Wealth Building Strategies: Grow Your Money in 2025

Imagine waking up one morning and realizing your money has been working harder than you have. While you slept, your investments grew. While you enjoyed time with family, your assets appreciated. This isn’t a fantasy; it’s the reality for people who understand and apply wealth-building strategies. The difference between those who build lasting wealth and those who struggle financially often comes down to knowledge and action, not just income level.

Building wealth isn’t about getting rich overnight or finding a secret formula. It’s about making smart, consistent decisions with your money over time. Whether you’re earning $30,000 or $300,000 a year, the principles remain the same. The journey starts with understanding that wealth building is a marathon, not a sprint, and anyone willing to learn can start growing their money today. Investopedia – Wealth Building

Key Takeaways

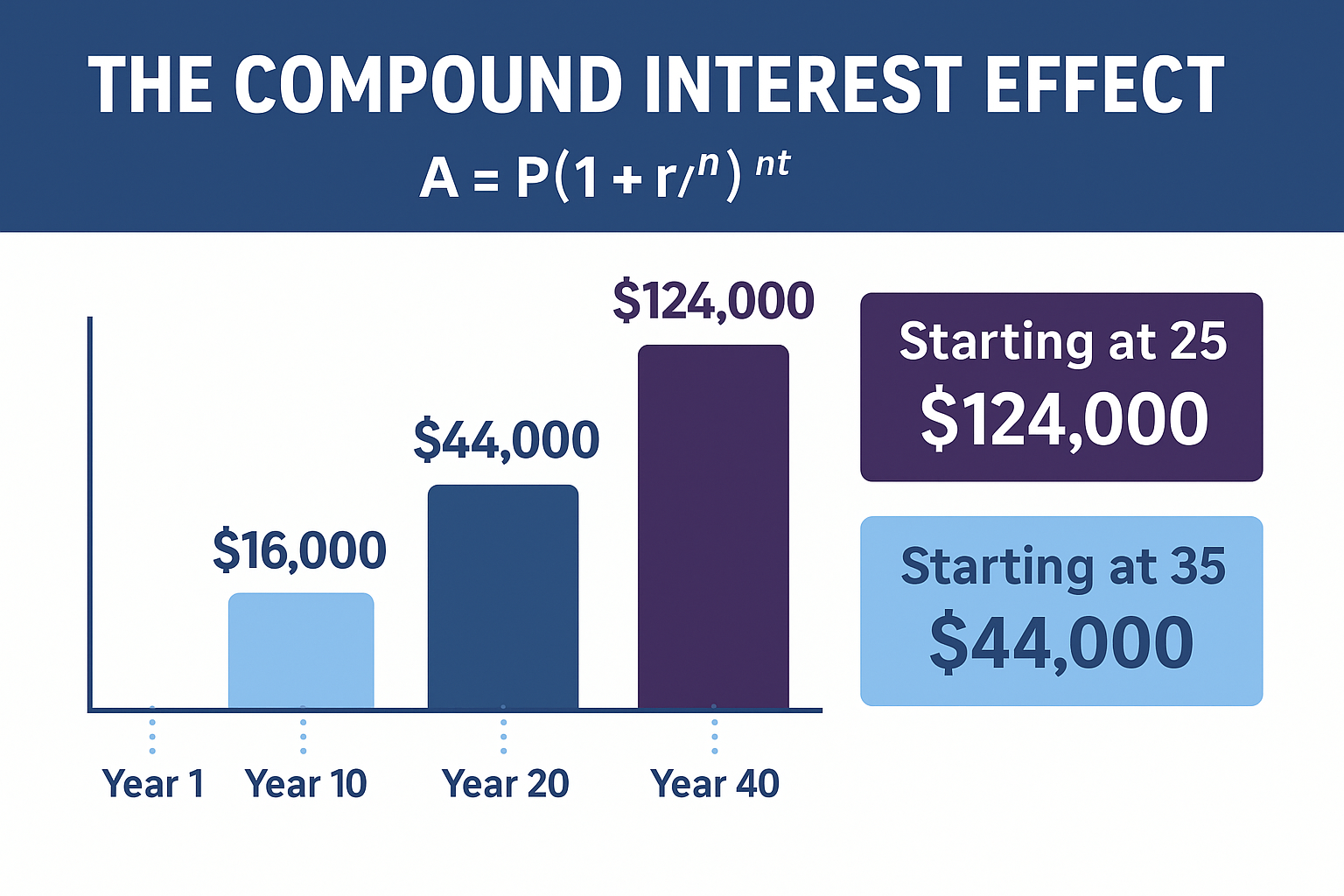

- Start early and stay consistent: Time is your greatest asset in wealth building. Compound interest works best over decades

