Picture this: You’re staring at your business dashboard, and the numbers just aren’t moving. Sales are flat, profits are stagnant, and you’re wondering what magic formula successful companies use to keep growing year after year. Here’s the truth: revenue growth isn’t about luck or magic. It’s about implementing proven strategies that consistently drive more money into your business. Whether you’re running a side hustle or scaling a full-fledged company, understanding how to accelerate revenue growth can transform your financial future and create the wealth-building opportunities you’ve been searching for.

TL;DR

- Revenue growth measures the increase in a company’s sales over a specific period and is the lifeblood of business success and long-term sustainability

- The most effective revenue growth strategies include expanding your customer base, increasing customer lifetime value, optimizing pricing, and diversifying revenue streams

- Small businesses can achieve 15-25% annual revenue growth by implementing proven tactics like upselling, cross-selling, and improving customer retention

- Tracking key metrics like Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV) helps you measure and optimize growth

- Sustainable revenue growth requires balancing short-term wins with long-term strategic investments in smart financial planning

What Is Revenue Growth?

Revenue growth is the percentage increase in a company’s sales over a specific time period, typically measured quarterly or annually. In simple terms, revenue growth means your business is bringing in more money than it did in the previous period.

The Formula For Revenue Growth

Revenue Growth Rate = [(Current Period Revenue – Previous Period Revenue) / Previous Period Revenue] × 100

For example, if your business earned $100,000 last year and $125,000 this year, your revenue growth rate would be:

[(125,000 – 100,000) / 100,000] × 100 = 25% growth

A higher revenue growth rate usually indicates a healthy, expanding business that’s capturing more market share, satisfying customer needs, and building momentum. Investors use revenue growth to measure a company’s potential and determine whether it’s worth putting their money into, much like how they evaluate investment opportunities in the stock market.

Why Revenue Growth Matters

Revenue growth isn’t just a vanity metric—it’s the foundation of business success for several critical reasons:

- Attracts investors and funding: Companies with consistent revenue growth are more likely to secure venture capital, loans, and investment

- Creates competitive advantages: Growing businesses can reinvest in product development, marketing, and talent acquisition

- Builds market confidence: Steady growth signals to customers, partners, and employees that your business is thriving

- Enables wealth creation: For business owners, revenue growth directly impacts personal wealth and financial freedom

- Provides flexibility: More revenue means more options to experiment, pivot, and weather economic downturns

The Core Drivers of Revenue Growth

Understanding what actually drives revenue growth helps you focus your efforts on the strategies that deliver the biggest impact. Let’s break down the fundamental levers you can pull:

1. Customer Acquisition

Bringing new customers into your business is the most obvious path to revenue growth. The key is doing it cost-effectively.

Customer Acquisition Cost (CAC) measures how much you spend to acquire each new customer. Successful businesses keep this number as low as possible while maximizing the value each customer brings.

Effective acquisition strategies include:

- Content marketing and SEO to attract organic traffic

- Paid advertising on platforms where your ideal customers spend time

- Referral programs that turn existing customers into advocates

- Strategic partnerships with complementary businesses

- Social media engagement and community building

2. Customer Retention and Loyalty

Here’s a powerful statistic: Acquiring a new customer costs 5-25 times more than retaining an existing one. Businesses that focus on keeping customers happy often see faster revenue growth than those constantly chasing new leads.

Customer Lifetime Value (CLV) represents the total revenue you can expect from a single customer throughout their relationship with your business. Increasing CLV is one of the most efficient ways to boost revenue growth.

Retention strategies that work:

- Exceptional customer service that exceeds expectations

- Loyalty programs with meaningful rewards

- Regular communication through email, SMS, or personalized outreach

- Product improvements based on customer feedback

- Creating a community around your brand

3. Pricing Optimization

Many businesses leave money on the table by underpricing their products or services. Strategic pricing adjustments can dramatically impact revenue growth without requiring more customers.

