than most stocks

Considerations: REIT dividends are typically taxed as ordinary income, making them ideal for tax-advantaged accounts.

Strategy 5: International Dividend Stocks

Expand beyond U.S. markets to capture income from global companies.

Benefits:

- Geographic diversification

- Exposure to faster-growing economies

- Currency diversification

Challenges:

- Foreign tax withholding (often 15-30%)

- Currency exchange risk

- Less familiar regulatory environments

Solution: Use international dividend ETFs for instant diversification and professional management.

How Much Portfolio Income Do You Need?

Setting clear targets helps maintain focus and measure progress.

The 4% Rule for Retirement

A widely used guideline suggests that withdrawing 4% of your portfolio annually in retirement provides income for 30+ years without depleting principal. See our full guide on The 4% Rule

Calculation:

- Desired annual income: $60,000

- Required portfolio: $60,000 ÷ 0.04 = $1,500,000

Example: A $1,500,000 portfolio generating 4% annually ($60,000) through dividends, interest, and strategic capital gains supports retirement spending.

Building to Your Target

Monthly savings needed depend on three factors:

- Current portfolio value

- Target portfolio value

- Investment timeline

- Expected annual return

Example calculation:

Starting from $0, targeting $1,000,000 in 25 years with 8% average annual returns:

- Required monthly investment: $1,051

Use the interactive calculator below to determine your personalized savings target.

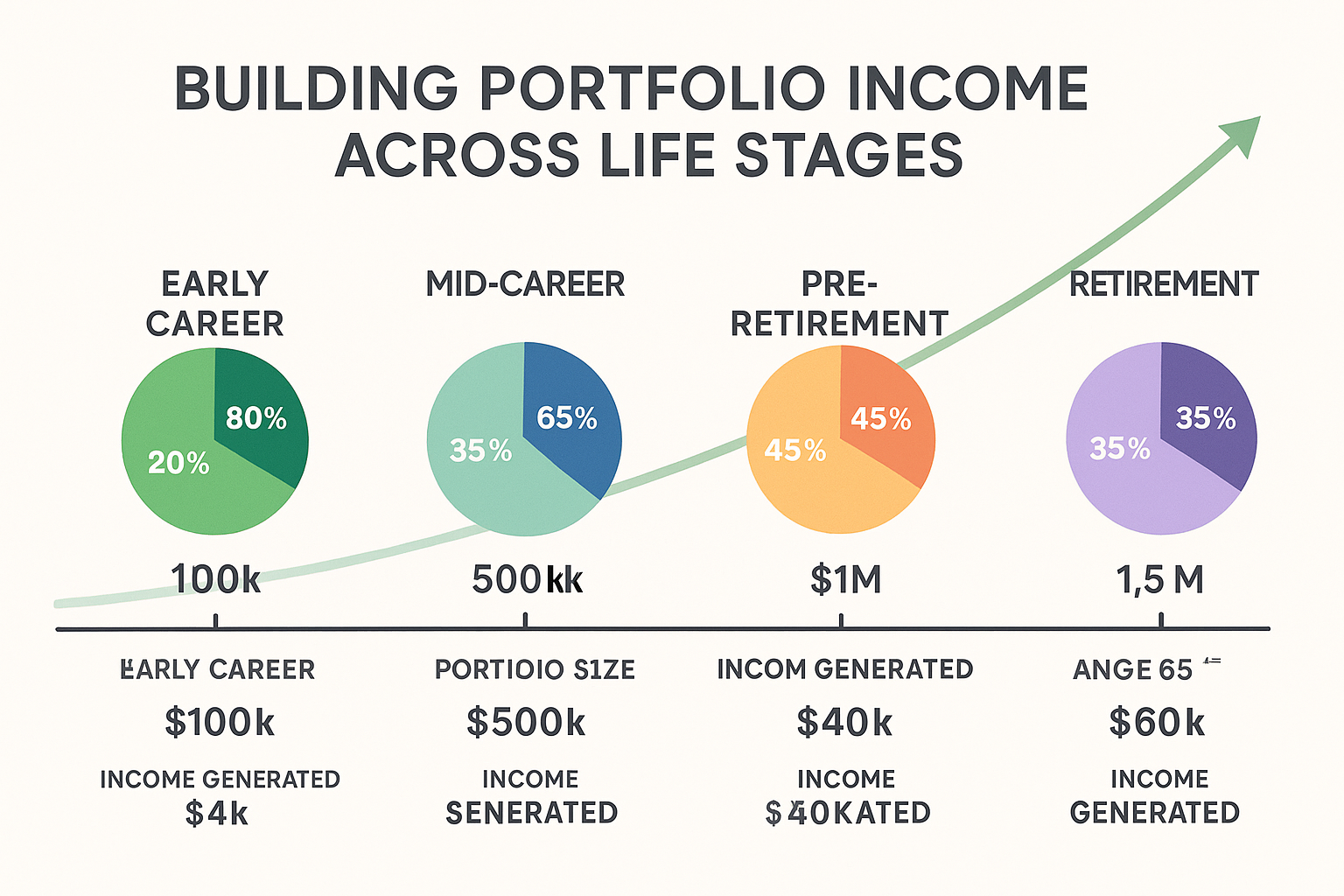

Portfolio Income Across Different Life Stages

Your strategy should evolve with your circumstances:

