Ever wonder why some people seem to effortlessly build wealth while others work just as hard but never get ahead? The secret isn’t luck, inheritance, or some complicated financial wizardry. It’s something much simpler: Rich Guy Math. This isn’t the math you learned in school; it’s the practical formula wealthy people use to make money decisions that compound over time. Whether you’re earning $40,000 or $400,000 a year, understanding Rich Guy Math can transform your financial future. Let’s break down this powerful concept into simple, actionable steps anyone can follow.

TL;DR

- Rich Guy Math is the principle that wealthy individuals focus on building assets that generate income rather than just trading time for money

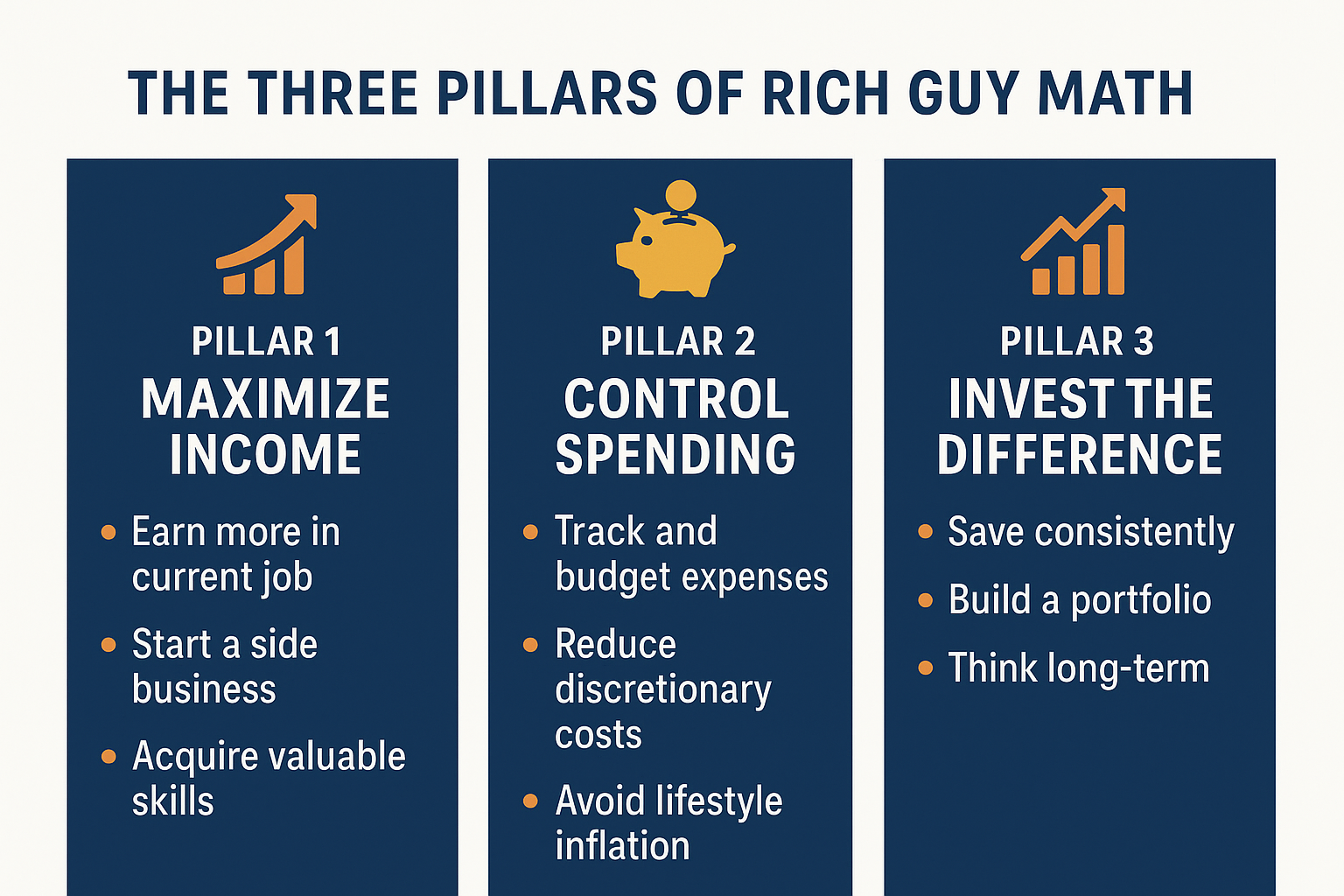

- The core formula focuses on three pillars: earning more, spending less than you earn, and investing the difference in income-generating assets

