When most people think about wealth, they picture luxury cars, mansions, and overflowing bank accounts. But here’s the truth that changes everything: wealth isn’t about how much you earn—it’s about how much you keep, grow, and protect over time. A physician earning $400,000 annually but spending $420,000 is not wealthy. Meanwhile, a teacher earning $60,000 who systematically invests 20% of their income and owns income-generating assets is building real wealth. The difference? Understanding what wealth actually means and applying the mathematical principles that create it.

Wealth represents the accumulation of valuable resources that provide financial security, freedom, and opportunity. It’s measured not by income statements but by balance sheets—the difference between what you own and what you owe. As a result, wealth-building becomes a systematic process of acquiring assets, managing liabilities, and allowing compound growth to work over decades. This comprehensive guide breaks down the fundamental concepts, proven strategies, and actionable steps that transform financial understanding into lasting prosperity.

Key Takeaways

- Wealth is net worth, not income—it’s calculated as total assets minus total liabilities, representing true financial position

- Asset accumulation drives wealth creation—productive assets like stocks, real estate, and businesses generate returns that compound over time

- Compound growth is the mathematical engine behind wealth—small, consistent contributions grow exponentially through reinvested returns

- Multiple wealth-building strategies work together—combining saving, investing, income growth, and tax efficiency accelerates results

- Time is the most powerful wealth variable—starting early and maintaining consistency matters more than perfect timing or large initial amounts

Understanding Wealth: Definition and Core Concepts

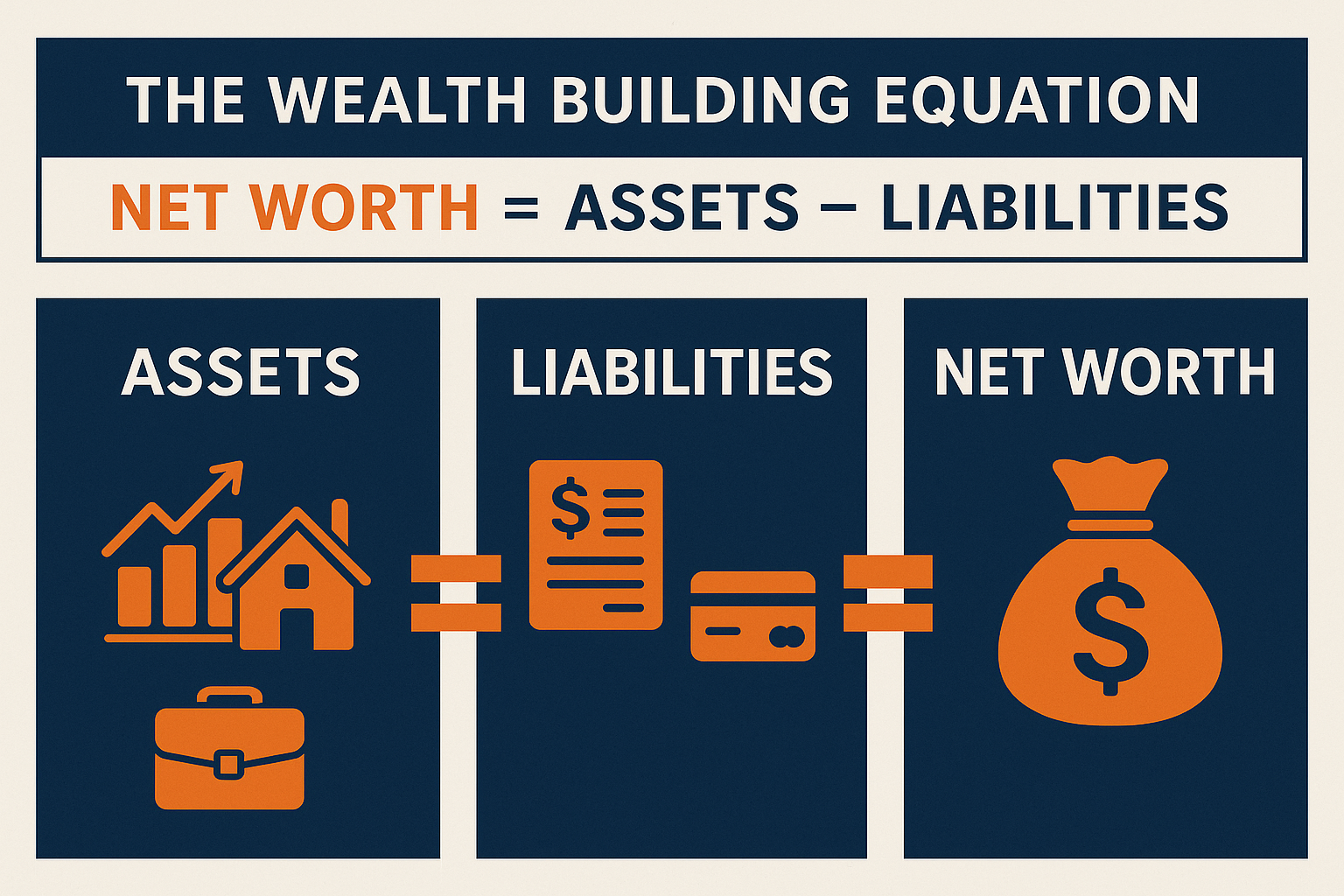

Wealth represents the total value of accumulated assets minus liabilities, creating a net worth figure that reflects true financial position. Unlike income, which measures money flowing in during a specific period, wealth captures the stock of resources available at any given moment. This distinction fundamentally changes how financial decisions should be evaluated.

The Net Worth Equation

The mathematical foundation of wealth is straightforward:

Net Worth = Total Assets – Total Liabilities

Assets include everything of value: cash, investment accounts, retirement funds, real estate equity, business ownership, and personal property. Liabilities encompass all debts: mortgages, student loans, credit card balances, auto loans, and other obligations. The resulting net worth number provides a snapshot of financial health that income alone cannot reveal.

According to the Federal Reserve’s 2022 Survey of Consumer Finances, the median net worth of U.S. households was $192,900, while the mean was $1,063,700—a significant difference that illustrates wealth concentration. Understanding where you stand relative to these benchmarks helps establish realistic goals and track progress over time.

Wealth vs Income: A Critical Distinction

Income measures the rate at which money enters your financial system, typically expressed annually. Wealth measures the accumulated result of past income, spending, and investment decisions. This difference creates several important implications:

High income does not guarantee wealth. Professional athletes earning millions often file for bankruptcy within years of retirement because spending exceeded income, and no wealth-building system existed. Conversely, modest earners who consistently save and invest can accumulate substantial wealth through disciplined execution and compound growth.

Wealth provides options that income cannot. A $100,000 salary requires continued work to maintain. A $2,500,000 investment portfolio generating 4% annually produces the same $100,000 without ongoing labor, creating financial independence. Therefore, wealth-building strategies should focus on converting income into productive assets rather than simply maximizing earnings.

The Three Forms of Wealth

Wealth manifests in three distinct categories, each serving different purposes:

1. Financial Wealth: Liquid and semi-liquid assets including cash, stocks, bonds, mutual funds, and retirement accounts. This category provides flexibility, generates investment returns, and creates the foundation for financial security.