Early Career (20s-30s)

Focus: Growth and accumulation

- Allocation: 80-90% stocks, 10-20% bonds

- Priority: Maximize contributions, capture employer matches

- Income approach: Reinvest all dividends and interest

- Risk tolerance: High—time heals market volatility

Mid-Career (40s-50s)

Focus: Balanced growth and income

- Allocation: 60-70% stocks, 30-40% bonds

- Priority: Increase savings rate, maximize tax advantages

- Income approach: Begin transitioning toward dividend-focused holdings

- Risk tolerance: Moderate, protect accumulated wealth while continuing growth

Pre-Retirement (55-65)

Focus: Capital preservation and income generation

- Allocation: 40-50% stocks, 50-60% bonds

- Priority: Fine-tune withdrawal strategy, optimize tax efficiency

- Income approach: Build a sustainable income stream to replace employment

- Risk tolerance: Moderate-low, reduce volatility as retirement approaches

Retirement (65+)

Focus: Sustainable income and legacy planning

- Allocation: 30-40% stocks, 60-70% bonds

- Priority: Maintain purchasing power, manage required distributions

- Income approach: Live on portfolio income while preserving principal

- Risk tolerance: Low, protect against sequence-of-returns risk

Real-World Portfolio Income Case Study

Let’s examine how Michael built portfolio income over 15 years:

Starting Point (2010)

- Age: 35

- Income: $65,000 annually

- Savings: $5,000 emergency fund, $0 investments

- Goal: Generate $50,000 annual portfolio income by age 60

Strategy Implemented

Year 1-5 (2010-2015):

- Contributed $500/month to 401(k) with 5% employer match

- Invested in target-date retirement fund (80% stocks, 20% bonds)

- Opened Roth IRA, contributed $5,000 annually

- Focused on low-cost index funds

Year 6-10 (2015-2020):

- Increased contributions to $750/month as income grew

- Diversified into dividend growth stocks and bond funds

- Opened a taxable brokerage account for additional savings

- Portfolio value reached $180,000

Year 11-15 (2020-2025):

- Maximized 401(k) contributions ($23,000 annually in 2025)

- Shifted allocation toward income-generating assets

- Portfolio value: $425,000

- Annual portfolio income: $14,500 (3.4% yield)

Projected Results

By age 60 (2035):

- Projected portfolio: $1,350,000 (assuming 7% annual returns)

- Projected annual income: $54,000 (4% withdrawal rate)

- Goal achieved: Exceeded target by $4,000 annually

Key success factors:

- Started early and remained consistent

- Maximized employer match (free money)

- Increased contributions as income grew

- Stayed invested through market volatility

- Minimized fees through index funds

Tools and Resources for Portfolio Income Investors

Leverage these resources to optimize your strategy:

Investment Platforms

Brokerage accounts:

- Vanguard – Low-cost index funds, excellent retirement accounts

- Fidelity – Zero-commission trades, robust research tools

- Charles Schwab – Comprehensive platform, strong customer service

- M1 Finance – Automated rebalancing, fractional shares

Robo-advisors:

- Betterment – Tax-loss harvesting, goal-based planning

- Wealthfront – Automated portfolio management, financial planning tools

- Schwab Intelligent Portfolios – No advisory fees, low-cost ETFs

Research and Analysis Tools

- Morningstar – Fund analysis, stock research, portfolio tools

- Yahoo Finance – Free real-time quotes, news, and basic analysis

- Seeking Alpha – Investment research, dividend analysis

- SEC EDGAR Database – Company filings, financial statements

Educational Resources

- SEC Investor.gov – Investor education, fraud alerts, calculators

- Investopedia – Financial definitions, tutorials, exam prep

- CFA Institute – Professional standards, research publications

- TheRichGuyMath.com – Practical investing guides, calculators, and strategies

Interactive Portfolio Income Calculator

💰 Portfolio Income Calculator

Calculate your annual portfolio income from dividends, interest, and capital gains

💡 Note: This calculator provides estimates based on your inputs. Actual portfolio income may vary due to market conditions, dividend changes, and realized vs. unrealized gains. Long-term capital gains and qualified dividends receive preferential tax treatment. Consult a financial advisor for personalized guidance.

