TL;DR — Quick Take

- The time value of money means a dollar today is worth more than a dollar tomorrow, because you can invest it and earn returns.

- Core formulas: Future Value (FV) and Present Value (PV) help compare cash flows across time.

- Always choose the right discount rate — risk-free Treasury yields, your personal investment return, or a company’s cost of capital.

- Use our simple calculator + Excel template to run your own numbers.

- Micro case studies (lottery lump sum vs annuity, retirement savings, mortgage payoff) show how TVM works in real life. Investopedia — Time Value of Money

Understanding this concept is crucial whether you’re budgeting, saving for retirement, or investing in the stock market. In this post, we’ll break it down simply, no complex math degrees required.

What is the Time Value of Money?

The time value of money (TVM) is one of the most important ideas in finance. Simply put, money today is worth more than the same amount in the future. Why? Because money you hold today can be invested to earn interest, dividends, or returns. Corporate Finance Institute — TVM

Think about it this way: if someone offers you $100 now or $100 a year from now, you’d almost always prefer it today because you can put it to work immediately.

This principle underpins nearly every financial decision: investing, borrowing, retirement planning, and business valuation. It’s the backbone of concepts like compound interest, net present value (NPV), and discounted cash flow (DCF) analysis.

Key Terms to Know

- Present Value (PV): How much a future sum of money is worth today.

- Future Value (FV): The amount your money will grow to at a given interest rate over time.

- Discount Rate: The rate used to calculate present value (often based on risk-free Treasury yields, personal investment return, or corporate WACC).

- Compounding: The process by which interest earns interest, magnifying growth over time.

Core Formulas of TVM

Future Value (FV)

Formula: FV = PV x (1 + i)^n

- PV = Present Value (today’s money)

- i = interest rate per period

- n = number of periods

Example: If you invest $5,000 at 6% for 5 years:

FV = 5,000 × (1.06)^5 = $6,691

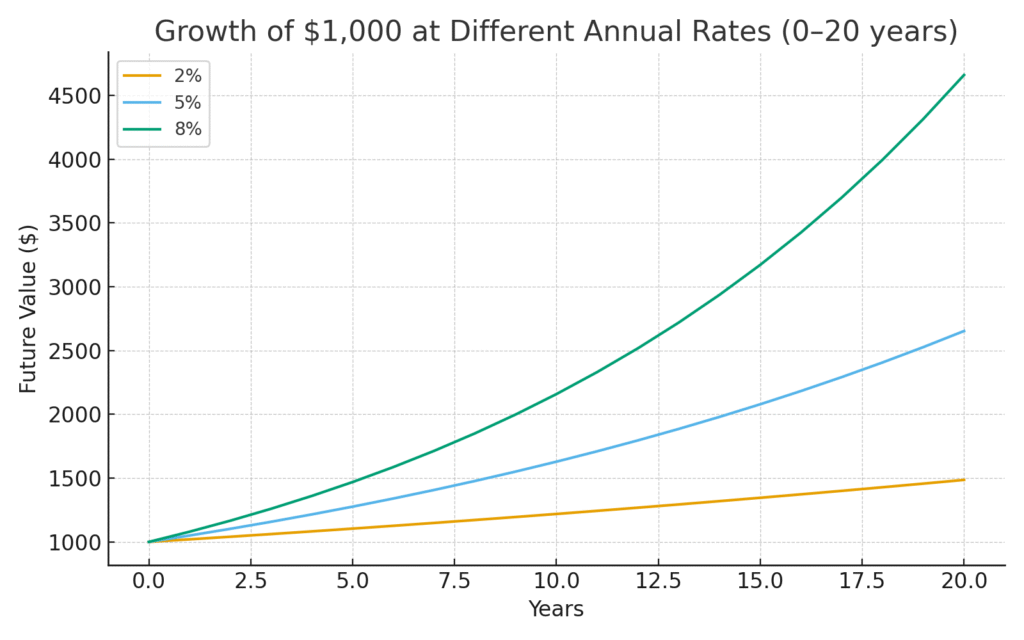

Growth chart: compounding makes even small rate differences large over 20 years (8% vs 2% diverges dramatically).Why Investing is a more powerful tool to build long-term wealth than saving