2. Physical Wealth: Tangible assets such as real estate, vehicles, equipment, and collectibles. These assets may appreciate over time, provide utility, or generate income through rental or business use.

3. Human Capital: The present value of future earning potential based on skills, education, experience, and health. While not captured on traditional balance sheets, human capital represents the largest asset for most working-age individuals and deserves strategic investment through education and skill development.

Takeaway: Wealth is a balance sheet concept, not an income statement metric. Building wealth requires converting income into productive assets that grow over time, creating financial resources that provide security and freedom independent of ongoing labor.

The Mathematics Behind Wealth Creation

Wealth accumulation follows predictable mathematical principles that, when understood and applied, create reliable results. The most powerful of these principles is compound growth—Albert Einstein allegedly called it “the eighth wonder of the world” because those who understand it earn it, while those who don’t pay it.

Compound Growth: The Wealth Multiplier

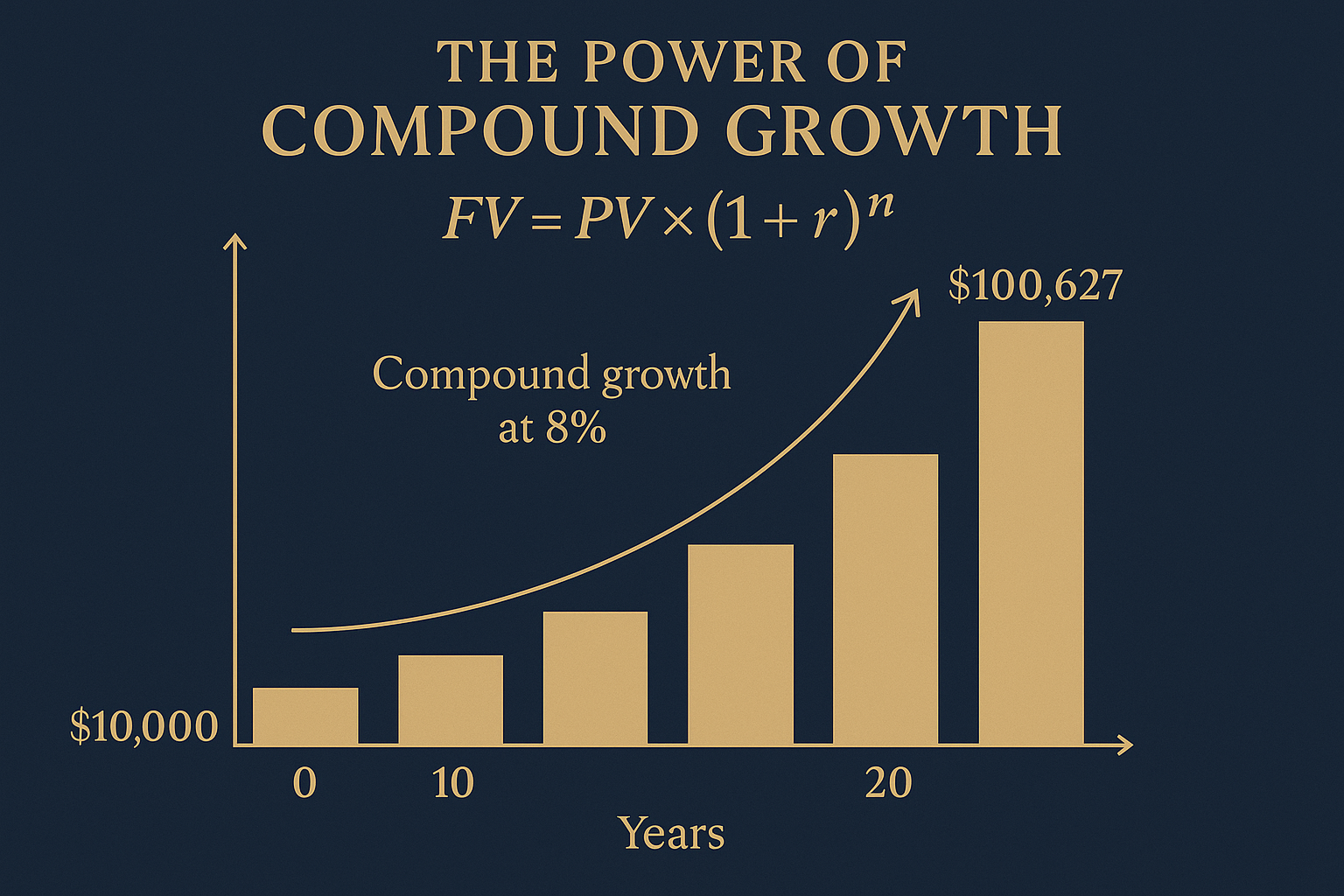

Compound growth occurs when investment returns generate their own returns, creating exponential rather than linear growth. The formula captures this powerful effect:

FV = PV × (1 + r)^n

Where:

- FV = Future Value

- PV = Present Value (initial investment)

- r = annual rate of return

- n = number of years

Consider two scenarios over 30 years with an 8% average annual return:

Scenario A: A single $10,000 investment grows to $100,627

Scenario B: $10,000 plus $500 monthly contributions grows to $745,180

The difference—$644,553—demonstrates how regular contributions combined with compound growth create wealth that far exceeds the sum of deposits. This mathematical reality explains why consistent investing matters more than perfect market timing.

The Rule of 72: Quick Estimation Tool

The Rule of 72 provides a mental shortcut for estimating doubling time:

Years to Double = 72 ÷ Annual Return (%)

At 8% annual returns, wealth doubles approximately every 9 years (72 ÷ 8 = 9). Therefore, $100,000 invested at age 25 becomes $200,000 at 34, $400,000 at 43, $800,000 at 52, and $1,600,000 at 61—all from a single initial investment. This visualization helps explain why starting early creates disproportionate advantages.

Time Value of Money

A dollar today is worth more than a dollar tomorrow because today’s dollar can be invested to generate returns. This fundamental principle drives all wealth-building decisions:

Present Value = Future Value ÷ (1 + r)^n

Understanding present value helps evaluate trade-offs between current spending and future wealth. Spending $50,000 on a luxury car at age 30 doesn’t just cost $50,000—it costs the future value that money would have generated. At 8% annual returns over 30 years, that $50,000 would grow to $503,133, making the true cost of the purchase over half a million dollars in forgone wealth. See our full guide on Time Value of Money(TVM)

The Savings Rate Impact

While investment returns matter, the savings rate—the percentage of income converted into assets—often determines wealth-building success more than any other variable. Research from the CFA Institute demonstrates that increasing the savings rate from 10% to 20% typically has a larger impact on retirement readiness than achieving an extra 2% in annual returns.

Wealth Accumulation = (Income × Savings Rate) × (1 + Return)^Time

This formula reveals why high earners who save little often have less wealth than moderate earners who save aggressively. A household earning $80,000 and saving 25% ($20,000 annually) builds wealth faster than a household earning $200,000 and saving 5% ($10,000 annually), even with identical investment returns.