- Unlike traditional budgeting, Rich Guy Math emphasizes increasing your income ceiling while maintaining disciplined spending habits

- The wealth-building formula compounds over time. Small, consistent actions today create exponential results in 10-20 years

- Anyone can apply Rich Guy Math principles, regardless of current income level, by starting with what they have and scaling gradually

What is Rich Guy Math? Understanding the Wealth Formula

In simple terms, Rich Guy Math means making financial decisions based on long-term wealth creation rather than short-term gratification. It’s the framework that separates those who build lasting wealth from those who remain stuck in the paycheck-to-paycheck cycle.

The formula for Rich Guy Math is straightforward:

Wealth = (Income – Expenses) × Time × Rate of Return

This equation might look basic, but each component plays a critical role. Wealthy people understand that increasing income, reducing unnecessary expenses, extending the investment timeline, and maximizing returns are all levers they can pull to accelerate wealth building.

Why Rich Guy Math Matters in 2025

Traditional financial advice often focuses solely on cutting expenses—skipping lattes, canceling subscriptions, and clipping coupons. While spending discipline matters, Rich Guy Math flips the script by asking: “How can I increase the numerator (income) while optimizing everything else?”

According to data from the Federal Reserve’s Survey of Consumer Finances, the top 10% of wealth holders derive a significant portion of their net worth from investment assets rather than salary alone. This isn’t because they earn astronomically high salaries (though some do), but because they understand how to make their money work for them.

The Three Pillars of Rich Guy Math

Pillar 1: Maximize Your Income Potential

Rich Guy Math starts with a fundamental truth: there’s a limit to how much you can cut expenses, but theoretically, no limit to how much you can earn.

Key strategies include:

- Developing high-income skills: Focus on abilities that command premium pay in the marketplace (coding, sales, marketing, financial analysis, project management)

- Multiple income streams: Don’t rely solely on your day job—explore side businesses, freelancing, or consulting

- Strategic career moves: Changing jobs strategically can result in 10-30% salary increases, far more than annual raises

- Negotiation mastery: Learning to negotiate salary, rates, and contracts can add hundreds of thousands to lifetime earnings

The wealthy understand that time is their most valuable asset. They constantly ask: “How can I earn more per hour of effort?” This mindset shift alone separates Rich Guy Math from conventional financial thinking. See our full guide on Wealthy Mindset

Pillar 2: Control Spending Without Sacrificing Quality of Life

Here’s where Rich Guy Math differs from extreme frugality: it’s not about being cheap; it’s about being intentional.

Wealthy individuals practice what’s called “conscious spending”—they spend generously on things they value while ruthlessly cutting costs on things that don’t matter to them.

The 50/30/20 rule optimized for wealth building:

| Category | Traditional Advice | Rich Guy Math Approach |

|---|---|---|

| Needs | 50% | 50% or less |

| Wants | 30% | 15-20% (be selective) |

| Savings/Investments | 20% | 30-35% or more |

See our full guide on Need vs Want

The goal is to maintain a high savings rate—ideally 30% or more of gross income. According to research from the CFA Institute, individuals who consistently save 30% or more of their income build wealth exponentially faster than those saving the commonly recommended 10-15%.

Smart spending strategies:

- Buy appreciating assets (real estate, stocks, businesses)

- Invest in education and skills that increase earning power

- Spend on health and relationships (long-term ROI)

- Avoid depreciating liabilities (new cars, luxury goods on credit)

- Minimize lifestyle inflation with each raise

Pillar 3: Invest the Difference in Income-Generating Assets

This is where the magic happens. The gap between what you earn and what you spend must be deployed strategically into assets that generate passive income and appreciate over time.

Rich Guy Math investment priorities:

- Stock market investments: Index funds, dividend stocks, and growth equities provide historical returns of 8-10% annually. Understanding why the stock market goes up helps maintain confidence during volatility.