Pricing strategies to consider:

- Value-based pricing: Charge based on the value you deliver, not just your costs

- Tiered pricing: Offer multiple price points to capture different customer segments

- Dynamic pricing: Adjust prices based on demand, seasonality, or customer behavior

- Bundle pricing: Package products together at a slight discount to increase average order value

- Premium positioning: Position yourself as the high-quality option and charge accordingly

4. Product Expansion and Diversification

Offering more products or services to your existing customer base can unlock significant revenue growth. This strategy works because you already have established trust and relationships.

Expansion approaches:

- Develop complementary products that solve related problems

- Add premium or deluxe versions of existing offerings

- Create subscription or membership models for recurring revenue

- License your expertise, methodology, or intellectual property

- Enter adjacent markets with modified versions of your core offering

Proven Revenue Growth Strategies

Now let’s dive into actionable strategies you can implement immediately to accelerate your revenue growth.

Strategy #1: Master the Art of Upselling and Cross-Selling

Upselling means encouraging customers to purchase a higher-end version of what they’re already buying. Cross-selling involves suggesting complementary products that enhance their purchase.

Amazon attributes up to 35% of its revenue to its recommendation engine—that’s the power of effective upselling and cross-selling.

Implementation tips:

- Train your sales team to identify upsell opportunities naturally

- Use “frequently bought together” suggestions on your website

- Offer bundle deals that provide genuine value

- Create comparison charts showing the benefits of premium options

- Time your offers strategically (at checkout, post-purchase, or during renewal)

Strategy #2: Implement a Referral Program That Actually Works

Word-of-mouth remains one of the most powerful marketing channels, and referral programs systematize this process.

Dropbox famously grew from 100,000 to 4 million users in 15 months using a simple referral program that rewarded both the referrer and the new user with additional storage space.

Key elements of successful referral programs:

- Make the reward valuable to both parties

- Keep the process simple (one-click sharing when possible)

- Provide shareable content (links, images, templates)

- Track and optimize conversion rates

- Thank and recognize your top referrers publicly

Strategy #3: Expand Your Market Reach

Geographic or demographic expansion can open entirely new revenue streams.

Expansion tactics:

- Geographic: Enter new cities, states, or countries

- Demographic: Target different age groups, income levels, or industries

- Channel: Sell through new platforms (e.g., adding Amazon if you only sell direct)

- Partnership: Collaborate with established players in new markets

- Digital transformation: Move offline offerings online (or vice versa)

Strategy #4: Optimize Your Sales Funnel

Your sales funnel represents the journey from awareness to purchase. Even small improvements at each stage can compound into significant revenue growth.

Funnel optimization checklist:

- Awareness: Increase traffic through SEO, ads, and content marketing

- Interest: Improve engagement with compelling content and clear value propositions

- Consideration: Address objections with testimonials, case studies, and guarantees

- Purchase: Streamline checkout, reduce friction, and offer multiple payment options

- Retention: Follow up, deliver exceptional experiences, and create loyalty

Strategy #5: Create Recurring Revenue Streams

Subscription models and recurring revenue provide predictable cash flow and higher customer lifetime value—two critical components of sustainable revenue growth.

Monthly Recurring Revenue (MRR) has become the gold standard metric for subscription businesses because it provides visibility into future revenue.

Recurring revenue models:

- Membership programs with exclusive benefits

- Subscription boxes or auto-delivery services

- Software-as-a-Service (SaaS) offerings

- Retainer-based consulting or services

- Maintenance, support, or warranty programs

Just as dividend investing creates passive income through regular payments, recurring revenue models create predictable business income that compounds over time.

Strategy #6: Leverage Data and Analytics

What gets measured gets managed. Businesses that track the right metrics and make data-driven decisions consistently outperform those flying blind.

Critical revenue growth metrics:

| Metric | What It Measures | Why It Matters |

|---|---|---|

| Revenue Growth Rate | Percentage increase in sales | Overall business health and trajectory |

| Customer Acquisition Cost (CAC) | Cost to acquire each customer | Marketing efficiency and profitability |

| Customer Lifetime Value (CLV) | Total revenue per customer | Long-term business sustainability |

| The percentage who buy | Relationship between value and cost | Return on marketing investment |

| Churn Rate | Percentage of customers lost | Retention effectiveness |

| Average Order Value (AOV) | Average transaction size | Revenue per transaction |

| Conversion Rate | Percentage who buy | Sales effectiveness |

Action steps:

- Set up analytics tracking (Google Analytics, CRM dashboards, etc.)