Insight: The mathematics of wealth creation favors those who start early, save consistently, and allow compound growth to work over decades. Small differences in savings rate and time horizon create enormous differences in outcomes due to exponential growth dynamics.

Asset Classes: The Building Blocks of Wealth

Wealth accumulation requires understanding the major asset classes, their characteristics, and how they contribute to portfolio growth. Each asset class offers distinct risk-return profiles, tax treatments, and roles in a comprehensive wealth-building strategy.

Equities: Ownership in Productive Enterprises

Stocks represent fractional ownership in businesses, entitling shareholders to a proportional claim on profits and assets. Historically, equities have delivered the highest long-term returns of any major asset class, averaging approximately 10% annually for the S&P 500 since 1926, according to data from Morningstar.

Equity returns come from two sources:

1. Capital Appreciation: Stock price increases as the underlying business grows earnings and expands operations

2. Dividends: Cash distributions from profits, typically ranging from 1-3% annually for broad market indices

The stock market provides access to this wealth-building asset class through individual stocks, mutual funds, and exchange-traded funds (ETFs). Understanding why the stock market goes up helps maintain conviction during volatile periods when short-term declines tempt investors to abandon their strategies.

Risk Considerations: Equities experience significant volatility—annual returns ranging from -40% to +50% in extreme years. This volatility requires a long-term investment horizon and the emotional discipline to stay invested through market cycles. Market volatility is the price investors pay for superior long-term returns.

Fixed Income: Stability and Income Generation

Bonds represent loans to governments or corporations, paying regular interest (coupon payments) and returning principal at maturity. Fixed income investments provide portfolio stability, predictable income, and diversification benefits that reduce overall portfolio volatility.

Bond characteristics include:

- Credit Quality: Ranges from ultra-safe U.S. Treasury bonds to higher-risk corporate bonds

- Duration: Longer-term bonds offer higher yields but greater price sensitivity to interest rate changes

- Tax Treatment: Municipal bonds offer tax-free interest for certain investors

While bonds historically return 4-6% annually—less than stocks—their lower volatility and negative correlation during equity market crashes make them valuable portfolio components, particularly as wealth accumulates and preservation becomes increasingly important.

Real Estate: Tangible Assets with Multiple Return Sources

Real estate provides wealth-building opportunities through appreciation, rental income, tax benefits, and leverage. Unlike financial assets, real estate offers tangible utility—a place to live or conduct business—while potentially increasing in value.

Real estate wealth-building strategies include:

Primary Residence: Builds equity through mortgage paydown and appreciation while providing housing utility

Rental Properties: Generate monthly cash flow plus appreciation, with tax deductions for depreciation, mortgage interest, and operating expenses

REITs (Real Estate Investment Trusts): Provide real estate exposure through publicly traded securities without direct property management

The leverage available through mortgages amplifies returns. A $50,000 down payment on a $250,000 property (20% down) that appreciates 5% annually gains $12,500 in year one—a 25% return on the initial $50,000 investment. However, leverage works both ways, magnifying losses when property values decline.

Alternative Investments: Diversification and Specialized Returns

Alternative investments include private equity, hedge funds, commodities, cryptocurrencies, and collectibles. These assets often exhibit low correlation with traditional stocks and bonds, providing diversification benefits and access to specialized return sources.

Considerations for alternatives:

- Liquidity: Many alternatives cannot be quickly converted to cash

- Complexity: Requires specialized knowledge to evaluate and manage

- Access: Some alternatives have high minimum investments or accreditation requirements

- Fees: Often charge higher management and performance fees than traditional investments

For most wealth-builders, alternatives should represent a small portfolio percentage until substantial wealth has been accumulated through traditional asset classes.

Cash and Cash Equivalents: Liquidity and Opportunity

Cash, savings accounts, money market funds, and short-term CDs provide liquidity and capital preservation but generate minimal returns, often below inflation rates. While cash doesn’t build wealth directly, it serves critical functions:

- Emergency Fund: Covers unexpected expenses without forced asset sales

- Opportunity Fund: Enables purchases during market dislocations

- Short-Term Needs: Preserves capital for near-term planned expenses

Financial advisors typically recommend 3-6 months of expenses in cash reserves, with the exact amount depending on income stability, insurance coverage, and risk tolerance. See our fulll guide on Emergency Fund

Takeaway: Effective wealth-building requires understanding each asset class’s characteristics and constructing a diversified portfolio that balances growth potential, risk tolerance, and time horizon. The optimal mix evolves as wealth accumulates and financial goals change.

Proven Wealth-Building Strategies

Understanding wealth concepts and asset classes provides the foundation, but systematic strategies convert knowledge into results. These proven approaches work together to accelerate wealth accumulation regardless of starting point or income level.

Strategy 1: Maximize Tax-Advantaged Accounts

Tax-advantaged retirement accounts provide three powerful wealth-building advantages: tax deductions on contributions, tax-deferred growth, and, in some cases, tax-free withdrawals. These benefits significantly accelerate wealth accumulation compared to taxable accounts.

401(k) and 403(b) Plans: Employer-sponsored retirement plans allow contributions up to $23,000 in 2025 ($30,500 for those 50+), often with employer matching. A 50% employer match on the first 6% of salary represents an immediate 50% return before any investment gains—the highest guaranteed return available.

Traditional and Roth IRAs: Individual Retirement Accounts provide additional tax-advantaged space with $7,000 contribution limits in 2025 ($8,000 for those 50+). Traditional IRAs offer upfront tax deductions, while Roth IRAs provide tax-free withdrawals in retirement.

Health Savings Accounts (HSAs): For those with high-deductible health plans, HSAs offer triple tax advantages—deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. With $4,300 individual and $8,550 family contribution limits in 2025, HSAs function as stealth retirement accounts for those who can pay current medical expenses from other sources.

Impact Example: Contributing $23,000 annually to a 401(k) from age 25 to 65 at 8% returns generates approximately $6,700,000. The same contributions to a taxable account, assuming 24% tax on contributions and 15% capital gains tax, would yield roughly $4,200,000—a $2,500,000 difference from tax efficiency alone.

Strategy 2: Implement Dollar-Cost Averaging

Dollar-cost averaging invests fixed amounts at regular intervals regardless of market conditions, removing emotion from investment decisions and creating a disciplined accumulation process. This strategy naturally buys more shares when prices are low and fewer when prices are high, potentially lowering the average cost per share over time.

Rather than attempting to time the market—a strategy that research from Morningstar shows even professional investors rarely execute successfully—dollar-cost averaging ensures continuous participation in market growth. Understanding what moves the stock market helps maintain conviction in this systematic approach during volatile periods.

Practical Implementation: Set up automatic contributions from each paycheck to investment accounts. This “pay yourself first” approach treats wealth-building as a non-negotiable expense rather than an afterthought funded with whatever remains at month-end.

Strategy 3: Minimize Investment Costs

Investment costs directly reduce returns, making cost minimization one of the most reliable ways to improve outcomes. A 1% difference in annual fees creates substantial wealth differences over decades due to compound effects.