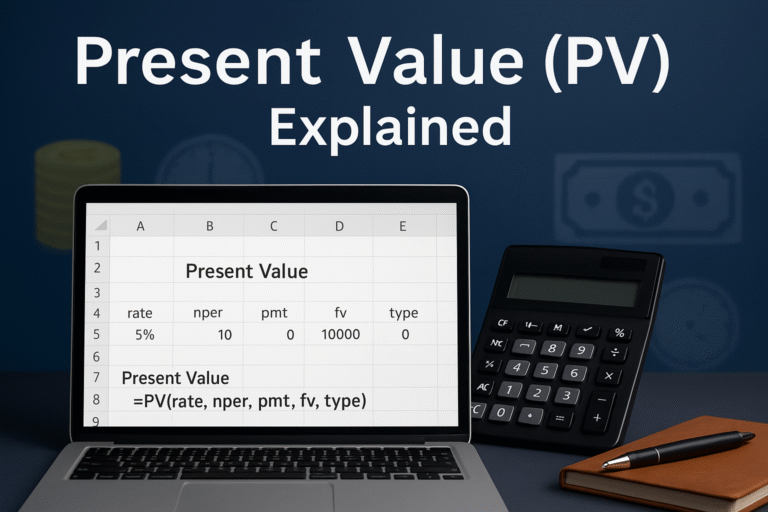

Present Value (PV)

Formula: PV = FV/(1+i)^n

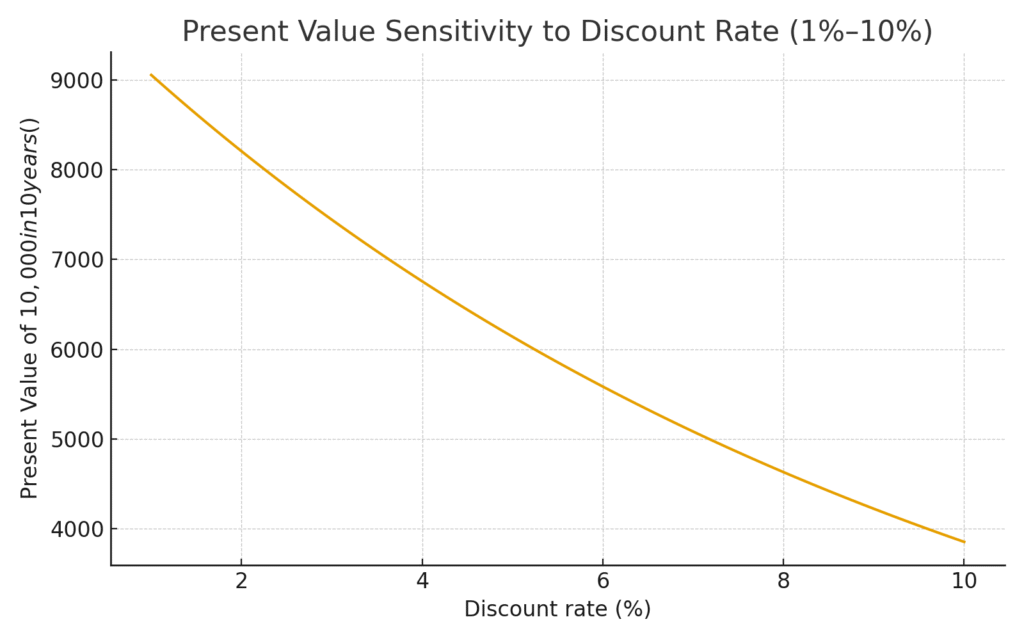

Example: You’re promised $10,000 in 4 years. At a discount rate of 7%:

PV = 10,000 ÷ (1.07^4) = $7,629

This tells you that receiving $10,000 in 4 years is equivalent to having about $7,629 today.

PV sensitivity: present value falls quickly as the discount rate increases. Small rate increases reduce PV significantly.

Annuity (Regular Payments)

When you receive payments over time (like pension or mortgage), use the annuity formula: PV A = A × 1−(1+i)^−n/i

Where A = payment amount, i = rate, n = number of periods.