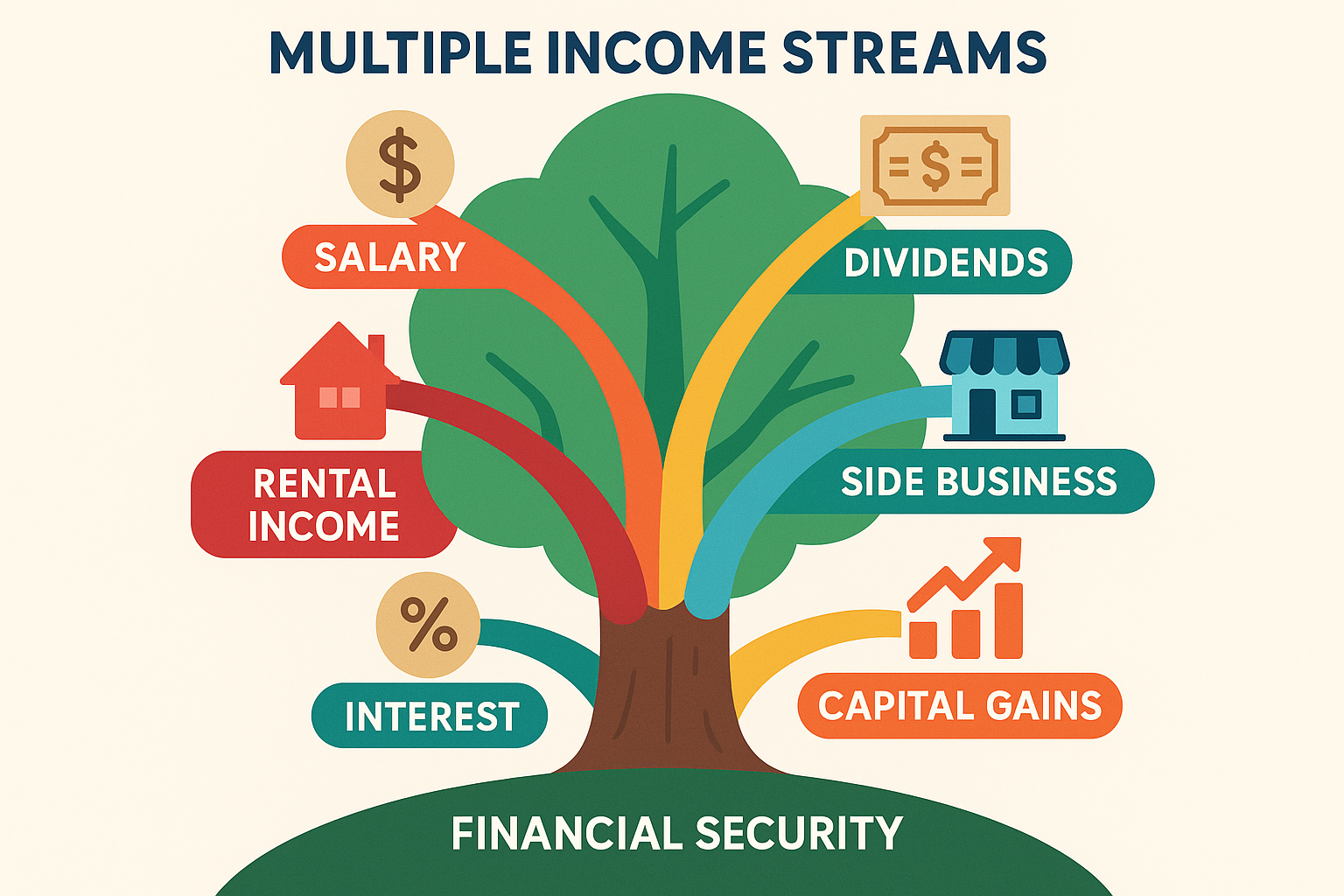

- Diversify your income streams: Relying on a single income source limits your wealth-building potential

- Invest in assets, not liabilities: Focus on purchases that appreciate or generate income rather than depreciating possessions

- Automate your wealth building: Set up automatic transfers and investments to remove emotions from financial decisions

- Educate yourself continuously: Financial literacy is the foundation of all successful wealth-building strategies

What Are Wealth Building Strategies?