Example: A $500,000 portfolio growing at 8% annually for 30 years reaches $5,031,000. The same portfolio with 1% annual fees (7% net return) reaches $3,811,000—a $1,220,000 difference from fees alone.

Cost reduction strategies include:

- Index Funds and ETFs: Typically charge 0.03-0.20% annually versus 0.50-1.50% for actively managed funds

- Tax-Loss Harvesting: Offset capital gains with losses to reduce tax drag

- Low-Turnover Strategies: Minimize trading costs and short-term capital gains taxes

- Fee-Only Advisors: Avoid conflicts of interest from commission-based compensation

Strategy 4: Increase Income and Human Capital

While controlling costs and optimizing investments matter, increasing the income available for saving and investing often creates the largest wealth-building impact. Human capital—the present value of future earnings—represents the largest asset for most working-age individuals.

Income growth strategies include:

Skill Development: Invest in education, certifications, and training that increase earning potential

Career Progression: Strategically change employers or roles to capture market-rate compensation

Side Businesses: Create additional income streams that can scale beyond hourly labor

Negotiation: Research market rates and advocate for appropriate compensation

Research from the Bureau of Labor Statistics shows that bachelor’s degree holders earn approximately $1,300,000 more over a lifetime than high school graduates—a return on educational investment that often exceeds financial asset returns.

Strategy 5: Create Multiple Income Streams

Diversifying income sources reduces risk and accelerates wealth accumulation by ensuring that financial progress doesn’t depend entirely on a single employer or income source. Smart ways to make passive income provide cash flow that can be reinvested to compound wealth growth.

Income stream categories include:

Earned Income: Salary, wages, and self-employment income from active work

Investment Income: Dividends, interest, and capital gains from financial assets

Rental Income: Cash flow from real estate properties

Business Income: Profits from enterprises that can operate without constant personal involvement

Royalty Income: Payments from intellectual property, books, or creative works

Dividend investing provides a particularly accessible path to investment income, with high dividend stocks generating regular cash distributions that can be reinvested or used to cover living expenses.

Strategy 6: Optimize Tax Efficiency

Tax optimization legally minimizes the percentage of wealth transferred to government entities, allowing more capital to compound over time. While tax avoidance (illegal) should never be pursued, tax efficiency (legal optimization) represents responsible wealth management.

Tax efficiency strategies include:

Asset Location: Hold tax-inefficient investments (bonds, REITs) in tax-advantaged accounts and tax-efficient investments (growth stocks, index funds) in taxable accounts

Tax-Loss Harvesting: Sell losing positions to offset gains and reduce taxable income

Qualified Dividends: Structure portfolios to favor qualified dividends (taxed at 0-20%) over ordinary income (taxed up to 37%)

Charitable Giving: Donate appreciated securities to avoid capital gains while receiving deductions

Estate Planning: Use trusts, gifting strategies, and other tools to minimize estate taxes

According to research from Vanguard, tax-efficient portfolio management can add approximately 0.75% to annual returns—a significant advantage that compounds over decades.

Strategy 7: Protect Wealth Through Risk Management

Building wealth requires protecting accumulated assets from catastrophic losses that could destroy years of progress. Risk management through insurance and diversification preserves wealth during unexpected events.

Essential risk management tools include:

Health Insurance: Prevents medical bankruptcy, the leading cause of personal bankruptcy in the U.S.

Disability Insurance: Replaces income if injury or illness prevents work

Life Insurance: Protects dependents from income loss (term insurance for most situations)

Liability Insurance: Shields assets from lawsuits through adequate auto, home, and umbrella coverage

Diversification: Spreads investment risk across asset classes, sectors, and geographies

The cost of insurance represents a small percentage of the wealth it protects. A $1,000,000 term life insurance policy might cost $500 annually for a healthy 35-year-old—0.05% of the coverage amount—making it one of the most cost-effective risk management tools available.

Insight: Successful wealth-building combines multiple strategies working in concert—maximizing tax-advantaged savings, maintaining consistent investment contributions, minimizing costs, increasing income, diversifying income sources, optimizing taxes, and protecting accumulated wealth. No single strategy creates optimal results; the combination generates compounding advantages.

The Wealth-Building Timeline: Age-Based Strategies

Optimal wealth-building strategies evolve as individuals progress through life stages. Time horizon, income level, financial responsibilities, and accumulated wealth all influence which strategies should receive priority.

Ages 20-30: Foundation Building and Aggressive Growth

The twenties represent the most powerful wealth-building decade due to the extended time horizon for compound growth. A dollar invested at 25 has 40 years to compound before traditional retirement age, creating exponential growth potential that cannot be replicated by starting later.

Priority Strategies:

- Establish Emergency Fund: Build 3-6 months of expenses in accessible savings

- Eliminate High-Interest Debt: Pay off credit cards and other debt above 6-8% interest rates

- Maximize Employer Match: Contribute enough to capture full 401(k) matching

- Invest Aggressively: Allocate 80-100% to equities, given the long time horizon

- Develop Human Capital: Invest in education and skills that increase earning potential

Example: Contributing $6,000 annually from ages 25-35 (just 10 years) and never adding another dollar generates approximately $520,000 by age 65 at 8% returns. Starting at 35 and contributing $6,000 annually for 30 years (triple the duration) generates only $680,000—demonstrating the disproportionate value of early contributions.

Ages 30-40: Income Growth and Wealth Acceleration

The thirties typically bring income increases and career advancement, creating opportunities to dramatically accelerate wealth accumulation. However, this decade also often includes major expenses—home purchases, growing families, and lifestyle inflation—that can derail progress without disciplined systems.

Priority Strategies:

- Increase Savings Rate: Direct raises and bonuses to savings rather than lifestyle expansion

- Max Out Tax-Advantaged Accounts: Fully fund 401(k), IRA, and HSA contributions

- Begin Tax Optimization: Implement tax-loss harvesting and asset location strategies

- Consider Real Estate: Evaluate home ownership and potential rental properties

- Protect Income: Secure adequate life and disability insurance

Wealth Milestone: Target net worth of 1-2× annual income by age 30 and 2-4× annual income by age 40, according to benchmarks from Fidelity Investments.

Ages 40-50: Peak Earning and Diversification

The forties represent peak earning years for many professionals, creating the highest capacity for wealth accumulation. Simultaneously, retirement transitions from an abstract concept to approaching reality, requiring more concrete planning.

Priority Strategies:

- Maximize Contributions: Take advantage of peak earnings to max out all available accounts

- Diversify Income Sources: Develop passive income through dividends, real estate, or side businesses

- Increase Bond Allocation: Gradually shift from 80-100% stocks toward 70-80% stocks

- Update Estate Planning: Ensure wills, trusts, and beneficiary designations reflect current wishes

- Calculate Retirement Needs: Develop specific retirement income and savings targets

Wealth Milestone: Target net worth of 4-6× annual income by age 50.

Ages 50-60: Preservation and Catch-Up Contributions

The fifties combine high earning potential with catch-up contribution provisions that allow larger retirement account deposits. This decade requires balancing continued growth with increasing emphasis on wealth preservation.