- Real estate: Rental properties generate monthly cash flow while appreciating in value

- Business ownership: Whether starting your own or investing in others’ businesses through private equity

- Dividend-paying investments: Creating streams of passive income through dividend investing that compound over time

The wealthy understand that smart ways to make passive income are essential to building wealth that doesn’t require trading time for money.

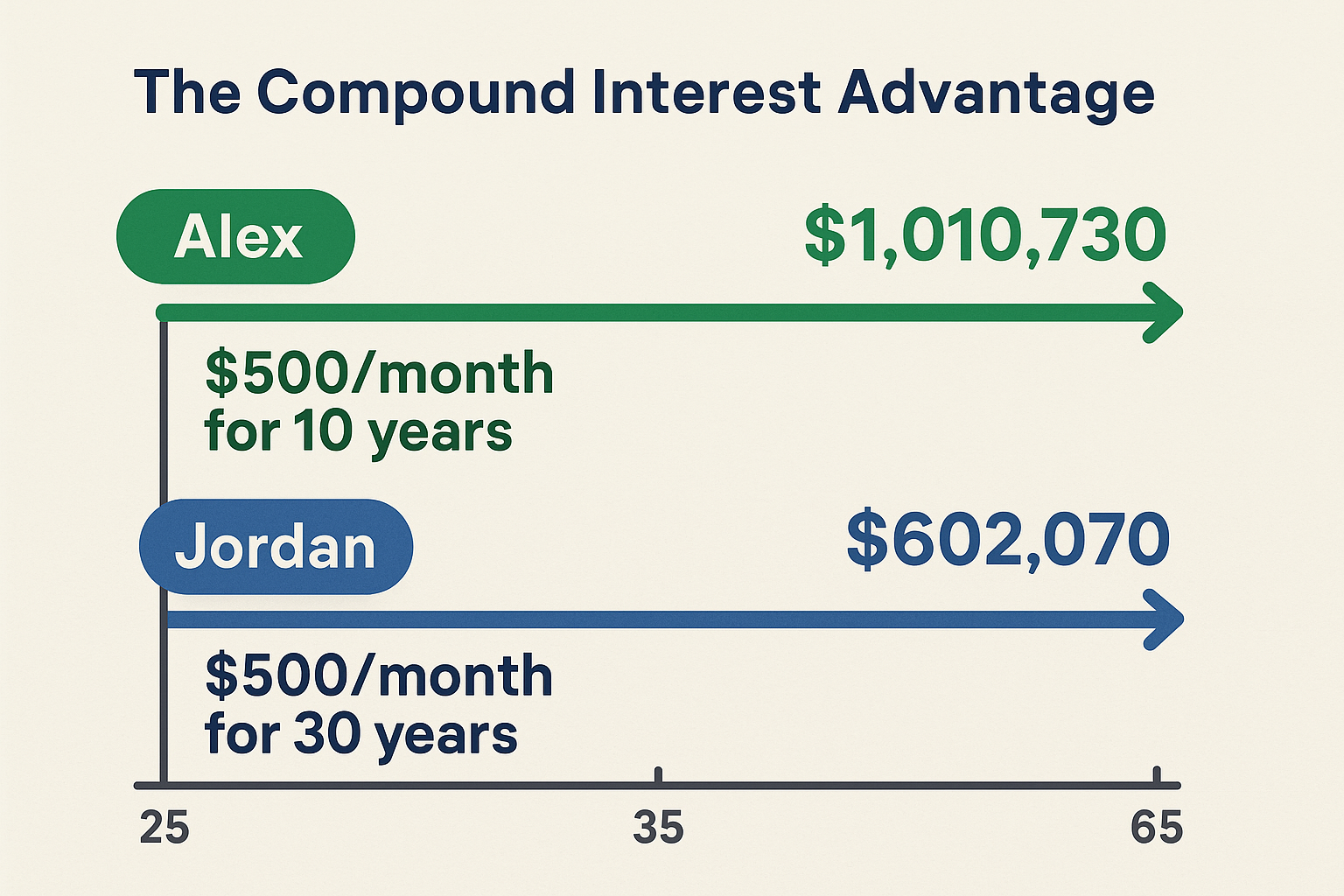

The Compound Interest Advantage: Time is Your Secret Weapon

Albert Einstein allegedly called compound interest “the eighth wonder of the world.” Whether he said it or not, the principle holds in Rich Guy Math.