Wealth-building strategies are systematic approaches to growing your financial assets over time. These strategies combine earning, saving, investing, and protecting money to create long-term financial security and independence. Unlike get-rich-quick schemes, legitimate wealth-building strategies focus on sustainable growth through proven financial principles.

At their core, these strategies recognize that wealth isn’t just about how much you earn, it’s about how much you keep, grow, and protect. A person earning $50,000 who saves and invests 20% can build more wealth than someone earning $150,000 who saves nothing.

Why Wealth Building Matters More Than Ever in 2025

The economic landscape of 2025 presents both challenges and opportunities. Inflation continues to erode purchasing power, traditional pension plans have largely disappeared, and Social Security may not provide adequate retirement income. Meanwhile, the cost of healthcare, education, and housing continues to rise faster than wages.

The reality is stark: Without intentional wealth building, maintaining your current lifestyle in retirement becomes increasingly difficult. However, the flip side is equally true: with the right strategies, building substantial wealth is more accessible than ever before. Technology has democratized investing, information is freely available, and barriers to entry have fallen dramatically.

Consider Sarah, a 28-year-old teacher earning $45,000 annually. By implementing basic wealth-building strategies, automating 15% of her income into retirement accounts and investments, she could accumulate over $1.2 million by age 65, assuming average market returns. That’s the power of starting early and staying consistent.

The Foundation: Building Your Financial Base

Emergency Fund: Your Financial Safety Net

Before investing in stocks or real estate, establish an emergency fund covering 3-6 months of essential expenses. This fund serves as your financial shock absorber, preventing you from derailing long-term wealth building when unexpected expenses arise.

Think of your emergency fund as insurance against life’s uncertainties:

- Job loss protection while you search for new employment

- Medical emergencies that exceed insurance coverage

- Major repairs to your home or vehicle

- Family emergencies requiring travel or financial support

Keep this money in a high-yield savings account where it remains accessible but separate from your everyday spending money. In 2025, many online banks will offer competitive interest rates that at least partially offset inflation.

Debt Management: Clearing the Path

High-interest debt acts like a weight around your ankles while trying to climb the wealth mountain. Credit card balances charging 18-25% interest make wealth building nearly impossible; you can’t invest your way out of high-interest debt.

The Debt Elimination Hierarchy

- Payday loans and title loans (eliminate immediately)

- Credit card debt (typically 15-25% interest)

- Personal loans (varies widely)

- Student loans (4-7% typically)

- Mortgage debt (3-7% typically)

Use either the avalanche method (highest interest first) or the snowball method (smallest balance first) to systematically eliminate debt. The avalanche method saves more money mathematically, while the snowball method provides psychological wins that keep you motivated.

Core Wealth Building Strategies for Beginners

Strategy 1: Maximize Tax-Advantaged Retirement Accounts 💰

One of the most powerful wealth-building strategies involves leveraging accounts that provide tax benefits. These accounts essentially give you free money through tax deductions, tax-free growth, or employer matching.

401(k) Plans: If your employer offers a 401(k) with matching contributions, contribute at least enough to capture the full match. This represents an immediate 50-100% return on your investment, something you’ll never find in the market.

For 2025, you can contribute up to $23,000 to a 401(k) ($30,500 if you’re 50 or older). Even if you can’t max out, start with whatever you can afford and increase by 1% annually.

Individual Retirement Accounts (IRAs): These accounts allow you to save an additional $7,000 annually ($8,000 if 50+). Choose between:

- Traditional IRA: Tax deduction now, pay taxes in retirement

- Roth IRA: No immediate deduction, but tax-free withdrawals in retirement

For most beginners, the Roth IRA offers exceptional value because your investments grow tax-free forever. Imagine investing $7,000 annually from age 25 to 65 and never paying taxes on the growth, that could mean hundreds of thousands in tax savings.

Strategy 2: Invest in the Stock Market

The stock market has historically provided average annual returns of 10% over long periods, making it one of the most reliable wealth-building tools available. Understanding why the stock market goes up helps you stay committed during volatile periods.