Priority Strategies:

- Utilize Catch-Up Contributions: Add extra $7,500 to 401(k) and $1,000 to IRA annually

- Reduce Portfolio Risk: Shift toward 60-70% stocks as retirement approaches

- Eliminate Debt: Pay off mortgage and other obligations before retirement

- Maximize Social Security: Understand claiming strategies and optimal timing

- Healthcare Planning: Prepare for Medicare transition and potential long-term care needs

Wealth Milestone: Target net worth of 6-8× annual income by age 60.

Ages 60+: Distribution Planning and Legacy

The sixties mark the transition from accumulation to distribution, requiring fundamental strategy shifts from building wealth to generating sustainable income while preserving capital.

Priority Strategies:

- Implement Withdrawal Strategy: Develop a systematic approach to generating retirement income

- Optimize Social Security: Time claiming to maximize lifetime benefits

- Manage Tax Liability: Strategically draw from taxable, tax-deferred, and tax-free accounts

- Required Minimum Distributions: Plan for mandatory withdrawals beginning at age 73

- Estate Planning: Finalize wealth transfer strategies and legacy goals

Wealth Milestone: Target net worth of 10-12× annual income by retirement to support 4% withdrawal rates.

Takeaway: Wealth-building strategies should evolve with age, shifting from aggressive growth and income development in early years toward preservation and distribution in later years. Starting early provides disproportionate advantages, but substantial wealth can still be built by implementing appropriate strategies at any age.

Common Wealth-Building Mistakes to Avoid

Understanding what not to do often matters as much as knowing the right strategies. These common mistakes destroy wealth or prevent accumulation, yet they remain surprisingly prevalent even among financially educated individuals.

Mistake 1: Lifestyle Inflation

Lifestyle inflation—increasing spending in proportion to income growth—represents the primary obstacle to wealth accumulation for middle and high earners. When raises, bonuses, and promotions fund larger homes, luxury vehicles, and expensive habits rather than increased savings, earning more fails to create more wealth.

The Solution: Implement the “50% rule”—direct at least 50% of every raise or income increase to savings and investments. This approach allows gradual lifestyle improvement while ensuring income growth translates to wealth growth.

Mistake 2: Carrying High-Interest Debt

Credit card balances, payday loans, and other high-interest debt charging 15-25% annually make wealth accumulation mathematically impossible. No investment strategy reliably generates returns that exceed these interest costs, making debt elimination the highest-return “investment” available.

The Solution: Prioritize eliminating all debt above 6-8% interest rates before making non-matched retirement contributions. The guaranteed “return” from avoiding 20% credit card interest exceeds the expected return from any investment.

Mistake 3: Attempting to Time the Market

Market timing—moving in and out of investments based on predictions about future price movements—consistently underperforms buy-and-hold strategies according to research from Morningstar and Dalbar. The best market days often occur immediately after the worst days, meaning investors who sell during declines miss the subsequent recovery.

The Data: Missing just the 10 best days in the market over 20 years reduces returns by approximately 50%, according to research from J.P. Morgan Asset Management. Since the best days are unpredictable and often occur during volatile periods, consistent market participation matters more than perfect timing.

The Solution: Implement dollar-cost averaging and maintain investments through complete market cycles, recognizing that volatility is the price paid for superior long-term returns.

Mistake 4: Paying Excessive Investment Fees

Investment fees compound negatively, reducing wealth over time. A 1% annual fee might seem insignificant, but over 30 years it can consume 25% or more of total portfolio value due to compound effects.

The Solution: Favor low-cost index funds and ETFs charging 0.03-0.20% annually over actively managed funds charging 0.50-1.50%. For a $500,000 portfolio, this difference saves $5,000-10,000 annually—money that compounds into substantial wealth over decades.

Mistake 5: Neglecting Tax Efficiency

Ignoring the tax implications of investment decisions unnecessarily transfers wealth to government entities rather than allowing it to compound. Holding tax-inefficient investments in taxable accounts, triggering unnecessary capital gains, and failing to utilize tax-advantaged accounts all reduce after-tax returns.

The Solution: Prioritize tax-advantaged accounts, implement tax-loss harvesting, favor qualified dividends and long-term capital gains over ordinary income, and consider tax implications before making investment changes.

Mistake 6: Failing to Diversify

Concentration risk—holding too much wealth in a single investment, asset class, or sector—exposes portfolios to catastrophic losses from company-specific or sector-specific events. Employees of Enron, Lehman Brothers, and countless other failed companies learned this lesson through devastating wealth destruction.

The Solution: Maintain diversification across asset classes (stocks, bonds, real estate), geographies (domestic and international), and sectors. Limit individual stock positions to 5-10% of portfolio value, with even lower percentages for employer stock.

Mistake 7: Emotional Decision-Making

Fear and greed—the primary emotions driving investment decisions—consistently lead to buying high and selling low, the opposite of wealth-building behavior. Panic selling during market declines locks in losses and misses recoveries, while euphoric buying during peaks purchases overvalued assets.

The Solution: Establish investment policy statements defining asset allocation and rebalancing rules before emotional market periods occur. Follow predetermined rules rather than feelings, and avoid checking portfolio values more frequently than quarterly.

Mistake 8: Underestimating Longevity

Planning for insufficient retirement duration creates the risk of outliving savings, one of the most devastating financial outcomes. With increasing life expectancies, retirement can easily span 30-40 years, requiring substantially more savings than many individuals accumulate.

The Solution: Plan for age 95+ when calculating retirement needs, even if family history suggests shorter lifespans. The cost of overestimating longevity (dying with excess savings) is far less severe than underestimating it (running out of money while alive).

Insight: Avoiding these common mistakes often contributes more to wealth-building success than finding optimal investment strategies. Discipline, consistency, and emotional control matter more than intelligence or perfect timing.

Measuring Wealth-Building Progress

Tracking progress provides motivation, identifies problems early, and enables course corrections before small issues become major obstacles. Effective wealth measurement goes beyond simple net worth calculations to include multiple metrics that paint a complete financial picture.

Net Worth Tracking

Net worth—total assets minus total liabilities—represents the primary wealth metric and should be calculated at least annually, ideally quarterly. Track net worth over time to visualize progress and identify trends.