Here’s a real-world example:

Two friends, Alex and Jordan, both 25 years old:

- Alex invests $500/month starting at age 25, stops at 35 (total invested: $60,000)

- Jordan waits until 35 to start, invests $500/month until 65 (total invested: $180,000)

Assuming 8% annual returns, at age 65:

- Alex’s portfolio: ~$878,000

- Jordan’s portfolio: ~$745,000

Alex invested $120,000 less but ended up with more money because of the extra 10 years of compound growth. This demonstrates why starting early is a critical component of Rich Guy Math.

The Rule of 72

The rule of 72: A quick mental math trick wealthy people use: Divide 72 by your expected annual return to see how long it takes to double your money.

- At 6% returns: 72 ÷ 6 = 12 years to double

- At 8% returns: 72 ÷ 8 = 9 years to double

- At 10% returns: 72 ÷ 10 = 7.2 years to double

This simple calculation helps visualize the power of consistent investing over time.

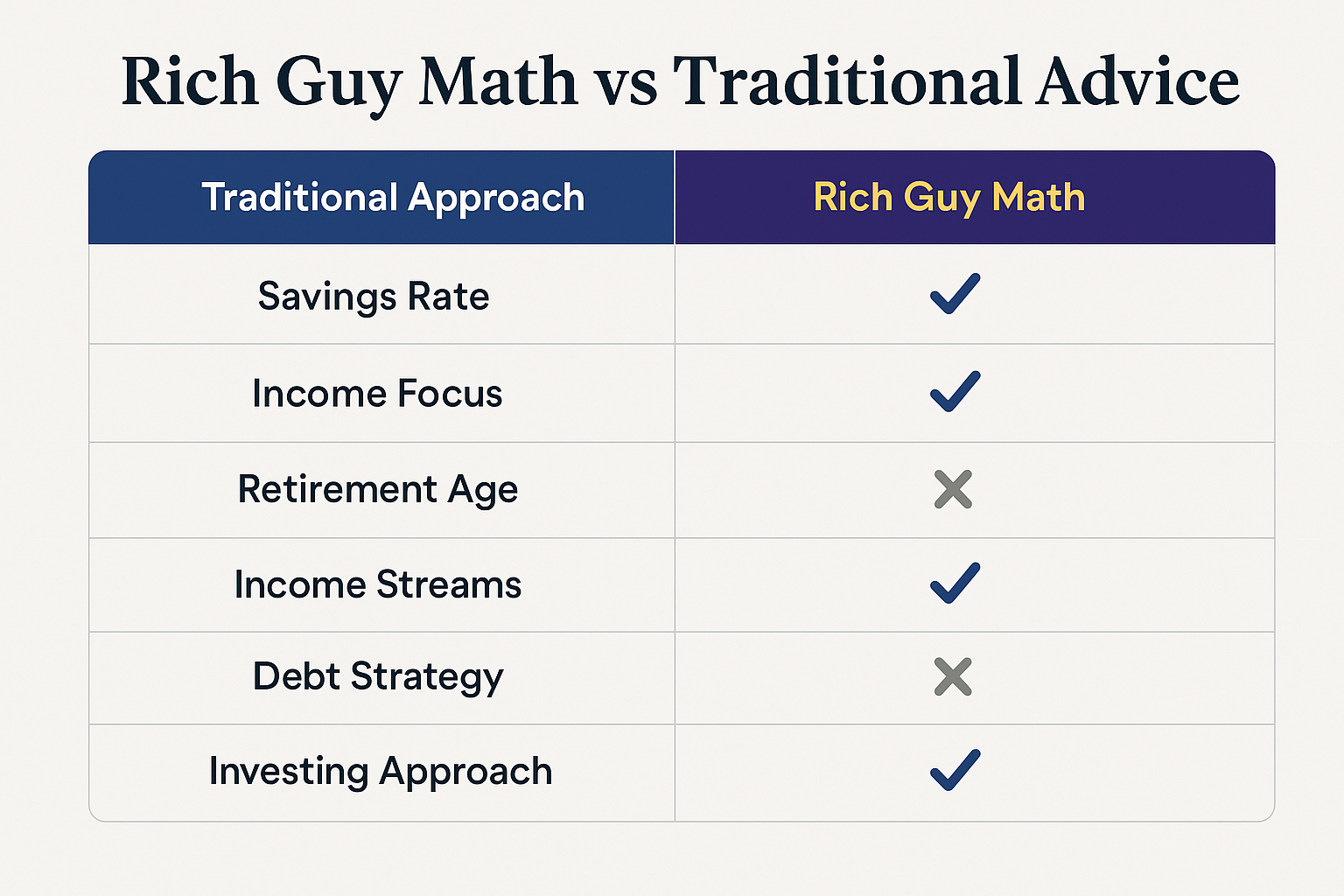

Rich Guy Math vs Traditional Financial Advice

| Traditional Approach | Rich Guy Math Approach |

|---|---|

| Focus on cutting expenses | Focus on increasing income AND optimizing expenses |

| Save 10-15% of income | Save 30%+ of income |

| Work until 65 | Build assets that allow earlier financial independence |

| Single income source (job) | Multiple income streams |

| Emergency fund only | Emergency fund + investment portfolio |

| Avoid all debt | Use strategic debt for appreciating assets |

| Conservative investing | Calculated risk-taking based on time horizon |

The difference isn’t about being reckless versus cautious; it’s about being strategic and growth-oriented while managing risk appropriately.

How to Calculate Your Personal Rich Guy Math Score

Want to know where you stand? Here’s a simple assessment:

Step 1: Calculate your savings rate

- (Monthly Savings + Investments) ÷ Gross Monthly Income × 100 = Savings Rate %

Step 2: Evaluate your income streams

- How many sources of income do you have? (1 = employee only, 2+ = side income, passive income, etc.)

Step 3: Assess your investment allocation

- What percentage of your net worth is in income-generating assets versus depreciating assets or cash?