Index Fund Investing: For beginners, low-cost index funds offer instant diversification and minimal fees. Rather than trying to pick individual stocks, you own a piece of hundreds or thousands of companies.

Popular index fund options include:

- S&P 500 index funds: Track the 500 largest U.S. companies

- Total market index funds: Own virtually every publicly traded U.S. company

- International index funds: Diversify globally

Dollar-Cost Averaging: Invest a fixed amount regularly regardless of market conditions. This strategy removes emotion from investing and ensures you buy more shares when prices are low and fewer when prices are high.

Many people lose money in the stock market because they let their emotions drive their decisions. Understanding the cycle of market emotions helps you avoid panic selling during downturns and overconfidence during booms.

Strategy 3: Create Multiple Income Streams

Relying solely on employment income limits your wealth-building potential. The wealthy typically have 3-7 income streams working simultaneously.

Dividend Investing: Start earning passive income through dividend investing by purchasing shares in companies that distribute profits to shareholders. High dividend stocks can provide quarterly income that compounds when reinvested.

Side Businesses: Use your skills to generate additional income:

- Freelancing in your area of expertise

- Consulting for businesses in your industry

- Online courses teach skills you’ve mastered

- E-commerce selling products or dropshipping

The beauty of side income is that it can be entirely directed toward investing since your primary job covers living expenses. Even an extra $500 monthly invested at 8% annual returns becomes $370,000 over 30 years.

For more ideas, explore these smart ways to make passive income that require minimal ongoing effort once established.

Strategy 4: Real Estate Investment

Real estate offers unique wealth-building advantages, including leverage, tax benefits, appreciation, and cash flow. You don’t need millions to start; several accessible entry points exist.

Primary Residence: Buying a home instead of renting can build wealth through forced savings (mortgage principal payments) and appreciation. However, only buy when:

- You plan to stay 5+ years

- You have a 20% down payment (or at least 10%)

- Monthly payments don’t exceed 28% of gross income

Real Estate Investment Trusts (REITs): These publicly traded companies own income-producing real estate. You can invest in REITs through your brokerage account with as little as $100, gaining exposure to commercial real estate without being a landlord.

House Hacking: Purchase a multi-unit property, live in one unit, and rent the others. The rental income covers your mortgage, allowing you to live rent-free while building equity.

Strategy 5: Invest in Yourself 🎓

The best investment often yields the highest return: yourself. Increasing your earning potential accelerates every other wealth-building strategy.

Skills Development: Invest in courses, certifications, or degrees that increase your market value. A $5,000 investment in education that boosts your income by $10,000 annually provides a 200% return in year one and continues paying dividends for decades.

Health: Medical expenses are among the top causes of bankruptcy. Investing in preventive health, quality food, exercise, and stress management saves enormous costs long-term while improving quality of life.

Networking: Your network determines opportunities. Attend industry events, join professional organizations, and build genuine relationships with people in your field and adjacent industries.

Advanced Wealth Building Concepts

The Power of Compound Interest

Albert Einstein allegedly called compound interest “the eighth wonder of the world.” Those who understand it earn it; those who don’t pay it. Compound interest means earning returns on your returns, creating exponential rather than linear growth.

Example: Investing $10,000 at 8% annual returns:

- After 10 years: $21,589

- After 20 years: $46,610

- After 30 years: $100,627

- After 40 years: $217,245

Notice how the final decade produces more growth than the first three decades combined. This demonstrates why starting early matters so much; time is the secret ingredient that transforms modest savings into substantial wealth.