Calculation Method:

Assets:

- Cash and savings accounts

- Investment accounts (taxable and retirement)

- Real estate equity (market value minus mortgage balance)

- Business ownership value

- Personal property (vehicles, valuable possessions)

Liabilities:

- Mortgage balances

- Student loans

- Auto loans

- Credit card balances

- Other debts

Net Worth = Total Assets – Total Liabilities

Net Worth Benchmarks by Age

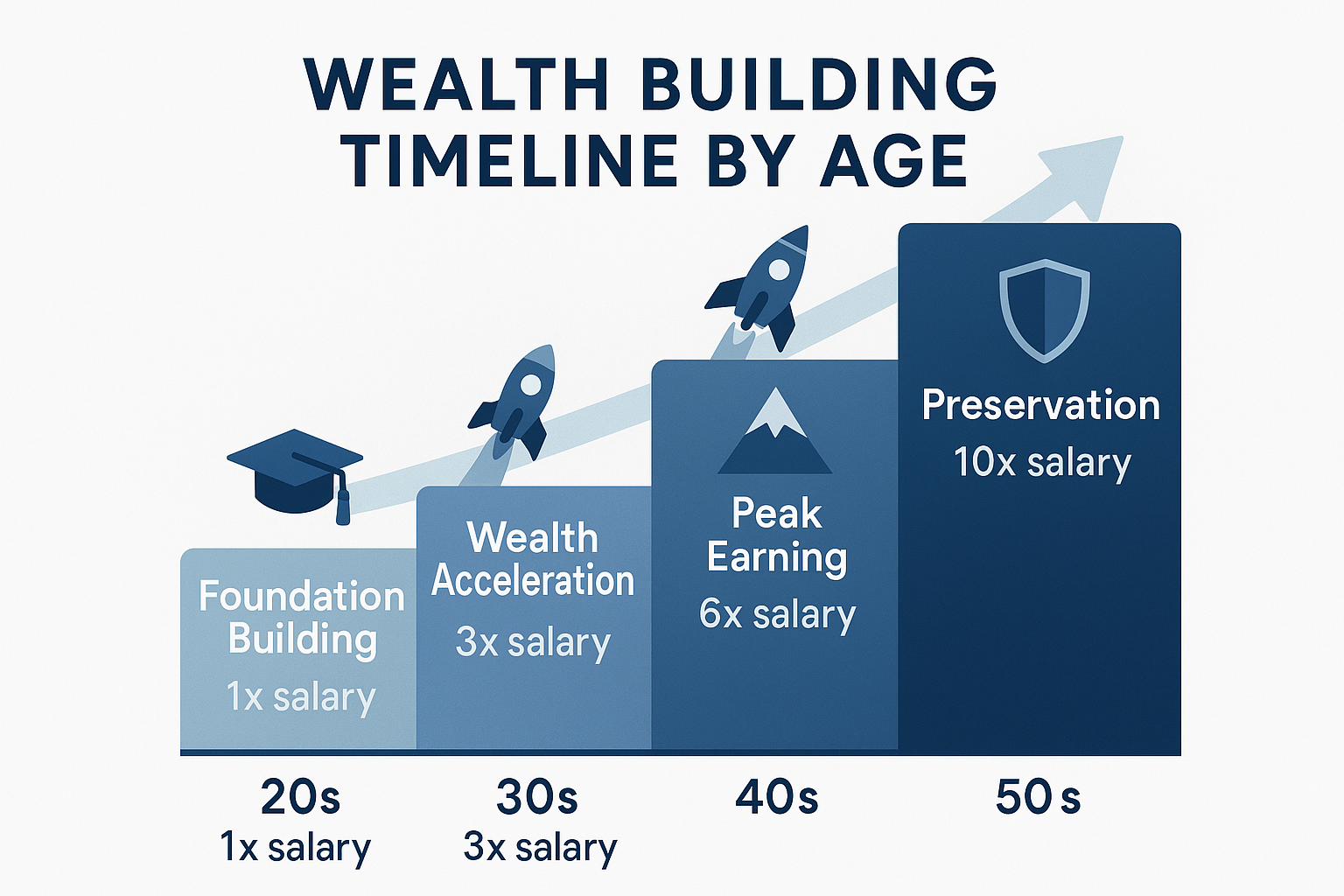

Fidelity Investments provides age-based net worth targets relative to annual income:

- Age 30: 1× annual salary

- Age 40: 3× annual salary

- Age 50: 6× annual salary

- Age 60: 8× annual salary

- Age 67: 10× annual salary

These benchmarks assume retirement at age 67 with 45% pre-retirement income replacement from savings (additional income from Social Security). Adjust targets based on retirement age goals and desired retirement income.

Savings Rate

Savings rate—the percentage of gross income directed to wealth-building—predicts financial independence timing more accurately than investment returns or income level. Calculate monthly savings rate:

Savings Rate = (Income – Spending) ÷ Income × 100

Target Savings Rates:

- Minimum: 15% for traditional retirement

- Aggressive: 25-30% for early financial independence

- Maximum: 50%+ for rapid wealth accumulation

Investment Return Tracking

Monitor investment returns to ensure portfolio performance aligns with expectations and identify underperforming holdings. Compare returns to appropriate benchmarks rather than absolute numbers:

- Total Stock Portfolio: S&P 500 index

- International Stocks: MSCI EAFE index

- Bonds: Bloomberg Aggregate Bond index

- Balanced Portfolio: Hybrid benchmark matching allocation

Underperforming benchmarks by more than 1% annually after fees suggests portfolio optimization opportunities.

Debt-to-Income Ratio

Debt-to-income ratio measures the percentage of gross monthly income required for debt payments, indicating whether debt levels are sustainable or problematic.

Debt-to-Income Ratio = Monthly Debt Payments ÷ Gross Monthly Income × 100

Benchmarks:

- Under 20%: Excellent

- 20-35%: Acceptable

- 36-49%: Concerning

- 50%+: Problematic

Financial Independence Progress

Financial independence occurs when passive income from investments exceeds living expenses, eliminating the need for employment income. Track progress toward this milestone:

FI Percentage = (Annual Investment Income ÷ Annual Expenses) × 100

At 100% FI percentage, work becomes optional. Many individuals target 125-150% to provide margin for unexpected expenses and market volatility.

Annual Wealth Growth Rate

Measuring year-over-year net worth growth reveals whether wealth-building efforts are accelerating, maintaining pace, or falling behind:

Annual Growth Rate = [(Current Net Worth – Previous Net Worth) ÷ Previous Net Worth] × 100

Target annual growth rates depend on starting point, but 10-20% represents strong progress for most wealth-builders combining savings contributions with investment returns.

Takeaway: Regular measurement of multiple financial metrics provides comprehensive insight into wealth-building progress, enabling data-driven decisions and early identification of problems requiring attention.

Advanced Wealth Strategies for High Net Worth Individuals

As wealth accumulates beyond $1-2 million, additional strategies become available and appropriate for optimizing tax efficiency, protecting assets, and planning wealth transfer. These advanced techniques require professional guidance but can provide substantial benefits for those with significant wealth.

Tax-Loss Harvesting and Tax-Alpha Strategies

Tax-loss harvesting systematically sells losing investments to offset capital gains and up to $3,000 of ordinary income annually, reducing tax liability while maintaining market exposure through substantially identical replacement securities.

Advanced Implementation: Direct indexing—owning individual stocks that replicate an index rather than index funds—enables continuous tax-loss harvesting throughout the year, potentially adding 0.5-1.5% to annual after-tax returns according to research from Parametric Portfolio Associates.

Charitable Giving Strategies

Donor-advised funds, charitable remainder trusts, and qualified charitable distributions enable tax-efficient philanthropy while reducing estate size and current tax liability.

Donor-Advised Funds (DAFs): Contribute appreciated securities, receive immediate tax deduction, and recommend grants to charities over time. DAFs provide flexibility while avoiding capital gains taxes on donated securities.

Qualified Charitable Distributions (QCDs): After age 70½, direct up to $105,000 annually from IRAs to qualified charities, satisfying required minimum distributions without increasing taxable income—particularly valuable for those who don’t itemize deductions.