Taking Action: Your Next Steps

Knowledge without action produces no results. Here’s your roadmap to start building portfolio income today:

Immediate Actions (This Week)

- Calculate your current net worth – List all assets and liabilities

- Review existing investments – Identify current portfolio income sources

- Open or review retirement accounts – Ensure you’re maximizing tax advantages

- Set specific income goals – Define target portfolio income by age milestones

- Create a budget – Identify how much you can invest monthly

Short-Term Actions (This Month)

- Research investment platforms – Compare fees, features, account types

- Establish emergency fund – Build 3-6 months of expenses before investing heavily

- Educate yourself – Read recommended books, follow reputable sources

- Define asset allocation – Choose a stock/bond mix appropriate for your age and risk tolerance

- Make your first investment – Start small if needed, but start

Long-Term Commitments (Ongoing)

- Automate contributions – Set up recurring transfers to investment accounts

- Reinvest dividends and interest – Enable DRIPs and automatic reinvestment

- Review quarterly – Monitor performance, rebalance as needed

- Increase contributions annually – Invest raises and bonuses

- Stay educated – Continue learning through courses, books, and trusted resources like TheRichGuyMath

Conclusion

Portfolio income represents one of the most powerful wealth-building tools available to everyday investors. Unlike earned income that requires constant time and effort, portfolio income works for you 24/7, generating returns through dividends, interest, and capital gains while you sleep, travel, or pursue passions.

The journey to substantial portfolio income doesn’t require perfect timing, exceptional intelligence, or insider connections. It requires:

Consistent action – Regular contributions matter more than perfect picks

Patient discipline – Compound growth requires time to work its magic

Strategic diversification – Spread risk across asset classes and sectors

Tax efficiency – Maximize returns by minimizing tax drag

Continuous learning – Markets evolve, and successful investors adapt

Whether you’re just starting with $100 monthly or managing a six-figure portfolio, the principles remain the same. Start where you are, use what you have, and do what you can. Every dividend reinvested, every percentage point of return, and every year of compound growth brings you closer to financial independence.

The best time to start building portfolio income was 10 years ago. The second-best time is today.

Take action now. Open that investment account. Make that first contribution. Set up automatic investing. Your future self will thank you for the portfolio income you’re building today.

FAQ

A good portfolio income yield depends on your goals and risk tolerance, but 3-5% annually is considered solid for balanced portfolios. Conservative income-focused portfolios might yield 4-6%, while growth-oriented portfolios may yield 1-3% with higher total returns from capital appreciation.

Portfolio income is calculated by adding all investment earnings over a period: Portfolio Income = Dividends + Interest + Realized Capital Gains. Divide this by your total portfolio value to determine your portfolio income yield percentage.

No, portfolio income and passive income are distinct IRS categories. Portfolio income comes from investments (stocks, bonds, mutual funds), while passive income typically comes from business activities like rental properties or limited partnerships where you’re not materially participating.

Qualified dividends receive preferential tax treatment (0%, 15%, or 20% rates) and must meet specific IRS criteria, including holding period requirements. Non-qualified dividends are taxed as ordinary income at higher rates (10-37% depending on tax bracket).

Most financial planners recommend building a portfolio that generates 25-30 times your annual expenses to safely withdraw 3-4% annually in retirement. For example, if you need $50,000 yearly, target a portfolio of $1,250,000-$1,500,000.

Yes, many retirees live entirely off portfolio income through strategic withdrawals combining dividends, interest, and capital gains. The key is building a sufficiently large, diversified portfolio that generates sustainable income without depleting principal. The 4% rule suggests this is achievable with proper planning.

During accumulation years (pre-retirement), reinvesting portfolio income accelerates compound growth. As you approach or enter retirement, taking income as cash provides living expenses. Many investors transition gradually, reinvesting less and taking more cash as income needs increase.

The best portfolio income investments include dividend aristocrat stocks, investment-grade bonds, dividend-focused ETFs, REITs, and preferred stocks. Diversification across these categories balances income generation with risk management and growth potential.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Portfolio income involves market risk, including potential loss of principal. Past performance does not guarantee future results. Tax laws are complex and subject to change; consult a qualified tax professional for personalized guidance. Investment decisions should be made based on individual circumstances, goals, and risk tolerance. Consider consulting with a licensed financial advisor before making significant investment decisions.

About the Author

Written by Max Fonji — your go-to source for clear, data-backed investing education. With over a decade of experience in financial markets and portfolio management, Max specializes in making complex investment concepts accessible to everyday investors. Through TheRichGuyMath.com, Max has helped thousands of readers build sustainable wealth through informed investing strategies.