Step 4: Project your financial independence timeline

- At your current savings and investment rate, how many years until your passive income exceeds your expenses?

Scoring:

- Excellent (Rich Guy Math Master): 30%+ savings rate, 3+ income streams, 70%+ in investments, FI timeline under 15 years

- Good (On the Right Track): 20-30% savings rate, 2 income streams, 50%+ in investments, FI timeline 15-25 years

- Needs Improvement: 10-20% savings rate, 1 income stream, 25-50% in investments, FI timeline 25+ years

- Start Now: <10% savings rate, 1 income stream, <25% in investments, no clear FI path

Common Mistakes That Sabotage Rich Guy Math

Even with the best intentions, people make predictable errors that derail wealth building. Understanding why people lose money in the stock market can help you avoid these pitfalls.

1: Lifestyle Inflation

The trap: Every time income increases, expenses increase proportionally (or more).

The fix: Implement the “50/50 rule”—when you get a raise, save/invest 50% and enjoy 50%. This allows lifestyle improvements while accelerating wealth building.

2: Emotional Investing

The trap: Buying high during market euphoria and selling low during panic. The cycle of market emotions is real and costly.

The fix: Create an investment policy statement and stick to it regardless of market conditions. Automate investments to remove emotion from the equation.

3: Not Tracking Net Worth

The trap: Focusing only on income without monitoring overall financial progress.

The fix: Calculate net worth monthly (Assets – Liabilities = Net Worth). This single metric reveals whether you’re actually building wealth or just earning and spending.

4: Waiting for the “Perfect Time”

The trap: “I’ll start investing when I earn more / when the market drops / when I understand everything.”

The fix: Start with whatever amount you can today. Even $50/month invested consistently beats $0 waiting for perfect conditions.

5: Ignoring Tax Optimization

The trap: Paying more taxes than necessary by not utilizing tax-advantaged accounts.

The fix: Maximize 401(k), IRA, HSA, and other tax-advantaged vehicles. Wealthy individuals understand that legal tax minimization is a critical component of Rich Guy Math.