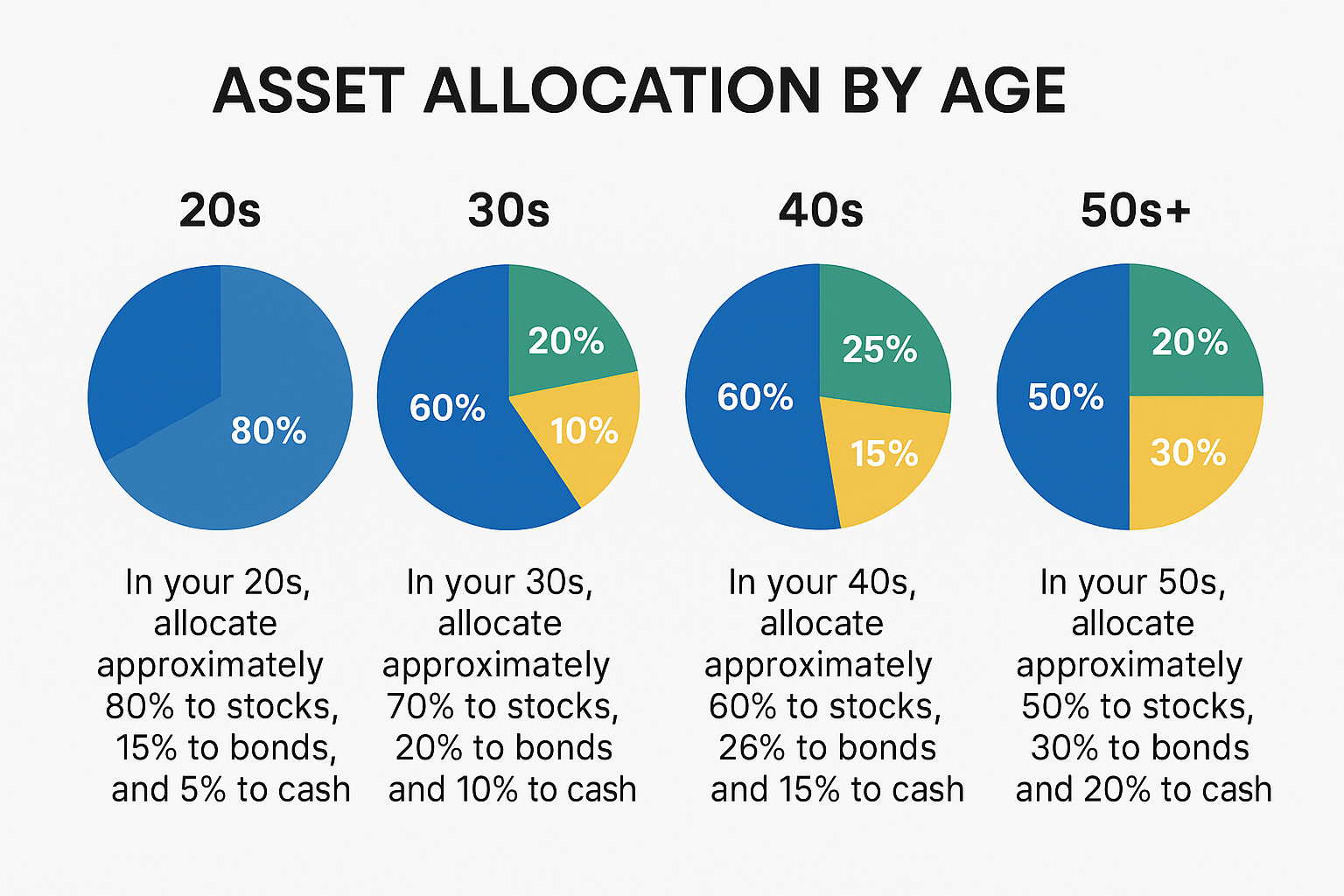

Asset Allocation and Rebalancing

Asset allocation refers to how you divide investments among different categories (stocks, bonds, real estate, cash). Your allocation should reflect your:

- Time horizon: Longer timeframes allow more stock exposure

- Risk tolerance: Ability to handle portfolio volatility

- Financial goals: Retirement, home purchase, education funding

A common rule of thumb suggests holding your age in bonds (e.g., at 30 years old, 30% bonds and 70% stocks). However, with increased life expectancies, many experts recommend more aggressive allocations.

Rebalancing involves periodically adjusting your portfolio back to target allocations. If stocks perform well, they may grow to represent 80% of your portfolio instead of the intended 70%. Rebalancing forces you to “sell high and buy low” systematically.

Tax Optimization Strategies

Taxes represent one of your largest lifetime expenses. Strategic tax planning can save hundreds of thousands over a career.

Tax-Loss Harvesting: Sell investments at a loss to offset capital gains, reducing your tax bill while maintaining market exposure by purchasing similar investments.

Roth Conversions: In low-income years, convert traditional IRA funds to Roth IRAs, paying taxes at lower rates now to avoid higher rates later.

Charitable Giving: Donate appreciated securities instead of cash to avoid capital gains taxes while claiming the full fair-market-value deduction.

Building Wealth at Different Life Stages

In Your 20s: Laying the Foundation

Your greatest asset in your 20s is time. Even small amounts invested now become substantial wealth later.