Estate Planning and Wealth Transfer

Estate planning minimizes transfer taxes and ensures wealth passes to intended beneficiaries according to specific wishes. Strategies include:

Irrevocable Life Insurance Trusts (ILITs): Remove life insurance from taxable estate while providing liquidity for estate taxes

Grantor Retained Annuity Trusts (GRATs): Transfer appreciating assets to beneficiaries with minimal gift tax

Family Limited Partnerships: Consolidate family assets while providing valuation discounts for gift and estate tax purposes

Annual Gifting: Utilize $18,000 annual exclusion per recipient (2025) to gradually transfer wealth

Asset Protection Strategies

Protecting accumulated wealth from lawsuits, creditors, and other claims becomes increasingly important as net worth grows. Legal structures include:

LLCs and Corporations: Separate business and personal assets, limiting liability exposure

Umbrella Insurance: Provides $1-5 million in additional liability coverage beyond auto and home policies

Domestic Asset Protection Trusts: Certain states allow self-settled trusts, providing creditor protection

Retirement Accounts: ERISA-qualified plans offer strong creditor protection in most states

Alternative Investment Access

High net worth individuals gain access to alternative investments unavailable to typical investors, including:

Private Equity: Direct investment in private companies or private equity funds

Hedge Funds: Alternative strategies with lower correlation to traditional markets

Private Real Estate: Institutional-quality properties and development projects

Venture Capital: Early-stage company investments with high risk and potential returns

These alternatives require accredited investor status ($1 million net worth excluding primary residence or $200,000+ annual income) and typically involve higher fees, lower liquidity, and greater complexity than traditional investments.

Insight: Advanced wealth strategies provide meaningful benefits for high-net-worth individuals but require professional guidance from CPAs, estate attorneys, and fee-only financial advisors to implement correctly and avoid costly mistakes.

Building Wealth in Different Economic Environments

Economic conditions—inflation rates, interest rates, market valuations, and growth trajectories—influence which wealth-building strategies perform best. Adapting to economic environments while maintaining long-term discipline creates optimal outcomes.

High Inflation Environments

Inflation erodes purchasing power, making cash and fixed-rate bonds less attractive while favoring real assets and inflation-protected securities.

Optimal Strategies:

- Real Estate: Property values and rents typically rise with inflation

- Equities: Companies can raise prices, maintaining real profitability

- TIPS (Treasury Inflation-Protected Securities): Principal adjusts with inflation

- I Bonds: Savings bonds with inflation-adjusted rates

- Commodities: Gold, oil, and other commodities often appreciate during inflation

Avoid: Long-term fixed-rate bonds and large cash positions that lose real value

Low Interest Rate Environments

Low interest rates reduce returns on savings accounts and bonds while making borrowing inexpensive and often inflating asset prices.

Optimal Strategies:

- Leverage Real Estate: Lock in low mortgage rates on appreciating properties

- Dividend Growth Stocks: Provide income when bond yields are minimal

- Refinance Debt: Reduce interest costs on existing obligations

- Growth Equities: Low rates increase the present value of future earnings

Avoid: Reaching for yield through excessive risk in pursuit of income

High Interest Rate Environments

High interest rates increase returns on savings and bonds while making borrowing expensive and often pressuring equity valuations.

Optimal Strategies:

- High-Yield Savings: Capture attractive risk-free returns

- Short-Term Bonds: Provide income with minimal interest rate risk

- Value Stocks: Often outperform growth stocks when rates rise

- Pay Down Debt: High-interest debt becomes increasingly costly

Avoid: Long-duration bonds that decline in value as rates rise

Market Corrections and Bear Markets

Market declines of 20%+ create emotional challenges but represent wealth-building opportunities for those with cash reserves and disciplined approaches.

Optimal Strategies:

- Maintain Contributions: Continue dollar-cost averaging to buy at lower prices

- Rebalance: Sell bonds that held value to buy discounted stocks

- Tax-Loss Harvest: Capture losses to offset future gains

- Avoid Panic Selling: Maintain a long-term perspective and investment policy

Historical Context: Every bear market in history has been followed by recovery and new highs, making selling during declines one of the most costly mistakes investors make.

Bull Markets and High Valuations

Extended bull markets create overconfidence and excessive valuations, requiring discipline to avoid abandoning diversification or taking excessive risk.

Optimal Strategies:

- Maintain Discipline: Continue systematic contributions regardless of market levels

- Rebalance: Sell appreciated stocks to maintain target allocation

- Avoid FOMO: Don’t abandon strategy to chase performance

- Build Cash Reserves: Prepare for eventual correction

Takeaway: While economic environments influence tactical decisions, maintaining long-term discipline and systematic contributions matters more than perfectly timing economic cycles. Adapt around the edges while keeping the core strategy intact.

The Psychology of Wealth Building

Behavioral factors often determine wealth-building success more than financial knowledge or intelligence. Understanding psychological tendencies and implementing systems to counteract destructive behaviors separates successful wealth-builders from those who struggle despite adequate income and understanding.

The Discipline-Consistency Paradox

Wealth accumulation requires boring, repetitive behaviors executed consistently over decades—precisely the opposite of exciting, dramatic actions that feel impactful. This creates a psychological challenge: behaviors that feel significant (market timing, stock picking, dramatic portfolio changes) typically harm results, while behaviors that feel insignificant (automatic contributions, buy-and-hold, systematic rebalancing) create wealth. See our full guide on The power of discipline.

The Solution: Automate wealth-building behaviors to remove willpower from the equation. Automatic payroll deductions, automatic investment contributions, and automatic rebalancing eliminate the need for repeated decisions and discipline.

Loss Aversion and Risk Perception

Behavioral economics research shows humans feel losses approximately 2-2.5 times more intensely than equivalent gains—a $10,000 portfolio decline creates more emotional impact than a $10,000 gain creates pleasure. This asymmetry causes investors to make irrational decisions, selling after declines and missing subsequent recoveries.

The Solution: Frame investment volatility as an opportunity rather than a loss. A declining market means future contributions buy more shares at lower prices—a positive outcome for long-term wealth-builders still accumulating assets.

Present Bias and Delayed Gratification

Humans systematically overvalue immediate consumption relative to future benefits, making wealth-building psychologically difficult. Spending $100 today feels more rewarding than the $1,000+ that $100 would grow to over 30 years, even though the future value is objectively 10× larger.

The Solution: Create vivid mental images of future financial freedom. Calculate the specific date when passive income will exceed expenses. Visualize the lifestyle, freedom, and options that accumulated wealth will provide. Making future benefits concrete and emotionally compelling counteracts present bias.

Social Comparison and Lifestyle Inflation

Comparing personal financial situations to peers, neighbors, and social media personalities creates pressure to spend on visible status symbols rather than accumulate invisible wealth. The wealthy-looking neighbor with the luxury car and large home may have negative net worth, while the modest-living neighbor may be a millionaire.

The Solution: Recognize that most displays of wealth represent consumption, not actual wealth. Focus on personal financial metrics and goals rather than external comparisons. Remember that true wealth provides options and freedom, not admiration from strangers.