Real-World Case Study: From Broke to Wealthy Using Rich Guy Math

Meet Sarah (composite of real examples):

Starting point (Age 28):

- Income: $55,000/year

- Savings: $3,000

- Debt: $25,000 student loans

- Net worth: -$22,000

Rich Guy Math implementation:

Years 1-2:

- Negotiated a 15% salary increase to $63,250

- Started a side business (freelance graphic design), earning $800/month

- Maintained the same lifestyle, applied all extra income to debt and investing

- Paid off student loans in 18 months

- Started investing $1,000/month in index funds

Years 3-5:

- Changed jobs for a 20% salary bump to $75,900

- Grew side business to $2,000/month

- Total monthly income: ~$8,300

- Living expenses: $3,500 (42% of income)

- Investing: $3,500/month (42% savings rate)

- Purchased first rental property with house-hacking strategy

Years 6-10:

- Continued career advancement to $95,000 salary

- Side business now $3,500/month

- Rental property generates $600/month cash flow

- Total monthly income: ~$11,400

- Still maintaining $4,000 monthly expenses (35% of income)

- Investing: $5,500/month (58% savings rate)

Result at Age 38 (10 years later):

- Net worth: $487,000

- Investment portfolio: $320,000

- Real estate equity: $150,000

- Business value: $17,000

- Monthly passive income: $2,100 (dividends + rental income)

Sarah’s transformation demonstrates that Rich Guy Math isn’t about starting with advantages; it’s about making smart decisions consistently over time.

How to Implement Rich Guy Math Starting Today

Ready to apply these principles? Here’s your action plan:

Immediate Actions (This Week)

- Calculate your current numbers: Income, expenses, savings rate, net worth

- Open or optimize investment accounts: If you don’t have a brokerage account, open one (Vanguard, Fidelity, Schwab)

- Automate your investments: Set up automatic transfers from checking to investment accounts

- Identify one income-increasing opportunity: Update resume, research side hustles, or schedule a performance review

Short-term Goals (Next 3 Months)

- Increase savings rate by 5%: Find expenses to cut or income to increase

- Start learning about investing: Read one book or take one course on stock market fundamentals

- Build emergency fund: Aim for 3-6 months of expenses in high-yield savings

- Develop a high-income skill: Identify and begin learning a skill that commands premium pay

Medium-term Goals (Next 12 Months)

- Reach 25-30% savings rate: Through income increases and spending optimization

- Create a second income stream: Launch a side business or an investment income source

- Invest in tax-advantaged accounts: Max out 401(k) match minimum, contribute to Roth IRA

- Increase net worth by 30%+: Through savings, investing, and debt reduction

Long-term Vision (5-10 Years)

- Build a substantial investment portfolio: Target $100K, then $250K, then $500K+ based on your timeline

- Create multiple passive income streams: Dividends, rental income, business income

- Achieve financial flexibility: Where work becomes optional, not mandatory

- Consider wealth transfer: Learn how to make your kid a millionaire through generational wealth planning

Advanced Rich Guy Math: Optimizing Each Variable

Once you’ve mastered the basics, wealthy individuals optimize each component of the wealth equation:

Optimizing Income (Increasing the Numerator)

- Value-based pricing: Charge based on value delivered, not hours worked

- Leverage and delegation: Build systems and teams that multiply your efforts

- Strategic partnerships: Collaborate with others to access bigger opportunities

- Investment in appreciating assets: Let money work as hard as you do

Optimizing Expenses (Decreasing the Subtrahend)

- Geo-arbitrage: Live in lower cost-of-living areas while earning high-location salaries (remote work)

- Tax efficiency: Use all legal deductions, credits, and tax-advantaged accounts

- Buying power: Purchase quality items that last versus cheap items that need replacing

- Negotiation: Negotiate everything—salary, rent, contracts, services

Optimizing Time (Extending the Multiplier)

- Start immediately: Every year of delay costs exponentially in compound growth

- Think in decades: Make decisions based on 10-20 year outcomes, not quarterly results

- Health as wealth: Investing in health extends your earning and compounding timeline

- Delay gratification: Trade short-term pleasure for long-term freedom

Optimizing Returns (Increasing the Rate)

- Asset allocation: Balance growth and stability based on timeline and risk tolerance

- Diversification: Spread risk across asset classes and investment types

- Regular rebalancing: Maintain target allocations to manage risk and capture gains

- Continuous education: Markets evolve; wealthy investors keep learning

For those interested in specific strategies, exploring high dividend stocks can provide both income and growth potential.