- Review metrics weekly or monthly

- Identify your biggest bottlenecks and opportunities

- Run A/B tests to optimize conversion points

- Create dashboards that make key metrics visible to your team

Revenue Growth vs Profit Growth: Understanding the Balance

While revenue growth is essential, it’s not the only metric that matters. Profit growth—the increase in your bottom line after expenses—ultimately determines your business’s financial health.

Some businesses pursue aggressive revenue growth at the expense of profitability, burning through cash to acquire customers. This can work in the short term (especially for startups seeking venture capital), but sustainable businesses balance both metrics.

Key considerations:

Healthy revenue growth is accompanied by:

- Improving or stable profit margins

- Decreasing customer acquisition costs over time

- Increasing customer lifetime value

- Positive cash flow or a clear path to profitability

Unsustainable revenue growth often shows:

- Shrinking profit margins

- Rising customer acquisition costs

- High churn rates

- Negative cash flow with no clear turnaround plan

Think of it like evaluating stocks—you want companies growing revenue and profits, not just top-line sales.

Common Revenue Growth Mistakes to Avoid

Even experienced business owners make critical errors that stunt revenue growth. Here are the most common pitfalls:

1: Focusing Only on New Customers

The “leaky bucket” problem—constantly acquiring new customers while existing ones leave—wastes resources and limits growth. Fix it: Invest equally in retention and acquisition.

2: Competing Solely on Price

Racing to the bottom on price attracts bargain hunters, erodes margins, and makes sustainable growth nearly impossible. Fix it: Compete on value, service, and differentiation.

3: Ignoring Customer Feedback

Your customers know what’s working and what isn’t. Ignoring their input means missing opportunities for improvement and innovation. Fix it: Create systematic feedback loops and act on insights.

4: Overextending Too Quickly

Expanding into too many markets, launching too many products, or scaling too fast can strain resources and dilute focus. Fix it: Grow strategically, validate before scaling, and maintain operational excellence.

5: Not Investing in Marketing

“Build it and they will come” rarely works. Underinvesting in marketing limits awareness and growth potential. Fix it: Allocate 7-12% of revenue to marketing (more for growth-stage companies).

6: Failing to Adapt to Market Changes

Markets evolve, customer preferences shift, and new competitors emerge. Rigidity kills growth. Fix it: Stay informed, remain flexible, and be willing to pivot when necessary—much like how investors must understand market volatility and adapt their strategies.

How to Calculate and Track Your Revenue Growth

Let’s get practical. Here’s exactly how to measure your revenue growth and use it to make better decisions.

Step 1: Choose Your Time Period

Revenue growth can be measured:

- Month-over-month (MoM): Good for fast-growing businesses or spotting trends quickly

- Quarter-over-quarter (QoQ): Balances short-term changes with longer trends

- Year-over-year (YoY): Best for seeing true growth while accounting for seasonality

Step 2: Apply the Formula

Revenue Growth Rate = [(Current Period Revenue – Previous Period Revenue) / Previous Period Revenue] × 100

Example calculation:

- Q1 2024 Revenue: $50,000

- Q1 2025 Revenue: $65,000

- Growth Rate: [(65,000 – 50,000) / 50,000] × 100 = 30% YoY growth

Step 3: Benchmark Against Your Industry

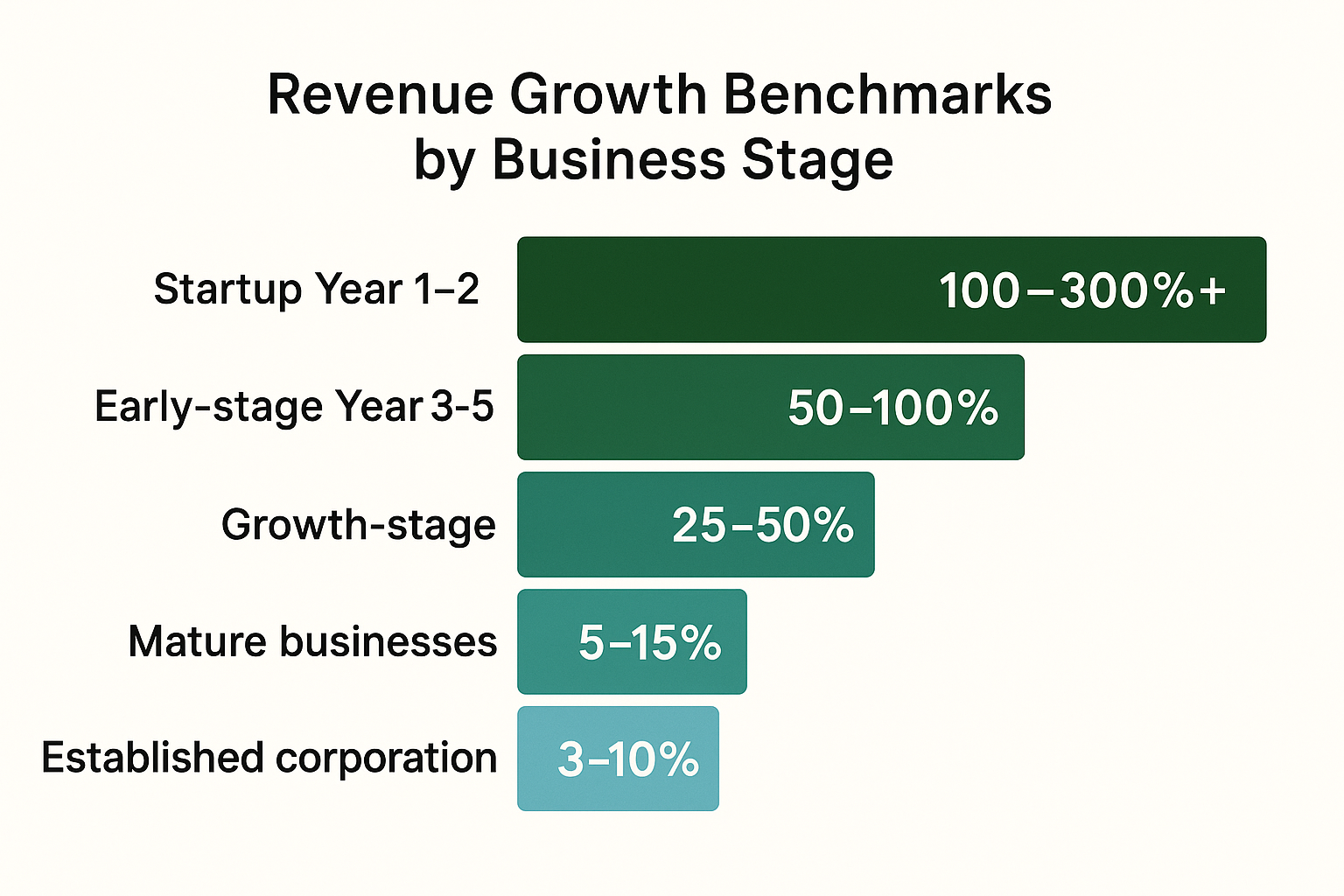

Revenue growth rates vary significantly by industry, business stage, and market conditions:

| Business Stage | Typical Annual Growth Rate |

|---|---|

| Startup (Year 1-2) | 100-300%+ (from low base) |

| Early-stage (Year 3-5) | 50-100% |

| Growth-stage | 25-50% |

| Mature businesses | 5-15% |

| Established corporations | 3-10% |

According to data from the U.S. Small Business Administration, small businesses that survive the first five years average about 10-15% annual revenue growth.

Step 4: Set Realistic Growth Targets

Based on your current stage, resources, and market conditions, set specific, measurable revenue growth goals:

SMART revenue growth goals:

- Specific: “Increase MRR by $10,000”

- Measurable: Track in your CRM or accounting software

- Achievable: Based on historical performance and resources

- Relevant: Aligned with overall business objectives

- Time-bound: “By Q4 2025”

Real-World Revenue Growth Example: A Case Study

Let’s look at how a fictional small business—a digital marketing agency—implemented revenue growth strategies.