Priorities:

- Establish an emergency fund

- Eliminate high-interest debt

- Contribute enough to 401(k) for a full employer match

- Open and fund a Roth IRA

- Invest in career development

Target: Save 15-20% of gross income. If this seems impossible, start with 5% and increase 1% annually.

In Your 30s: Accelerating Growth

Your 30s typically bring increased income and competing priorities (home purchase, family, education costs). Balance current needs with future security.

Priorities:

- Increase retirement contributions to 15-20%

- Build substantial taxable investment accounts

- Purchase adequate life and disability insurance

- Consider real estate investment

- Maximize tax-advantaged accounts

Target: Net worth should equal your age times annual income divided by 5. At 35, earning $75,000, the target net worth of $525,000.

In Your 40s: Peak Earning Years

The 40s often represent peak earning potential. Maximize this advantage while retirement looms closer.

Priorities:

- Maximize all retirement account contributions

- Aggressively pay down the mortgage

- Fund children’s education without sacrificing retirement

- Diversify income streams

- Review and update estate plans

Target: Save 20-25% of gross income. Your net worth should be 2-3 times your annual income.

In Your 50s and Beyond: Preservation and Optimization

Shift focus toward preservation, risk reduction, and tax optimization.

Priorities:

- Maximize catch-up contributions ($7,500 additional for 401(k), $1,000 for IRA)

- Develop retirement income strategy

- Optimize Social Security claiming strategy

- Consider long-term care insurance

- Update estate documents

Target: Net worth should be 6-8 times annual income by 55, 10-12 times by 60.

Common Wealth Building Mistakes to Avoid

Lifestyle Inflation

As income increases, expenses tend to rise proportionally, a phenomenon called lifestyle inflation. The person earning $100,000 often feels as financially stretched as they did earning $50,000 because spending increased with income.

Solution: When you receive a raise, immediately direct at least 50% toward savings and investments. Enjoy the other 50% guilt-free, knowing you’re still progressing toward financial goals.

Trying to Time the Market

Countless studies demonstrate that time in the market beats timing the market. Missing just the 10 best market days over 20 years can cut your returns in half.

Solution: Invest consistently regardless of market conditions. Use dollar-cost averaging to remove emotion from the equation.

Neglecting Insurance

Insurance isn’t exciting, but adequate coverage protects wealth from catastrophic loss. Insufficient health, disability, life, or property insurance can destroy decades of careful wealth building in moments.

Solution: Review coverage annually. Carry:

- Health insurance with reasonable out-of-pocket maximums

- Disability insurance replaces 60-70% of income

- Term life insurance if others depend on your income

- Adequate property and liability coverage

Following Hot Tips

Your brother-in-law’s stock tip, the cryptocurrency your coworker swears will “moon,” or the investment seminar promising guaranteed returns, these rarely build wealth and often destroy it.

Solution: Stick to boring, proven strategies. Index funds, dividend stocks, and real estate investment trusts aren’t exciting dinner conversation, but they work.

Creating Your Personalized Wealth Building Plan

Step 1: Define Your Goals

Vague aspirations like “be rich” don’t drive action. Create specific, measurable goals:

- “Accumulate $1 million in retirement accounts by age 60”

- “Generate $3,000 monthly passive income within 10 years”

- “Achieve financial independence by age 50”

Write down your goals and review them quarterly. Research shows people who write goals achieve them at significantly higher rates than those who don’t.

Step 2: Calculate Your Numbers

Determine your:

- Current net worth: Assets minus liabilities

- Savings rate: Percentage of gross income saved/invested

- Investment returns: Realistic expectations (7-10% for stocks long-term)

- Timeline: Years until you need the money

Use these numbers to project where you’ll be in 5, 10, 20, and 30 years if you maintain current habits. If the projection doesn’t align with goals, adjust your strategy.

Step 3: Automate Everything

Willpower is unreliable. Automation removes decision-making from the equation.

Set up automatic transfers for:

- 401(k) contributions (directly from paycheck)

- IRA contributions (monthly from checking)

- Taxable investment accounts (monthly from checking)

- High-yield savings (emergency fund building)

When money moves automatically, you adapt your lifestyle to what remains rather than consciously choosing to save.

Step 4: Monitor and Adjust

Review your wealth-building progress quarterly. Check:

- Are you meeting savings targets?