The Psychology of Rich Guy Math: Mindset Matters

Numbers and formulas are important, but mindset separates those who apply Rich Guy Math successfully from those who don’t.

Abundance vs. Scarcity Thinking

Scarcity mindset: “There’s only so much to go around. If someone else wins, I lose.”

Abundance mindset: “There are unlimited opportunities. Creating value for others creates wealth for me.”

Wealthy individuals operate from abundance. They focus on creating value, solving problems, and expanding possibilities rather than competing for fixed resources.

Delayed Gratification

The famous Stanford marshmallow experiment demonstrated that children who could delay gratification achieved better life outcomes. Rich Guy Math is the adult version—choosing long-term wealth over immediate consumption.

Practice delayed gratification:

- Wait 30 days before major purchases (impulse control)

- Invest first, spend what’s left (pay yourself first)

- Celebrate milestones with experiences, not expensive things

- Find free or low-cost sources of happiness

Growth Mindset

Carol Dweck’s research on growth mindset applies perfectly to wealth building. People with growth mindsets believe abilities and outcomes can improve through effort and learning.

In Rich Guy Math terms:

- “I can’t afford it” becomes “How can I afford it?”

- “I’m not good with money” becomes “I’m learning to manage money better.”

- “Investing is too risky” becomes “How can I invest intelligently while managing risk?”

Risk Tolerance and Calculated Risk-Taking

Wealthy people aren’t reckless, but they understand that avoiding all risk is itself risky. Inflation and opportunity cost erode wealth held in cash.

Smart risk management:

- Diversify across assets and income streams

- Invest based on time horizon (longer = can handle more volatility)

- Keep the emergency fund separate from investments

- Educate yourself to make informed decisions rather than gambling

Rich Guy Math for Different Life Stages

The principles remain constant, but the application varies by age and circumstances:

In Your 20s: Maximum Growth Phase

Advantages: Time is your greatest asset; you can take more risks; fewer obligations

Focus areas:

- Invest aggressively in skills and education that increase earning power

- Take calculated career risks for higher income potential

- Start investing immediately, even in small amounts

- Build good financial habits before lifestyle inflation sets in

- Consider higher-risk, higher-reward investments (growth stocks, entrepreneurship)

Target: 20-30% savings rate, focus on income growth

In Your 30s: Acceleration Phase

Advantages: Higher income than 20s; still have 30+ years for compounding; established career

Challenges: Family expenses, housing costs, lifestyle creep

Focus areas:

- Maximize income through strategic career moves and side income

- Increase savings rate to 30%+ as income grows

- Balance growth investing with some stability

- Protect wealth with proper insurance (life, disability, umbrella)

- Consider real estate investing for diversification

Target: 30-40% savings rate, building a substantial portfolio

In Your 40s: Optimization Phase

Advantages: Peak earning years; investment knowledge and experience; clear priorities

Challenges: College costs, aging parents, time horizon shortening

Focus areas:

- Maximize retirement account contributions

- Shift toward a more balanced portfolio (still growth-focused but less aggressive)

- Develop passive income streams

- Tax optimization becomes increasingly important

- Consider wealth transfer and estate planning

Target: 35-45% savings rate, substantial net worth accumulation

In Your 50s+: Preservation and Income Phase

Advantages: Highest earning potential; large portfolio to compound; financial wisdom

Challenges: Shorter time horizon; retirement approaching; health considerations

Focus areas:

- Transition from accumulation to income generation

- Gradually shift toward capital preservation

- Develop sustainable withdrawal strategies

- Optimize Social Security timing

- Focus on tax-efficient income in retirement

Target: 40%+ savings rate, portfolio generating meaningful passive income

Tools and Resources for Rich Guy Math Success

Essential Tracking Tools

Net worth tracking:

- Personal Capital (free portfolio tracking)

- Mint (expense tracking)

- YNAB (You Need A Budget) for detailed budgeting

- Simple spreadsheet (often most effective)

Investment platforms:

- Vanguard, Fidelity, Schwab (low-cost index funds)

- M1 Finance (automated portfolio management)