Overconfidence and Expertise Illusion

Success in careers or other domains creates confidence that often doesn’t transfer to investing. Intelligent, accomplished professionals often underperform simple index strategies because they overestimate their ability to select investments, time markets, or identify opportunities.

The Solution: Recognize that markets are efficient enough that beating them consistently requires either superior information (often illegal insider knowledge) or superior analysis (requiring full-time dedication). For most individuals, accepting market returns through low-cost index funds produces better results than attempting to outperform.

Analysis Paralysis and Information Overload

The abundance of financial information, opinions, and strategies creates paralysis, preventing individuals from taking any action while they search for the perfect approach. This perfectionism costs more than any suboptimal strategy would cost.

The Solution: Recognize that good enough executed consistently beats perfect delayed indefinitely. Start with simple strategies—max out 401(k) match, contribute to IRA, invest in target-date funds—and optimize over time as knowledge increases.

Insight: Successful wealth-building requires understanding and counteracting psychological tendencies through automation, framing, visualization, and systems that make beneficial behaviors the path of least resistance.

Wealth Building Action Plan: 90-Day Implementation

Knowledge without implementation creates no results. This 90-day action plan converts concepts into concrete steps that begin building wealth immediately, regardless of starting point.

Days 1-30: Foundation and Assessment

Week 1: Calculate Current Financial Position

- List all assets with current values

- List all liabilities with balances and interest rates

- Calculate net worth

- Calculate the monthly savings rate

- Identify current investment allocation

Week 2: Establish Emergency Fund

- Open a high-yield savings account

- Calculate 3-6 months of essential expenses

- Set up automatic transfers to build an emergency fund

- Target: $1,000 immediately, full fund within 6-12 months

Week 3: Optimize Employer Benefits

- Review 401(k) contribution percentage

- Ensure contributions capture full employer match

- Select appropriate investment options (target-date fund or three-fund portfolio)

- Review health insurance and HSA eligibility

Week 4: Eliminate High-Interest Debt Plan

- List all debts by interest rate

- Create a payoff plan prioritizing the highest rates

- Consider a balance transfer or consolidation for credit card debt

- Set up automatic payments exceeding minimums

Days 31-60: Account Optimization and Automation

Week 5: Open Tax-Advantaged Accounts

- Open a Roth or a Traditional IRA based on income and tax situation

- Open an HSA if eligible for a high-deductible health plan

- Research 529 plans if children are part of the financial picture

- Set up automatic contributions to all accounts

Week 6: Investment Strategy Implementation

- Determine appropriate asset allocation based on age and risk tolerance

- Select low-cost index funds or ETFs for each asset class

- Implement a three-fund portfolio or target-date fund

- Set up automatic rebalancing or calendar reminders

Week 7: Automate Wealth-Building

- Set up automatic payroll deductions to a 401(k)

- Set up automatic transfers to an IRA every month

- Set up automatic transfers to a taxable investment account if retirement accounts are maxed

- Set up automatic transfers to the emergency fund until the target is reached

Week 8: Insurance Review

- Review health insurance coverage and deductibles

- Obtain term life insurance quotes if dependents exist

- Review auto and home insurance with umbrella policy consideration

- Review disability insurance coverage

Days 61-90: Optimization and Advanced Strategies

Week 9: Tax Optimization

- Review tax withholding to avoid large refunds or payments

- Research tax-loss harvesting opportunities in taxable accounts

- Consider asset location optimization (tax-efficient investments in taxable accounts)

- Calculate potential Roth conversion opportunities

Week 10: Income Increase Planning

- Update resume and LinkedIn profile

- Research market salary rates for the current role

- Identify skills or certifications that increase earning potential

- Explore side income opportunities aligned with skills and interests

Week 11: Additional Income Streams

- Research dividend investing strategies

- Explore real estate investment options (REITs or rental properties)

- Consider creating digital products or services

- Evaluate business or freelance opportunities

Week 12: Review and Adjust

- Recalculate net worth and compare to Day 1

- Review all automated systems to ensure functioning correctly

- Adjust contribution amounts based on budget optimization

- Set calendar reminders for quarterly reviews

- Establish an annual review process

Takeaway: Implementing this 90-day plan creates the systems, accounts, and automation that build wealth systematically over decades. The most important step is starting—perfect optimization can occur over time, but delayed action costs more than any suboptimal strategy.

💰 Wealth Building Calculator

Calculate your future wealth based on consistent investing

💡 Key Insight

Your wealth will grow through the power of compound returns.

Conclusion: Your Wealth-Building Journey Starts Today

Wealth represents accumulated financial resources that provide security, freedom, and options—measured by net worth rather than income. Building wealth requires understanding fundamental concepts, implementing proven strategies, and maintaining discipline through decades of consistent execution. The mathematical principles are straightforward: convert income into productive assets, minimize costs and taxes, allow compound growth to work over time, and protect accumulated wealth from catastrophic losses.

The strategies outlined in this guide—maximizing tax-advantaged accounts, implementing dollar-cost averaging, minimizing investment costs, increasing income and human capital, creating multiple income streams, optimizing tax efficiency, and protecting wealth through risk management—work together to accelerate accumulation regardless of starting point or income level. No single strategy creates optimal results; the combination generates compounding advantages that transform modest contributions into substantial wealth over decades.

The most important wealth-building decision is starting immediately rather than waiting for perfect conditions, higher income, or complete knowledge. A 25-year-old contributing $6,000 annually for just 10 years and never adding another dollar accumulates more wealth by retirement than someone who waits until 35 and contributes for 30 years—demonstrating the disproportionate value of time and early action.

Wealth-building is not about luck, perfect market timing, or exceptional intelligence. It’s about understanding basic principles, implementing systematic strategies, and maintaining consistency through market cycles and life changes. The path is clear, the tools are accessible, and the results are predictable for those who execute with discipline.

Your wealth-building journey begins with the first contribution, the first automated transfer, the first decision to prioritize future financial freedom over current consumption. Every day delayed represents compounding opportunities lost forever. Start today, maintain consistency, and allow the mathematics of wealth creation to work in your favor.

For more insights on building lasting financial success, explore additional resources on smart financial moves and continue learning about the math behind money at The Rich Guy Math.

About the Author

Written by Max Fonji, founder of TheRichGuyMath.com—a finance educator and investor who explains the “math behind money” in simple, actionable terms. With experience in investment strategy, personal finance, and wealth-building systems, Max helps readers understand how financial decisions create lasting results. His evidence-based approach combines financial theory with practical implementation, empowering individuals to build wealth through systematic strategies and disciplined execution.

Connect with Max and explore more wealth-building resources at TheRichGuyMath.com.

Disclaimer

Disclaimer: The content on TheRichGuyMath.com is for educational purposes only and does not constitute financial or investment advice. Always consult a qualified professional before making financial decisions. Investment returns are not guaranteed, past performance does not indicate future results, and all investing involves risk, including potential loss of principal. Tax laws and regulations change frequently—consult a tax professional for guidance specific to your situation. The strategies discussed may not be appropriate for all individuals depending on personal circumstances, risk tolerance, and financial goals.