- Is your asset allocation appropriate?

- Have life circumstances changed, requiring strategy adjustments?

- Are fees and expenses optimized?

Annual deep reviews should include:

- Rebalancing portfolios

- Tax-loss harvesting opportunities

- Insurance coverage adequacy

- Estate plan updates

The Role of Financial Advisors

As wealth grows, professional guidance often provides value exceeding its cost. However, not all financial advisors are created equal.

Fee-Only Advisors: Charge flat fees or hourly rates rather than commissions. This structure aligns their interests with yours—they profit from giving good advice, not selling products.

Robo-Advisors: Automated platforms provide algorithm-driven investment management at low costs (typically 0.25-0.50% annually). Suitable for straightforward situations but lacks personalized planning. Federal Reserve – Personal Finance Resources

When to Consider an Advisor:

- Complex tax situations

- Significant wealth requires estate planning

- Approaching retirement with multiple account types

- Lack of time or interest in managing investments

- Major life transitions (inheritance, divorce, business sale)

For most beginners, self-directed investing through low-cost index funds provides excellent results. As complexity increases, professional guidance becomes more valuable. Explore smart financial moves to determine if you’re ready for professional assistance.

Understanding How Financial Institutions Work

Building wealth requires understanding the financial system. Learning how banks work helps you make informed decisions about where to keep money, how to borrow strategically, and why certain financial products exist.

Banks profit from the spread between what they pay depositors and charge borrowers. This knowledge helps you negotiate better rates and understand why high-yield savings accounts matter; every 0.5% difference in interest rates adds up substantially over time.

The Psychological Side of Wealth Building

Financial success is 80% behavior and 20% knowledge. Understanding money psychology separates those who know what to do from those who actually do it.

Delayed Gratification

The famous marshmallow experiment demonstrated that children who could delay gratification achieved better life outcomes decades later. Wealth building requires consistently choosing future security over present consumption.

Practice: Before any non-essential purchase over $100, wait 72 hours. Often, the desire fades, revealing it as an impulse rather than a genuine need.

Abundance vs Scarcity Mindset

The scarcity mindset sees wealth as finite; someone else’s gain is your loss. This perspective creates fear-based decisions and missed opportunities.

An abundance mindset recognizes that wealth creation expands the pie. Others’ success doesn’t diminish your potential. This perspective encourages risk-taking, investment, and collaboration.

Comparison Trap

Social media creates constant comparison with others’ highlight reels. Keeping up with neighbors’ new cars, vacations, and homes derails wealth building faster than almost anything.

Solution: Define success for yourself. Someone else’s luxury car doesn’t improve your life; financial security does. Focus on your goals, not their possessions. Morningstar Investment Research

Real-Life Wealth Building Story

Meet James and Maria, a couple who started their wealth-building journey with $30,000 in student loan debt and minimal savings at age 27. Their combined income was $85,000.

Years 1-3: They aggressively paid off student loans while contributing 10% to retirement accounts. They lived in a modest apartment, drove used cars, and cooked most meals at home. By 30, they were debt-free with $45,000 in retirement accounts.

Years 4-7: With debt eliminated, they increased retirement contributions to 20% and began saving for a home down payment. They both pursued professional development, increasing their combined income to $125,000. At 34, they purchased a duplex for $350,000 with 20% down, living in one unit and renting the other.

Years 8-12: Rental income covered most of their mortgage. They maintained 20% retirement contributions and began investing in taxable accounts. Side hustles brought in an additional $15,000 annually. By 39, their net worth exceeded $500,000.

Years 13-20: They purchased a second rental property and continued maximizing retirement accounts. Their combined income reached $180,000. At 47, their net worth topped $1.5 million, and they were on track to achieve financial independence by 55.

