What Is SMH Stock?

SMH stock refers to the VanEck Semiconductor ETF (SMH), a popular exchange-traded fund that tracks the performance of major U.S. and global semiconductor companies. It is designed to provide exposure to the semiconductor industry, which powers everything from smartphones to artificial intelligence and autonomous vehicles.

- Ticker Symbol: SMH

- Fund Type: Sector ETF (Technology/Semiconductors)

- Issuer: VanEck

- Inception Date: December 20, 2011

- Expense Ratio: 0.35%

SMH ETF Top Holdings (2025)

| Company | % Allocation |

|---|---|

| NVIDIA Corporation | 19.5% |

| Taiwan Semiconductor | 13.2% |

| ASML Holding NV | 9.7% |

| Broadcom Inc. | 8.3% |

| Advanced Micro Devices | 7.9% |

| Intel Corporation | 5.4% |

| Texas Instruments | 4.7% |

| Qualcomm Inc. | 4.2% |

| Applied Materials | 3.8% |

| Lam Research | 3.6% |

✅ These top holdings make SMH a high-concentration ETF, heavily weighted in leading semiconductor giants like NVIDIA and TSMC.

SMH Stock Performance Overview

Past Performance (As of 2025)

| Time Period | Return (%) |

|---|---|

| 1-Year | +38.2% |

| 5-Year Avg. | +22.4% |

| 10-Year Avg. | +18.9% |

Why SMH Stock Is Gaining Attention in 2025

- AI Boom: Semiconductors are foundational for AI model training and deployment (NVIDIA’s dominance in GPUs).

- Global Demand: Chips are in everything—smartphones, cars, IoT, servers, robotics.

- Geopolitical Significance: TSMC and U.S. chipmakers are key to global tech security.

- Government Backing: U.S. CHIPS Act and global tech investments support semiconductor innovation and manufacturing.

Risks of Investing in SMH Stock

- Concentration Risk: Heavy weighting in a few names increases exposure to individual stock volatility.

- Cyclicality: Semiconductor demand is highly cyclical, impacting short-term returns.

- Geopolitical Tension: Tensions between the U.S., China, and Taiwan can impact chip supply chains and valuations.

SMH vs. Other Semiconductor ETFs

| ETF Name | Ticker | Expense Ratio | Top Holdings | Strategy |

|---|---|---|---|---|

| VanEck Semiconductor | SMH | 0.35% | NVIDIA, TSMC, AMD | High-conviction |

| iShares Semiconductor | SOXX | 0.35% | Broadcom, Intel, AMD | Broad sector |

| SPDR Semiconductor | XSD | 0.35% | Balanced exposure | Equal-weighted |

SMH is best for investors who believe in the long-term growth of dominant chip leaders like NVIDIA and TSMC.

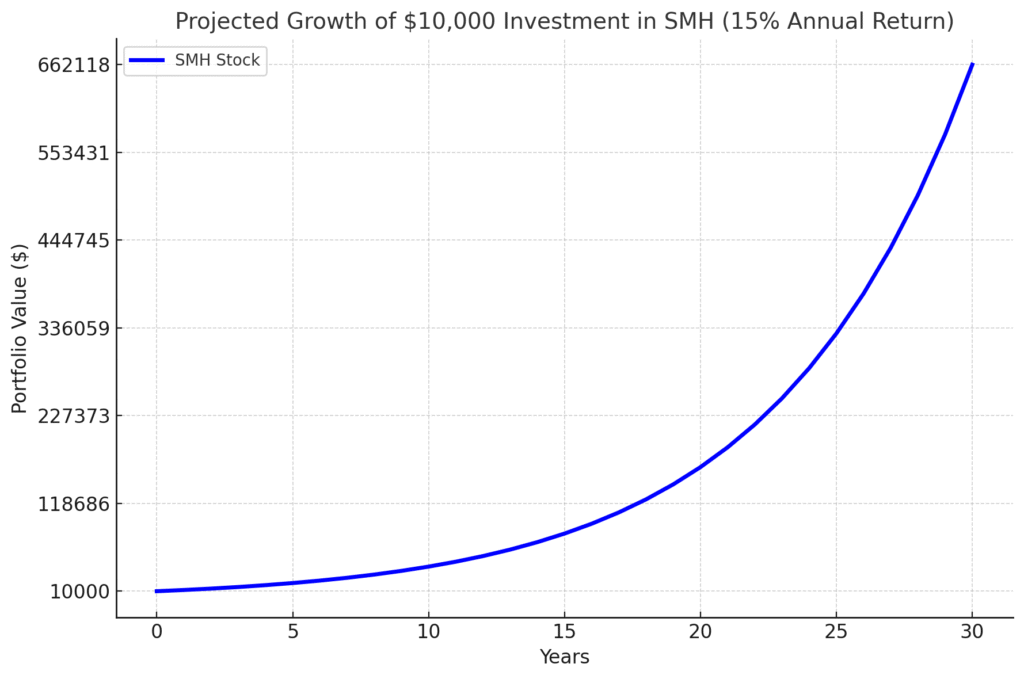

If You Invest $10,000 in SMH in 2025.

Let’s assume a compounded annual return of 15% based on historical averages and growth prospects:

| Year | Portfolio Value |

|---|---|

| 5 | $20,113 |

| 10 | $40,455 |

| 20 | $163,665 |

| 30 | $661,437 |

📈 Long-term investing in SMH could potentially turn $10,000 into over $600,000 in 30 years if the semiconductor trend continues.

Should You Buy SMH Stock in 2025?

SMH is a strong choice if you’re bullish on:

- Artificial intelligence and automation

- Semiconductor manufacturing and innovation

- Long-term global tech growth

However, if you’re risk-averse or want broader exposure, consider blending SMH with general tech or total market ETFs.

Yes, if you believe in the long-term growth of semiconductors and leading companies like NVIDIA and TSMC, SMH offers high upside with sector-specific exposure.

The expense ratio of SMH is 0.35%, which is reasonable for a thematic, sector-based ETF.

Yes. SMH can be held in IRAs, Roth IRAs, and brokerage accounts to benefit from long-term growth.

Yes, SMH pays quarterly dividends, though the yield is modest compared to dividend-focused ETFs.

Final Thoughts: Is SMH Stock the Right Investment for You?

The VanEck Semiconductor ETF (SMH) stands out in 2025 as a powerful gateway to the booming semiconductor industry. With its concentrated exposure to top-tier companies like NVIDIA, TSMC, and ASML, SMH offers investors a high-growth opportunity driven by megatrends such as:

- Artificial intelligence (AI)

- Quantum computing

- 5G and IoT expansion

- Electric vehicles and autonomous tech

However, it’s crucial to understand that higher potential returns come with higher volatility. SMH is not a “set and forget” ETF—it demands an investor who believes in the long-term dominance of the tech hardware ecosystem.

If you’re seeking:

- High-conviction growth

- Exposure to world-leading chipmakers

- A sector ETF for your tech portfolio

👉 Then, SMH stock is worth considering in 2025.

For diversified exposure, you may also want to pair SMH with broader ETFs like VTI or QQQ to balance risk.