- Real estate crowdfunding (Fundrise, RealtyMogul for diversification)

Educational Resources

Books:

- “The Simple Path to Wealth” by JL Collins

- “The Millionaire Next Door” by Thomas Stanley

- “Your Money or Your Life” by Vicki Robin

- “The Psychology of Money” by Morgan Housel

Websites:

- TheRichGuyMath.com blog for ongoing wealth-building education

- Investopedia for financial term definitions

- SEC.gov for investor education and company research

- Morningstar for investment research and analysis

Podcasts:

- ChooseFI

- BiggerPockets Money

- The Investor’s Podcast

- Planet Money

Conclusion: Your Rich Guy Math Journey Starts Now

Rich Guy Math isn’t complicated, but it does require discipline, patience, and consistent action. The formula is simple: earn more, spend intentionally, invest the difference, and let time work its magic through compound growth.

The wealthy aren’t using secret strategies unavailable to everyone else. They’re simply applying these fundamental principles consistently over long periods. The difference between financial struggle and financial freedom often comes down to the daily decisions you make about earning, spending, and investing.

Your next steps:

- Calculate your current financial position using the assessment tool in this article

- Set specific targets for savings rate, income growth, and net worth milestones

- Automate your wealth building with automatic investment contributions

- Educate yourself continuously about investing, income generation, and wealth optimization

- Track progress monthly and adjust strategies based on results

- Stay consistent through market volatility and life changes

Remember: the best time to start was 10 years ago; the second-best time is today. Every day you delay implementing Rich Guy Math costs you in compound growth and opportunity.

The path to wealth isn’t mysterious or reserved for the lucky few. It’s a formula anyone can follow. Start applying Rich Guy Math principles today, and your future self will thank you.

For more strategies and insights on building wealth intelligently, explore the smart moves that successful investors make consistently.

Interactive Rich Guy Math Calculator

💰 Rich Guy Math Wealth Calculator

Discover your path to financial freedom using the wealth-building formula

FAQ: Rich Guy Math

Rich Guy Math is the practice of making financial decisions that prioritize long-term wealth building over short-term consumption. It focuses on increasing income, maintaining high savings rates (30%+ of income), and investing consistently in assets that generate passive income and appreciate over time.

You can start Rich Guy Math with any amount—even $50 per month. The principles work at every income level. What matters most is the percentage you save and invest, not the absolute dollar amount. Someone earning $40,000 who saves 30% ($12,000) is practicing better Rich Guy Math than someone earning $200,000 who saves 5% ($10,000).

Wealthy individuals typically maintain savings rates of 30% or higher. The higher your savings rate, the faster you build wealth and the sooner you achieve financial independence. A 50% savings rate means you can sustain your lifestyle for one year with every year worked. A 10% savings rate requires working 9 years for every 1 year of lifestyle sustained.

Absolutely not. Rich Guy Math principles work at any income level. While higher income accelerates wealth building, the core principles—living below your means, investing the difference, and optimizing all variables—apply universally. Many millionaires built wealth on middle-class incomes through consistent application of these principles over decades.

Initial results appear within months (increased savings, growing investment accounts), but substantial wealth accumulation typically takes 5-10 years of consistent application. The compounding effect accelerates over time—your second decade of investing produces dramatically more wealth than your first decade due to compound growth on a larger base.

This depends on interest rates and debt type. The general rule: pay off high-interest debt first (credit cards, personal loans over 7-8%), while simultaneously investing enough to capture employer 401(k) matches. For low-interest debt (mortgages under 4%, student loans under 5%), many wealth-builders invest while making minimum payments, as investment returns typically exceed these interest rates over time.

The biggest mistake is not starting. People wait for perfect conditions—higher income, more knowledge, better market timing—and miss years of compound growth. The second biggest mistake is lifestyle inflation—increasing spending proportionally with income instead of maintaining spending while investing raises and additional income.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Before making any investment decisions, consult with a qualified financial advisor who understands your specific situation, goals, and risk tolerance. The strategies discussed may not be suitable for all investors.

Written by Max Fonji — With a decade of experience in financial education and investing, Max is your go-to source for clear, data-backed investing education. His mission is to demystify wealth-building and make proven financial strategies accessible to everyone, regardless of starting point or income level.