Their secret? No lottery winnings or inheritance, just consistent application of basic wealth-building strategies, living below their means, and staying focused on long-term goals despite short-term temptations. SEC – Investor Education

Wealth Building Resources

Continuous education accelerates wealth building. Valuable resources include:

Books:

- “The Millionaire Next Door” by Thomas Stanley

- “The Simple Path to Wealth” by JL Collins

- “Your Money or Your Life” by Vicki Robin

- “The Intelligent Investor” by Benjamin Graham

Websites:

- The Rich Guy Math blog for practical wealth-building insights

- Bogleheads.org for investment philosophy

- Mr. Money Mustache for financial independence strategies

Podcasts:

- ChooseFI

- BiggerPockets Money

- The Dave Ramsey Show

- Afford Anything

Online Communities:

- Reddit’s r/financialindependence

- Bogleheads forum

- BiggerPockets forums

Taking Action Today

Knowledge without action changes nothing. Start your wealth-building journey today with these immediate steps:

- Calculate your net worth (assets minus liabilities)

- Determine your savings rate (monthly savings ÷ monthly income)

- Open a high-yield savings account if you don’t have one

- Enroll in your employer’s 401(k) at least up to the match

- Set up one automatic transfer to a savings or investment account

Don’t wait for the perfect moment, a higher salary, or complete understanding. Start small, start now, and adjust as you learn. The person who starts investing $100 monthly today will build more wealth than the person who waits five years to invest $200 monthly.

Conclusion

Wealth-building strategies aren’t mysterious secrets reserved for the financial elite; they’re proven principles anyone can apply regardless of income level. The strategies outlined in this guide, maximizing tax-advantaged accounts, investing in the stock market, creating multiple income streams, strategic real estate investment, and continuous self-improvement, form a comprehensive approach to growing your money.

Remember that wealth building is a marathon requiring patience, discipline, and consistency. There will be market downturns, unexpected expenses, and moments of doubt. Success comes from staying committed to the process even when results aren’t immediately visible.

The most important decision isn’t which specific investment to choose or which strategy to prioritize; it’s the decision to start. Every wealthy person began with a single step: choosing to save their first dollar, make their first investment, or educate themselves about money.

Your financial future is created by the decisions you make today. Start implementing these wealth-building strategies now, and your future self will thank you. The best time to plant a tree was 20 years ago; the second-best time is today. The same truth applies to building wealth.

Interactive Wealth Building Calculator

💰 Wealth Building Calculator

See how your money can grow over time with consistent investing

Your Wealth Building Projection

FAQ: Wealth-Building Strategies

Yes! Consistency, smart budgeting, and starting early matter more than the size of your income.

Aim for at least 15–20% of your income if possible. Starting small is better than not starting at all.

No shortcuts. The safest approach combines consistent investing, budgeting, and diversification.

ETFs reduce risk by diversifying automatically, making them ideal for beginners.

How do I track my wealth-building progress?

Use net worth trackers or apps, monitor investments quarterly, and compare against financial goals.

Saving involves setting aside money in safe, liquid accounts (savings accounts, money market funds) for short-term goals and emergencies. Investing puts money into assets expected to grow over time (stocks, bonds, real estate) for long-term goals. Both are essential, save for near-term needs and emergencies, and invest for long-term wealth building.

The 50/30/20 rule suggests allocating 50% of after-tax income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and investments. While this provides a helpful framework, many wealth builders increase the savings portion to 30-40% by reducing wants and optimizing needs.

Prioritize paying off high-interest debt (credit cards, payday loans) before investing, as these debts typically charge higher rates than investment returns. For moderate-interest debt (4-7%), balance debt repayment with investing, and contribute enough to capture employer 401(k) matches while making extra debt payments. Low-interest debt (under 4%) can be paid on schedule while focusing on investing.

Disclaimer

This article provides general information about wealth-building strategies for educational purposes only. It is not personalized financial, investment, tax, or legal advice. Individual financial situations vary significantly, and strategies that work for one person may not be appropriate for another.

Before making any financial decisions, consult with qualified professionals, including financial advisors, tax professionals, and legal counsel, who can evaluate your specific circumstances. Past investment performance does not guarantee future results, and all investments carry risk, including potential loss of principal.

The author and publisher are not responsible for any financial decisions made based on information in this article. Always conduct thorough research and due diligence before implementing any wealth-building strategy.

About the Author

Max Fonji is a financial educator and wealth-building strategist with over 8 years of experience helping individuals achieve financial independence. His practical, no-nonsense approach to personal finance has helped thousands of people build sustainable wealth through proven strategies.

Max specializes in making complex financial concepts accessible to beginners, believing that everyone deserves the knowledge to build a secure financial future. His work focuses on tax-efficient investing, passive income generation, and long-term wealth accumulation strategies.

When not writing about finance, Max enjoys analyzing market trends, studying behavioral economics, and helping others develop the financial literacy needed to achieve their goals. Connect with Max and explore more wealth-building resources at The Rich Guy Math.