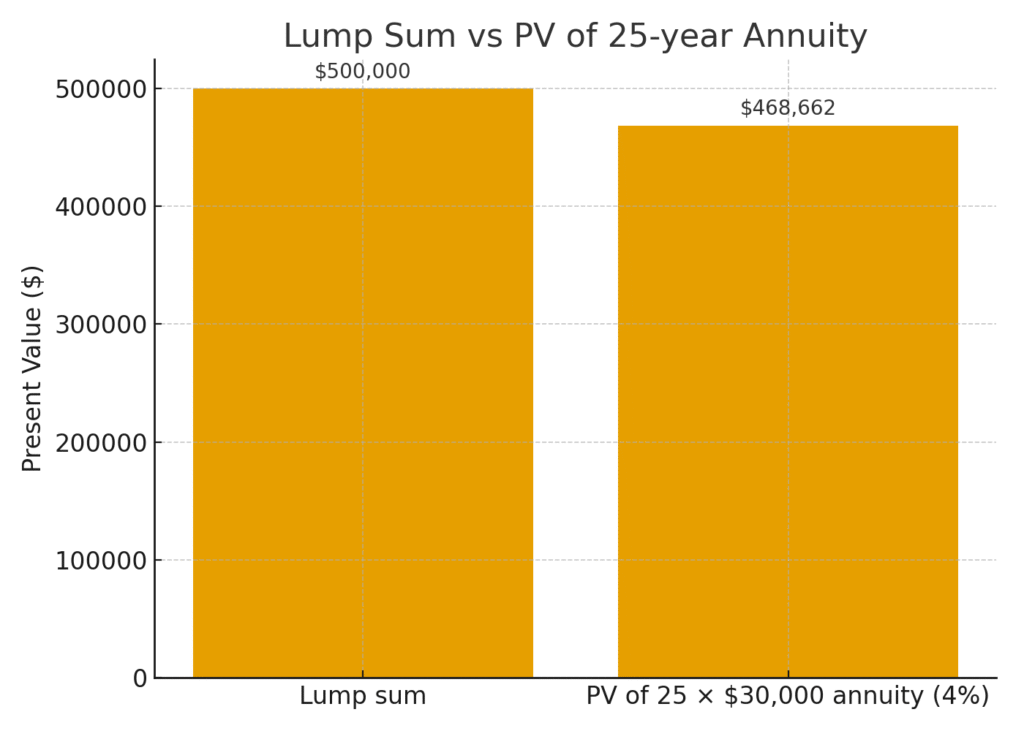

Lump vs annuity: at 4%, PV of the annuity is approximately the value shown on the chart (close to $491k) — small changes in discount rate can flip which option is better.

Real-Life Case Studies

1 — $10,000 Today or $12,000 in 2 Years?

- PV of $12,000 at 5% = 12,000 ÷ (1.05^2) = $10,885

- Since $10,885 > $10,000, you should take the $12,000 (assuming no risk).

2 — Lottery: $500k Lump Sum vs $30k for 25 Years

- Using a 4% discount rate: PV of annuity ≈ $491,000

- Pretty close to $500k lump sum → decision depends on taxes, investment return, and your time horizon.

3 — Retirement Contributions

- Start saving $300/month at age 25 (8% return). By 65 → ~$932,000.

- Wait until age 35 to start → only ~$420,000.

- Lesson: Time is the most valuable input in TVM.

How to Choose the Right Discount Rate

Choosing the right rate is critical:

- Risk-free baseline: U.S. Treasury yields (10-year often used).

- Personal finance: Your expected after-tax return (e.g., 7% stock market average).

- Corporate finance: Weighted Average Cost of Capital (WACC).

- Inflation adjustment: Use the “real” rate when comparing future purchasing power.

Example: If nominal return = 6% and inflation = 2%, your real return is:

(1.06/1.02) − 1 = 3.9%

U.S. Treasury — Daily Yield Curve Rates

Tool: Spreadsheet

To make this practical, include:

- Interactive TVM calculator (inputs: PV, FV, rate, periods, payment).

- Downloadable Excel template with functions:

=PV(rate, nper, pmt, [fv])=FV(rate, nper, pmt, [pv])=NPV(rate, value1, [value2])

Common Mistakes

- Mixing nominal and real values.

- Ignoring taxes and fees (use after-tax returns).

- Using too high/too low a discount rate → can make projects look artificially good or bad.

Advanced Note: Continuous Compounding

For advanced users, if compounding happens continuously:

FV = PV x e^rt

This is useful in bond pricing and advanced valuation models.

Because it can earn returns if invested.

Typically, your after-tax investment return or risk-free Treasury yield.

It erodes future purchasing power, so always consider real returns.

Yes, with negative interest rates or deflationary environments.

Loan payments are annuities that banks calculate using PV and FV formulas.

Simple interest = no reinvestment; compound = reinvestment, which accelerates growth.

Yes, discounted cash flow (DCF) models rely entirely on TVM principles.

Conclusion

The time value of money is more than just a finance theory; it’s a decision-making tool that affects every financial choice you make. Whether it’s a mortgage, retirement plan, or lottery winnings, the formulas of PV and FV give you clarity.

Action step: Use the above to download the Excel template and run your own scenarios.

Disclaimer

This content is for educational purposes only and not financial advice. Always consult a licensed professional before making investment or tax decisions.

Author Bio

Max Fonji — Author & Founder of TheRichGuyMath.com. With over 8 years of financial writing and SEO expertise, I specialize in breaking down complex money concepts into beginner-friendly guides. Featured resources, tools, and practical case studies help readers make smarter financial decisions.