Starting point (January 2024):

- Monthly Revenue: $25,000

- 10 active clients

- Average project value: $2,500

- No recurring revenue

Strategies implemented:

- Shifted to retainer model: Converted 6 clients to monthly retainers ($3,000/month each)

- Upselling: Offered additional services (SEO, content creation) to existing clients

- Referral program: Incentivized clients to refer for one month of free service

- Pricing increase: Raised rates by 15% for new clients based on proven results

- Content marketing: Published weekly blog posts to attract organic leads

Results (December 2024):

- Monthly Revenue: $42,000

- 14 active clients (8 on retainers)

- Average client value: $3,000

- Revenue growth: 68% annually

Key takeaways from this example:

- Recurring revenue provided stability and predictability

- Existing clients were the fastest path to growth (upselling + referrals)

- Strategic pricing increased revenue without proportionally increasing workload

- Content marketing reduced customer acquisition costs over time

Advanced Revenue Growth Tactics for Ambitious Entrepreneurs

Once you’ve mastered the fundamentals, these advanced strategies can accelerate growth even further.

1: Strategic Acquisitions

Acquiring competitors or complementary businesses can instantly increase revenue, expand your customer base, and add capabilities.

Considerations:

- Ensure cultural fit and operational compatibility

- Conduct thorough due diligence

- Have a clear integration plan

- Secure appropriate financing

2: Platform or Marketplace Models

Creating a platform where others can sell (and you take a commission) can scale revenue beyond your direct capacity.

Examples:

- Etsy (handmade goods marketplace)

- Airbnb (accommodation platform)

- Udemy (course marketplace)

3: Licensing and Franchising

If you’ve built a proven business model, licensing or franchising allows others to replicate it while you collect fees and royalties.

Requirements:

- Documented, repeatable processes

- Strong brand recognition

- Legal framework for protection

- Support systems for licensees/franchisees

4: International Expansion

Global markets offer enormous growth potential, though they come with complexity around regulations, currencies, and cultural differences.

Start with:

- English-speaking markets for easier entry

- Digital products (easier to scale internationally)

- Partnership with local distributors

- Thorough market research

The Role of Investment in Revenue Growth

Just as smart investing creates passive income, reinvesting business profits strategically accelerates revenue growth.

High-ROI investment areas:

Marketing and sales: Typically returns $3-5 for every $1 invested when done well

Technology and automation: Reduce costs and increase capacity

Team expansion: Adds expertise and bandwidth to serve more customers

Product development: Creates new revenue streams and competitive advantages

Customer experience: Improves retention and increases lifetime value

The key is measuring return on investment (ROI) for each area and doubling down on what works—similar to how investors analyze what moves the stock market to make informed decisions.

Revenue Growth in Different Business Models

Different business models require tailored revenue growth strategies.

E-commerce Businesses

Growth levers:

- Conversion rate optimization (CRO)

- Average order value increases (bundles, upsells)

- Email marketing and retargeting

- Expanding product catalog

- Improving customer reviews and social proof

Service-Based Businesses

Growth levers:

- Increasing billable hours or rates

- Transitioning to higher-value services

- Productizing services (templates, courses, tools)

- Building a team to increase capacity

- Creating retainer relationships

SaaS and Subscription Businesses

Growth levers:

- Reducing churn rate

- Expanding into new customer segments

- Adding features that justify higher pricing tiers

- Improving onboarding to activate users faster

- Creating an annual payment option (cash flow boost)

Content and Media Businesses

Growth levers:

- Growing audience size (traffic, subscribers, followers)

- Diversifying revenue streams (ads, sponsorships, products, memberships)

- Creating premium content tiers

- Licensing content to other platforms

- Building community and engagement

Taking Action: Your Revenue Growth Roadmap

Ready to accelerate your revenue growth? Follow this practical roadmap:

Month 1: Assessment and Planning

- Calculate your current revenue growth rate

- Identify your top revenue sources

- Analyze customer acquisition and retention metrics

- Set specific revenue growth goals for the next 12 months

- Choose 2-3 strategies from this guide to implement first

Month 2-3: Quick Wins

- Implement a pricing review and strategic adjustments

- Launch or improve your upselling and cross-selling process

- Create a customer referral program

- Optimize your highest-traffic conversion points

- Improve customer onboarding and early experience

Month 4-6: Building Systems

- Develop recurring revenue offerings

- Expand your product or service portfolio

- Invest in marketing channels showing positive ROI

- Build customer retention programs

- Create data dashboards to track key metrics

Month 7-12: Scaling and Optimization

- Double down on what’s working

- Test expansion into new markets or segments

- Automate and systematize successful processes

- Build or expand your team strategically

- Plan next year’s growth initiatives

Remember, sustainable revenue growth is a marathon, not a sprint. Focus on building strong foundations, delivering exceptional value, and continuously improving your strategies based on data and feedback.

Conclusion: Your Path to Sustainable Revenue Growth

Revenue growth isn’t a mystery reserved for Fortune 500 companies or Silicon Valley unicorns. It’s a systematic process built on understanding your customers, delivering exceptional value, and implementing proven strategies consistently.

The businesses that thrive in 2025 and beyond will be those that:

Balance acquisition and retention rather than chasing only new customers

Make data-driven decisions while staying connected to customer needs

Invest strategically in areas that compound over time

Adapt to changing markets while maintaining core principles

Focus on sustainable growth rather than unsustainable shortcuts

Whether you’re growing a side business into a full-time income or scaling an established company, the strategies in this guide provide a roadmap for accelerating revenue growth while building a sustainable, profitable business.

Start with one or two strategies that align with your current situation and resources. Measure results, learn from what works, and continuously refine your approach. Just as understanding investing fundamentals creates long-term wealth, mastering revenue growth principles creates business success that compounds year after year.

Your next step: Choose one revenue growth strategy from this guide and implement it this week. Track the results for 30 days, then add another strategy. Small, consistent actions compound into remarkable results.

The path to revenue growth starts with a single decision to take action today. Your future business success is waiting—go build it!

📈 Revenue Growth Calculator

Calculate your revenue growth rate and track business performance

📊 What This Means

A good revenue growth rate depends on your industry, business stage, and market conditions. Generally, 10-25% annual growth is considered healthy for established small businesses, while startups often target 100%+ growth in early years. Compare your growth rate to industry benchmarks and your historical performance.

Focus on strategies that leverage existing resources: raise prices strategically, upsell and cross-sell to current customers, improve conversion rates, reduce churn, and optimize your sales process. These tactics increase revenue per customer or transaction without proportionally increasing costs.

Revenue growth and sales growth are often used interchangeably, but technically, revenue includes all income sources (product sales, services, licensing, interest, etc.), while sales typically refers specifically to product or service transactions. For most businesses, the terms are functionally equivalent.

Timeline varies by strategy. Pricing changes and upselling can impact revenue immediately, while content marketing and SEO may take 3-6 months to show results. Referral programs typically generate results within 1-3 months. Set realistic expectations and track leading indicators (traffic, leads, conversion rates) while waiting for revenue impact.

Yes, many growth-stage businesses intentionally operate at a loss while investing heavily in customer acquisition and market expansion. This strategy works if there’s a clear path to profitability and sufficient funding. However, sustainable businesses eventually need to balance revenue growth with profit growth—similar to how high dividend stocks balance growth with income generation.

Track Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), churn rate, conversion rate, average order value, gross margin, and net profit margin. These metrics provide context for whether your revenue growth is healthy and sustainable.

During economic downturns, focus on retention, customer service, and value demonstration rather than aggressive expansion. In strong economies, invest more heavily in acquisition and expansion. Adapt your strategies to market conditions while maintaining core principles of delivering value and building relationships.

Disclaimer

This article is for educational purposes only and does not constitute financial, business, or investment advice. Revenue growth strategies should be evaluated based on your specific business circumstances, industry, and market conditions. Always consult with qualified financial advisors, accountants, or business consultants before making significant business decisions. Past performance and examples cited do not guarantee future results.

About the Author

Written by Max Fonji — with a decade of experience in business growth, financial analysis, and investment strategy, Max is your go-to source for clear, data-backed insights on building wealth through smart business and investing decisions. Follow along at TheRichGuyMath.com for more actionable financial education.